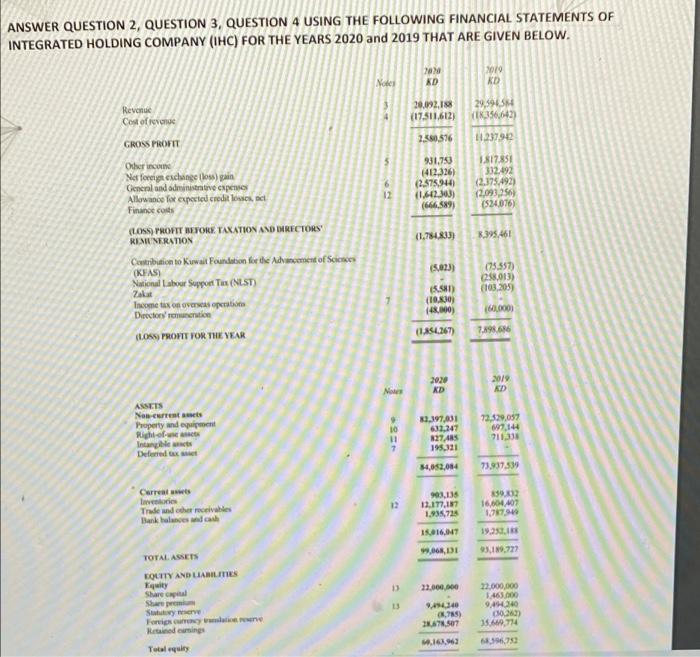

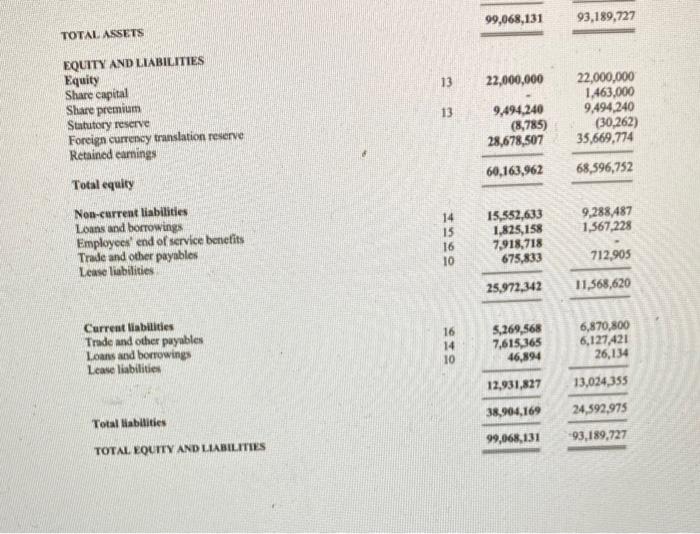

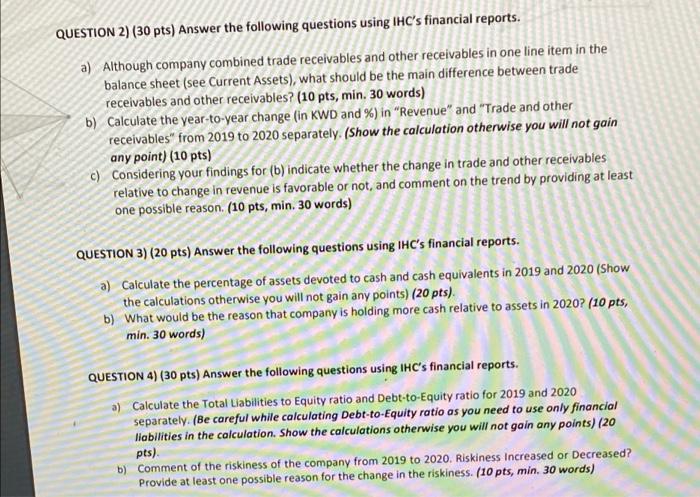

ANSWER QUESTION 2, QUESTION 3, QUESTION 4 USING THE FOLLOWING FINANCIAL STATEMENTS OF INTEGRATED HOLDING COMPANY (IHC) FOR THE YEARS 2020 and 2019 THAT ARE GIVEN BELOW. 100 KD 1019 KD Notes 20.092,19 (17.511.612) 29,5945 (1.356,642) 2.380,576 11.237.90 931,753 412.326) (2.375.944 (1.612.303) (666.589) 1.817.851 332492 (2.375,492) (2,093,256 (534 076) 12 Revenue Cost of revenge GROSS PROFIT Oder income Net foreign exchange (los) gain Genel and administrative expenses Allowance for expert credit losses, Finance costs GLOSS) PROFIT BEFORE TAXATION AND DIRECTORS REMUNERATION Contribution to Kuwait Foundation for the dancement of Sciences ( KAS) National Labour Support Tax (NLST) zakar Income tax on over tim Directors romantion LOS PROFIT FOR THE YEAR (1,788) 395,461 033) (73,557) 058.013) (103,205 13.51) (TOKO (48.000) 60.000) (1.254.367 7.198.686 2010 2020 KD Mos ASSETS Non- Property and pot Right-of- Ingible Deferred tax 83.397,031 633,247 127.45 195.311 73.329,057 97,144 71133 14.053,084 73.937539 Carreto lava Trade and the receives Bank holes 12 03.135 12.177,137 1.935725 15.0 16.017 39.802 16.64407 1.98746 19.25.1 9,068,131 319,722 13 22,000,000 TOTAL ASSETS LOUITY AND LIABILITIES Equity Share Share Stuhy Force wine Retained usings 13 0340 22.000.000 1463.000 9A340 (1024) 35.409,774 6.50 2.671.507 1.163.63 Totally 99,068,131 93,189,727 TOTAL ASSETS 13 22,000,000 EQUITY AND LIABILITIES Equity Share capital Share premium Statutory reserve Foreign currency translation reserve Retained earnings 13 9,494,240 (8,785) 28,678,507 22,000,000 1.463,000 9,494,240 (30,262) 35,669,774 60,163,962 68,596,752 Total equity 9,288,487 1,567,228 Nou-current liabilities Loans and borrowings Employees' end of service benefits Trade and other payables Lease liabilities 14 15 16 10 15,352,633 1.825,158 7,918,718 675,833 712,905 25,972,342 11,568,620 Current liabilities Trade and other puyables Loans and borrowing Lease liabilities 16 14 10 5,269,568 7,615,365 46,894 6,870.800 6,127,421 26,134 12,931,827 13,034,355 24,592,975 93,189,727 38,904,169 99,068,131 Total liabilities TOTAL EQUITY AND LIABILITIES QUESTION 2) (30 pts) Answer the following questions using THC's financial reports. a) Although company combined trade receivables and other receivables in one line item in the balance sheet (see Current Assets), what should be the main difference between trade receivables and other receivables? (10 pts, min. 30 words) b) Calculate