Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer please I will like Jamison and Co makes lightweight yoga mats. Jamison is preparing its budget for the second quarter of 2023. 1. Each

Answer please I will like

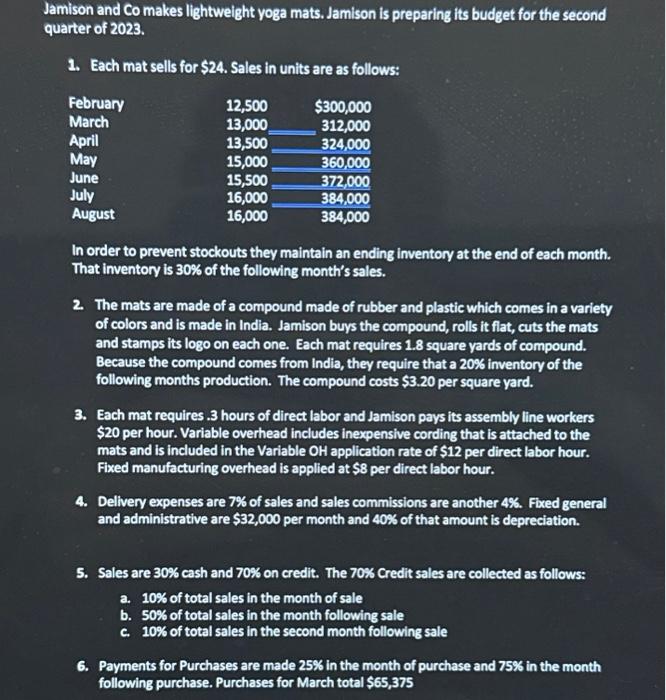

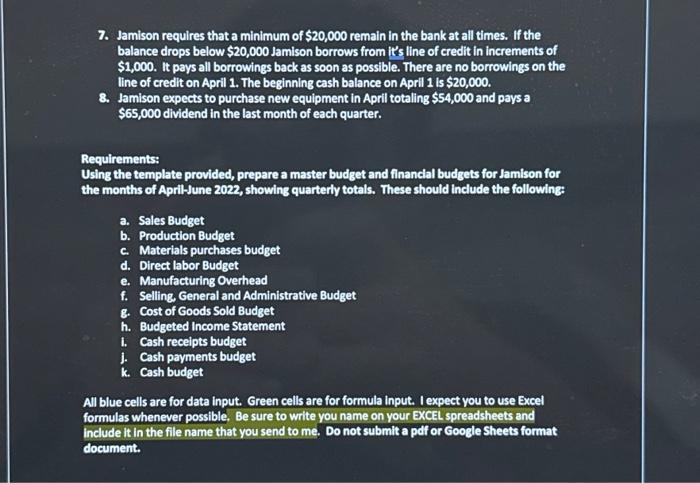

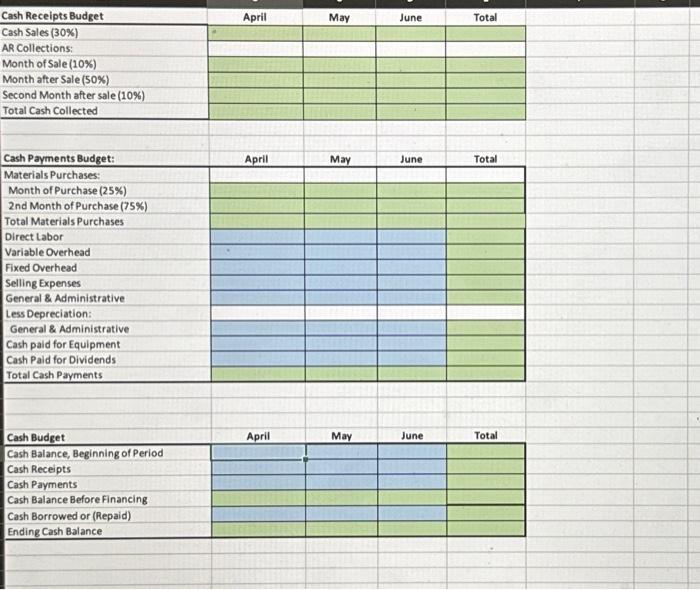

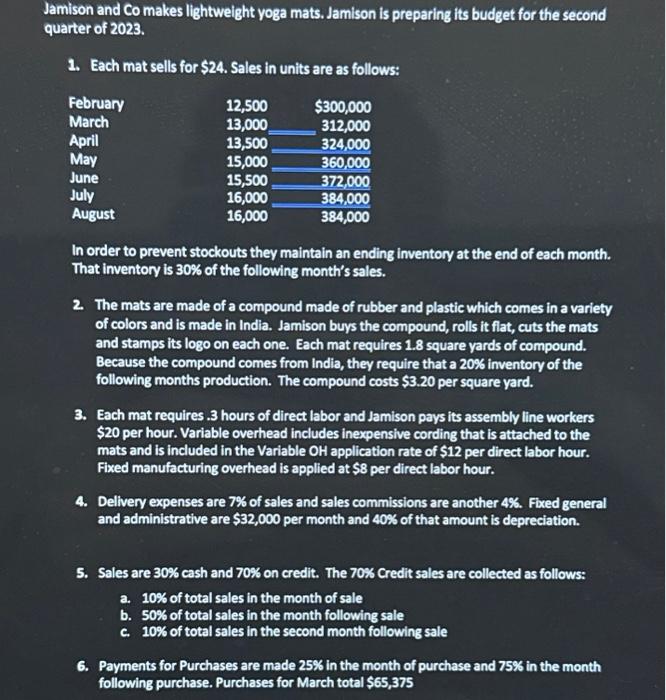

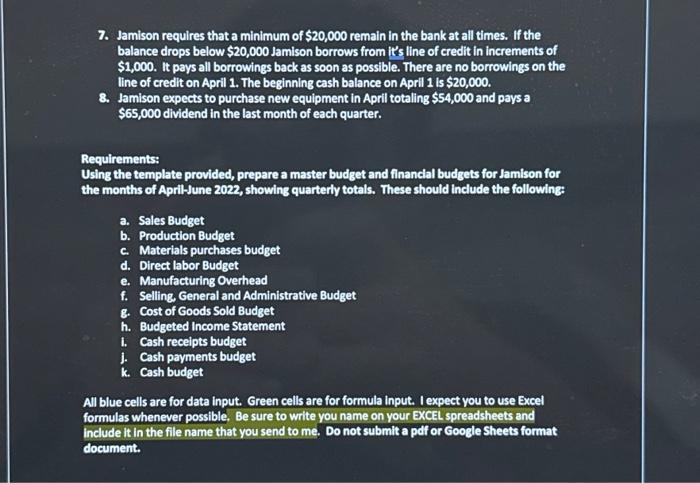

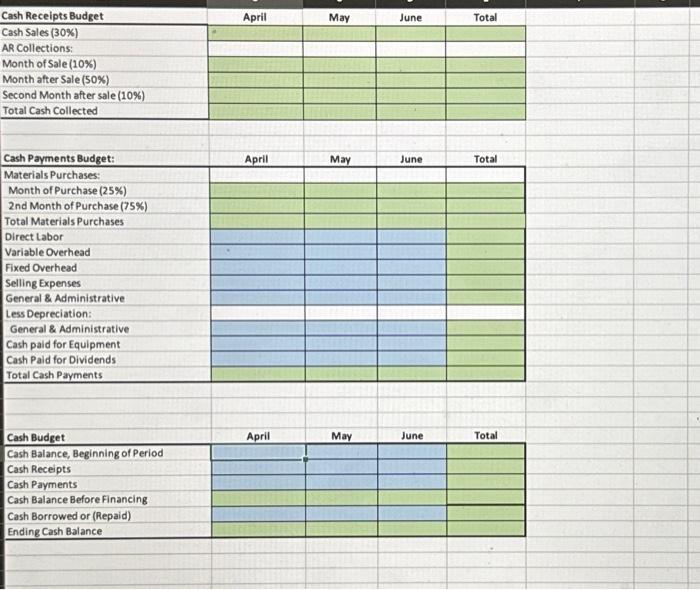

Jamison and Co makes lightweight yoga mats. Jamison is preparing its budget for the second quarter of 2023. 1. Each mat sells for $24. Sales in units are as follows: In order to prevent stockouts they maintain an ending inventory at the end of each month. That inventory is 30% of the following month's sales. 2. The mats are made of a compound made of rubber and plastic which comes in a variety of colors and is made in India. Jamison buys the compound, rolls it flat, cuts the mats and stamps its logo on each one. Each mat requires 1.8 square yards of compound. Because the compound comes from India, they require that a 20% inventory of the following months production. The compound costs $3.20 per square yard. 3. Each mat requires .3 hours of direct labor and Jamison pays its assembly line workers $20 per hour. Variable overhead includes inexpensive cording that is attached to the mats and is included in the Variable OH application rate of $12 per direct labor hour. Fixed