answer part C and D

answer parts C and D

answer parts C-D

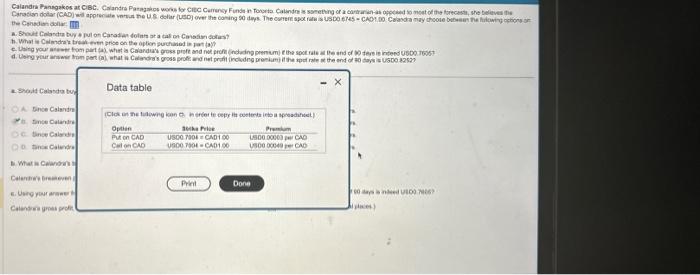

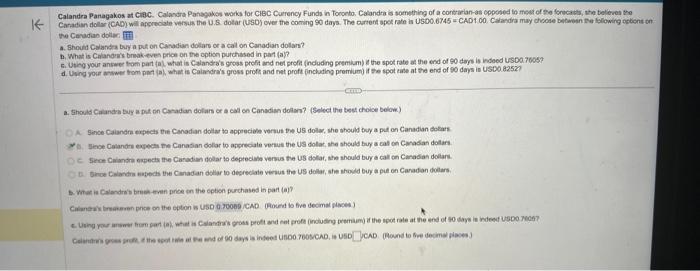

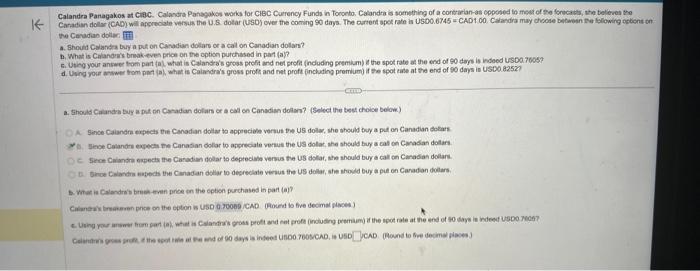

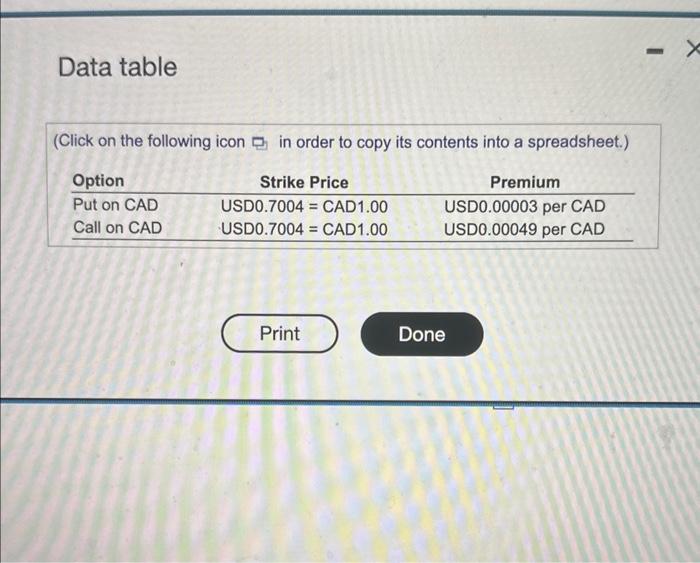

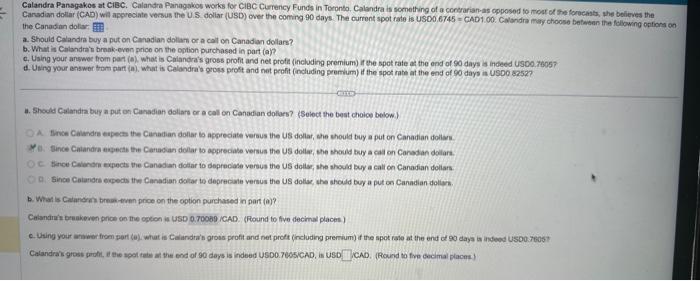

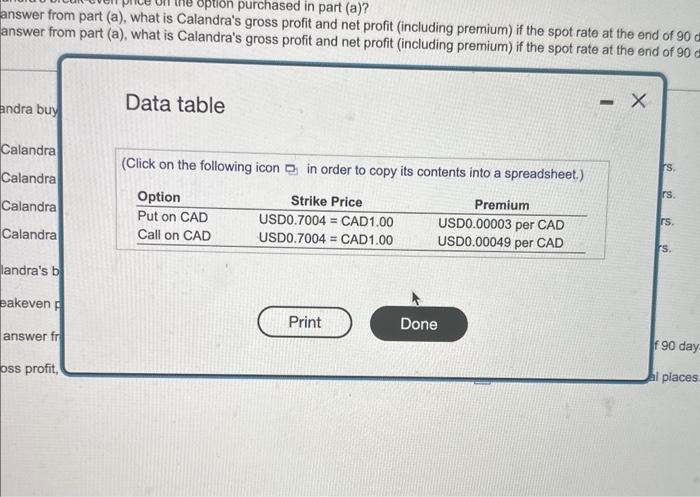

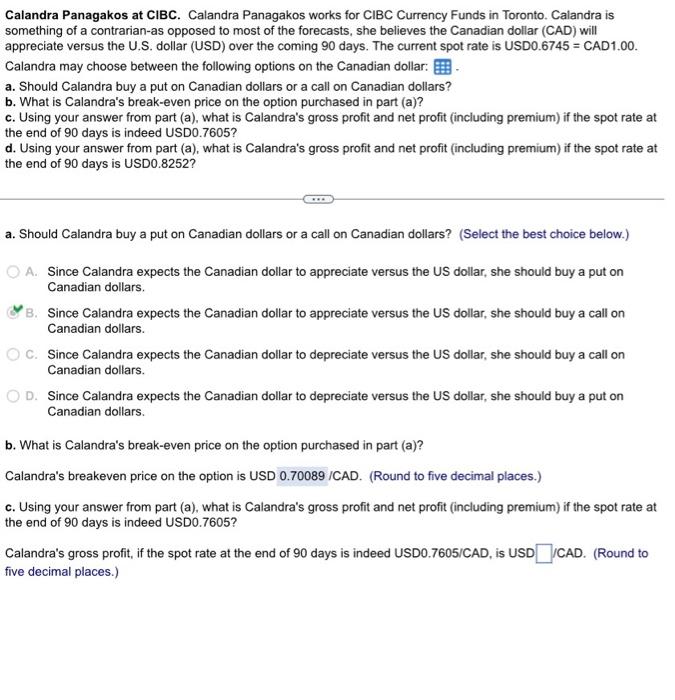

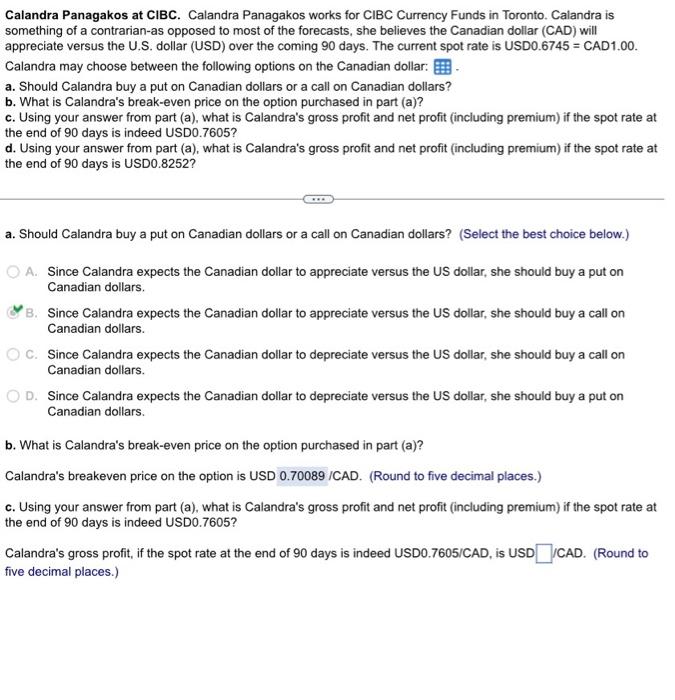

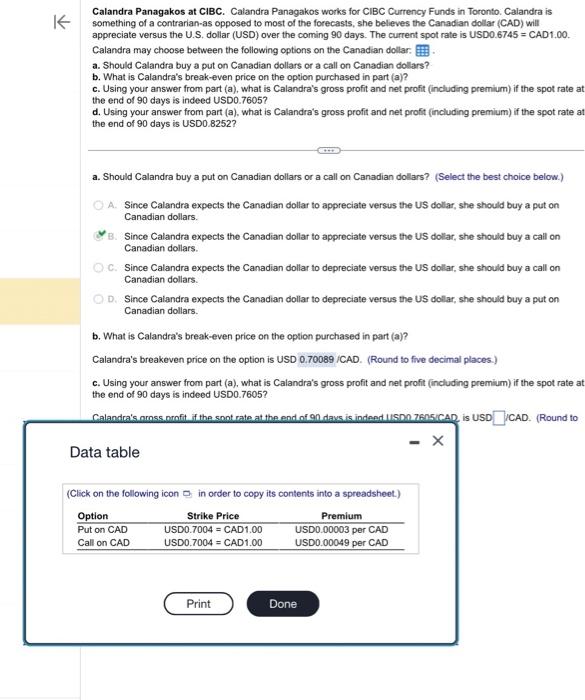

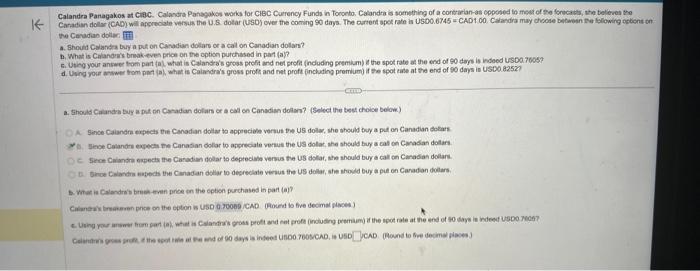

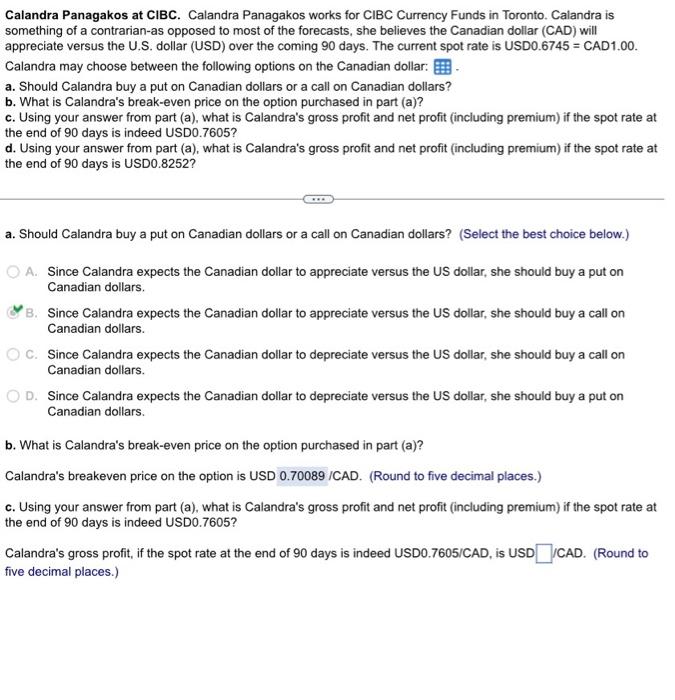

te cansdan dolse a. Shova Calandra buy a put on Caradan colart er a cal on Caradian dolars? the Consdithasias: Cin A. Bhoult Calandta buy a pul on Canadian dofint or a tal en Cansam dobias? Calandra Panagakos at CibC. Calandra Patagabes woks for CIBC Cuerency Funds in Tocoeb. Calandra is something of a conterarlan-as coposed to meet of the forteats, ate beleres the the Casadan doliter a. Should Cyandra buy a put on Canadian dolars or a cal on Canodian dolars? b. What is Calanderis binak-eves price on the option pulchased in pat (a)? a. Should Calandra Euy a pat on Casadan dofars or a cal en Canadim dolari? (Sielect the best choice below.) - Since Caiandn expets tie Canodan dolar to appreciale versus De US doll, she thould boyy a pit en Canadian dobars. B. Jece Calandre exseca pe Canasian dolor to apgresale veruit the US dolat, ahe should buy a cal ch Cwadian dotars. What is Calandres bruen-eren price in the cotion purchased in part (a)? Data table (Click on the following icon 2 in order to copy its contents into a spreadsheet.) Calandra Pansgakos at CiBC. Calandra Painagawos works for ClBC Curency Funds in Toronto. Calandra