Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer part b, and dropdown options are (Yes/No) H55 Ltd. prepares an aging schedule for its accounts receivable at the end of each month and

Answer part b, and dropdown options are (Yes/No)

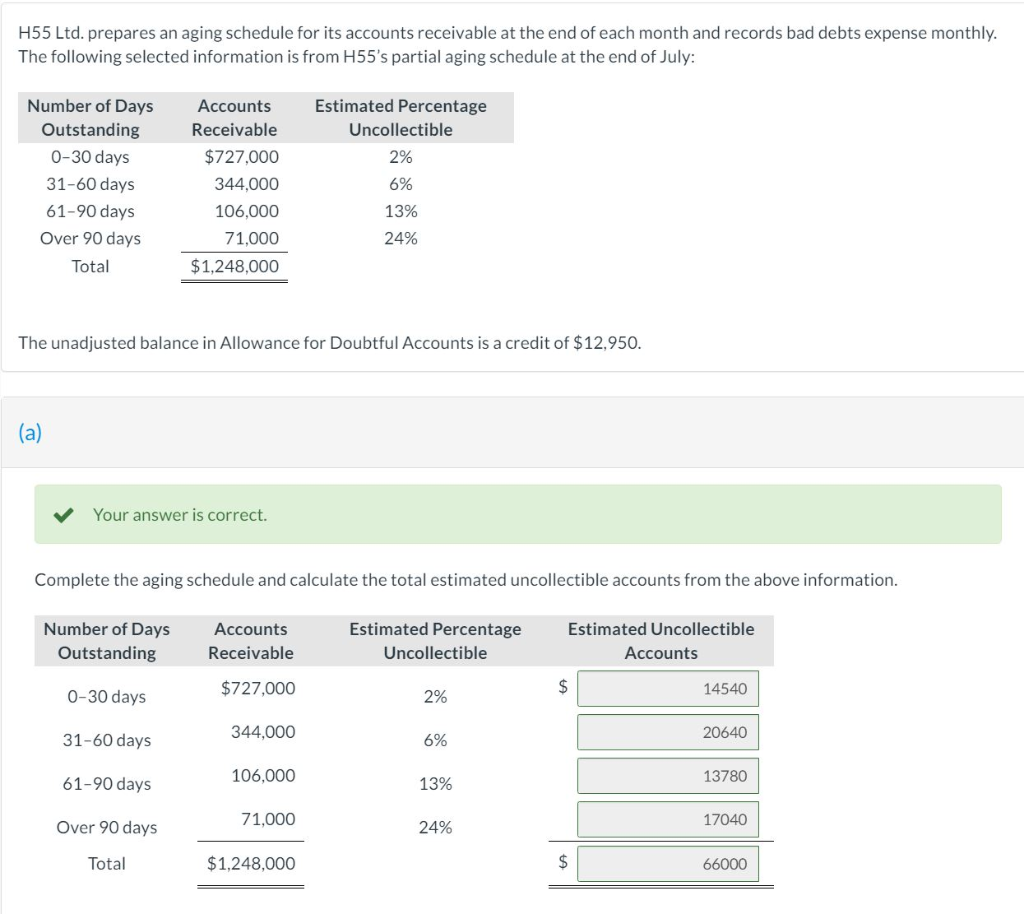

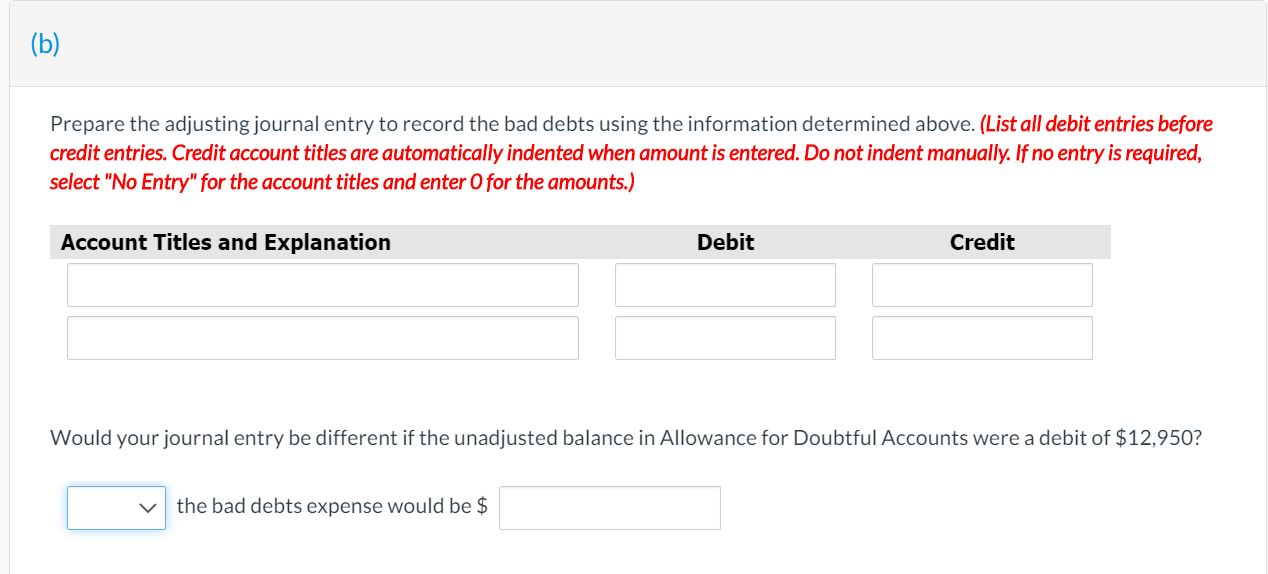

H55 Ltd. prepares an aging schedule for its accounts receivable at the end of each month and records bad debts expense monthly. The following selected information is from H55's partial aging schedule at the end of July: Estimated Percentage Uncollectible 2% Number of Days Outstanding 0-30 days 31-60 days 61-90 days Over 90 days Total Accounts Receivable $727,000 344,000 106,000 71.000 $1,248,000 6% 13% 24% The unadjusted balance in Allowance for Doubtful Accounts is a credit of $12,950. (a) Your answer is correct. Complete the aging schedule and calculate the total estimated uncollectible accounts from the above information. Number of Days Outstanding Accounts Receivable Estimated Percentage Uncollectible Estimated Uncollectible Accounts $727,000 $ 0-30 days 2% 14540 31-60 days 344,000 6% 20640 106,000 13780 61-90 days 13% Over 90 days 71,000 24% 17040 Total $1,248,000 $ 66000 (b) Prepare the adjusting journal entry to record the bad debts using the information determined above. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Would your journal entry be different if the unadjusted balance in Allowance for Doubtful Accounts were a debit of $12,950? the bad debts expense would be $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started