Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer only part b (i) and (ii) There are TWO Sections Section B- 2 questions with sub-questions (25 * 2 = 50) Question 1: a)

answer only part b (i) and (ii)

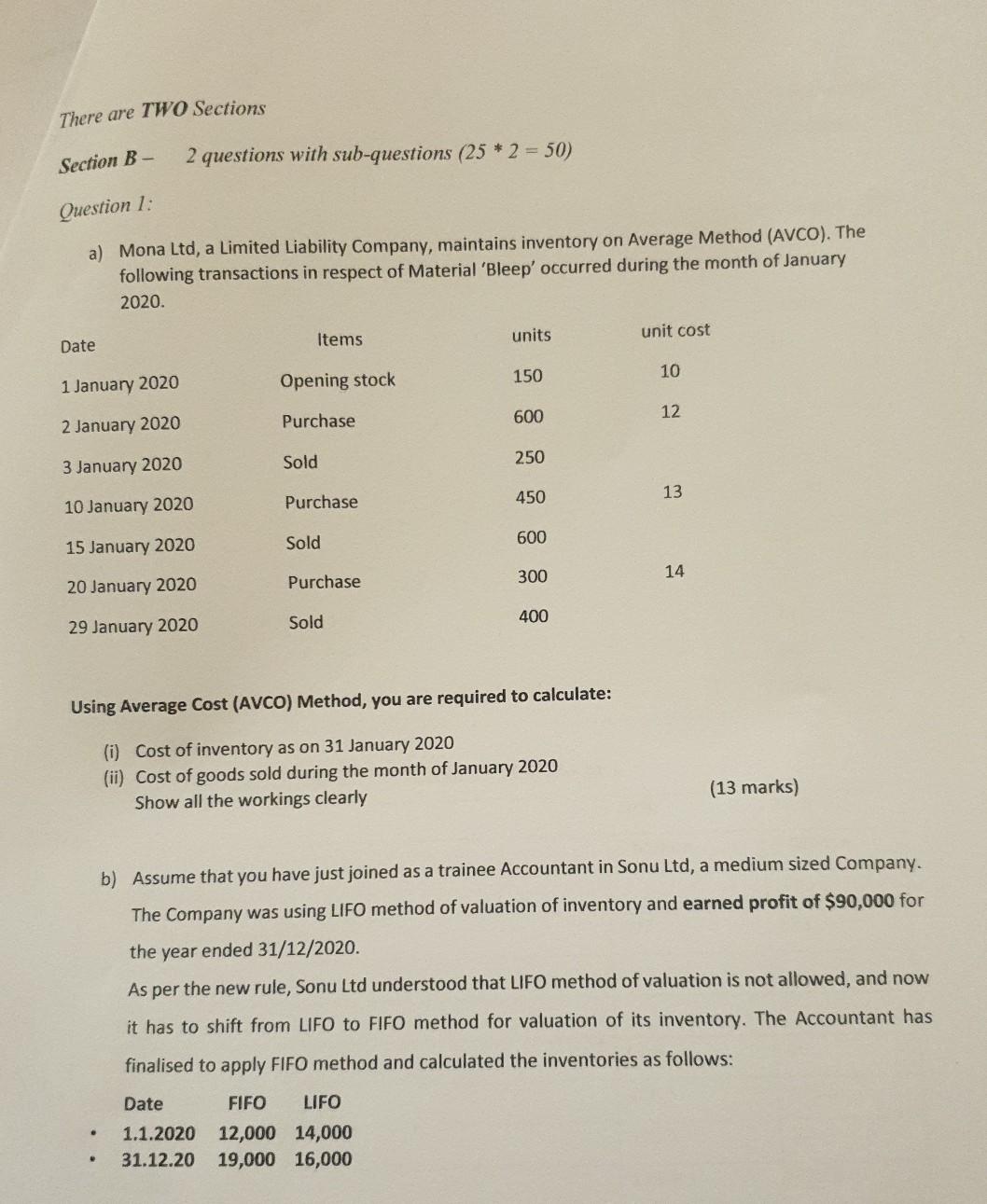

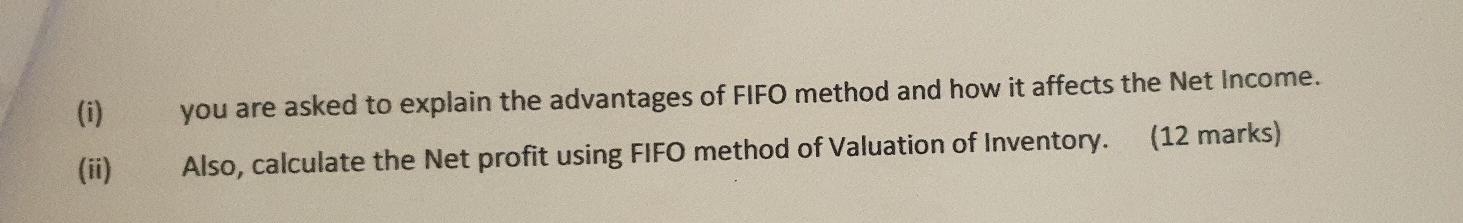

There are TWO Sections Section B- 2 questions with sub-questions (25 * 2 = 50) Question 1: a) Mona Ltd, a Limited Liability Company, maintains inventory on Average Method (AVCO). The following transactions in respect of Material 'Bleep' occurred during the month of January 2020. units unit cost Date Items 150 10 1 January 2020 Opening stock 600 12 Purchase 2 January 2020 Sold 250 3 January 2020 450 13 Purchase 10 January 2020 Sold 15 January 2020 600 300 14 Purchase 20 January 2020 Sold 400 29 January 2020 Using Average Cost (AVCO) Method, you are required to calculate: (i) Cost of inventory as on 31 January 2020 (ii) Cost of goods sold during the month of January 2020 Show all the workings clearly (13 marks) b) Assume that you have just joined as a trainee Accountant in Sonu Ltd, a medium sized Company. The Company was using LIFO method of valuation of inventory and earned profit of $90,000 for the year ended 31/12/2020. As per the new rule, Sonu Ltd understood that LIFO method of valuation is not allowed, and now it has to shift from LIFO to FIFO method for valuation of its inventory. The Accountant has finalised to apply FIFO method and calculated the inventories as follows: Date FIFO LIFO 1.1.2020 12,000 14,000 31.12.20 19,000 16,000 you are asked to explain the advantages of FIFO method and how it affects the Net Income. Also, calculate the Net profit using FIFO method of Valuation of Inventory. (12 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started