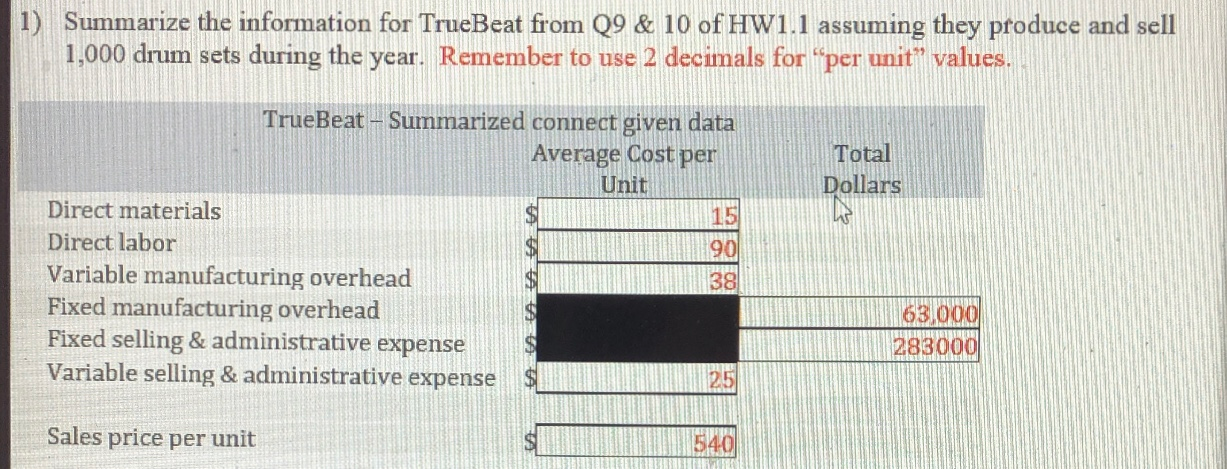

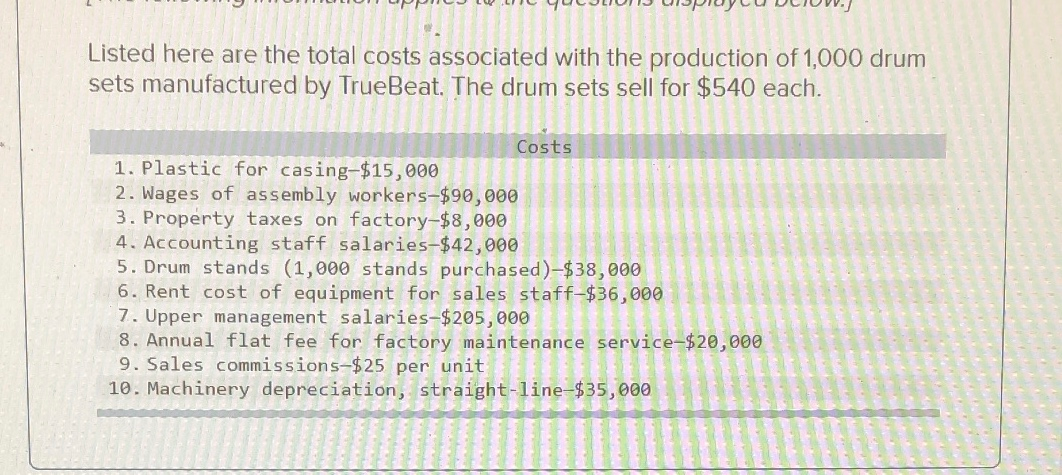

Question

answer question 2 using the table from question 2. Assume, due to the significant success of the drum sets, TrueBeat has obtained a contract to

answer question 2 using the table from question

2. Assume, due to the significant success of the drum sets, TrueBeat has obtained a contract to provide drum sets to a national merchandising chain. This contract is expected to increase TrueBeats sales over the next 3 years. Current operations have a relevant range of 500 to 1,800 drum sets. TrueBeats anticipates selling 3,000 units in Year 2, 5,000 units in Year 3 and 6,000 units in Year 4. Making the following cost changes, TrueBeat will increase their relevant range of production to between 4,000 and 8,000 drum sets.

- This significant increase to production will stair-step some of their costs. Specifically, the company will have to purchase additional equipment that will increase their machinery depreciation expense by 50% (Fixed overhead. The new equipment will allow TrueBeat to produce up to 10,000 drum sets a year.

- With increased production levels, TrueBeat will need to pay shift premium to assembly workers such that the average Direct labor will increase by $18 a unit. Additionally, production supervisor will be hired for $120,000 (fixed overhead).

- Additionally, the company providing factory maintenance services has agreed to a new contract. The new contract will include a fixed component (overhead) equal to half of the original flat fee and a variable component (overhead) that will be $0.25 per assembly wage dollars

- The company needs to increase its sales staff. Rather than paying their sales staff commission only, TrueBeat will pay sales staff a flat salary (fixed S&A) equal to twice the amount paid in Year 1 and a reduced commission per drum set equal to 50% of the previous commission rate.

- All other costs are considered consistent and within relevant range for production of 4,000 to 8,000 units.

Use the information provided above to adjust amounts from the table in 1). Include the adjusted amounts in the table below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started