Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer problem 1 2 and 3 **UPDATED QUESTIONS*** 1) what discourses or information, if any, does the company include about their products in inventory. What

answer problem 1 2 and 3

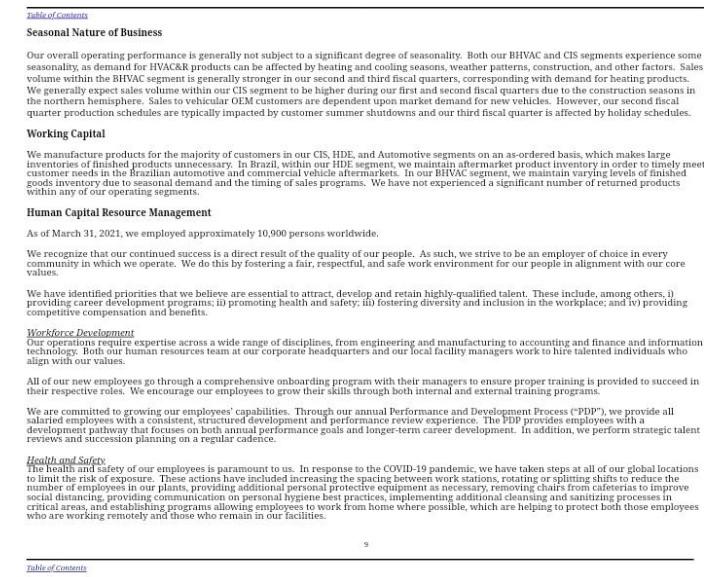

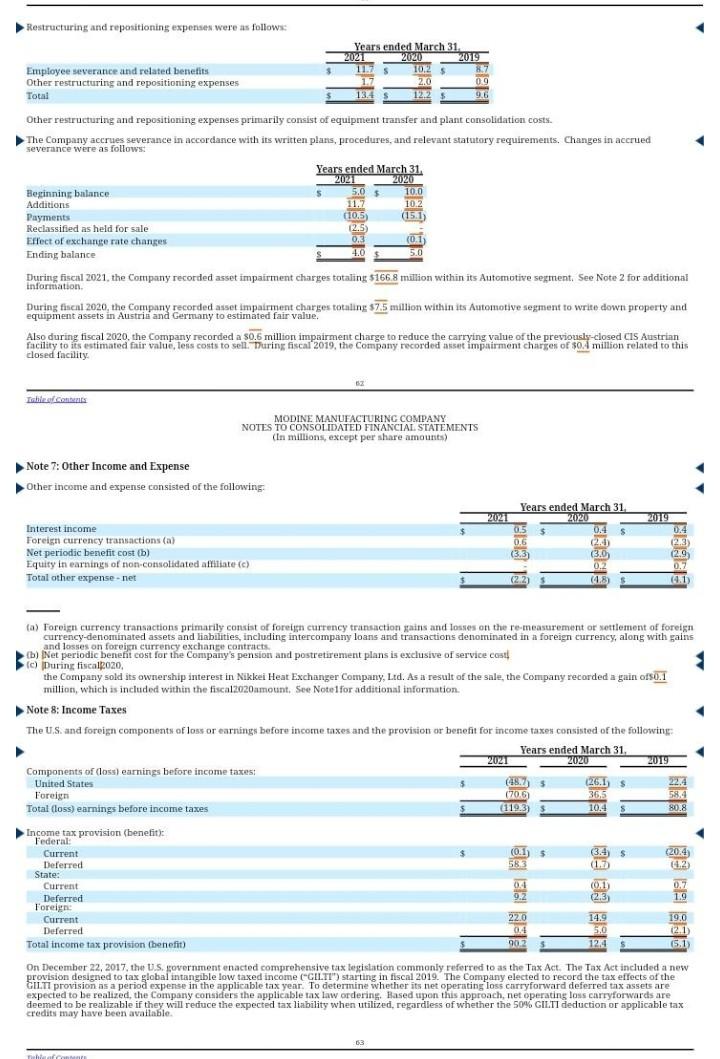

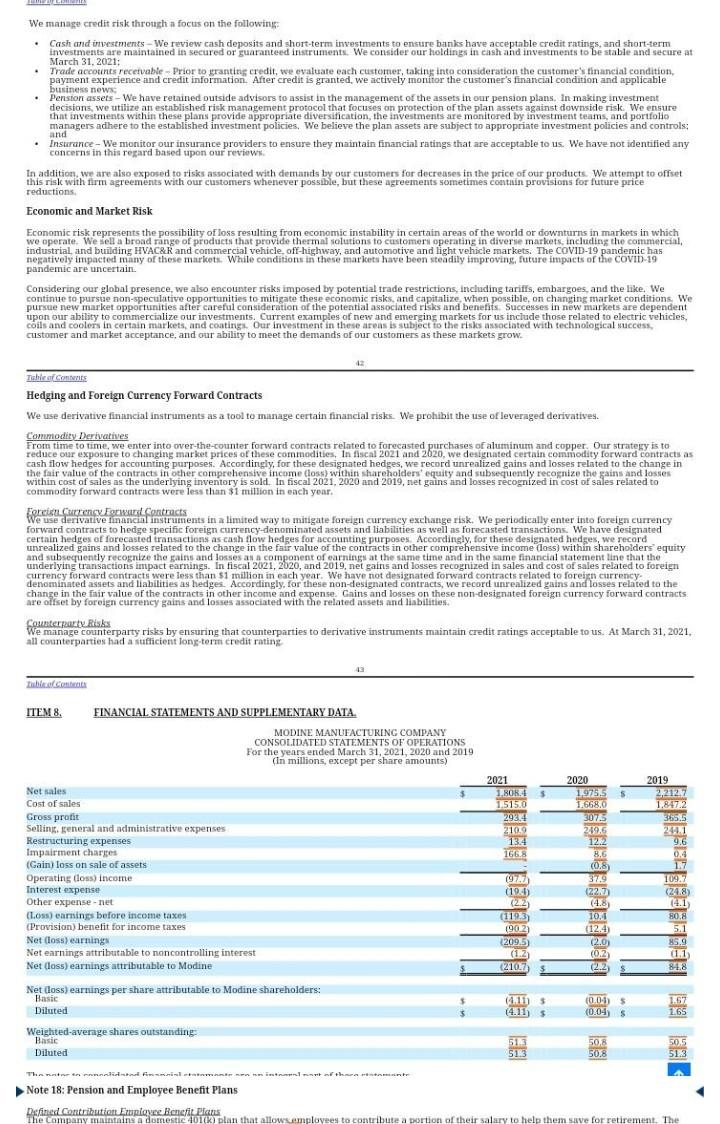

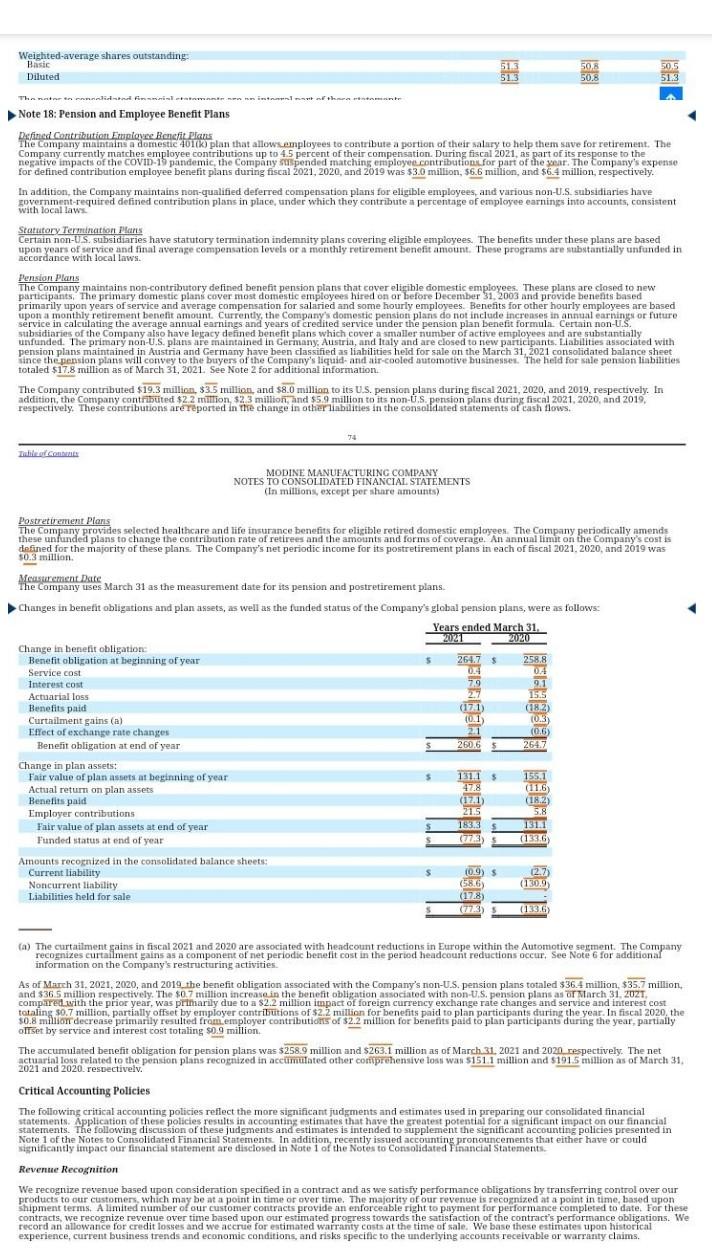

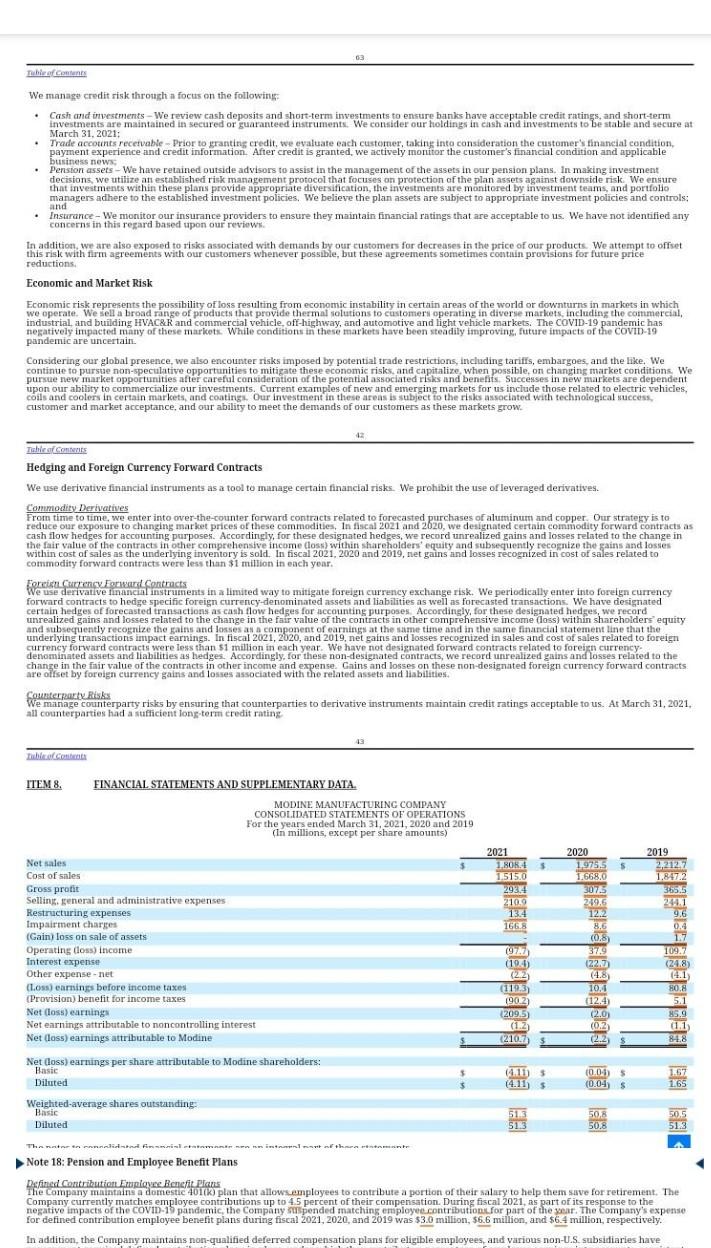

**UPDATED QUESTIONS*** 1) what discourses or information, if any, does the company include about their products in inventory. What key details are important to understanding their inventory details and whatever else is necessary 2) Explain how the company uses a periodic inventory system and explain key details about the figures below. explain why it's useful to use a periodic inventory system. 3) How does the company value it's inventory? what cost method do they use? explain key details to the company method. tel.com Seasonal Nature of Business Our overall operating performance is generally not subject to a significant degree of seasonality. Both our BHVAC and CIS segments experience some seasonality, as demand for HVAC&R products can be affected by heating and cooling seasons, weather patterns, construction, and other factors, Sales volume within the BHVAC segment is generally stronger in our second and third fiscal quarters, corresponding with demand for heating products. We generally expect sales volume within our CIS segment to be higher during our first and second fiscal quarters due to the construction seasons in the northern hemisphere. Sales to vehicular OEM customers are dependent upon market demand for new vehicles. However, our second fiscal quarter production schedules are typically impacted by customer summer shutdowns and our third fiscal quarter is affected by holiday schedules Working Capital We manufacture products for the majority of customers in our CIS, HDE, and Automotive segments on an as-ordered basis, which makes large inventories of finished products unnecessary. In Brazil, within our HDE segment, we maintain aftermarket product inventory in order to timely meet customer reeds in the Brazilian automotive and commercial vehicle aftermarkets. In our BHVAC segment, we maintain varying levels of finished goods inventory due to seasonal demand and the timing of sales programs. We have not experienced a significant number of returned products within any of our operating segments, Human Capital Resource Management As of March 31, 2021, we employed approximately 10,900 persons worldwide, We recognize that our continued success is a direct result of the quality of our people. As such, we strive to be an employer of choice in every community in which we operate. We do this by fostering a fair, respectful, and safe work environment for our people in alignment with our core values We have identified priorities that we believe are essential to attract develop and retain highly-qualified talent. These include, among others, i) providing career development programs i promoting health and safety, il) fostering diversity and inclusion in the workplace; and iv) providing competitive compensation and benefits Workforce Development Our operations require expertise across a wide range of disciplines, from engineering and manufacturing to accounting and finance and information technology. Both our human resources team at our corporate headquarters and our local facility managers work to hire talented individuals who align with our values All of our new employees go through a comprehensive onboarding program with their managers to ensure proper training is provided to succeed in their respective roles. We encourage our employees to grow their skills through both internal and external training programs. We are committed to growing our employees' capabilities. Through our annual Performance and Development Process (PDP"), we provide all salaried employees with a consistent, structured development and performance review experience. The PDP provides employees with a development pathway that focuses on both annual performance goals and longer-term career development. In addition, we perform strategic talent reviews and succession planning on a regular cadence Health and Safety The health and safety of our employees is paramount to us. In response to the COVID-19 pandemic, we have taken steps at all of our global locations to limit the risk of exposure. These actions have included increasing the spacing between workstations, rotating or splitting shifts to reduce the number of employees in our plants, providing additional personal protective equipment as necessary, removing chairs from cafeterias to improve social distancing, providing communication on personal hygiene best practices, implementing additional cleansing and sanitizing processes in critical areas, and establishing programs allowing employees to work from home where possible, which are helping to protect both those employees who are working remotely and those who remain in our facilities. Table of Table of Contents MODINE MANUFACTURING COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (In millions, except per share amounts) Note 15: Product Warranties and Other Commitments Product Warranties Many of the Company's products are covered under a warranty period ranging from one to five years. The Company records a liability for product warranty obligations at the time of sale and adjusts its warranty accruals if it becomes probable that expected claims will differ from previous estimates Changes in accrued warranty costs were as follows: Years ended March 31. 2021 2020 Beginning balance 70 7.9 $ 92 Warranties recorded at time of sale 5.5 543 Adjustments to pre-existing warranties 10.9 (1.6) Settlements 15.6 (4.8) Reclassified as held for sale (2.0 Effect of exchange rate changes 0.3 10.2 Ending balance Indemnifications comments From time to time, the Company provides indemnification agreements related to the sale or purchase of an entity or facility. These indemnification agreements cover customary representations and warranties typically provided in conjunction with such transactions, including income, sales, excise arather tax matters.environmental matters and other third-party claims. The indemnification periods provided generally range from less than one year to fifteen years. In addition, standard indemnification provisions reside in many commercial agreements to which the Company is a party and relate to responsillity in the event of potential third-party claims. The fair value of the Company's outstanding indemnification obligations at March 31, 2021 was not material. Commitments At March 31, 2021, the Company had capital expenditure commitments of $10.0 million, excluding commitments of the held for sale liquid- and air- cooled automotive businesses. Significant commitments include tooling and equipment expenditures for new and renewal programs with vehicular customers. The Company utilizes inventory arrangements with certain vendors in the normal course of business under which the vendors maintain inventory stock at the Company's facilities or at outside facilities. Title passes to the Company at the time goods are withdrawn for use in production The Company has agreements with the vendors to use the material within a specific period of time. In some cases, the Company bears the risk of loss for the inventory because Modine is required to insure the inventory against damage and/or theft. This inventory is included within the Company's consolidated balance sheets as raw materials inventory Note 16: Leases Effective April 1, 2019, the Company adopted new lease accounting guidance see Note 1 for additional information. The Company determines if an arrangement is a lease at contract inception. The lease term begins upon lease commencement, which is when the