Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer question 1 and 2. Introduction The cash module is a comprehensive coverage of the cash account, along with the related processes Within this module,

Answer question 1 and 2.

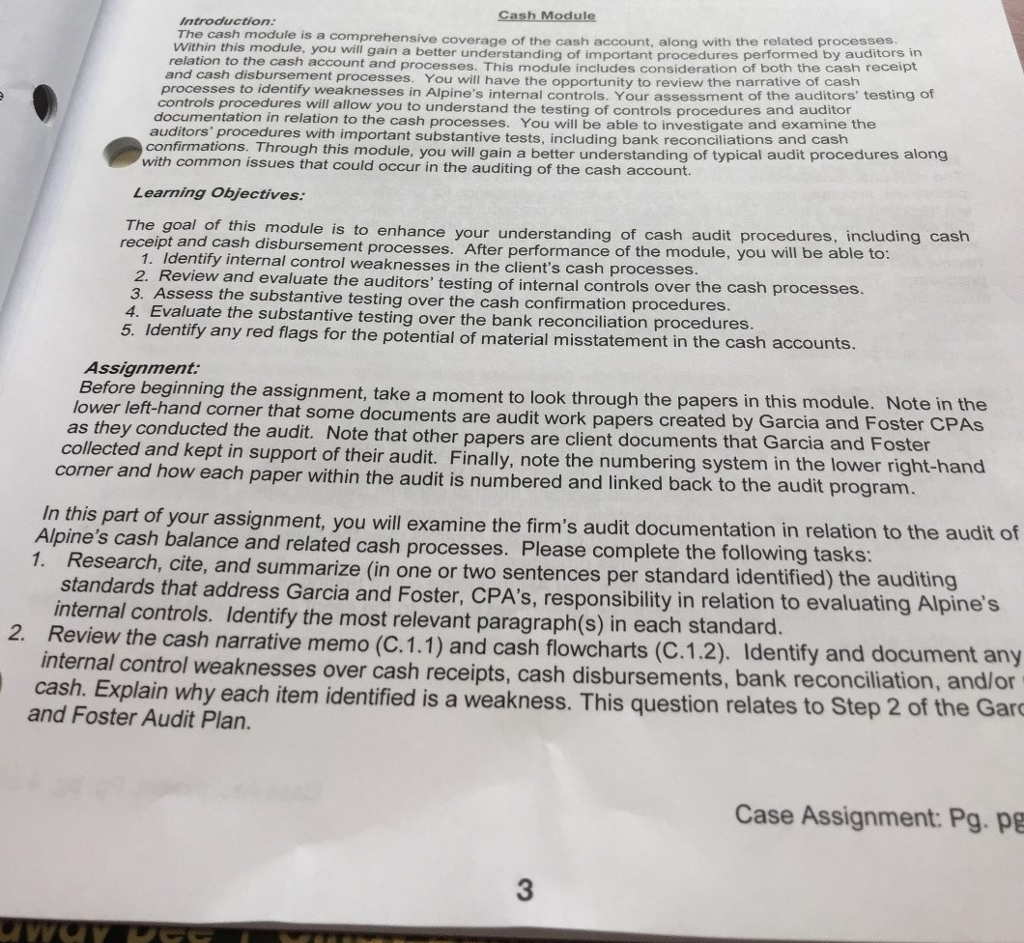

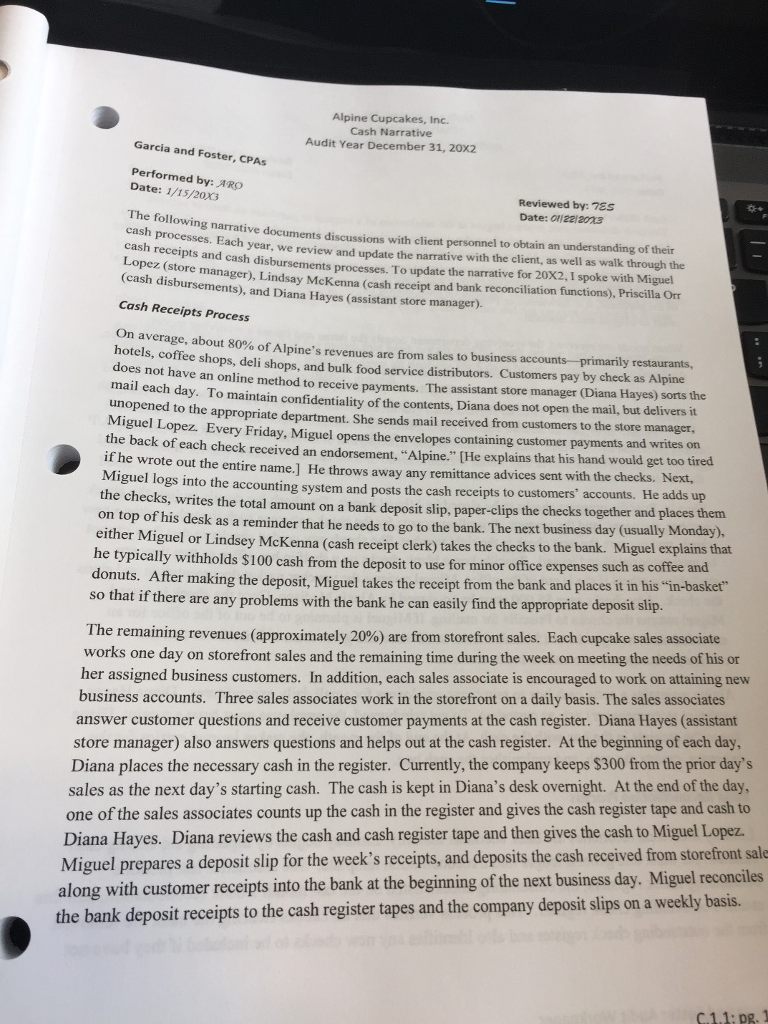

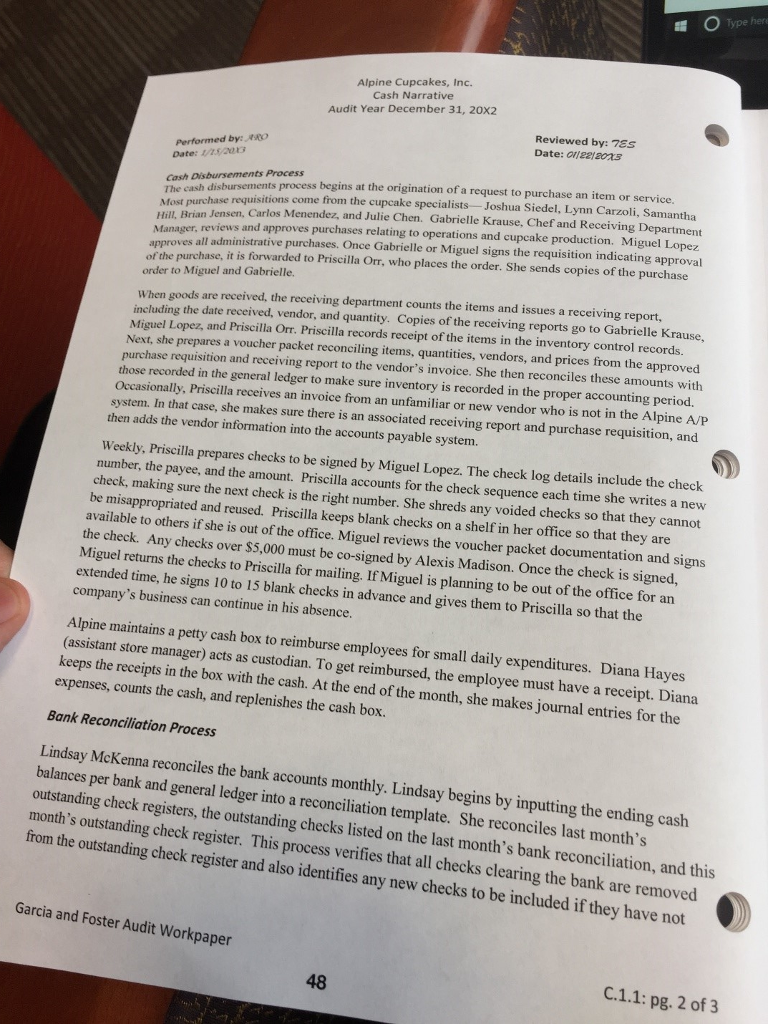

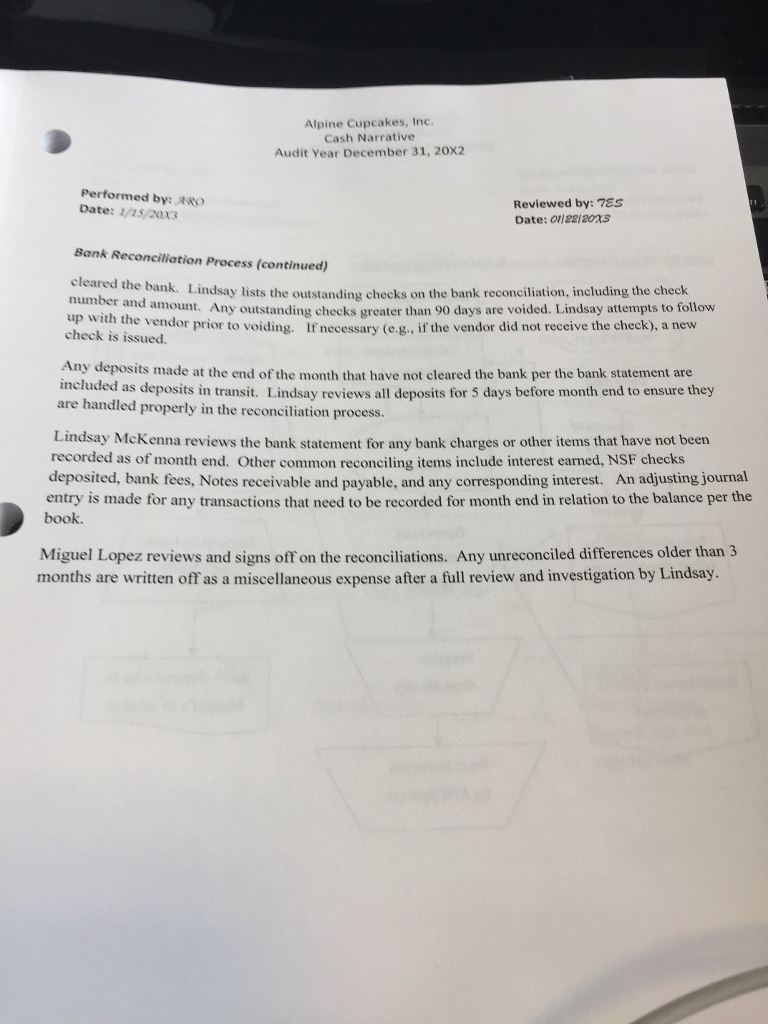

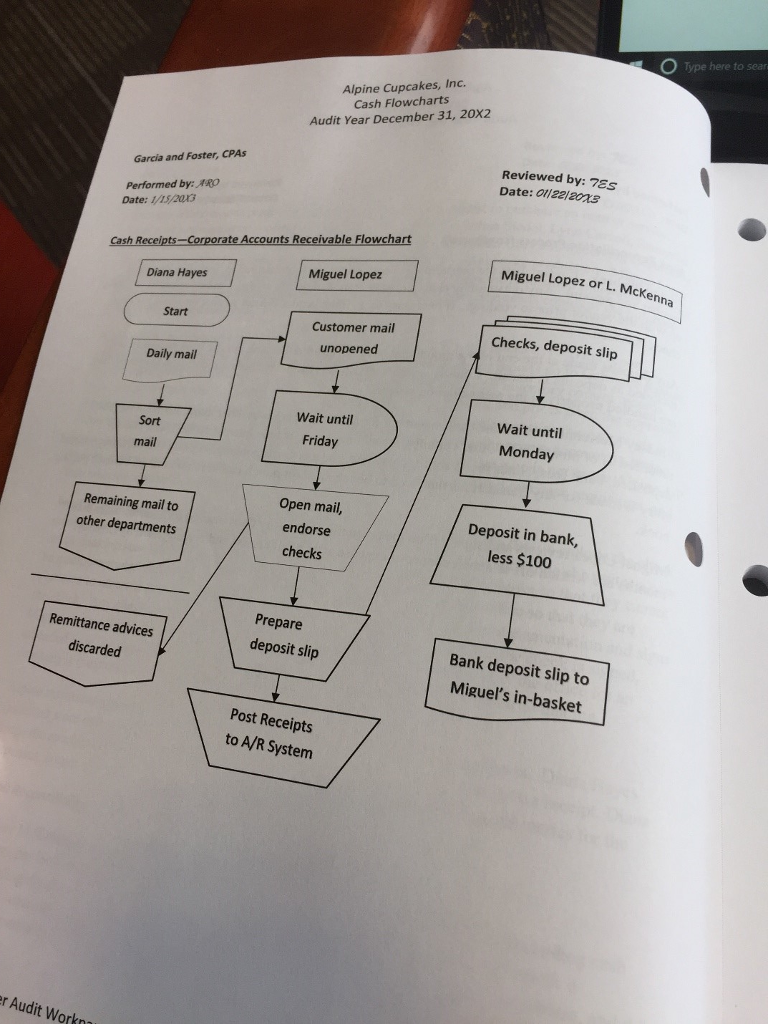

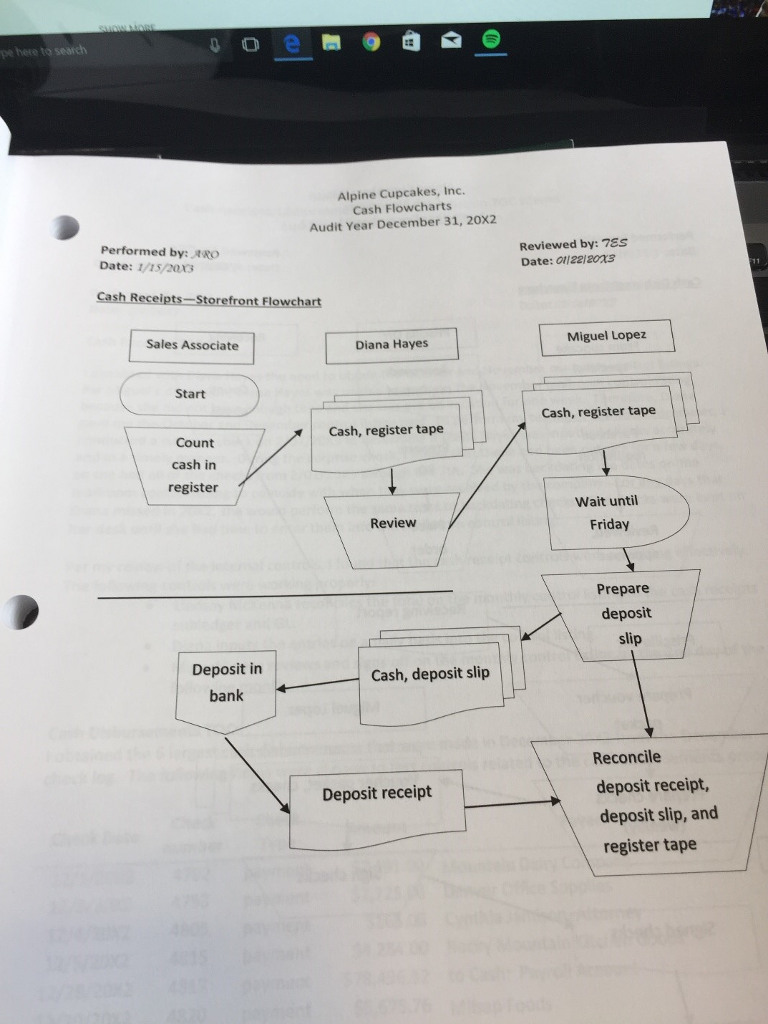

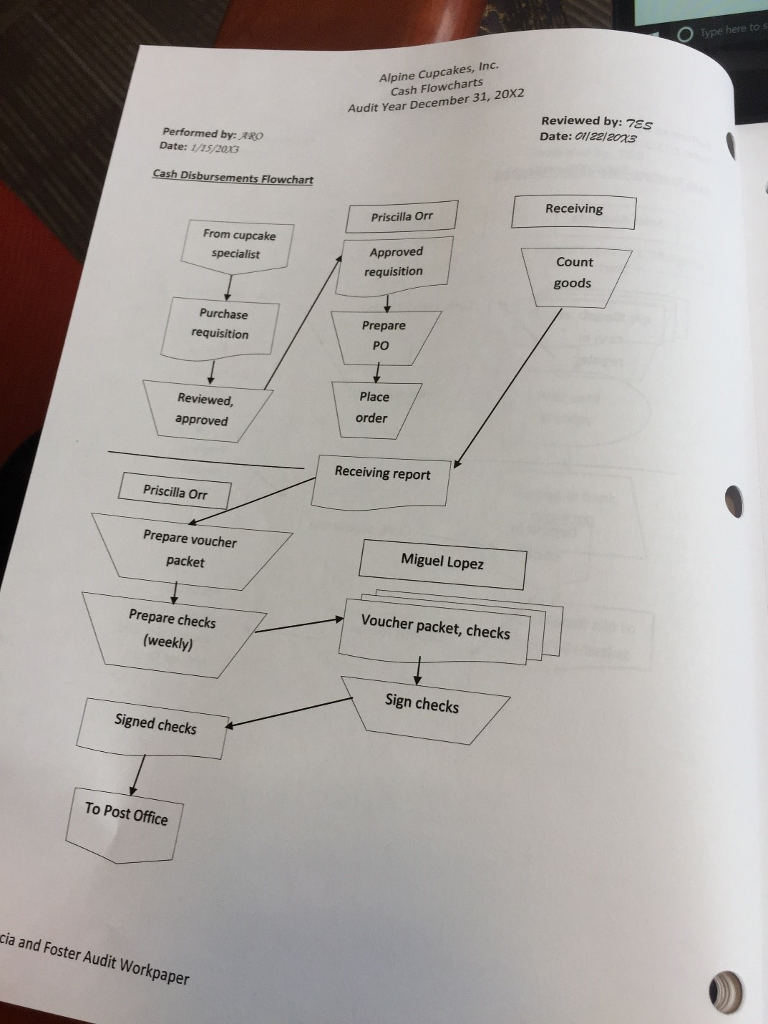

Introduction The cash module is a comprehensive coverage of the cash account, along with the related processes Within this module, you will gain a better understanding of important procedures performed by auditors in relation to the cash account and processes. This module includes consideration of both the cash receipt and cash disbursement processes. You will have the opportunity to review the narrative of cash processes to identify weaknesses in Alpine's internal controls. Your assessment