Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer pls Question 5 (20 points) The following information as to earnings and deductions for the two-wook pay period ended January 29, was taken from

answer pls

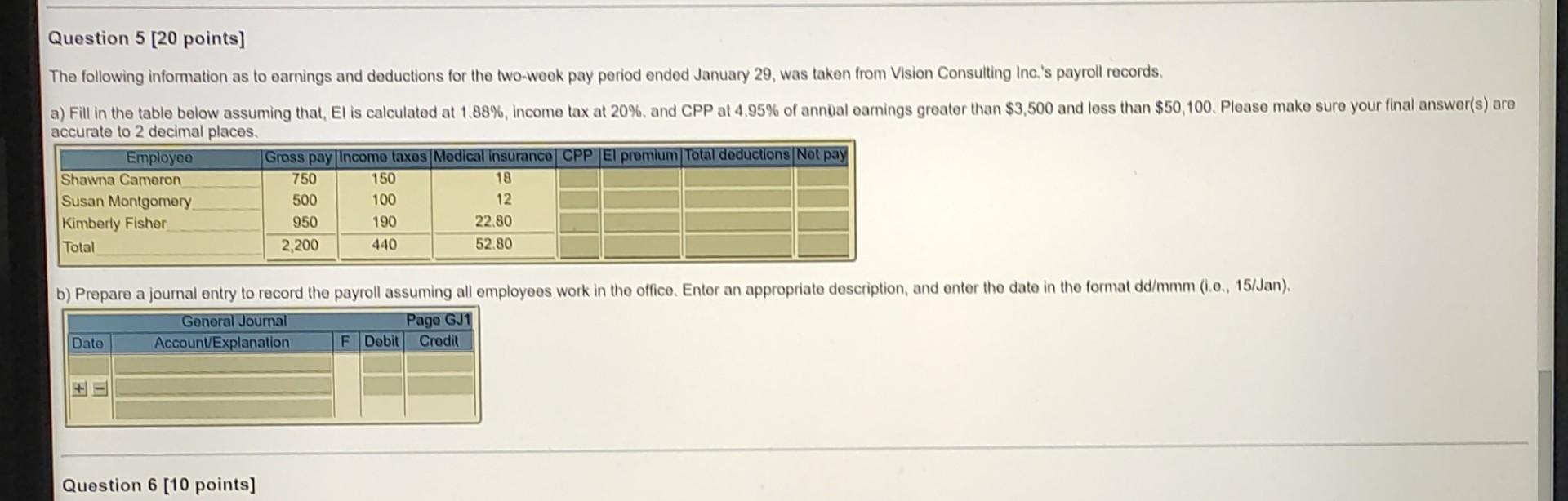

Question 5 (20 points) The following information as to earnings and deductions for the two-wook pay period ended January 29, was taken from Vision Consulting Inc.'s payroll records, a) Fill in the table below assuming that, El is calculated at 1.88%, income tax at 20%, and CPP at 4.95% of annual earnings greater than $3,500 and less than $50,100. Please make sure your final answer(s) are accurate to 2 decimal places. Employee Gross pay Income taxes Medical Insurance CPP El premium Total deductions Not pay Shawna Cameron 750 150 18 Susan Montgomery 500 100 12 Kimberly Fisher 950 190 22.80 Total 2,200 440 52.80 b) Prepare a journal entry to record the payroll assuming all employees work in the office. Entor an appropriate description, and enter the date in the format dd/mmm (1 o., 15/Jan). General Journal Pago GJ1 Date Account/Explanation F Dobit Crodit Question 6 (10 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started