Question

Answer question 2 and 3. some notes for question 2 and 3. Just need answer question 2 and 3 Solution for question 1: EPS =

Answer question 2 and 3.

some notes for question 2 and 3.

Just need answer question 2 and 3

Solution for question 1:

EPS = $0.52

DPS = $31,200 /100,000 = 0.312

Total number of shares = 2*100,000 = 200,000

Growth rate = ROE * Dividend retention ratio

= ROE * (1 - DPS/EPS)

=15% * (1 - 0.312 /0.52)

= 6%

Hence, current growth rate = 6%

Current year dividend per share = $0.312

Dividend next year (Year 1) = D1 = $0.312 * (1 +6%) = $0.33072

Share Price = D1 / (Required rate of Return - Growth rate)

= $0.33072 /(12% - 6%)

=$5.512

Share price of the company = $5.512

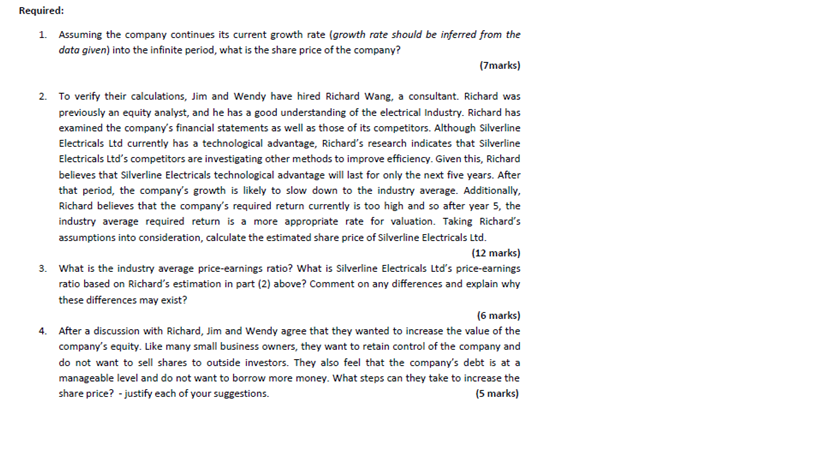

Question 2

Notes: for question 2. Year 1 to year 5, use Silverlines EPS=0.52, DPS=0.312, ROE=15%.

Year 6, use Industry Averages EPS=0.36, DPS=0.27, ROE=11%.

Need to calculate D1 D2 D3 D4 D5 D6

VE=D1/(RE-g)

g=ROE*(1-DPS/EPS)

Question 3

Notes for question 3, PE ratio for Silverline use EPS=0.52 for Silverline.

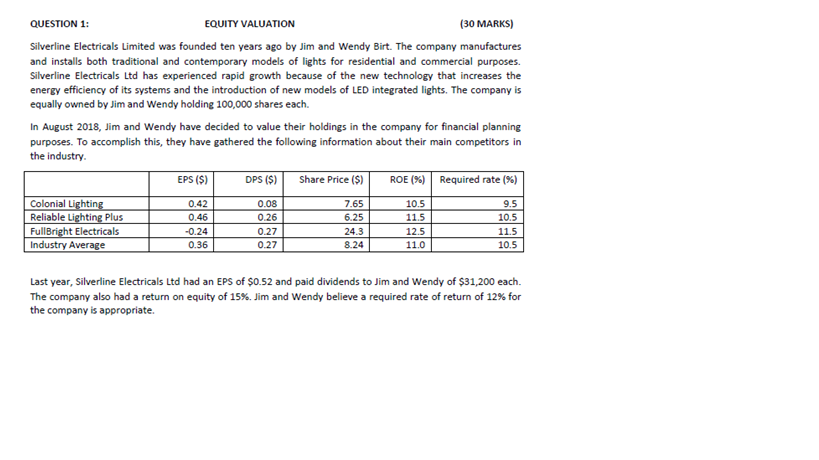

QUESTION 1: EQUITY VALUATION (30 MARKS) Silverline Electricals Limited was founded ten years ago by Jim and Wendy Birt. The company manufactures and installs both traditional and contemporary models of lights for residential and commercial purposes. Silverline Electricals Ltd has experienced rapid growth because of the new technology that increases the energy efficiency of its systems and the introduction of new models of LED integrated lights. The company is equally owned by Jim and Wendy holding 100,000 shares each. In August 2018, Jim and Wendy have decided to value their holdings in the company for financial planning purposes. To accomplish this, they have gathered the following information about their main competitors in the industry EPS (S) DPS (S) Share Price ($) | ROE (96) | Required rate (%) Colonial Lightin Reliable Full Industry Average 0.42 0.46 0.24 0.36 0.08 0.26 0.27 0.27 10.5 11.5 12.5 11.0 9.5 10.5 11.5 10.5 7.65 Plus t Electricals 24.3 8.24 Last year, Silverline Electricals Ltd had an EPS of $0.52 and paid dividends to Jim and Wendy of $31,200 each. The company also had a return on equity of 15%. Jim and wendy believe a required rate of return of 12% for the company is appropriateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started