Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer part B!!! On July 1 , the company declared a 5% stock dividend at the fair value of the shares to the remaining common

Answer part B!!!

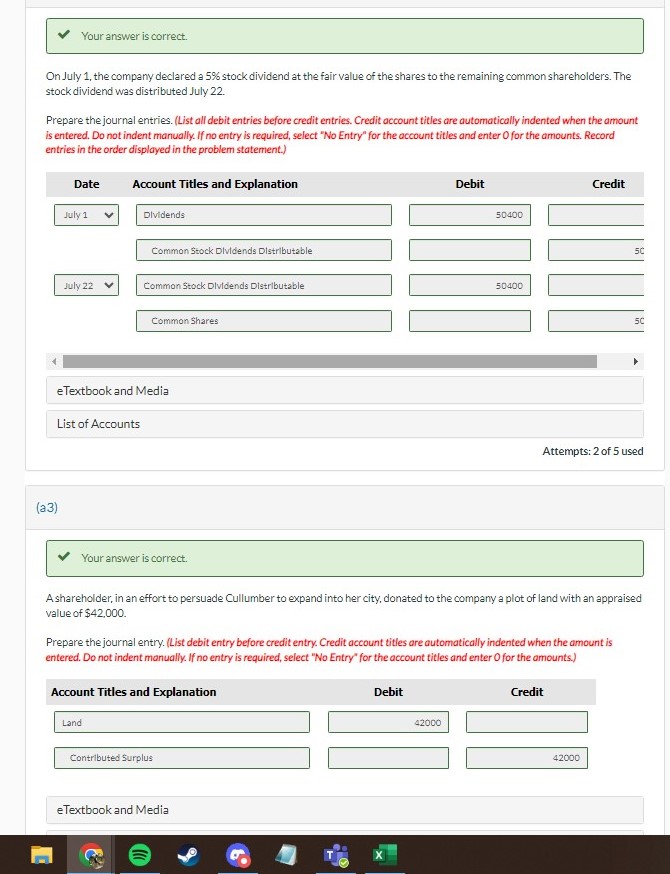

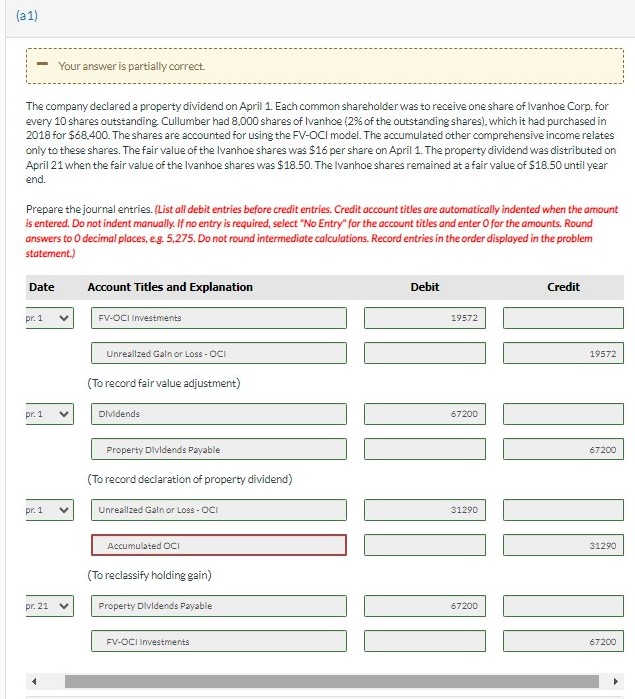

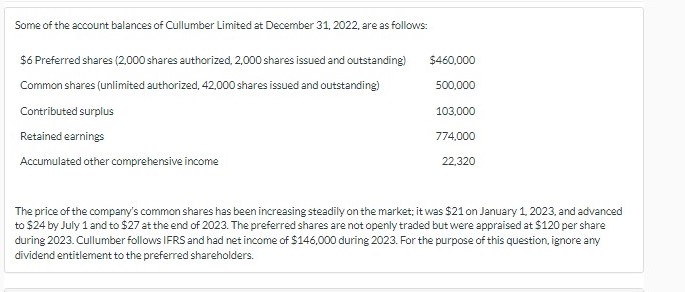

On July 1 , the company declared a 5% stock dividend at the fair value of the shares to the remaining common shareholders. The stock dividend was distributed July 22. Prepare the journal entries. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record entries in the order displayed in the problem statement.) Attempts: 2 of 5 used (a3) A shareholder, in an effort to persuade Cullumber to expand into her city, donated to the company a plot of land with an appraised value of $42,000. Prepare the journal entry. (List debit entry before credit entry. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select 'No Entry' for the account titles and enter O for the amounts.) The company declared a property dividend on April 1. Each common shareholder was to receive one share of Ivanhoe Corp. for every 10 shares outstanding. Cullumber had 8,000 shares of Ivanhoe ( 2% of the outstanding shares), which it had purchased in 2018 for $68,400. The shares are accounted for using the FV-OCl model. The accumulated other comprehensive income relates only to these shares. The fair value of the Ivanhoe shares was $16 per share on April 1. The property dividend was distributed on April 21 when the fair value of the lvanhoe shares was $18.50. The Ivanhoe shares remained at a fair value of $18.50 until year end. Prepare the journal entries. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 0 decimal places, e.g. 5,275. Do not round intermediate calculations. Record entries in the order displayed in the problem statement.) Some of the account balances of Cullumber Limited at December 31, 2022, are as follows: The price of the company's common shares has been increasing steadily on the market; it was $21 on January 1, 2023, and advanced to $24 by July 1 and to $27 at the end of 2023 . The preferred shares are not openly traded but were appraised at $120 per share during 2023. Cullumber follows IFRS and had net income of $146,000 during 2023 . For the purpose of this question, ignore any dividend entitlement to the preferred shareholdersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started