Answered step by step

Verified Expert Solution

Question

1 Approved Answer

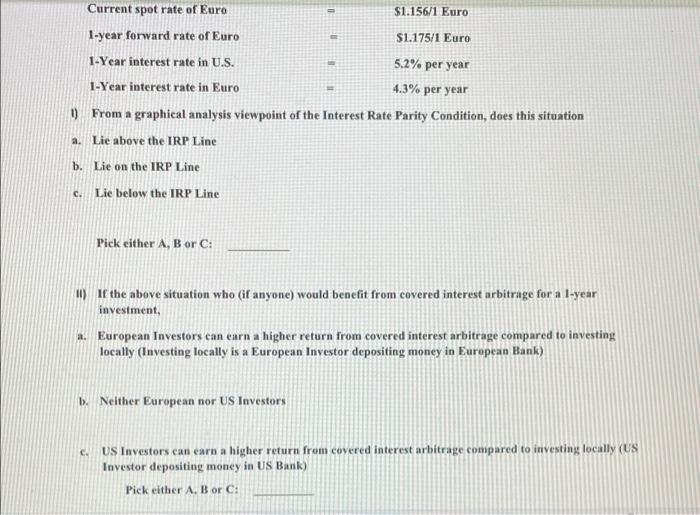

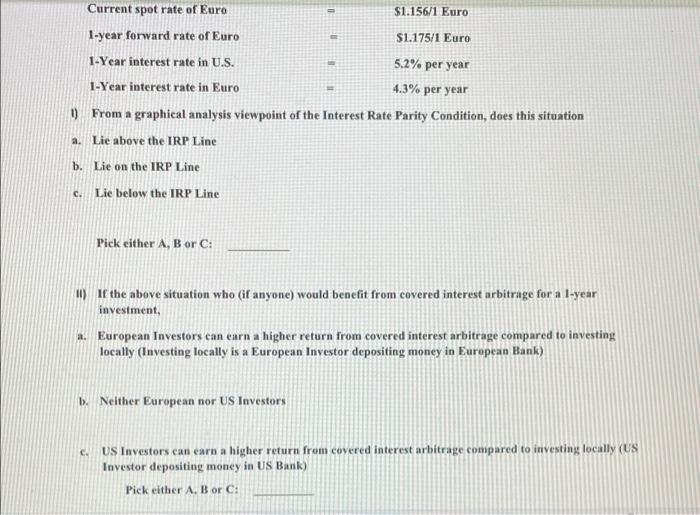

answer part 2 please Current spot rate of Euro $1.156/1 Euro 1-year forward rate of Euro $1.175/1 Euro 1-Year interest rate in U.S. 5.2% per

answer part 2 please

Current spot rate of Euro $1.156/1 Euro 1-year forward rate of Euro $1.175/1 Euro 1-Year interest rate in U.S. 5.2% per year 1-Year interest rate in Euro 4.3% per year 0 From a graphical analysis viewpoint of the Interest Rate Parity Condition, does this situation Lie above the IRP Line b. Lie on the IRP Line Lie below the IRP Line a. C. Pick either A, B or C: .) If the above situation who (if anyone) would benefit from covered interest arbitrage for a l-year investment, a. European Investors can earn a higher return from covered interest arbitrage compared to investing locally (Investing locally is a European Investor depositing money in European Bank) . Neither European por US Investors C. US Investors can earn a higher return from covered interest arbitrage compared to investing locally (US Investor depositing money in US Bank) Pick either A, B or C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started