answer please urgent need

do not use excell

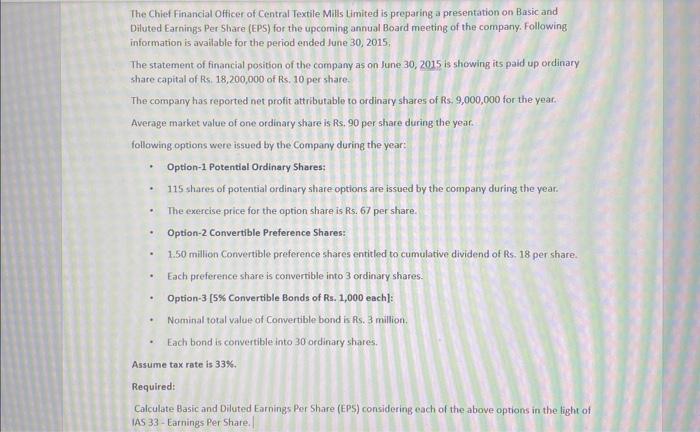

The Chief Financial Officer of Central Textile Mills timited is preparing a presentation on Basic and Diluted Earnings Per-Share (EPS) for the upcorning annual Board meeting of the company. Following information is available for the period ended June 30, 2015, The statement of financial position of the company as on lune 30,2015 is showing its paid up ordinary share capital of Rs, 18,200,000 of Rs. 10 per share. The company has reported net profit attributable to ordinary shares of Rs, 9,000,000 for the year. Average market value of one ordinary share is Rs, 90 per share during the year. following options were issued by the Company during the year: - Option-1 Potential Ordinary Shares: - 115 shares of potential ordinary share options are issued by the company during the year. - The exercise price for the option share is Rs. 67 per share. - Option-2 Convertible Preference Shares: - 1.50 million Convertible preference shares entitled to cumulative dividend of Rs. 18 per share. - Each preference share is convertible into 3 ordinary shares. - Option-3 [5\% Convertible Bonds of Rs. 1,000 each]: - Nominal total value of Comvertible bond is fs. 3 million. - Each bond is convertible into 30 ordinary shares. Assume tax rate is 33%. Required: Calculate Basic and Diluted Earnings Per Share (EPS) considering each of the above options in the light of IAS 33 - Earnings Per Share. The Chief Financial Officer of Central Textile Mills timited is preparing a presentation on Basic and Diluted Earnings Per-Share (EPS) for the upcorning annual Board meeting of the company. Following information is available for the period ended June 30, 2015, The statement of financial position of the company as on lune 30,2015 is showing its paid up ordinary share capital of Rs, 18,200,000 of Rs. 10 per share. The company has reported net profit attributable to ordinary shares of Rs, 9,000,000 for the year. Average market value of one ordinary share is Rs, 90 per share during the year. following options were issued by the Company during the year: - Option-1 Potential Ordinary Shares: - 115 shares of potential ordinary share options are issued by the company during the year. - The exercise price for the option share is Rs. 67 per share. - Option-2 Convertible Preference Shares: - 1.50 million Convertible preference shares entitled to cumulative dividend of Rs. 18 per share. - Each preference share is convertible into 3 ordinary shares. - Option-3 [5\% Convertible Bonds of Rs. 1,000 each]: - Nominal total value of Comvertible bond is fs. 3 million. - Each bond is convertible into 30 ordinary shares. Assume tax rate is 33%. Required: Calculate Basic and Diluted Earnings Per Share (EPS) considering each of the above options in the light of IAS 33 - Earnings Per Share