the year-to-year change (in KWD and %) in "Revenue" and "Trade and other receivables" from 2019 to 2020 separately. (Show the calculation otherwise you will not gain any point) (10 pts) c) Considering your findings for (b) indicate whether the change in trade and other receivables relative to change in revenue is favorable or not, and comment on the trend by providing at least one possible reason. (10 pts, min. 30 words) QUESTION 3) (20 pts) Answer the following questions using THC's financial reports. a) Calculate the percentage of assets devoted to cash and cash equivalents in 2019 and 2020 (Show the calculations otherwise you will not gain any points) (20 pts). b) What would be the reason that company is holding more cash relative to assets in 2020? (10 pts, min. 30 words) QUESTION 4) (30 pts) Answer the following questions using IHC's financial reports. a) Calculate the Total Liabilities to Equity ratio and Debt-to-Equity ratio for 2019 and 2020 separately. (Be careful while calculating Debt-to-Equity ratio as you need to use only financial liabilities in the calculation. Show the calculations otherwise you will not gain any points) (20 pts) b) Comment of the riskiness of the company from 2019 to 2020. Riskiness Increased or Decreased? Provide at least one possible reason for the change in the riskiness. (10 pts, min. 30 words) ANSWER QUESTION 2, QUESTION 3, QUESTION 4 USING THE FOLLOWING FINANCIAL STATEMENTS OF INTEGRATED HOLDING COMPANY (IHC) FOR THE YEARS 2020 and 2019 THAT ARE GIVEN BELOW. 100 KD 1019 KD Notes 20.092,19 (17.511.612) 29,5945 (1.356,642) 2.380,576 11.237.90 931,753 412.326) (2.375.944 (1.612.303) (666.589) 1.817.851 332492 (2.375,492) (2,093,256 (534 076) 12 Revenue Cost of revenge GROSS PROFIT Oder income Net foreign exchange (los) gain Genel and administrative expenses Allowance for expert credit losses, Finance costs GLOSS) PROFIT BEFORE TAXATION AND DIRECTORS REMUNERATION Contribution to Kuwait Foundation for the dancement of Sciences ( KAS) National Labour Support Tax (NLST) zakar Income tax on over tim Directors romantion LOS PROFIT FOR THE YEAR (1,788) 395,461 033) (73,557) 058.013) (103,205 13.51) (TOKO (48.000) 60.000) (1.254.367 7.198.686 2010 2020 KD Mos ASSETS Non- Property and pot Right-of- Ingible Deferred tax 83.397,031 633,247 127.45 195.311 73.329,057 97,144 71133 14.053,084 73.937539 Carreto lava Trade and the receives Bank holes 12 03.135 12.177,137 1.935725 15.0 16.017 39.802 16.64407 1.98746 19.25.1 9,068,131 319,722 13 22,000,000 TOTAL ASSETS LOUITY AND LIABILITIES Equity Share Share Stuhy