is something of a conerarian-as cpposed to moat of he foroeints, the beieves the Ihe Canadian dolar a. Should Calandra buy a put on Caradian dollam or a cat on Canadian dollars? b. What is Calandnet brenk-even price on the option purchased in part (a)? c. Using your arswer from pat (a). what is Cmlandra's gross profit and net proff (including premium) ir the spot rate at the end of 90 days is indeed USD0.7tos? d. Using your answer tom part (a), what is Celandrab gross proft and net peofit (neluding premum) if the spot rate at the end of 90 days it USD0 azs?? a. Should Calandta buy a put on Canadian ooliars or a call on Canadian dolars? (iSoloct the best choice bolow) answer from part (a), what is Calandra's gross profit and net profit (including premium) if the spot rate at the end of 90 answer from part (a), what is Calandra's gross profit and net profit (including premium) if the spot rate at the end of 90c Data table Calandra Calandra (Click on the following icon in order to copy its contents into a spreadsheet.) Calandra Panagakos at CIBC. Calandra Panagakos works for CIBC Currency Funds in Toronto. Calandra is something of a contrarian-as opposed to most of the forecasts, she believes the Canadian dollar (CAD) will appreciate versus the U.S. dollar (USD) over the coming 90 days. The current spot rate is USD0.6745 = CAD1.00. Calandra may choose between the following options on the Canadian dollar: a. Should Calandra buy a put on Canadian dollars or a call on Canadian dollars? b. What is Calandra's break-even price on the option purchased in part (a)? c. Using your answer from part (a), what is Calandra's gross profit and net profit (including premium) if the spot rate at the end of 90 days is indeed USD0.7605? d. Using your answer from part (a), what is Calandra's gross profit and net profit (including premium) if the spot rate at the end of 90 days is USD0.8252? a. Should Calandra buy a put on Canadian dollars or a call on Canadian dollars? (Select the best choice below.) A. Since Calandra expects the Canadian dollar to appreciate versus the US dollar, she should buy a put on Canadian dollars. B. Since Calandra expects the Canadian dollar to appreciate versus the US dollar, she should buy a call on Canadian dollars. C. Since Calandra expects the Canadian dollar to depreciate versus the US dollar, she should buy a call on Canadian dollars. D. Since Calandra expects the Canadian dollar to depreciate versus the US dollar, she should buy a put on Canadian dollars. b. What is Calandra's break-even price on the option purchased in part (a)? Calandra's breakeven price on the option is USD 0.70089 /CAD. (Round to five decimal places.) c. Using your answer from part (a), what is Calandra's gross profit and net profit (including premium) if the spot rate at the end of 90 days is indeed USDO.7605? Calandra's gross profit, if the spot rate at the end of 90 days is indeed USD0.7605/CAD, is USD ICAD. (Round to five decimal places.) Calandra Panagakos at CIBC. Calandra Panagakos works for CIBC Currency Funds in Toronto. Calandra is something of a contrarian-as opposed to most of the forecasts, she believes the Canadian dollar (CAD) will appreciate versus the U.S. dollar (USD) over the coming 90 days. The current spot rate is USD0.6745 = CAD1.00. Calandra may choose between