Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer part a,b,c,d and e with formulas 5 Mr Cowdrey runs a manufacturing business. He is considering whether to accept one of two mutually exclusive

Answer part a,b,c,d and e with formulas

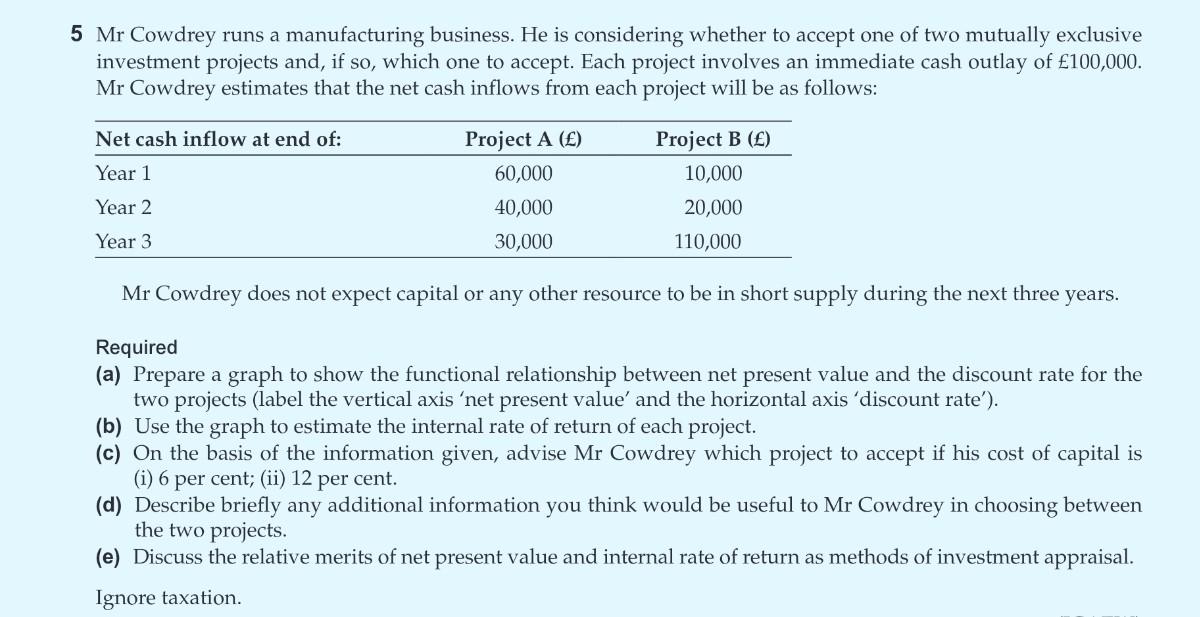

5 Mr Cowdrey runs a manufacturing business. He is considering whether to accept one of two mutually exclusive investment projects and, if so, which one to accept. Each project involves an immediate cash outlay of 100,000. Mr Cowdrey estimates that the net cash inflows from each project will be as follows: Net cash inflow at end of: Year 1 Project A () 60,000 40,000 30,000 Project B () 10,000 20,000 Year 2 Year 3 110,000 Mr Cowdrey does not expect capital or any other resource to be in short supply during the next three years. Required (a) Prepare a graph to show the functional relationship between net present value and the discount rate for the two projects (label the vertical axis 'net present value and the horizontal axis 'discount rate'). (b) Use the graph to estimate the internal rate of return of each project. (c) On the basis of the information given, advise Mr Cowdrey which project to accept if his cost of capital is (i) 6 per cent; (ii) 12 per cent. (d) Describe briefly any additional information you think would be useful to Mr Cowdrey in choosing between the two projects. (e) Discuss the relative merits of net present value and internal rate of return as methods of investment appraisal. Ignore taxationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started