Question

ANSWER PART E & F List the above items in a T account Equity and Liabilities Amount Assets Amount Bank capital 10 loan (debtors) 90

ANSWER PART E & F

- List the above items in a T account

| Equity and Liabilities | Amount | Assets | Amount |

| Bank capital | 10 | loan (debtors) | 90 |

| Deposits | 100 | (loan to power investments inc) | 05 |

| (withdrawal) | (10) | 95 | |

| 90 | (deduct bad debts) | (05) | |

| Reserves (90*10%) | 09 | net loan / debtors | 90 |

| securities | 10 | ||

| cash / cash equivalents | 09 | ||

| 109 | 109 |

- Assume the desired reserve is 10%. Calculate the desired and the excess reserve, if any, for both banks.

BANK A

- Desired reserves= deposit x desired reserve ratio

- Desired reserves = 100 x 10%

- Desired reserves= 100 x 0.1

- Desired reserves=10

- Excess reserves= reserves - desired reserves

- Excess reserves=10-10

- Excess reserves=0.

- BANK A has desired reserves of 10 and excess reserves of 0.

BANK B

- Desired reserves= 110 x 10%

- Desired reserves=110 x 0.1

- Desired reserves= 11

- Excess reserves= reserves - desired reserves

- Excess reserves=14-11

- Excess reserves= 3

- BANK B has desired reserves of 11 and excess reserves of 3.

- A client withdrew 10 million from Bank B. Show the changes in the T account of Bank B. If there is a reserve deficiency what would the bank do?

| Bank B | |||||||

| Assets | Original Amount | Change | Amount after change | Liabilities | Original Amount | Change | Amount after change |

| Reserves | 14 | -10 | 4 | Deposits | 110 | -10 | 100 |

| Loans | 90 | 0 | 90 | Bank's Capital | 4 | 0 | 4 |

| Securities | 10 | 0 | 10 | ||||

| Total | 114 | 104 | Total | 114 | 104 |

- If the withdrawal results in a reserve shortage, Bank B can take the following actions:

- Alternatively, sell the securities, reclaim the loans, or borrow funds from the central bank.

- Suppose that each Bank made a $5 million loan to Power Investments Incorporated. Power Investments uses its loans to undertake a risky project, goes bankrupt and defaults on its loans. How will this affect each of the two banks? Show your work

We can observe that Bank A has a total of $10 million in bank capital. As a result, if a loan of $5 million goes bad and causes losses, Bank A's capital is cut to $5 million, and the company goes out of business. Despite the fact that bank A's capital remains positive, the bank becomes more vulnerable to new bad loans, if any are made.

The existing bank capital of bank B is merely $4 million, as can be seen in the example above. If a loan for $5 million goes bad, the bank's capital will fall into negative territory, and the bank will be forced to file for bankruptcy. Bank B is required to raise capital as soon as possible in order to avoid bankruptcy proceedings being filed against it.

E. What types of government regulations might have prevented these outcomes in d?

F. What types of actions by the banks might have prevented these outcomes in d?

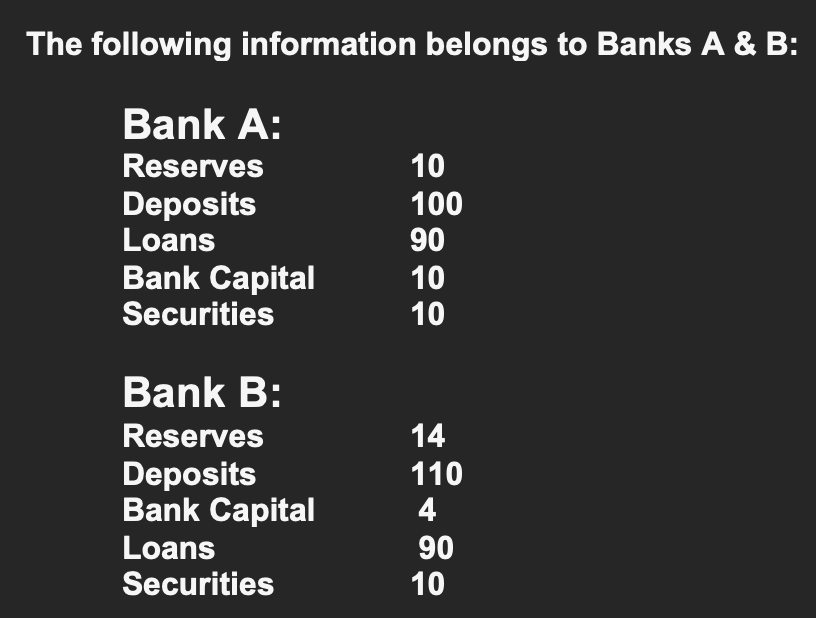

The following information belongs to Banks A & B: Bank A: Reserves Deposits Loans Bank Capital Securities 10 100 90 10 10 Bank B: Reserves Deposits Bank Capital Loans Securities 14 110 4 90 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started