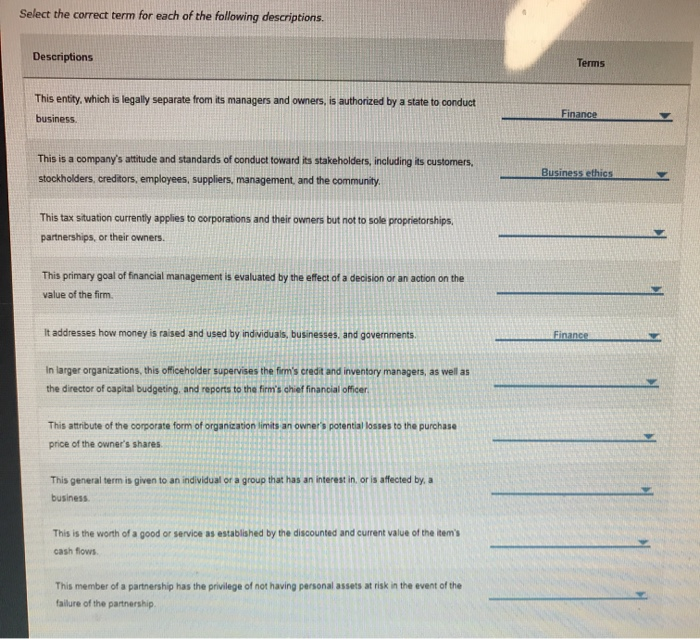

answer options are (business ethics, corporation, double taxation of dividends, finance, limited liability, limited partner, shareholder wealth maximization, stakeholder, treasurer, value)

Select the correct term for each of the following descriptions. Descriptions Terms This entity, which is legally separate from its managers and owners, is authorized by a state to conduct Finance business. This is a company's attitude and standards of conduct toward its stakeholders, including its customers, Business ethics stockholders, creditors, employees, suppliers, management, and the community. This tax situation currently applies to corporations and their owners but not to sole proprietorships, partnerships, or their owners. This primary goal of financial management is evaluated by the effect of a decision or an action on the value of the firm. It addresses how money is raised and used by individuais, businesses, and governments. Finance In larger organizations, this officeholder supervises the firm's credit and inventory managets, as well as the director of capital budgeting, and reports to the firm's chief financial officer. This attribute of the corporate form of organization limits an owner's potential losses to the purchase price of the owner's shares. This general term is given to an individual or a group that has an interest in, or is affected by, a business This is the worth of a good or service as established by the discounted and current value of the item's cash flows. This member of a partnership has the privilege of not having personal assets at risk in the event of the failure of the partnership. Select the correct term for each of the following descriptions. Descriptions Terms This entity, which is legally separate from its managers and owners, is authorized by a state to conduct Finance business. This is a company's attitude and standards of conduct toward its stakeholders, including its customers, Business ethics stockholders, creditors, employees, suppliers, management, and the community. This tax situation currently applies to corporations and their owners but not to sole proprietorships, partnerships, or their owners. This primary goal of financial management is evaluated by the effect of a decision or an action on the value of the firm. It addresses how money is raised and used by individuais, businesses, and governments. Finance In larger organizations, this officeholder supervises the firm's credit and inventory managets, as well as the director of capital budgeting, and reports to the firm's chief financial officer. This attribute of the corporate form of organization limits an owner's potential losses to the purchase price of the owner's shares. This general term is given to an individual or a group that has an interest in, or is affected by, a business This is the worth of a good or service as established by the discounted and current value of the item's cash flows. This member of a partnership has the privilege of not having personal assets at risk in the event of the failure of the partnership