manufacturing overhead is applied at $8 per direct labor hour. 4. Delivery expenses are 7% of sales and sales commissions are another 4%. Fixed general and administrative are $32,000 per month and 40% of that amount is depreciation. 5. Sales are 30% cash and 70% on credit. The 70% Credit sales are collected as follows: a. 10% of total sales in the month of sale b. 50% of total sales in the month following sale c. 10% of total sales in the second month following sale 6. Payments for Purchases are made 25% in the month of purchase and 75% in the month following purchase. Purchases for March total \$65,375 7. Jamison requires that a minimum of $20,000 remain in the bank at all times. If the balance drops below $20,000 Jamison borrows from it's line of credit in increments of $1,000. It pays all borrowings back as soon as possible. There are no borrowings on the line of credit on April 1. The beginning cash balance on April 1 is $20,000. 8. Jamison expects to purchase new equipment in April totaling $54,000 and pays a $65,000 dividend in the last month of each quarter. Requirements: Using the template provided, prepare a master budget and financlal budgets for Jamison for the months of April-June 2022, showing quarterly totals. These should include the following: a. Sales Budget b. Production Budget c. Materials purchases budget d. Direct labor Budget e. Manufacturing Overhead f. Selling, General and Administrative Budget g. Cost of Goods Sold Budget