Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer only part (e) Due Date - Tuesday, March 29th On December 1, 2020, Snow Unlimited Resorts, Inc. factored $465,000 of accounts receivable with Fast

answer only part (e)

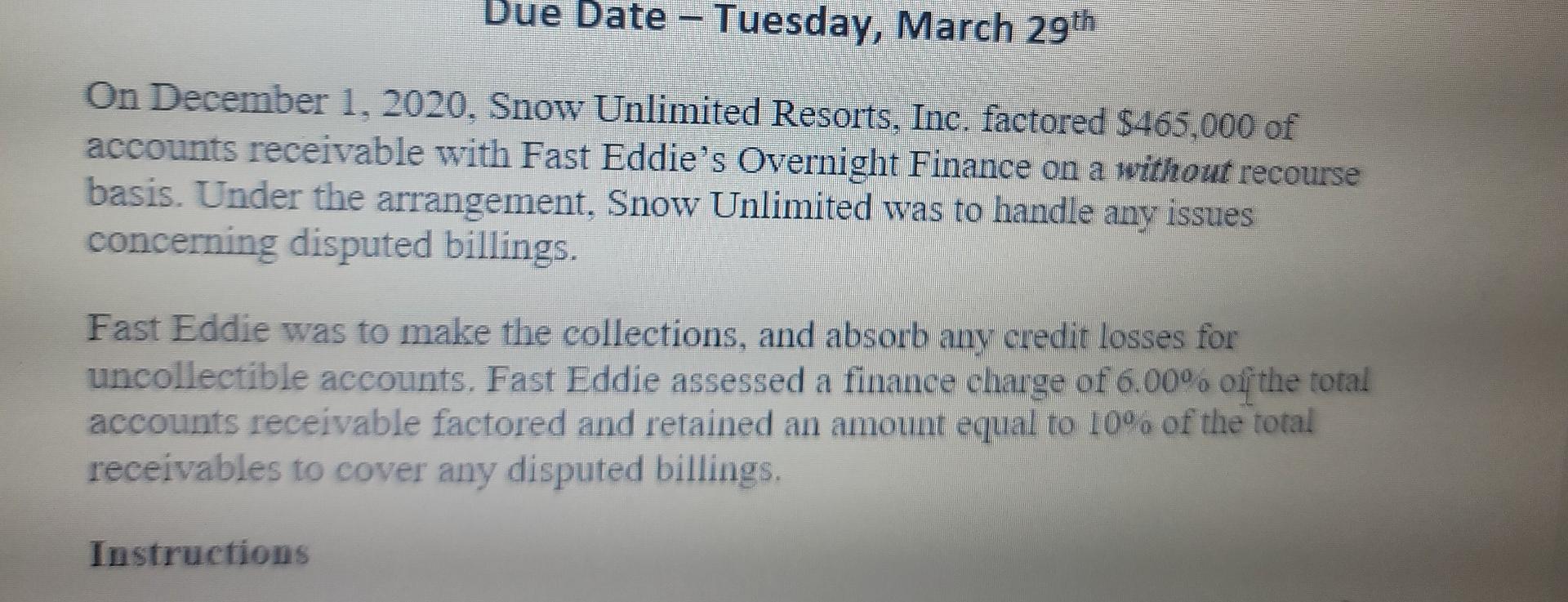

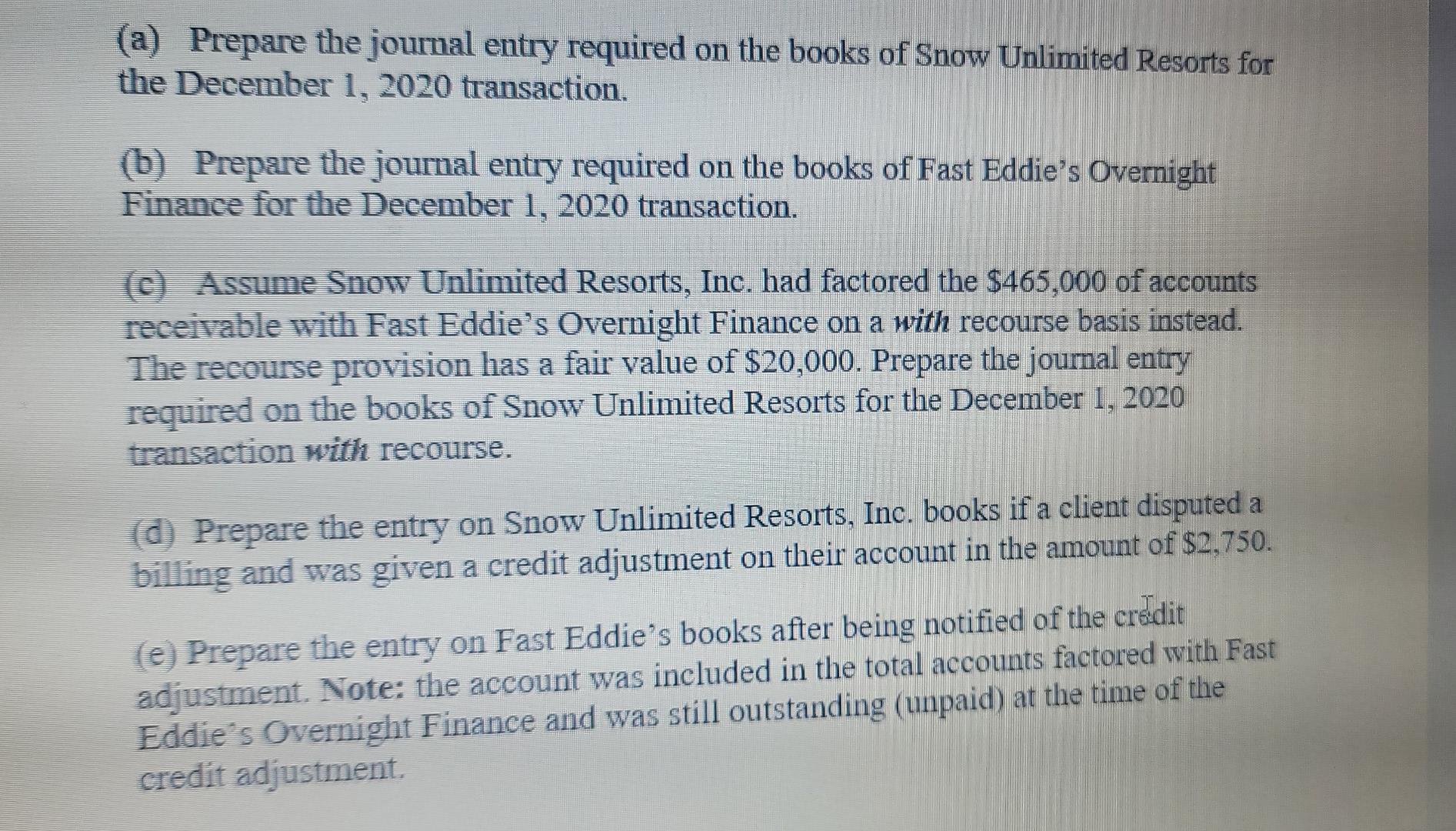

Due Date - Tuesday, March 29th On December 1, 2020, Snow Unlimited Resorts, Inc. factored $465,000 of accounts receivable with Fast Eddie's Overnight Finance on a without recourse basis. Under the arrangement. Snow Unlimited was to handle any issues concerning disputed billings. Fast Eddie was to make the collections, and absorb any credit losses for uncollectible accounts, Fast Eddie assessed a finance charge of 6.00% of the total accounts receivable factored and retained an amount equal to 10% of the total receivables to cover any disputed billings. Instructions (a) Prepare the journal entry required on the books of Snow Unlimited Resorts for the December 1, 2020 transaction. (b) Prepare the journal entry required on the books of Fast Eddie's Overnight Finance for the December 1, 2020 transaction. (c) Assume Snow Unlimited Resorts, Inc. had factored the $465,000 of accounts receivable with Fast Eddie's Overnight Finance on a with recourse basis instead. The recourse provision has a fair value of $20,000. Prepare the journal entry required on the books of Snow Unlimited Resorts for the December 1, 2020 transaction with recourse. (d) Prepare the entry on Snow Unlimited Resorts, Inc. books if a client disputed a billing and was given a credit adjustment on their account in the amount of $2,750. (e) Prepare the entry on Fast Eddie's books after being notified of the credit adjustment. Note: the account was included in the total accounts factored with Fast Eddie's Overnight Finance and was still outstanding (unpaid) at the time of the credit adjustmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started