Company takes possession of the asset, and may include options to extend or terminate the lease when it is reasonably certain that such options will be exercised. The Company uses the Jease term within its determination of the appropriate lease classification, either as an operating lease or as a finance lease, and to calculate straight-line lease expense for its operating leases. ROU assets represent the Company's right to use an underlying asset for the lease term and lease linbilities represent the Company's obligation to make lease payments arising from the lease. The Company recognizes ROL assets and lease liabilities at the lease commencement date, based upon the present value of lease payments over the lease term. As its Tense agreements typically do not provide an implicit interest rate, the Company primarily uses an incremental borrowing rate to calculate the ROU asset and lease linbility. In determining the incremental borrowing rate, the Company considers its current collateralized borrowing rate, the term of the lease, and the economic environment where the lease activity is concentrated. The Company believes this method effectively estimates a borrowing rate that it could obtain for a debt instrument with similar terms as the lease agreement. Tube In addition, the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act and other similar anti-corruption laws generally prohibit companies and their intermediaries from making payments to improperly influence foreign government officials or other persons for the purpose of obtaining or retnining business. In recent years, there has been a substantial increase in the global enforcement of anti-corruption laws. In the event that we believe our employees or agents may have violated applicable anti-corruption laws, or if we are subject to allegations of any such violations, we may have to expend significant time and financial resources towards the investigation and remediation of the matter, which could disrupt our business and result in a material adverse effect on our financial condition, results of operations and reputation Challenges of Maintaining a Competitive Cost Structure We may be unable to maintain competitive cost structures within our business. In recent years, we have engaged in various restructuring activities in our CIS, HDE and Automotive segments in order to optimize our manufacturing footprint and cost structure These restructuring activities have included targeted headcount reductions that support our objective of reducing operational and SG&A cost structures and the consolidation and/or closure of manufacturing facilities in North America, Europe and Asia In addition, we continue to focus on reducing costs for materials and services through targeted adjustments and negotiations with our supply base, Our successful execution of these initiatives and our ability to identify and execute future opportunities to optimize our cost structures, is critical to enable us to establish a cost environment that will increase and sustain our long-term competitiveness. Any failure to do so could, turn, adversely affect our results of operations and financial condition Challenges of Program Launches We continue to launch a significant number of new programs at our facilities across the world. The success of these launches is critical to our business We design technologically advanced products, and the processes required to produce these products can be difficult and complex We spend significant time and financial resources to ensure the successful launch of new products and programs. Due to our high level of launch activity. particularly within our HDE segment, we must appropriately manage these launches and deploy our operational and administrative resources to fake advantage of the resulting increase in our business. If we do not successfully launch new products and programs, we may lose market share or damage relationships with our customers, which could negatively affect our business. In addition, any failure in our manufacturing strategy for these new products or programs could result in operating inefficiencies or asset impairment charges, which could adversely affect our results of operations Information Technology (ID Systems We may be adversely affected by a substantial disruption in, or material breach of our IT systems. We are dependent upon our IT infrastructure, including network, hardware, and software systems, to conduct our business. Despite network and other cybersecurity measures we have in place, our IT systems could be disrupted or we could experience a security breach from computer viruses, break-ins or similar disruptions. A substantial disruption in our IT systems for a prolonged time period, or a material breach of our IT systems, could result in delays in receiving inventory and supplies or filling customer orders, and/or the release of otherwise confidential information, including personal information that is protected by the General Data Protection Regulation, adversely affecting our customer service and relationships as well as our reputation, and could lead to significant remediation expenses and litigation risks. Our systems, and the systems of our service providers or thers could he breached damaged internted har stacles or other manmade intentional or unintentional artants her natural disasters Environmental Health and Safety Regulations We could be adversely impacted by the costs of environmental health and safety regulations. Our operations are subject to various federal, state, local and foreign laws and regulations overning, among other things, emissions to air discharge to waters and the generation, handling, storage, transportation, treatment and disposal of waste and other materials. The operation of our manufacturing facilities entails risks in these areas and there can be no assurance we will avoid material costs or liabilities relating to such matters. Our financial responsibility to clean up contaminated property may extend to previously owned or used property, properties owned by unrelated companies, as well as properties we currently own and use, regardless of whether the contamination is attributable to prior owners. In addition, potentially significant expenditures could be required in order to comply with evolving environmental health and safety Inws, regulations or other requirements that may be adopted or imposed in the future. Claims and Litigation We may incur material losses and costs as a result of warranty and product liability claims and litigation or other legal proceedings. In the event our products fail to perform as expected, we are exposed to warranty and product liability claims and may be required to participate in a recall or other field campaign of such products. Many of our vehicular customers offer extended warranty protection for their vehicles and require their supply base to extend warranty coverage as well. If our customers demand higher warranty-related cost recoveries, or if our products fail to perform as expected, it could have a material adverse impact on our results of operations and financial condition. We are also involved in various legal proceedings from time to time incidental to our business. If any such proceeding has a negative result, it could adversely affect our business, results of operations, financial condition and reputation. C. STRATEGIC RISKS Business Exit Strategy The optimization of our company's future profitability depends, in part, upon the success of our evaluation of strategie alternatives for our Automotive segment's business operations. We previously disclosed our evaluation of strategic alternatives for the businesses within our Automotive segment. As of March 31, 2021, we classified the liquid- and air-cooled automotive businesses within the Automotive segment as held for sale on our consolidated balance