answer part b please. thank you

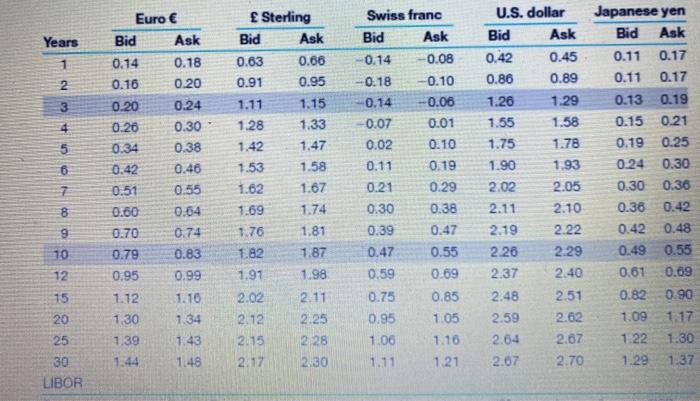

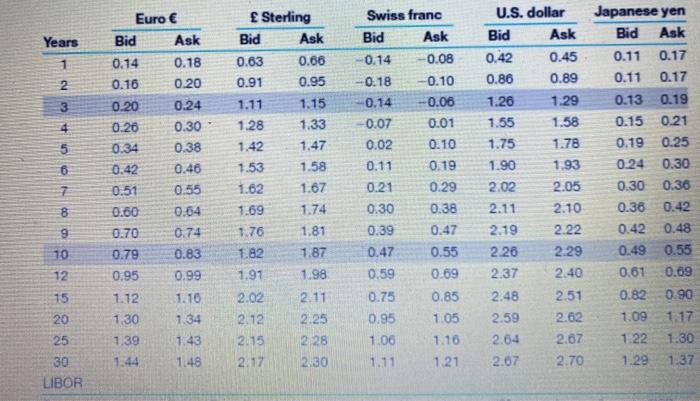

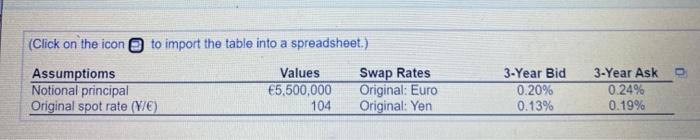

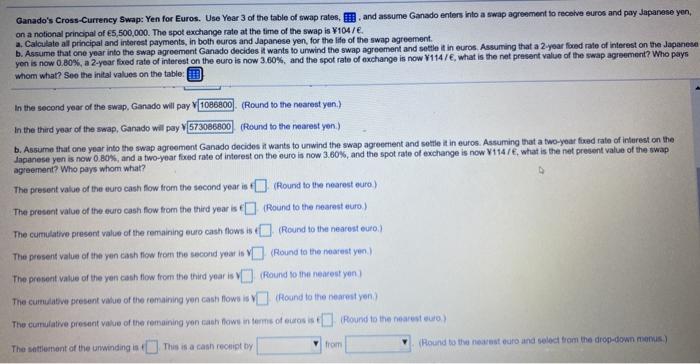

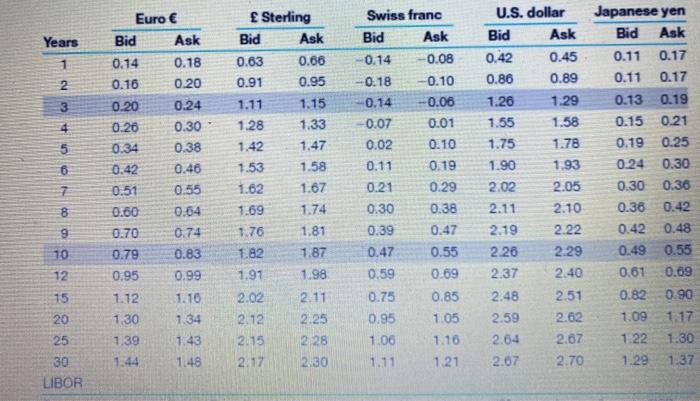

Years 2 3 1.11 4 6 7 Euro Bid Ask 0.14 0.18 0.16 0.20 0.20 0.24 0.26 0.30 0:34 0.38 0.42 0.46 0.51 0.55 0.60 0.04 0.70 0.74 0.79 0.83 0.95 0.99 1.12 1.16 1.30 1.34 1.39 1.43 1.48 Sterling Bid Ask 0.63 0.06 0.91 0.95 1.15 1.28 1.33 1.42 1.47 1.53 1.58 1.62 1.67 1.69 1.74 1.76 1.81 1.82 1.87 1.91 1.98 2.02 2.11 2.12 2:25 2.15 2.28 2.17 2.30 Swiss franc Bid Ask -0.14 -0.08 0.18 -0.10 0.14 -0.06 0.07 0.01 0.02 0.10 0.11 0.19 0.21 0.29 0.30 0.38 0.39 0.47 0.47 0.55 0.59 0.69 0.75 0.85 0.95 1.05 1.06 1.16 1.11 1.21 U.S. dollar Bid Ask 0.42 0.45 0.86 0.89 1.26 1.29 1.55 1.58 1.75 1.78 1.90 1.93 2.02 2.05 2.11 2.10 2.19 2.22 2.26 2.29 2.37 2.40 2.48 2.51 2.59 2.62 2.64 2.07 2.07 2.70 Japanese yen Bid Ask 0.11 0.17 0.11 0.17 0.13 0.19 0.15 0.21 0.19 0.25 0.24 0.30 0.30 0.36 0.36 0.42 0.42 0.48 0.49 0.55 0.61 0.09 0.82 0.90 1.09 1.17 1.22 1.30 1.29 1.37 8 9 10 12 15 20 25 30 LIBOR (Click on the icon to import the table into a spreadsheet.) Assumptioms Notional principal Original spot rate (Y/C) Values 5,500,000 104 Swap Rates Original: Euro Original: Yen 3-Year Bid 0.20% 0.13% 3-Year Ask 0.24% 0.19% Ganado's Cross-Currency Swap: Yen for Euros. Uno Year 3 of the table of swap rates, and assume Ganado enters into a swap agreement to receive euros and pay Japanese yen, on a notional principal of 5,500,000. The spot exchange rate at the time of the swap is V1047. a. Calculate all principal and interest payments, in both euros and Japanese yen, for the life of the swap agreement b. Assume that one year into the swap agreement Ganado decides i wants to unwind the swap agreement and settle it in euros. Assuming that a 2-year ford rate of interest on the Japanese yon is now 0.80%, a 2-year foxed rate of interest on the euro is now 3.60%, and the spot rate of exchange is now V1147, what is the net present value of the swap agreement? Who pays whom what? See the inital values on the table: In the second year of the swap, Ganado will pay 1086800). (Round to the nearest yan.) In the