Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer options: a. $2,278,000 b. $2,050,200 c. $2,505,800 d. $1,822,400 A multinational corporation (MNC) can be valued in a similar manner to that of a

Answer options:

a. $2,278,000 b. $2,050,200 c. $2,505,800 d. $1,822,400

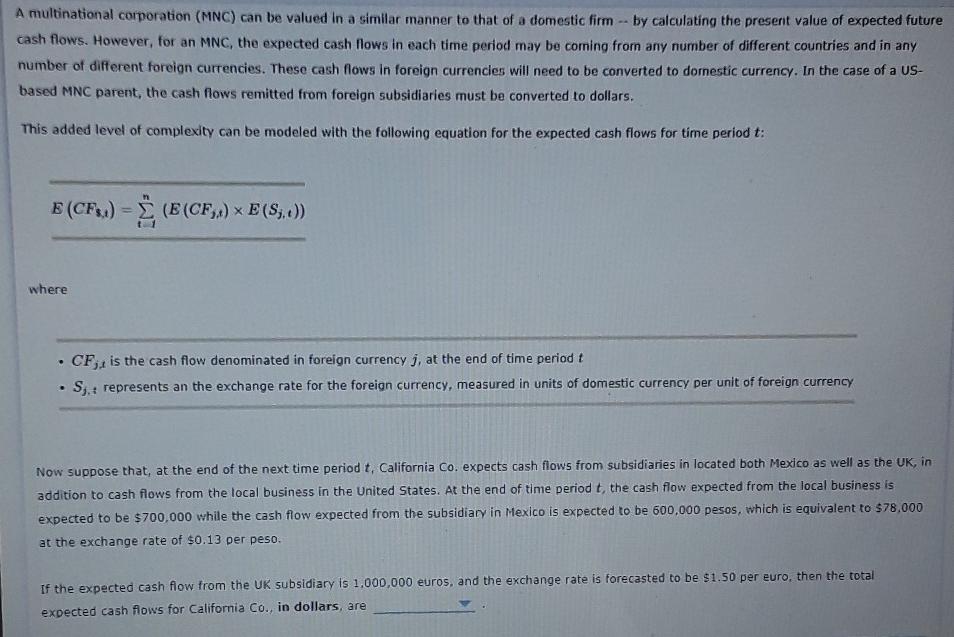

A multinational corporation (MNC) can be valued in a similar manner to that of a domestic firm by calculating the present value of expected future cash flows. However, for an MNC, the expected cash flows in each time period may be coming from any number of different countries and in any number of different foreign currencies. These cash flows in foreign currencies will need to be converted to domestic currency. In the case of a US- based MNC parent, the cash flows remitted from foreign subsidiaries must be converted to dollars. This added level of complexity can be modeled with the following equation for the expected cash flows for time period t: E (CF.) = (E (CF..) xE(S...) where . CF, is the cash flow denominated in foreign currencyj, at the end of time period t Sy represents an the exchange rate for the foreign currency, measured in units of domestic currency per unit of foreign currency . Now suppose that, at the end of the next time period t, California Co. expects cash flows from subsidiaries in located both Mexico as well as the UK, in addition to cash flows from the local business in the United States. At the end of time period t, the cash flow expected from the local business is expected to be $700.000 while the cash flow expected from the subsidiary in Mexico is expected to be 600.000 pesos, which is equivalent to $78.000 at the exchange rate of $0.13 per peso. If the expected cash flow from the UK subsidiary is 1.000.000 euros, and the exchange rate is forecasted to be $1.50 per euro, then the total expected cash flows for California Co., in dollars, areStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started