sheet. The sale of the air-cooled automotive business to Schmid Metall GmbH closed on April 30 2021. The sale of the liquid-cooled automotive business to Dana Incorporated is subject to the receipt of governmental and third-party approvals and satisfaction of other closing conditions. There can be no assurance that the pending sale will be consumated. We are also evaluating strategic alternatives for the other Automotive segment business operations and are committed to exiting this business in a manner that is in the best interest of our shareholders. It is possible that our exit strategy may ultimately include winding-down or closing the remaining business operations within the Automotive segment If our evaluation process does not result in the stuccessful consummation of strategic alternatives, or if we are otherwise unable through such consummation to realize our goals for the Automotive segment, we may not be able to optimize our future profitability, which could adversely affect our results of operations and inancial condition In addition, the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act and other similar anti-corruption laws generally prohibit companies and their intermediaries from making payments to improperly influence foreign government officials or other persons for the purpose of obtaining or retaining business. In recent years, there has been a substantial increase in the global enforcement of anti-corruption laws. In the event that we believe our employees or agents may have violated applicable anti-corruption laws, or if we are subject to allegations of any such violations, we may have to expend significant time and financial resources towards the investigation and remediation of the matter, which could disrupt our business and result in a material adverse effect on our financial condition, results of operations and reputation Challenges of Maintaining a Competitive Cost Structure We may be unable to maintain competitive cost structures within our business. In recent years, we have engaged in various restructuring activities in our CIS, HDE and Automotive segments in order to optimize our manufacturing footprint and cost structure. These restructuring activities have included targeted headcount reductions that support our objective of reducing operational and SCRA cost structures and the consolidation and/or closure of manufacturing facilities in North America Europe and Asia, In addition, we continue to focus on reducing costs for materials and services through targeted adjustments and negotiations with our supply base. Our successful execution of these initiatives, and our ability to identify and execute future opportunities to optimize our cost structures, is critical to enable us to establish a cost environment that will increase and sustain our long-term competitiveness. Any failure to do so could in turn, adversely affect our results of operations and financial condition. Challenges of Program Launches We continue to launch a significant number of new programs at our facilities across the world. The success of these launches is critical to our business We design technologically advanced products, and the processes required to produce these products can be difficult and complex. We spend significant time and financial resources to ensure the successful launch of new products and programs. Due to our high level of launch activity. particularly within our HDE segment, we must appropriately manage these launches and deploy our operational and administrative resources to iake advantage of the resulting increase in our business. If we do not successfully launch new products and programs, we may lose market share or damage relationships with our customers, which could negatively affect our business. In addition, any failure in our manufacturing strategy for these new products or programs could result in operating inefficiencies or asset impairment charges, which could adversely affect our results of operations Information Technology (ID Systems We may be adversely affected by a substantial disruption in, or material breach of, our IT systems. We are dependent upon our IT infrastructure, including network, hardware and software systems, to conduct our business. Despite network and other cybersecurity measures we have in place our IT systems could be disrupted or we could experience a security breach from computer viruses, break-ins or similar disruptions. A substantial disruption in our IT systems for a prolonged time period, or a material breach of our IT systems, could result in delays in receiving inventory and supplies or filling customer orders and/or the release of otherwise confidential information, including personal information that is protected by the General Data Protection Regulation, adversely affecting our customer service and relationships as well as our reputation, and could lead to significant remedintion expenses and litigation risks. Our systems, and the systems of our service providers or others, could be breached, damaged or interrupted by cyber-attacks or other man-made intentional or unintentional events, or by natural disasters or occurrences, many of which may, despite our best efforts, be beyond our ability to effectively detect, anticipate or control. This impact may be heightened by the increased disbursement of our workforce resulting from our own and from government efforts to mitigate the spread of the COVID-19 pandemic. Any such events and the related delays, problems or costs could have a material adverse effect on our business, financial condition, results of operations and reputation 14 Restructuring and repositioning expenses were as follows: Employee severance and related benefits Other restructuring and repositioning expenses Total Years ended March 31 2021 2020 2019 11 10.25 87 11 2.0 09 123 12.25 Other restructuring and repositioning expenses primarily consist of equipment transfer and plant consolidation costs. The Company accrues severance in accordance with its written plans, procedures, and relevant statutory requirements. Changes in accrued severance were as follows: Years ended March 31 2021 20/20 Beginning balance 5.0 10.0 Additions 11.7 10.2 Payments (10.5) (15.1) Reclassified as held for sale (245 Effect of exchange rate changes . 0,3 (0.1 Ending balance 4.0 During fiscal 2021, the Company recorded asset impairment charges totaling $166.8 million within its Automotive segment. See Note 2 for additional Information During fiscal 2020, the Company recorded asset impairment charges totaling $7,5 million within its Automotive segment to write down property and equipment assets in Austria and Germany to estimated fair value. Also during fiscal 2020, the Company recorded a 50.6 million impairment charge to reduce the carrying value of the previously closed CIS Austrian facility to its estimated fair value, Tess costs to sell. Turing fiscal 2019, the Company recorded asset impairment charges of $0.4 million related to this closed facility Table Contents MODINE MANUFACTURING COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS In millions, except per share amounts) Note 7: Other Income and Expense Other income and expense consisted of the following Interest income Foreign currency transactions (a) Net periodic benefit costb) Equity in earnings of non-consolidated affiliate (c) Total other expense.net Years ended March 31 12041 2012 0.5 0.4 0,6 (3.3) (3.0) 0.2 (2.2) (4.8) 2009 0.4 ( 123 (2.9 0.2 (4.1 (a) Toreign currency transactions primarily consist of foreign currency transaction gains and losses on the re-measurement or settlement of foreign currency-denominated assets and liabilities, including intercompany loans and transactions denominated in a foreign currency, along with gains b) Net periodic benefit cost for the company's pension and postretirement plans is exclusive of service cost c) During fiscal2020, the Company sold its ownership interest in Nikkei Heat Exchanger Company, Led. As a result of the sale, the Company recorded a gain ofs0.1 million, which is included within the fisca12020 amount. See Notel for additional information Note 8: Income Taxes The U.S. and foreign components of loss or earnings before income taxes and the provision or benefit for income taxes consisted of the following: Years ended March 31, 2021 2020 2019 Components of (loss) earnings before income taxes United States (8.25 126.15 22.4 Foreign (706 36,5 58,4 Total (loss) earnings before income taxes (1193) 10.4 s 80.8 0.1 ( 583 (3.4 (1.7 (20.4 ( 4.2 Income tax provision (benefit) Federal: Current Deferred State: Current Deferred Foreign Current Deferred Total income tax provision benefit) (0.1) 0. 