Answered step by step

Verified Expert Solution

Question

1 Approved Answer

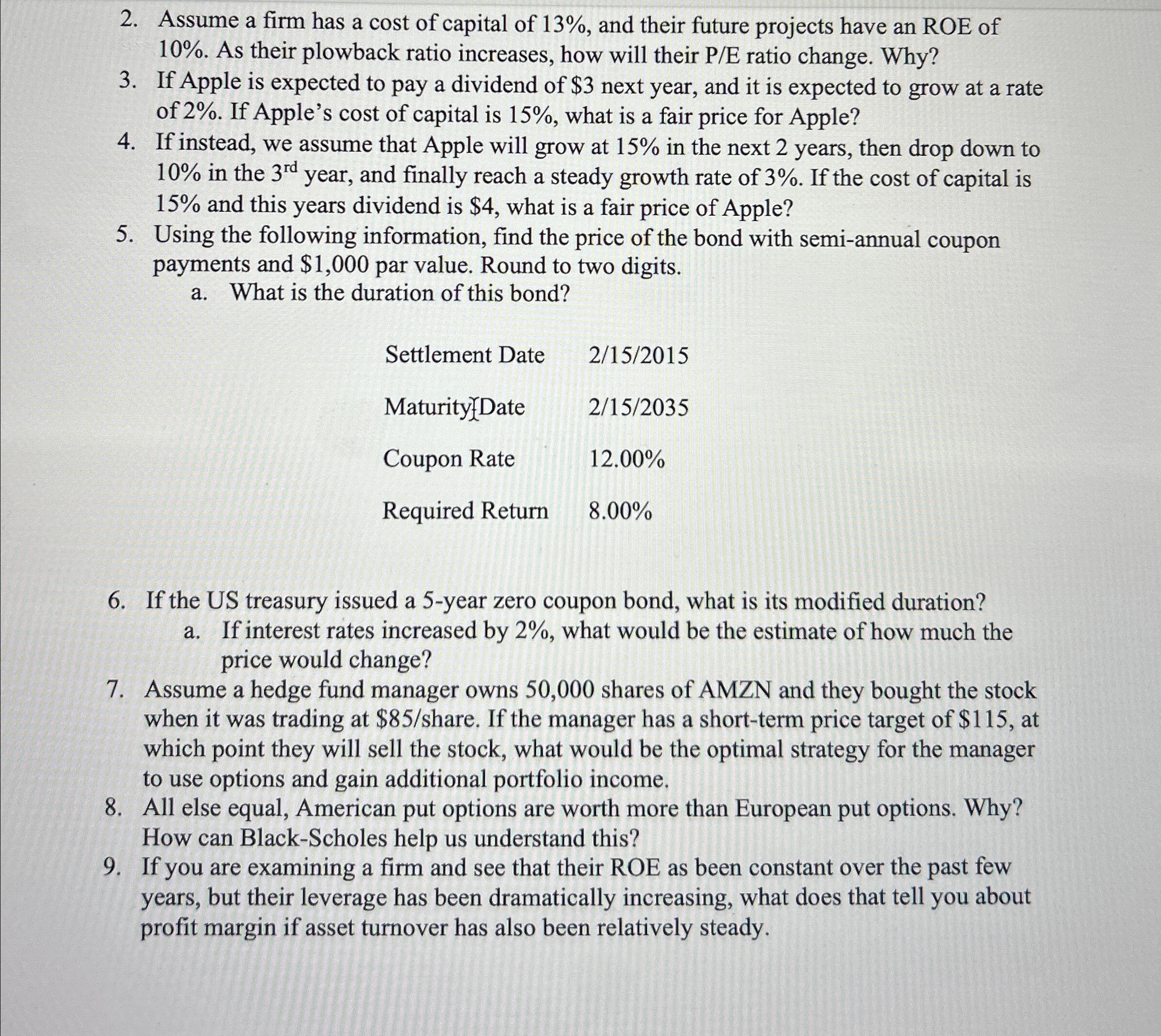

Answer question 2 In excel with cell refrances, the growth rate is 3 . 8 5 % . Assume a firm has a cost of

Answer question In excel with cell refrances, the growth rate is Assume a firm has a cost of capital of and their future projects have an ROE of As their plowback ratio increases, how will their ratio change. Why?

If Apple is expected to pay a dividend of $ next year, and it is expected to grow at a rate of If Apple's cost of capital is what is a fair price for Apple?

If instead, we assume that Apple will grow at in the next years, then drop down to in the year, and finally reach a steady growth rate of If the cost of capital is and this years dividend is $ what is a fair price of Apple?

Using the following information, find the price of the bond with semiannual coupon payments and $ par value. Round to two digits.

a What is the duration of this bond?

tableSettlement Date,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started