Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer please The following information has been extracted from Pride Co. and Safola Co. on June 30, 2020. Pride Co. Safola Co. Safola Co. Book

answer please

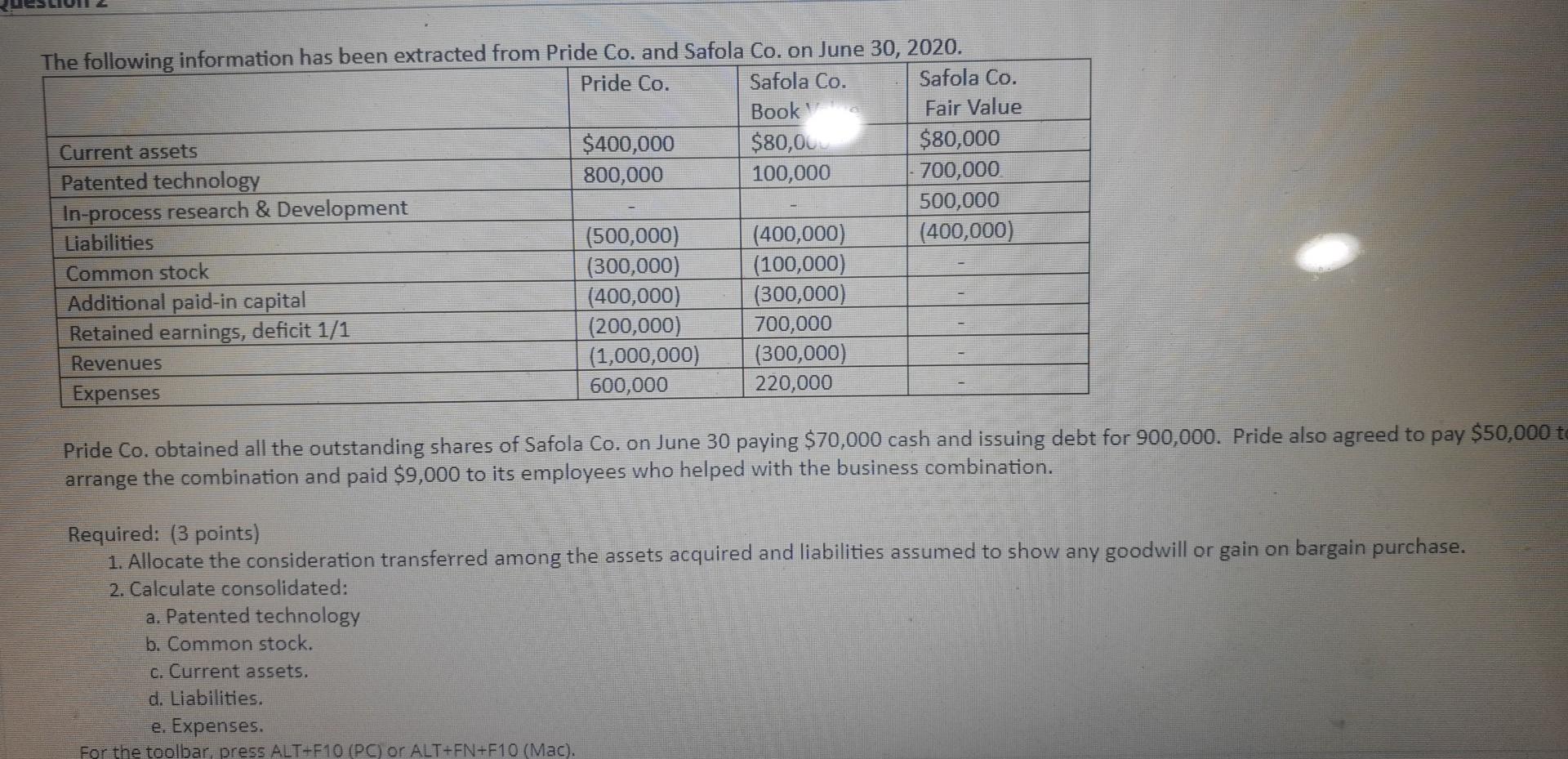

The following information has been extracted from Pride Co. and Safola Co. on June 30, 2020. Pride Co. Safola Co. Safola Co. Book Fair Value Current assets $400,000 $80,00 $80,000 Patented technology 800,000 100,000 - 700,000 In-process research & Development 500,000 Liabilities (500,000) (400,000) (400,000) Common stock (300,000) (100,000) Additional paid-in capital (400,000) (300,000) Retained earnings, deficit 1/1 (200,000) 700,000 Revenues (1,000,000) (300,000) Expenses 600,000 220,000 Pride Co. obtained all the outstanding shares of Safola Co. on June 30 paying $70,000 cash and issuing debt for 900,000. Pride also agreed to pay $50,000 to arrange the combination and paid $9,000 to its employees who helped with the business combination. Required: (3 points) 1. Allocate the consideration transferred among the assets acquired and liabilities assumed to show any goodwill or gain on bargain purchase. 2. Calculate consolidated: a. Patented technology b. Common stock. c. Current assets. d. Liabilities. e. Expenses. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started