9.2 O.Z 19 (23) 220 0.4 90.2 14.9 5.0 12.4 19.0 12.1 (5.1 On December 22, 2017, the U.S. government enacted comprehensive tax legislation commonly referred to as the Tax Act. The Tax Act included a provision designed to tax global intangible low taxed income (GILTI") starting in fiscal 2019. The Company elected to record the tax effects of the GILTI provision as a period expense in the applicable tax year. To determine whether its net operating loss carryforward deferred tax assets are expected to be realized the Company considers the applicable tax law ordering. Based upon this approach, net operating loss carryforwards are deemed to be realizable if they will reduce the expected tax liability when utilized, regardless of whether the 50% GILTI deduction or applicable tax credits may have been available 63 That . . We manage credit risk through a focus on the following: Cash and investments - We review cash deposits and short-term investments to ensure banks have acceptable credit ratings, and short-term investments are maintained in secured or guaranteed instruments. We consider our holdings in cash and investments to be stable and secure at March 31, 2021: Trade accounts recevable - Prior to granting credit, we evaluate each customer, taking into consideration the customer's financial condition, payment experience and credit information. After credit is granted, we actively monitor the customer's financial condition and applicable business news Pension assets - We have retained outside advisors to assist in the management of the assets in our pension plans. In making investment decisions, we utilize an established risk management protocol that focuses on protection of the plan assets against downside risk. We ensure that investments within these plans provide appropriate diversification, the investments are monitored by investment teams, and portfolio managers adhere to the established investment policies. We believe the plan assets are subject to appropriate investment policies and controls: and . Insurance - We monitor our insurance providers to ensure they maintain financial ratings that are acceptable to us. We have not identified any concerns in this regard based upon our reviews In addition, we are also exposed to risks associated with demands by our customers for decreases in the price of our products. We attempt to offset reductions this risk with firm agreements with our customers whenever possible, but these agreements sometimes contain provisions for future price Economic and Market Risk Economic risk represents the possibility of loss resulting from economic instability in certain areas of the world or downturns in markets in which we operate. We sell a broad range of products that provide thermal solutions to customers operating in diverse markets, including the commercial industrial, and building HVAC&R and commercial vehicle, off-highway, and automotive and light vehicle markets. The COVID-19 pandemic has negatively impacted many of these maricots. While conditions in these markets have been steadily improving, future impacts of the COVID-19 pandemic are uncertain. Considering our global presence, we also encounter risks imposed by potential trade restrictions, including tariffs, embargoes, and the like. We continue to pursue non-speculative opportunities to mitigate these economic risks and capitalize when possible, on changing market conditions. We pursue new market opportunities after careful consideration of the potential associated risks and benefits. Successes in new markets are dependent upon our ability to commercialize our investments. Current examples of new and emerging markets for us include those related to electric vehicles, coils and coolers in certain markets, and coatings. Our investment in these areas is subject to the risks associated with technological success customer and market acceptance, and our ability to meet the demands of our customers as these markets grow. 42 Table of Con Hedging and Foreign Currency Forward Contracts We use derivative financial instruments as a tool to manage certain financial risks. We prohibit the use of leveraged derivatives. Commodity Derivatives From time to time, we enter into over-the-counter forward contracts related to forecasted purchases of aluminum and copper. Our strategy is to reduce our exposure to changing market prices of these commodities, in fiscal 2021 and 2620, we designated certain commodity forward contracts as cash flow hedges for accounting purposes. Accordingly, for these designated hedges, we record unrealized gains and losses related to the change in the fair value of the contracts in other comprehensive income loss) within shareholders' equity and subsequently recognize the gains and losses within cost of sales as the underlying inventory is sold. In fiscal 2021, 2020 and 2019, net gains and losses recognized in cost of sales related to commodity forward contracts were less than $1 million in each year. Eoriku Currency forward Contracts We use derivative financial instruments in a limited way to mitigate foreign currency exchange risk. We periodically enter into foreign currency forward contracts to hedge specific foreign currency-denominated assets and liabilities as well as forecasted transactions. We have designated certain hedges of forecasted transactions as cash flow hedges for accounting purposes. Accordingly, for these designated hedges, we record unrealized gains and losses related to the change in the fair value of the contracts in other comprehensive income (loss) within shareholders equity and subsequently recognize the gains and losses as a component of earnings at the same time and in the same financial statement line that the underlying transactions impact earnings. In fiscal 2021, 2020, and 2019, net gains and losses recognized in sales and cost of sales related to foreign currency forward contracts were less than $1 million in each year. We have not designated forward contracts related to foreign currency denominated assets and liabilities as hedges. Accordingly, for these non-designated contracts, we record unrealized gains and losses related to the change in the fair value of the contracts in other income and expense. Gains and losses on these non-designated foreign currency forward contracts are offset by foreign currency gains and losses associated with the related assets and liabilities. Counterparty Risk We manage counterparty risks by ensuring that counterparties to derivative instruments maintain credit ratings acceptable to us. At March 31, 2021. all counterparties had a sufficient long-term credit rating 43 ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. MODINE MANUFACTURING COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS For the years ended March 31, 2021, 2020 and 2019 (in millions, except per share amounts) 2019 1.872 2021 1.80K 1.5150 2932 2109 13.4 166.8 Net sales Cost of sales GI D8% protit Selling general and administrative expenses Restructuring expenses Impairment charges (Gain) loss on sale of assets Operating doss) income