of the auditors' testing of controls procedures will allow documentation in relation to the cash processes. Yo auditors' procedure confirmations. Through this module, you will gain a better understanding of typical audit procedures along you to understand the testing of controls procedures and auditor u will be able to investigate and examine the s with important substantive tests, including bank reconciliations and cash with common issues that could occur in the auditing of the cash account. Learning Objectives: The goal of this module is to enhance receipt and cash disbursement process your understanding of cash audit procedures, including cash es. After performance of the module, you will be able to 1. Identify internal control weaknesses in the cl ient's cash processes luate the auditors' testing of internal controls over the cash processes 3. Assess the substantive testing over the cash confirmation procedures 4. Evaluate the substantive testing over the bank reconciliation procedure 5. Identify any red fl ags for the potential of material misstatement in the cash accounts Assignment Before beginning the assignment, take a moment to look through the papers in this module. Note in the ted by Garcia and Foster CPAs lower left-hand corner that some documents are audit work papers crea as they conducted collected and kep the audit. Note that other papers are client documents that Garcia and Foster t in support of their audit. Finally, note the numbering system in the lower right-hand corner and how each paper within the audit i ack to the audit program. In this part of your assignment, you will examine the firm's audit documentation 1. Research, cite, and summarize (in on d related cash processes. Please complete the following tasks: e or two sentences per standard identified) the auditing standards that address Garcia and Foster, CPA's, responsibility in relation to evaluating Alpine's n each standard. 