third year of the swap, Ganado will pay 573088800 (Round to the nearestyen) b. Assume that one year into the swap agreement Ganado decides it wants to unwind the swap agreement and settle it in euros. Assuming that a two-year foxed rate of interest on the Japanese yen is now 0.80%, and a two-year foxed rate of interest on the euro is now 3.60%, and the spot rate of exchange is now V114/6, what is the net present value of the swap agreement? Who pays whom what? The present value of the euro cash flow from the second year is (Round to the nearest euro) The present value of the euro cash flow from the third year is & Round to the nearest euro) The cumulative present value of the remaining euro cash flows is Round to the nearest euro) The present value of the yen cash flow from the second year is (Round to the nearest yon) The present value of the yen cash flow from the third year is (Round to the nearest yon The cumulative present value of the romaning yon canh tows is VD (Hound to the nearest yon) The cumulative present value of the romaining yon cash flow in terms of euros Round to the nearest euro) The matlument of the unwinding in this is a cash rooniat by from (Round to the nearest euro and select from the drop-down menus) Years 2 3 1.11 4 6 7 Euro Bid Ask 0.14 0.18 0.16 0.20 0.20 0.24 0.26 0.30 0:34 0.38 0.42 0.46 0.51 0.55 0.60 0.04 0.70 0.74 0.79 0.83 0.95 0.99 1.12 1.16 1.30 1.34 1.39 1.43 1.48 Sterling Bid Ask 0.63 0.06 0.91 0.95 1.15 1.28 1.33 1.42 1.47 1.53 1.58 1.62 1.67 1.69 1.74 1.76 1.81 1.82 1.87 1.91 1.98 2.02 2.11 2.12 2:25 2.15 2.28 2.17 2.30 Swiss franc Bid Ask -0.14 -0.08 0.18 -0.10 0.14 -0.06 0.07 0.01 0.02 0.10 0.11 0.19 0.21 0.29 0.30 0.38 0.39 0.47 0.47 0.55 0.59 0.69 0.75 0.85 0.95 1.05 1.06 1.16 1.11 1.21 U.S. dollar Bid Ask 0.42 0.45 0.86 0.89 1.26 1.29 1.55 1.58 1.75 1.78 1.90 1.93 2.02 2.05 2.11 2.10 2.19 2.22 2.26 2.29 2.37 2.40 2.48 2.51 2.59 2.62 2.64 2.07 2.07 2.70 Japanese yen Bid Ask 0.11 0.17 0.11 0.17 0.13 0.19 0.15 0.21 0.19 0.25 0.24 0.30 0.30 0.36 0.36 0.42 0.42 0.48 0.49 0.55 0.61 0.09 0.82 0.90 1.09 1.17 1.22 1.30 1.29 1.37 8 9 10 12 15 20 25 30 LIBOR (Click on the icon to import the table into a spreadsheet.) Assumptioms Notional principal Original spot rate (Y/C) Values 5,500,000 104 Swap Rates Original: Euro Original: Yen 3-Year Bid 0.20% 0.13% 3-Year Ask 0.24% 0.19% Ganado's Cross-Currency Swap: Yen for Euros. Uno Year 3 of the table of swap rates, and assume Ganado enters into a swap agreement to receive euros and pay Japanese yen, on a notional principal of 5,500,000. The spot exchange rate at the time of the swap is V1047. a. Calculate all principal and interest payments, in both euros and Japanese yen, for the life of the swap agreement b. Assume that one year into the swap agreement Ganado decides i wants to unwind the swap agreement and settle it in euros. Assuming that a 2-year ford rate of interest on the Japanese yon is now 0.80%, a 2-year foxed rate of interest on the euro is now 3.60%, and the spot rate of exchange is now V1147, what is the net present value of the swap agreement? Who pays whom what? See the inital values on the table: In the second year of the swap, Ganado will pay 1086800). (Round to the nearest yan.) In the third year of the swap, Ganado will pay 573088800 (Round to the nearestyen) b. Assume that one year into the swap agreement Ganado decides it wants to unwind the swap agreement and settle it in euros. Assuming that a two-year foxed rate of interest on the Japanese yen is now 0.80%, and a two-year foxed rate of interest on the euro is now 3.60%, and the spot rate of exchange is now V114/6, what is the net present value of the swap agreement? Who pays whom what? The present value of the euro cash flow from the second year is (Round to the nearest euro) The present value of the euro cash flow from the third year is & Round to the nearest euro) The cumulative present value of the remaining euro cash flows is Round to the nearest euro) The present value of the yen cash flow from the second year is (Round to the nearest yon) The present value of the yen cash flow from the third year is (Round to the nearest yon The cumulative present value of the romaning yon canh tows is VD (Hound to the nearest yon) The cumulative present value of the romaining yon cash flow in terms of euros Round to the nearest euro) The matlument of the unwinding in this is a cash rooniat by from (Round to the nearest euro and select from the drop-down menus)