Interest expense Other expense - net (Loss) earnings before income taxes (Provision) benefit for income taxes Net Coss) earnings Net earnings attributable to non controlling interest Net loss) earnings attributable to Modine ( Net doss) earnings per share attributable to Modine shareholders: Hasic Diluted 2020 1.975 1.668.0 307 289,6 1122 8,6 (0.8 379 (227) (4.8) 10,4 (12.4) (2.0) (0.2 (2.2) (194) (2.2 (1193 190.2 (2095) ( (1.2 (2107 385.5 24.1 9.6 0.4 117 109,7 (24.8 (4.1 80,8 5.1 85.9 (1.1 84.8 1.57 (4111 5 (4.11$ 10.01) (0.04) S 165 Welshited average shares outstanding 5111 5113 50,8 50.8 Diluted 505 51.3 The first in the Note 18: Pension and Employee Benefit Plans Defined contribution Employee Benefit Plans The Company intains a domestic 401(K) plan that allows employees to contribute a portion of their salary to help them save for retirement. The . Weighted average shares outstanding: Diluted 513 513 50,8 50.8 50.5 51.3 Note 18: Pension and Employee Benefit Plans Defined Contribution Employee Benefit Plans The Company maintains a domestic 401(K) plan that allows employees to contribute a portion of their salary to help them save for retirement. The Company currently matches employee contributions up to 4.5 percent of their compensation. During fiscal 2021, as part of its response to the negative impacts of the Covin-1 pandemic, the Company suspended matching employee contribution for part of the year. The Company's expense for defined contribution employee benefit plans during fiscal 2021, 2020, and 2019 was $3.0 million, 56.6 million, and $6.4 million, respectively. In addition, the Company maintains non-qualified deferred compensation plans for eligible employees and various non-U.S. subsidiaries have government required defined contribution plans in place, under which they contribute a percentage of employee earnings into accounts, consistent with local laws. Statutory Termination Parts Certain non-US subsidiaries have statutory termination indemnity plans covering eligible employees. The benefits under these plans are based upon years of service and final average compensation levels or a morithly retirement benefit amount. These programs are substantially unfunded in accordance with local laws. Pension Plans The Company maintains non-contributory defined benefit pension plans that cover eligible domestic employees. These plans are closed to to new participants. The primary domestic plans cover most domestic employees hired on or before December 31, 2003 and provide benefits based primarily upon years of service and average compensation for salaried and some hourly employees. Benefits for other hourly employees are based upon a monthly retirement benefit amount Currently, the Company's domestic pension plans do not include increnses in annual earnings or future service in calculating the average annual earnings and years of credited service under the pension plan benefit formula Certain non-U.S. subsidiaries of the Company also have legacy defined benefit plans which cover a smaller number of active employees and are substantially unfunded. The primary non-U.S. plans are maintained in Germany, Austria, and Italy and are closed to new participants. Llabilities associated with pension plans maintained in Austria and Germany have been classified as liabilities held for sale on the March 31, 2021 consolidated balance sheet Since the pension plans will convey to the buyers of the Company's liquid- and air-cooled automotive businesses. The held for sale pension linbilities totaled $17.8 million as of March 31, 2021. See Note 2 for additional information The Company contributed $19.3 million, $3.5 million and $8.0 million to its U.S. pension plans during fiscal 2021, 2020, and 2019, respectively. In addition, the Company contributed $2.2 million $2.3 million and $5.9 million to its non-U.S. pension plans during fiscal 2021, 2020, and 2019, respectively. These contributions are reported in the change in other liabilities in the consolidated statements of cash flows. MODINE MANUFACTURING COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (In millions, except per share amounts) , Postretirement Plans The Company provides selected healthcare and life insurance benefits for eligible retired domestic employees. The Company periodically amends these unfunded plans to change the contribution rate of retirees and the amounts and forms of coverage. An annual limit on the Company's cost is defined for the majority of these plans. The Company's net periodic income for its postretirement plans in each of fiscal 2021 2020, and 2019 was 50.3 million Measurement Date The Company uses March 31 as the measurement date for its pension and postretirement plans Changes in benefit obligations and plan assets, as well as the funded status of the Company's global pension plans, were as follows: Years ended March 31, . 2021 2020 Change in benefit obligation Benefit obligation at beginning of year 264.7 $ 258.8 Service cost 024 0.4 Interest cost 79 9.1 Actuarial loss 2 1542 Benefits paid (171) (18.2) Curtailment gains (a) (0.1 03 Effect of exchange rate changes 2 (0.6 Benefit obligation at end of year 260,6 2647 Change in plan assets: Fair value of plan assets at beginning of year $ 1311 1551 Actual return on plan assets 47.8 (11.6 ( Benefits paid 171 (18.2 Employer contributions 21.5 5.8 Fair value of plan assets at end of year 183 13141 Funded status at end of year (7743 (1336 Amounts recognized in the consolidated balance sheets: Current liability (0.9) (2.7) Noncurrent liability 586 (130.9 Liabilities held for sale (17.8 (7713 (133.6 (A) The curtaiment gains in fiscal 2021 and 2020 are associated with headcount reductions in Europe within the Automotive segment. The Company recognizes curtailment gains as a component of net periodic benefit cost in the period headcount reductions occur. See Note 6 for additional information on the Company's restructuring activities As of March 31, 2021, 2020, and 2019. the benefit obligation associated with the Company's non-US. pension plans totaled $36.4 million $35.7 million, and $365 million respectively. The $0.7 million increase in the benefit obligation associated with non-U.S. pension plans as of March 31, 202T compared with the prior year, was primarily due to a $2.2 million impact of foreign currency exchange rate changes and service and interest cost totaling $0.7 million, partially offset by employer contributions of $2.2 million for benefits paid to plan participants during the year. In fiscal 2020, the $0.8 million decrease primarily resulted from employer contributies of $2.2 million for benefits paid to plan participants during the year, partially olset by service and interest cost totaling $0.9 million The accumulated benefit obligation for pension plans was $258.9 million and $263.1 million as of March 31, 2021 and 2020 respectively. The net actuarial loss related to the pension plans recognized in acetimulated other contiprehensive loss was 5151.1 million and $1915 million as of March 31, 2021 and 2020. respectively. Critical Accounting Policies The following critical accounting policies reflect the more significant judgments and estimates used in preparing our consolidated financial statements. Application of these policies, results in accounting estimates that have the greatest potential for a significant impact on our financial statements. The following discussion of these judgments and estimates is intended to supplement the significant accounting policies presented in Note 1 of the Notes to Consolidated Financial Statements. In addition, recently issued accounting pronouncements that either have or could significantly impact our financial statement are disclosed in Note 1 of the Notes to Consolidated Financial Statements Revenue Recognition We recognize revenue based upon consideration specified in a contract and as we satisfy performance obligations by transferring control over our products to our customers, which may be at a point in time or over time. The majority of our revenue is recognized at a point in time, based upon Shipment terms. A limited number of our customer contracts provide an enforceable right to payment for performance completed to date. For these contracts, we recognize revenue over time based upon our estimated progress towards the satisfaction of the contract's performance obligations. We record an allowance for credit losses and we accrue for estimated warranty costs at the time of sale. We base these estimates upon historical experience, current business trends and economic conditions, and risks specific to the underlying accounts receivable or warranty claims. 