Force wine Retained usings 13 0340 22.000.000 1463.000 9A340 (1024) 35.409,774 6.50 2.671.507 1.163.63 Totally 99,068,131 93,189,727 TOTAL ASSETS 13 22,000,000 EQUITY AND LIABILITIES Equity Share capital Share premium Statutory reserve Foreign currency translation reserve Retained earnings 13 9,494,240 (8,785) 28,678,507 22,000,000 1.463,000 9,494,240 (30,262) 35,669,774 60,163,962 68,596,752 Total equity 9,288,487 1,567,228 Nou-current liabilities Loans and borrowings Employees' end of service benefits Trade and other payables Lease liabilities 14 15 16 10 15,352,633 1.825,158 7,918,718 675,833 712,905 25,972,342 11,568,620 Current liabilities Trade and other puyables Loans and borrowing Lease liabilities 16 14 10 5,269,568 7,615,365 46,894 6,870.800 6,127,421 26,134 12,931,827 13,034,355 24,592,975 93,189,727 38,904,169 99,068,131 Total liabilities TOTAL EQUITY AND LIABILITIES QUESTION 2) (30 pts) Answer the following questions using THC's financial reports. a) Although company combined trade receivables and other receivables in one line item in the balance sheet (see Current Assets), what should be the main difference between trade receivables and other receivables? (10 pts, min. 30 words) b) Calculate the year-to-year change (in KWD and %) in "Revenue" and "Trade and other receivables" from 2019 to 2020 separately. (Show the calculation otherwise you will not gain any point) (10 pts) c) Considering your findings for (b) indicate whether the change in trade and other receivables relative to change in revenue is favorable or not, and comment on the trend by providing at least one possible reason. (10 pts, min. 30 words) QUESTION 3) (20 pts) Answer the following questions using THC's financial reports. a) Calculate the percentage of assets devoted to cash and cash equivalents in 2019 and 2020 (Show the calculations otherwise you will not gain any points) (20 pts). b) What would be the reason that company is holding more cash relative to assets in 2020? (10 pts, min. 30 words) QUESTION 4) (30 pts) Answer the following questions using IHC's financial reports. a) Calculate the Total Liabilities to Equity ratio and Debt-to-Equity ratio for 2019 and 2020 separately. (Be careful while calculating Debt-to-Equity ratio as you need to use only financial liabilities in the calculation. Show the calculations otherwise you will not gain any points) (20 pts) b) Comment of the riskiness of the company from 2019 to 2020. Riskiness Increased or Decreased? Provide at least one possible reason for the change in the riskiness. (10 pts, min. 30 words)