the following options on the Canadian dollar: a. Should Calandra buy a put on Canadian dollars or a call on Canadian dollars? b. What is Calandra's break-even price on the option purchased in part (a)? c. Using your answer from part (a), what is Calandra's gross profit and net profit (including premium) if the spot rate at the end of 90 days is indeed USDO.7605? d. Using your answer from part (a), what is Calandra's gross profit and net profit (including premium) if the spot rate a the end of 90 days is USD0 8252 ? a. Should Calandra buy a put on Canadian dollars or a call on Canadian dollars? (Select the best choice below.) A. Since Calandra expects the Canadian dollar to appreciate versus the US dollar, she should buy a put on Canadian dollars. B. Since Calandra expects the Canadian dollar to appreciate versus the US dollar, she should buy a call on Canadian dollars. C. Since Calandra expects the Canadian dollar to depreciate versus the US dollar, she should buy a call on Canadian dollars. D. Since Calandra expects the Canadian dollar to depreciate versus the US dollar, she should buy a put on Canadian dollars. b. What is Calandra's break-even price on the option purchased in part (a)? Calandra's breakeven price on the option is USD 0.70089 /CAD. (Round to five decimal places.) c. Using your answer from part (a), what is Calandra's gross profit and net profit (including premium) if the spot rate at the end of 90 days is indeed USD0.7605? Calandra's mross monfit if the snot rate at the end of 9n davs is indead ISDO 760 SCAD, is USD ICAD. (Round to Data table (Click on the following icon in order to copy its contents into a spreadsheet.)