h. Budgeted Income Statement i. Cash recelpts budget j. Cash payments budget k. Cash budget All blue cells are for data input. Green cells are for formula input. I expect you to use Excel formulas whenever possible, Be sure to write you name on your EXCEL spreadsheets and include it in the file name that you send to me. Do not submit a pdf or Google Sheets format document. Cash Receipts Budget April May June Total Cash Sales (30\%) AR Collections: Month of Sale (10\%) Month after Sale ( 50% ) Second Month after sale (10\%) Total Cash Collected \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Cash Payments Budget: Materials Purchases: Month of Purchase (25\%) 2nd Month of Purchase (75\%) Total Materials Purchases Direct Labor Variable Overhead Fixed Overhead Selling Expenses General \& Administrative Less Depreciation: General \& Administrative Cash paid for Equipment Cash Paid for Dividends Total Cash Payments April May June Total \begin{tabular}{|c|c|c|c|c|} \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline Cash Budget & April & May & June & Total \\ \hline \multicolumn{5}{|l|}{ Cash Balance, Beginning of Period } \\ \hline \multicolumn{5}{|l|}{ Cash Receipts } \\ \hline \multicolumn{5}{|l|}{ Cash Payments } \\ \hline \multicolumn{5}{|l|}{ Cash Balance Before Financing } \\ \hline \multicolumn{5}{|l|}{ Cash Borrowed or (Repaid) } \\ \hline Ending Cash Balance & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started