2. Review the cash narrative memo (C.1.1) a internal control weaknesses over cash receipts, cash disbursements, bank reconciliation nd cash flowcharts (C.1.2). Identify and document any , and/or cash. Explain why each item identified is a weakness. This question relates to Step 2 of and Foster Audit Plan. Case Assignment: Pg. pg 3 Introduction The cash module is a comprehensive coverage of the cash account, along with the related processes Within this module, you will gain a better understanding of important procedures performed by auditors in relation to the cash account and processes. This module includes consideration of both the cash receipt and cash disbursement processes. You will have the opportunity to review the narrative of cash processes to identify weaknesses in Alpine's internal controls. Your assessment of the auditors' testing of controls procedures will allow documentation in relation to the cash processes. Yo auditors' procedure confirmations. Through this module, you will gain a better understanding of typical audit procedures along you to understand the testing of controls procedures and auditor u will be able to investigate and examine the s with important substantive tests, including bank reconciliations and cash with common issues that could occur in the auditing of the cash account. Learning Objectives: The goal of this module is to enhance receipt and cash disbursement process your understanding of cash audit procedures, including cash es. After performance of the module, you will be able to 1. Identify internal control weaknesses in the cl ient's cash processes luate the auditors' testing of internal controls over the cash processes 3. Assess the substantive testing over the cash confirmation procedures 4. Evaluate the substantive testing over the bank reconciliation procedure 5. Identify any red fl ags for the potential of material misstatement in the cash accounts Assignment Before beginning the assignment, take a moment to look through the papers in this module. Note in the ted by Garcia and Foster CPAs lower left-hand corner that some documents are audit work papers crea as they conducted collected and kep the audit. Note that other papers are client documents that Garcia and Foster t in support of their audit. Finally, note the numbering system in the lower right-hand corner and how each paper within the audit i ack to the audit program. In this part of your assignment, you will examine the firm's audit documentation 1. Research, cite, and summarize (in on d related cash processes. Please complete the following tasks: e or two sentences per standard identified) the auditing standards that address Garcia and Foster, CPA's, responsibility in relation to evaluating Alpine's n each standard. 2. Review the cash narrative memo (C.1.1) a internal control weaknesses over cash receipts, cash disbursements, bank reconciliation nd cash flowcharts (C.1.2). Identify and document any , and/or cash. Explain why each item identified is a weakness. This question relates to Step 2 of and Foster Audit Plan. Case Assignment: Pg. pg 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started