Answered step by step

Verified Expert Solution

Question

1 Approved Answer

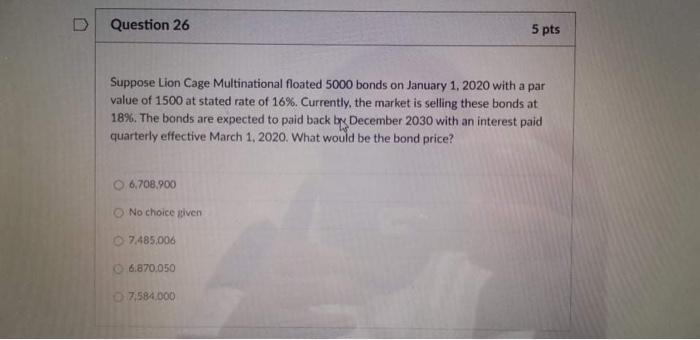

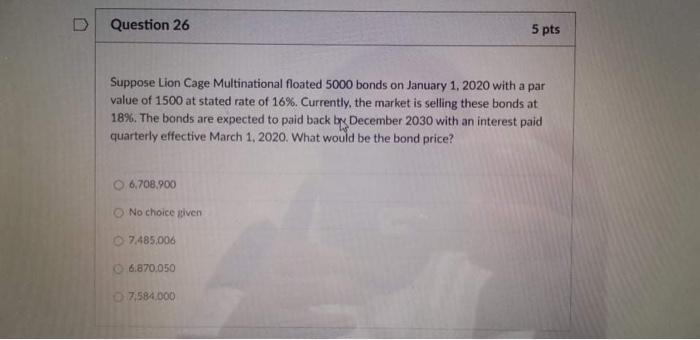

answer pls D Question 26 5 pts Suppose Lion Cage Multinational floated 5000 bonds on January 1, 2020 with a par value of 1500 at

answer pls

D Question 26 5 pts Suppose Lion Cage Multinational floated 5000 bonds on January 1, 2020 with a par value of 1500 at stated rate of 16%. Currently, the market is selling these bonds at 18%. The bonds are expected to paid back by December 2030 with an interest paid quarterly effective March 1, 2020. What would be the bond price? 6.708.900 No choice iven 7.485.006 6.870.050 7,584,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started