03 Table of Contents . We manage credit risk through a focus on the following: Cash and investments - We review cash deposits and short-term investments to ensure banks have acceptable credit ratings, and short-term investments are maintained in secured or guaranteed instruments. We consider our holdings in cash and investments to be stable and secure at March 31, 2021: Trade accounts recevable - Prior to granting credit, we evaluate each customer, taking into consideration the customer's financial condition, payment experience and credit information. After credit is granted, we actively monitor the customer's financial condition and applicable business news Pension assets - We have retained outside advisors to assist in the management of the assets in our pension plans. In making investment decisions, we utilize an established risk management protocol that focuses on protection of the plan assets against downside risk. We ensure that investments within these plans provide appropriate diversification, the investments are monitored by investment teams, and portfolio managers adhere to the established investment policies. We believe the plan assets are subject to appropriate investment policies and controls: and Insurance - We monitor our insurance providers to ensure they maintain financial ratings that are acceptable to us. We have not identified any . concerns in this regard based upon our reviews In addition, we are also exposed to risks associated with demands by our customers for decreases in the price of our products. We attempt to offset this risk with firm agreements with our customers whenever possible, but these agreements sometimes contain provisions for future price reductions Economic and Market Risk Economic risk represents the possibility of loss resulting from economic instability in certain areas of the world or downturns in markets in which we operater. We sell a broad range of products that provide thermal solutions to customers operating in diverse markets, including the commercial industrial, and building HVAC&R and commercial vehicle, off-highway, and automotive and light vehicle markets. The COVID-19 pandemic has negatively impacted many of these maricots. While conditions in these markets have been steadily improving, future impacts of the COVID-19 pandemic are uncertain Considering our global presence, we also encounter risks imposed by potential trade restrictions, including tariffs, embargoes, and the like. We continue to pursue non-speculative opportunities to mitigate these economic risks and capitalize when possible, on changing market conditions. We pursue new market opportunities after careful consideration of the potential associated risks and benefits. Successes in new markets are dependent upon our ability to commercialize our investments. Current examples of new and emerging markets for us include those related to electric vehicles, coils and coolers in certain markets, and coatings. Our investment in these areas is subject to the risks associated with technological success Customer and market acceptance, and our ability to meet the demands of our customers as these markets grow. 12 Telecom Hedging and Foreign Currency Forward Contracts We use derivative financial instruments as a tool to manage certain financial risks. We prohibit the use of leveraged derivatives. Commodity Derivatives From time to time, we enter into over-the-counter forward contracts related to forecasted purchases of aluminum and copper. Our strategy is to reduce our exposure to changing market prices of these commodities, in fiscal 2021 and 2620, we designated certain commodity forward contracts as cash flow hedges for accounting purposes. Accordingly, for these designated hedges, we record unrealized gains and losses related to the change in the fair value of the contracts in other comprehensive income (loss) within shareholders' equity and subsequently recognize the gains and losses within cost of sales as the underlying inventory is sold. In fiscal 2021, 2020 and 2019, net gains and losses recognized in cost of sales related to commodity forward contracts were less than $1 million in each year. Erik Currency forward Contracts We use derivative financial instruments in a limited way to mitigate foreign currency exchange risk. We periodically enter into foreign currency forward contracts to hedge specific foreign currency-denominated assets and liabilities as well as forecasted transactions. We have designated certain hedges of forecasted transactions as cash flow hedges for accounting purposes. Accordingly, for these designated hedges, we record unrealized gains and losses related to the change in the fair value of the contracts in other comprehensive income loss) within shareholders equity and subsequently recognize the gains and losses as a component of earnings at the same time and in the same financial statement line that the underlying transactions impact earnings. In fiscal 2021, 2020, and 2019, net gains and losses recognized in sales and cost of sales related to foreign currency forward contracts were less than $1 million in each year. We have not designated forward contracts related to foreign currency denominated assets and liabilities as hedges. Accordingly, for these non-designated contracts, we record unrealized gains and losses related to the change in the fair value of the contracts in other income and expense. Gains and losses on these non-designated foreign currency forward contracts - are offset by foreign currency gains and losses associated with the related assets and liabilities. Counterparty Risks We manage counterparty risks by ensuring that counterparties to derivative instruments maintain credit ratings acceptable to us. At March 31, 2021, all counterparties had a sufficient long-term credit rating Tubular Centro ITEM 8. 8 FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. MODINE MANUFACTURING COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS For the years ended March 31, 2021, 2020 and 2019 (in millions, except per share amounts) S Net sales Cost of sales Gross profit 2021 1.808.4 115150 293.4 210.9 13:4 166 Selling, general and administrative expenses Restructuring expenses Impairment charges (Gain) loss on sale of assets Operating doss) income Interest expense Other expense - net (Loss) earnings before income taxes (Provision) benefit for income taxes Net (Loss) earnings Net earnings attributable to noncontrolling interest Net loss) earnings attributable to Modine 2020 19755 1.668.0 3073 219,6 12.2 8.6 (0.8 379 (227) (4.8) 10,4 (12.4) (2.0) (9.2 (2.2) 2019 2,21217 1.8472 365.5 244.1 9.6 04 187 10927 (24.8 (4.1 80.8 5.1 85.9 (1.1 84.8 (972 (19.4) (222 ( (1193 190.23 (2095) ( (1.2 (210.7 Net doss) earnings per share attributable to Modine shareholders: ) Basic 5 Diluted (4.11 (4.11) 0.04 5 (0.04) $ ) 1.57 1.65 Weighted average shares outstanding: Basic Diluted 515 5133 50,6 50.8 50.5 51.3 Note 18: Pension and Employee Benefit Plans Defined contribution Employee Benefit Plans The company maintains a domestic 401(k) plan that allows employees to contribute