Answer Q. 2. With Shareholders Equity = 1200, Debt = 400, EBITDA = 8000, Interest = 200.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Please answer the instructions above based on the case below, thank you for your help.

(Answer will be scanned, including other Chegg answers, thumbs down for plagiarism)

__________________________________________________________________________________

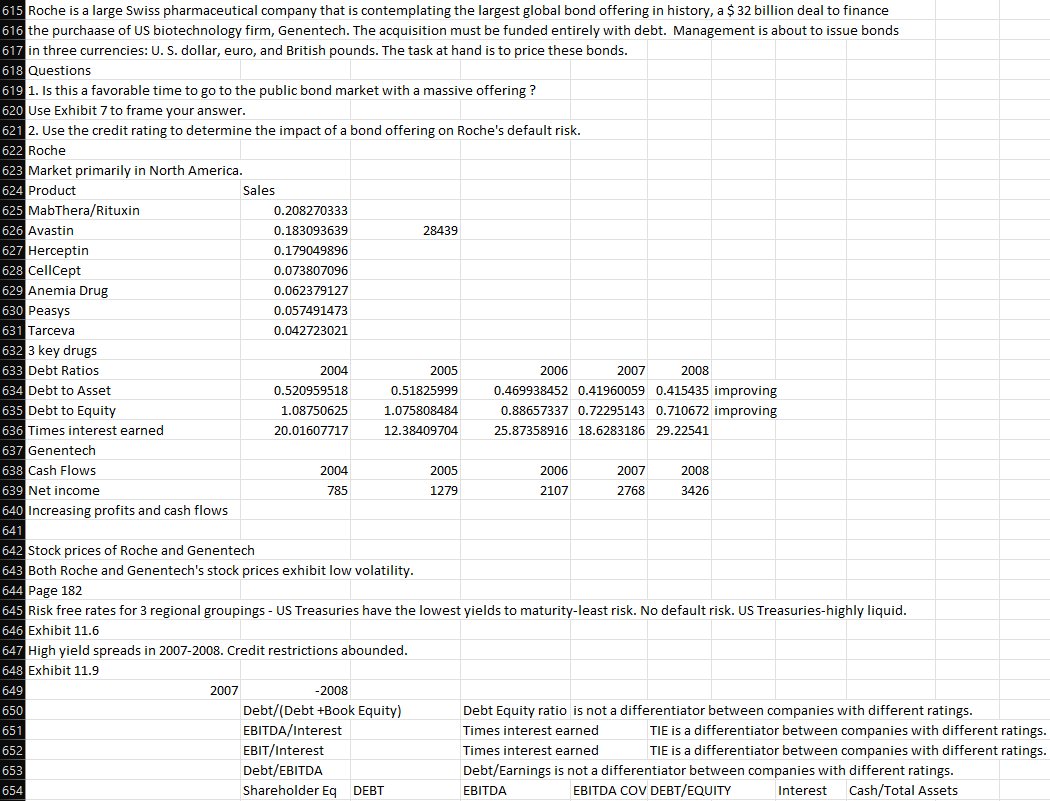

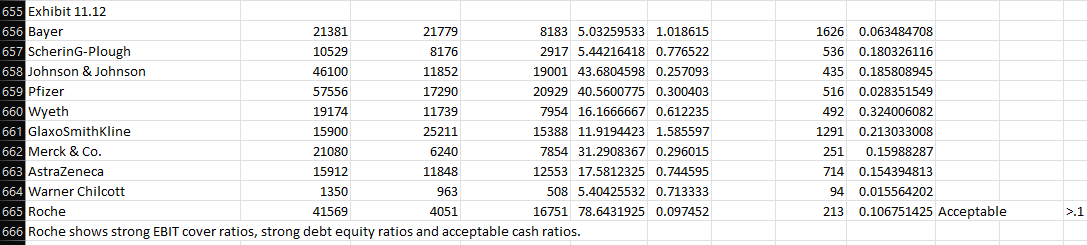

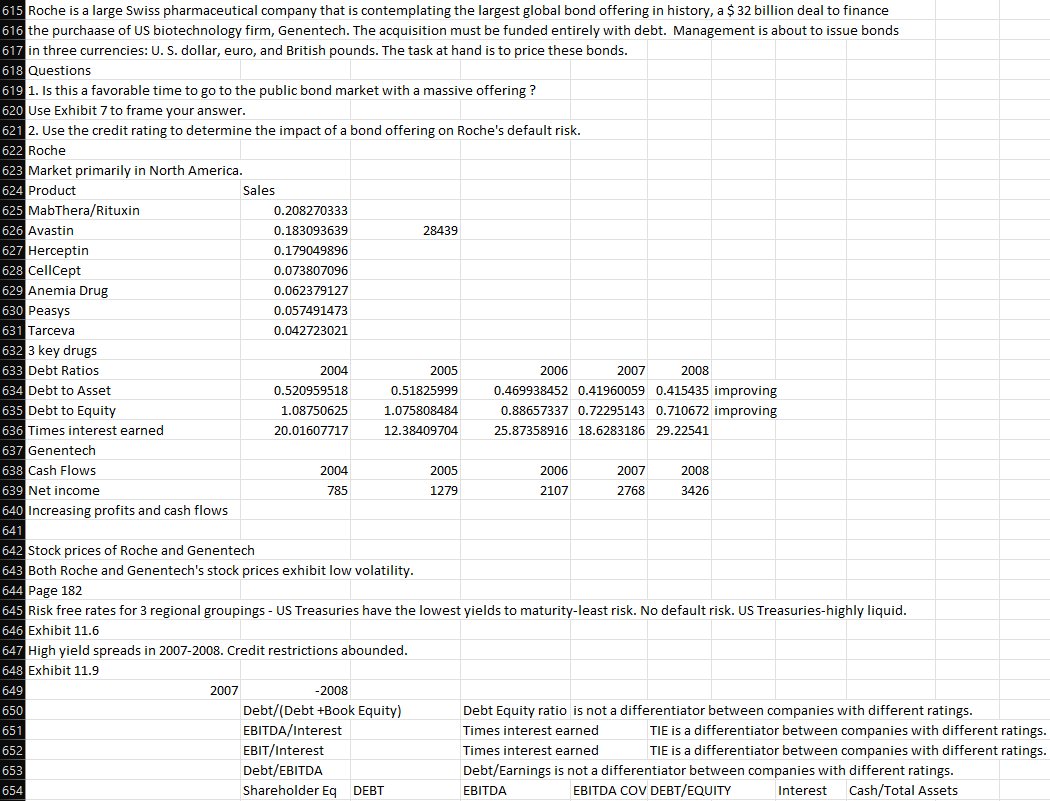

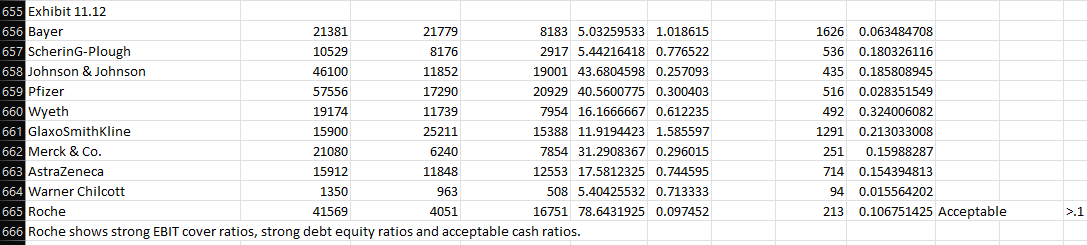

615 Roche is a large Swiss pharmaceutical company that is contemplating the largest global bond offering in history, a $32 billion deal to finance 616 the purchaase of US biotechnology firm, Genentech. The acquisition must be funded entirely with debt. Management is about to issue bonds 617 in three currencies: U. S. dollar, euro, and British pounds. The task at hand is to price these bonds. Questions 1. Is this a favorable time to go to the public bond market with a massive offering ? Use Exhibit 7 to frame your answer. 2. Use the credit rating to determine the impact of a bond offering on Roche's default risk. Roche Market primarily in North America. Increasing profits and cash flows Stock prices of Roche and Genentech Both Roche and Genentech's stock prices exhibit low volatility. Page 182 Risk free rates for 3 regional groupings - US Treasuries have the lowest yields to maturity-least risk. No default risk. US Treasuries-highly liquid. Exhibit 11.6 High yield spreads in 2007-2008. Credit restrictions abounded. Exhibit 11.9 \begin{tabular}{|l|l|l|l|} \hline 2007 & \multicolumn{2}{|c|}{2008} & \\ \hline Debt/(Debt +Book Equity) & Debt Equity ratio is not a differentiator between companies with different ratings. \\ \hline EBITDA/Interest & Times interest earned & TIE is a differentiator between companies with different ratings. \\ \hline EBIT/Interest & Times interest earned & TIE is a differentiator between companies with different ratings. \\ \hline Debt/EBITDA & Debt/Earnings is not a differentiator between companies with different ratings. \\ \hline Shareholder Eq & DEBT & EBITDA & EBITDA COV DEBT/EQUITY Interest Cash/Total Assets \end{tabular} 655 Exhibit 11.12 666 Roche shows strong EBIT cover ratios, strong debt equity ratios and acceptable cash ratios. 