Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer please 1. a. There are 6 (Six) sets of questions, Answer any 4 (Four) sets. Suppose, you have recently taken a short-term loan of

answer please

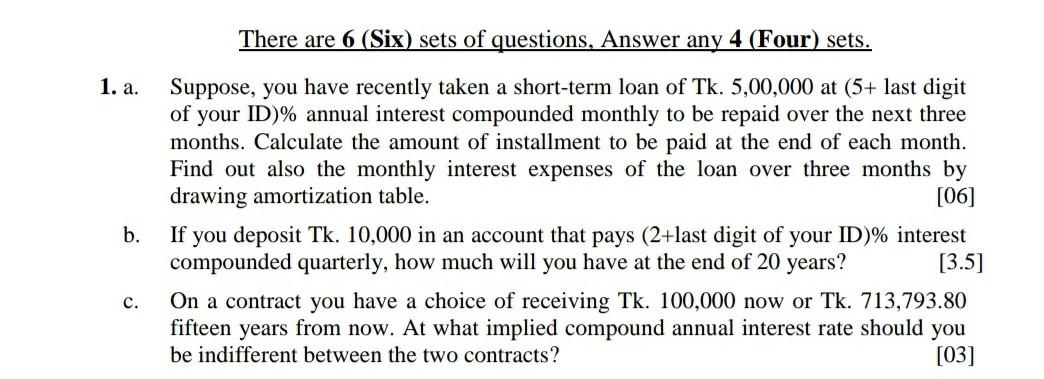

1. a. There are 6 (Six) sets of questions, Answer any 4 (Four) sets. Suppose, you have recently taken a short-term loan of Tk. 5,00,000 at (5+ last digit of your ID)% annual interest compounded monthly to be repaid over the next three months. Calculate the amount of installment to be paid at the end of each month. Find out also the monthly interest expenses of the loan over three months by drawing amortization table. [06] If you deposit Tk. 10,000 in an account that pays (2+last digit of your ID)% interest compounded quarterly, how much will you have at the end of 20 years? [3.5] On a contract you have a choice of receiving Tk. 100,000 now or Tk. 713,793.80 fifteen years from now. At what implied compound annual interest rate should you be indifferent between the two contracts? [03] b. c. 1. a. There are 6 (Six) sets of questions, Answer any 4 (Four) sets. Suppose, you have recently taken a short-term loan of Tk. 5,00,000 at (5+ last digit of your ID)% annual interest compounded monthly to be repaid over the next three months. Calculate the amount of installment to be paid at the end of each month. Find out also the monthly interest expenses of the loan over three months by drawing amortization table. [06] If you deposit Tk. 10,000 in an account that pays (2+last digit of your ID)% interest compounded quarterly, how much will you have at the end of 20 years? [3.5] On a contract you have a choice of receiving Tk. 100,000 now or Tk. 713,793.80 fifteen years from now. At what implied compound annual interest rate should you be indifferent between the two contracts? [03] b. cStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started