a portion of their salary to help them save for retirement. The Company currently matches employee contributions up to 45 percent of their compensation. During fiscal 2021, as part of its response to the negative impacts of the COVID-15 pandemic, the Company suspended matching employee contribution for part of the year. The company's expense for defined contribution employee benefit plans during fiscal 2021, 2020, and 2019 was $3.0 million, 56.6 million, and $6.4 million, respectively. In addition, the Company maintains non-qualified deferred compensation plans for eligible employees and various non-U.S. subsidiaries have FETEOR UDSAL ons Our caleulation of the expense and liabilities of our pension plans is dependent upon various assumptions. At March 31, 2021, our pension liabilities totaled $77 million. The most significant assumptions include the discount rate, long-term expected return on plan assets, and mortality rates. We base our selection of assumptions on historical trends and economic and market conditions at the time of valuation. In accordance with U.S. GAAP actual results that differ from these assumptions are accumulated and amortized over future periods. These differences impact future pension expenses. Currently, participants in our domestic pension plans are not accruing benefits based upon their current service as the plans do not include increases in annual earnings or for future service in calculating the average annual earnings and years of credited service under the per plan formula Shipping and Handling Costs The company records shipping and handling costs incurred upon the shipment of products to its customers in cost of sales, and related amounts hilled to these customers in net sales. Tras Accounts Receivable The company records trade receivables at the invoiced amount. Trade receivables do not bear interest if paid according to the original terms. The Company maintains an allowance for credit losses, representing its estimate of expected losses associated with its trade accounts receivable. The Company bases its estimate using historical loss experience and considers the aging of the receivables and risks specific to customers where appropriate. At March 31, 2021 and 2020, the allowance for credit losses was $1.3 million and $1.9 million, respectively. The Company enters into supply chain financing programs from time to time to sell accounts receivable, without recourse, to third-party financial institutions Sales of accounts receivable are reflected as a reduction of accounts receivable on the consolidated balance sheets and the proceeds are included in cash flows from operating activities in the consolidated statements of cash flows. During fiscal 2021, 2020, and 2019, the Company sold 588.7 million, 575.4 million, and $85.1 million, respectively, of accounts receivable to accelerate cash receipts. During fiscal 2021, 2020, and 2019, the company recorded a loss on the site of accounts receivable of 50.2 million, 50,5 million, and $0.6 million, respectively, in the consolidated statements of operations Warranty The Company provides product warranties for specific product lines and accrues for estimated future warranty costs in the period in which the sale is recorded. The Company records warranty expense within cost of sales, based upon historical and current claims data or based upon estimated future claims. Accrual balances, which are recorded within other current liabilities, are monitored and adjusted if it is probable that expected claims will differ from previous estimates. See Note 15 for additional information. Teoting The Company accounts for production tooling costs as a component of property, plant and equipment when it owns title to the tooling and amortizes the capitalized cost to cost of sales over the estimated life of the asset, which is generally three years. At March 31, 2021 and 2020, Company-owned tooling totaled $14.1 million and $23.3 million, respectively. The decrease in Company-owned cooling during fiscal 2021 was primarily due to asset impairment charges recorded with the Automotive segment upon classification of the liquid- and air-cooled automotive businesses as held for sale See Note 2 for additional information In certain instances, tooling is customer-owned. At the time customer-owned tooling is completed and customer acceptance is obtained the Company records tooling revenue and related production costs within ne sales and cost of sales, respectively, in the consolidated statements of operations. If the customer has agreed to reimburse the Company, unbilled customer-owned tooling costs are recorded as a receivable within other current assets. No significant arrangements exist where customer-owned tooling costs were not accompanied by guaranteed reimbursement At March 31, 2021 and 2020, customer-owned tooling receivables totaled $8.1 million and $7.8 million, respectively. Of the $8.1 million, 55.6 million was included within assets held for sale on the March 31, 2021 consolidated balance sheet 30 Table of Contents MODINE MANUFACTURING COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (In millions, except per share amounts) Stock-based Compensation The Company recognizes stock based compensation tising the fair value method. Accordingly, compensation expense for stock options, restricted stock and performance-based stock awards is calculated based upon the fair value of the instruments at the time of grant, and is recognized as expense over the respective vesting periods. See Note 5 for additional information Research and Development The company expenses research and development costs as incurred within SG&A expenses. During fiscal 2021 2020, and 2019, research and development costs totaled $45.3 million, $59.5 million, and $69.8 million, respectively. Translation of Foreign Currencies The Company translates assets and liabilities of foreign subsidiaries and equity investments into U.S. dollars at the period-end exchange rates, and translates income and expense items at the monthly average exchange rate for the period in which the transactions occur. The Company reports resulting translation adjustments within accumulated other comprehensive income (loss) within shareholders' equity. The Company includes foreign currency transaction gains or losses in the statement of operations within other income and expense. Derative Instruments The Company enters into derivative financial instruments from time to time to manage certain financial risks. The Company enters into forward contracts to reduce exposure to changing future purchase prices for aluminum and copper and into foreign currency exchange contracts to hedge specific foreign currency-denominated assets and liabilities as well as forecasted transactions. The Company designates certain derivative financial instruments as cash flow hedges for accounting purposes. These it struments are used to manage financial risks and are not speculative. See Note 19 for additional information Income Taxes The Company determines deferred tax assets and linbilities based upon the difference between the amounts reported in the financial statements and the tax basis of assets and liabilities, using enacted tax rates in effect in the years in which the differences are expected to reverse. The Company establishes a valuation allowance if it is more likely than not that a deferred tax asset, or portion thereof, will not be realized. The Company records the tax effects of global intangible low taxed income CGILTI") as a period expense in the applicable tax year. The Company uses the portfolio approach for releasing income tax effects from accumulated other comprehensive income foss). See Note 8 for additional information Earnings per Share The Company calculates basic earnings per share based upon the weighted average number of common shares outstanding during the