Answer part a, b & c i'm giving you tables aswell give me the cprrect amswers, please. Answer the following questions. Table 6-4 or Table

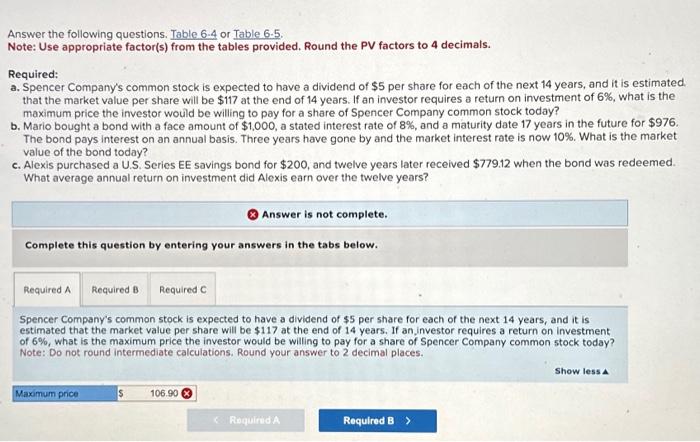

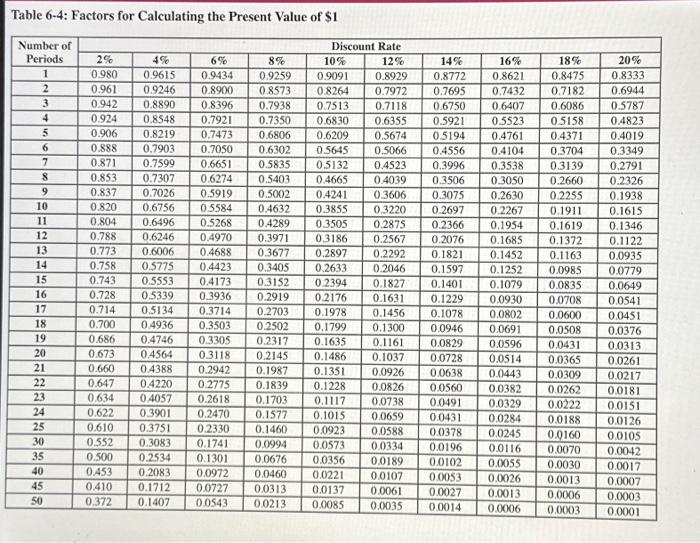

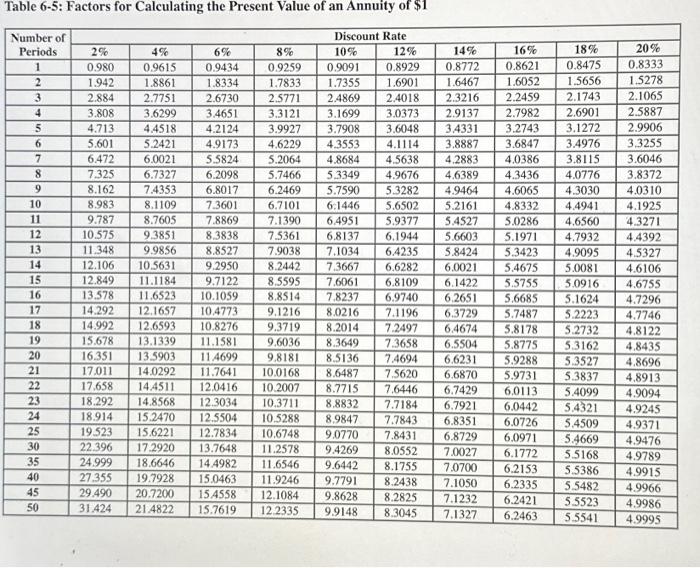

Answer the following questions. Table 6-4 or Table 6-5. Note: Use appropriate factor(s) from the tables provided. Round the PV factors to 4 decimals. Required: a. Spencer Company's common stock is expected to have a dividend of $5 per share for each of the next 14 years, and it is estimated. that the market value per share will be $117 at the end of 14 years. If an investor requires a return on investment of 6%, what is the maximum price the investor would be willing to pay for a share of Spencer Company common stock today? b. Mario bought a bond with a face amount of $1,000, a stated interest rate of 8%, and a maturity date 17 years in the future for $976. The bond pays interest on an annual basis. Three years have gone by and the market interest rate is now 10%. What is the market value of the bond today? c. Alexis purchased a U.S. Series EE savings bond for $200, and twelve years later received $779.12 when the bond was redeemed. What average annual return on investment did Alexis earn over the twelve years? Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required C Spencer Company's common stock is expected to have a dividend of $5 per share for each of the next 14 years, and it is estimated that the market value per share will be $117 at the end of 14 years. If an investor requires a return on investment of 6%, what is the maximum price the investor would be willing to pay for a share of Spencer Company common stock today? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Maximum price $ 106.90 Required A Required B > Show less A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Required A Calculating the maximum price an investor would be willing to pay for a share of Spencer Company common stock today Given Annual dividend 5 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started