615 Roche is a large Swiss pharmaceutical company that is contemplating the largest global bond offering in history, a $32 billion deal to finance 616 the purchaase of US biotechnology firm, Genentech. The acquisition must be funded entirely with debt. Management is about to issue bonds 617 in three currencies: U. S. dollar, euro, and British pounds. The task at hand is to price these bonds. Questions 1. Is this a favorable time to go to the public bond market with a massive offering ? Use Exhibit 7 to frame your answer. 2. Use the credit rating to determine the impact of a bond offering on Roche's default risk. Roche Market primarily in North America. Increasing profits and cash flows Stock prices of Roche and Genentech Both Roche and Genentech's stock prices exhibit low volatility. Page 182 Risk free rates for 3 regional groupings - US Treasuries have the lowest yields to maturity-least risk. No default risk. US Treasuries-highly liquid. Exhibit 11.6 High yield spreads in 2007-2008. Credit restrictions abounded. Exhibit 11.9 \begin{tabular}{|l|l|l|l|} \hline 2007 & \multicolumn{2}{|c|}{2008} & \\ \hline Debt/(Debt +Book Equity) & Debt Equity ratio is not a differentiator between companies with different ratings. \\ \hline EBITDA/Interest & Times interest earned & TIE is a differentiator between companies with different ratings. \\ \hline EBIT/Interest & Times interest earned & TIE is a differentiator between companies with different ratings. \\ \hline Debt/EBITDA & Debt/Earnings is not a differentiator between companies with different ratings. \\ \hline Shareholder Eq & DEBT & EBITDA & EBITDA COV DEBT/EQUITY Interest Cash/Total Assets \end{tabular} 655 Exhibit 11.12 666 Roche shows strong EBIT cover ratios, strong debt equity ratios and acceptable cash ratios