period, while the calculation of diluted earnings per share includes the dilutive effect of potential common shares outstanding during the period. The calculation of diluted earnings per share excludes potential common shares if their inclusion would have an anti-dilutive effect. In prior years, certain restricted stock awards provided recipients with a non-forfeltable right to receive dividends declared by the Company. These restricted stock awards have been included in computing earnings per share pursuant to the two-class method. See Notes for additional information. Cash and Cash Equivalents The Company considers all highly-liquid investments with original maturities of three months or less to be cash equivalents. Under the Company's cash management system, cash balances at certain banks are funded when checks are presented for payment. To the extent checks issued, but not yet presented for payment, exceed the balance on hand at the specific bank against which they were written, the Company reports the amount of those checks within accounts payable in the consolidated balance sheets Short-term investments The Company invests in time deposits with original maturities of more than three months but not more than one year. The Company records these short-term investments at cost, which approximates fair value, within other current assets in the consolidated balance sheets. As of March 31, 2021 and 2020, the Company's short-term investments totaled $3.7 million and $3.2 million, respectively. Inventaries The company values inventories using a first-in, first-out or weighted average basis, at the lower of cost and net realizable value. 31 A US LLCI O. MI, UU, UT NULLUE SUE Wa Lumply L-U.S. un peu 30. DEL LUL and $36.5 million respectively. The $0.7 million increase in the benefit obligation associated with non-U.S. pension plans as of March 31, ZOZT. compared with the prior year, was primarily due to a $2.2 million impact of foreign currency exchange rate changes and service and interest cost totaling $0.7 million, partially offset by employer contributions of $2.2 million for benefits paid to plan participants during the year. In fiscal 2020, the 50.8 million decrease primarily resulted from employer contributions of S2.2 million for benefits paid to plan participants during the year, partially offset by service and interest cost totaling $0.9 million The accumulated benefit obligation for pension plans was $258.9 million and S263.1 million as of March 31, 2021 and 2020. respectively. The net actuarial loss related to the pension plans recognized in accumulated other comprehensive loss was $151.1 million and $191.5 million as of March 31, 2021 and 2020. respectively. Critical Accounting Policies The following critical accounting policies reflect the more significant judgments and estimates used in preparing our consolidated financial statements. Application of these policies results in accounting estimates that have the greatest potential for a significant impact on our financial statements. The following discussion of these judgments and estimates is intended to supplement the significant accounting policies presented in Note 1 of the Notes to Consolidated Financial Statements. In addition, recently issued accounting pronouncements that either have or could significantly impact our financial statement are disclosed in Note 1 of the Notes to Consolidated linancial Statements Revenue Recognition We recognize revenue based upon consideration specified in a contract and as we satisfy performance obligations by transferring control over our products to our customers, which may be at a point in time or over time. The majority of our revenue is recognized at a point in time, based upon shipment terms. A limited number of our customer contracts provide an enforceable right to payment for performance completed to date. For these contracts, we recognize revenue over time based upon our estimated progress towards the satisfaction of the contract's performance obligations. We record an allowance for credit losses and we accrue for estimated warranty costs at the time of sale. We base these estimates upon historical experience, current business trends and economic conditions, and risks specific to the underlying accounts receivable or warranty claims 35 Telef.contem Impairment of Long-Lived Assets We perform impairment evaluations of long-lived assets, including property, plant and equipment and intangible assets, whenever business conditions or events indicate that those assets may be impaired. We consider factors such as operating losses, declining financial outlooks and market conditions when evaluating the necessity for an impairment analysis. When the net asset values exceed undiscounted cash flows expected to be generated by the assets, we write down the assets to fair value and record an impairment charge to current operations. We estimate fair value in various ways depending on the nature of the underlying assets. Fair value is generally based upon appraised value, estimated salvage value, or selling prices under negotiation, an applicable. The most significant long-lived assets we evaluated for impairment indicators were property, plant and equipment and intangible assets, which totaled $270 million and $101 million, respectively at March 31, 2021. Within property, plant and equipment, the most significant assets evaluated are buildings and improvements and machinery and equipment. Our most significant intangible assets evaluated are customer relationships, trade names, and acquired technology, the majority of which are related to our CIS segment. We evaluate impairment at the lowest level of separately identifiable cash flows, which is generally at the manufacturing plant level. We monitor manufacturing plant financial performance to determine whether indicators exist that would require an impairment evaluation for the facility. This includes significant adverse changes in plant profitability metrics: substantial changes in the mix of customer products manufactured in the plant; changes in manufacturing strategy and the shifting of programs to other facilities under a manufacturing reallynment strategy. When such indicators are present, we perform an impairment evaluation. During fiscal 2021 and upon classifying the liquid- and air-cooled automotive businesses within the Automotive segment as held for sale, we evaluated the disposal groups for impairment. Based upon the selling prices of the businesses and anticipated costs to sell, we estimated implied losses in excess of the respective carrying value of each disposal group's long-lived assets. As a result, we wrote down the carrying value of the disposal groups' long-lived assets, which consist entirely of property, plant and equipment and right-of-use lease assets, to zero See Note 2 of the Notes to the Consolidated Financial Statements for additional information regarding the $167 million of impairment charges that we recorded during fiscal 2021 Impairment of Goodwill We perform goodwill Impairment tests annually, as of March 31, unless business events or other conditions exist that require a more frequent evaluation. We consider factors such as operating losses, declining financial and market outlooks, and market capitalization when evaluating the necessity for an interim impairment analysis. We test goodwill for impairment at a reporting unit level Reporting units resulting from recent acquisitions generally represent the highest risk of impairment, which typically decreases as the businesses are integrated into the Company and positioned for future operating and financial performance. We test goodwill for impairment by comparing the fair value of each reporting unit with its carrying value. We determine the fair value of a reporting tinit based u

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started