Answer Question:

2. What is the cost of equity capital and the weighted average cost of capital (WACC) for Boeing?

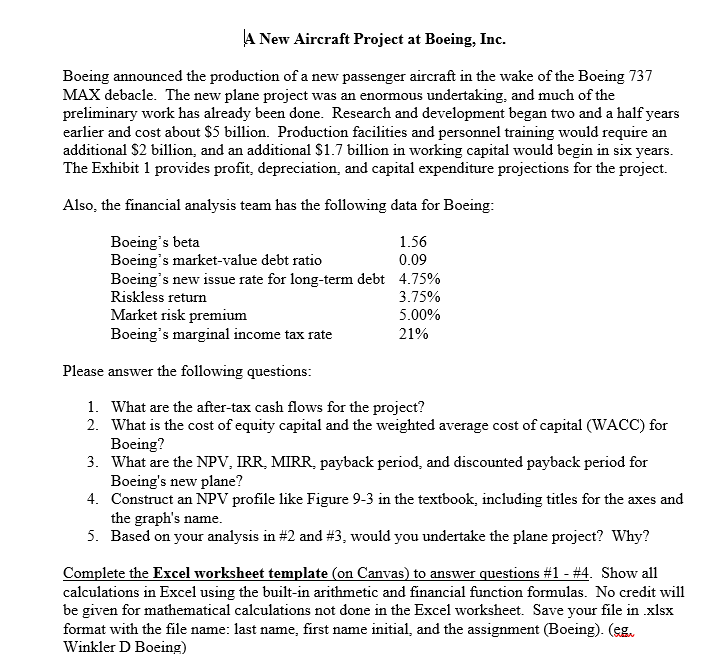

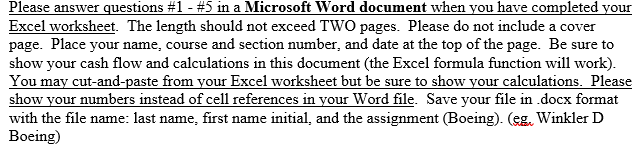

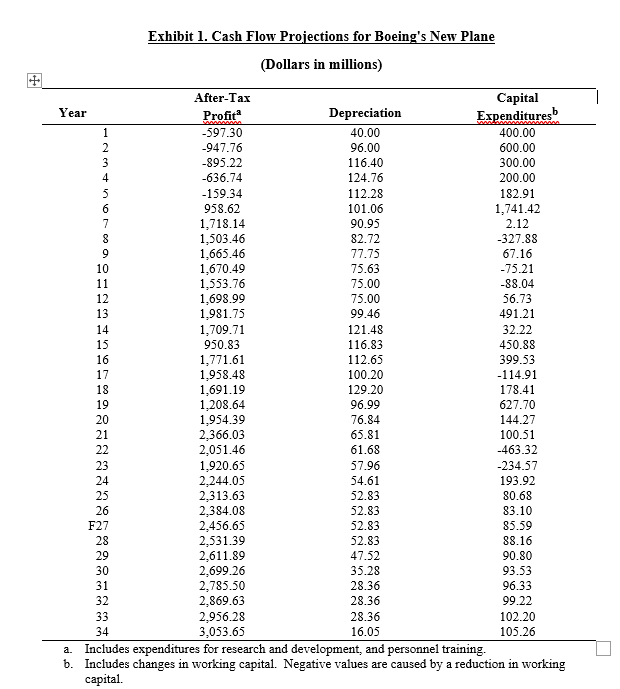

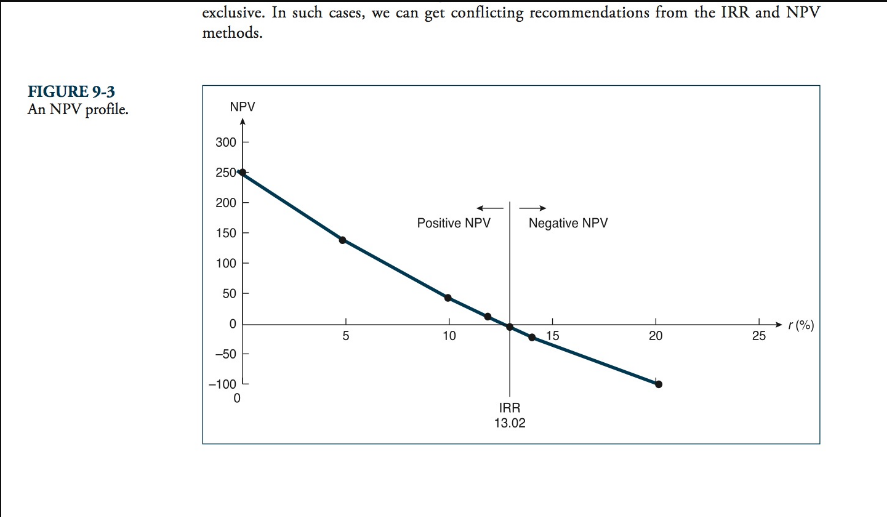

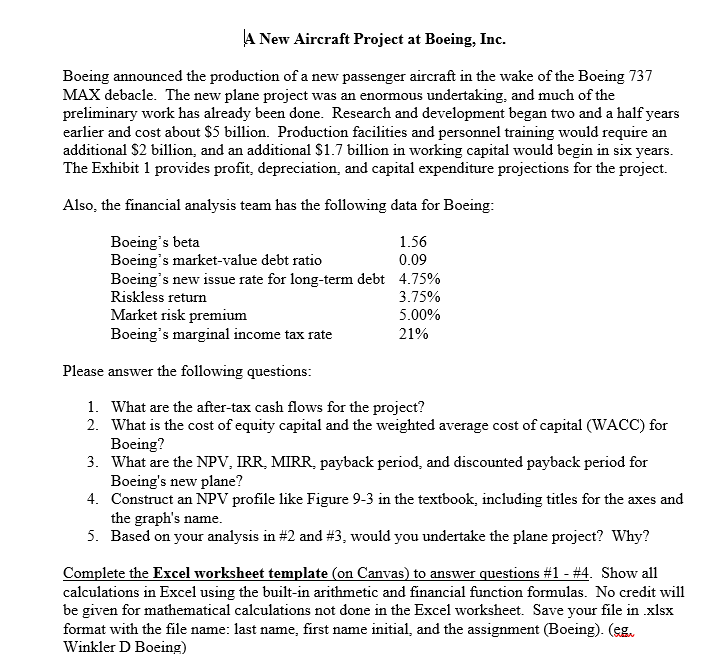

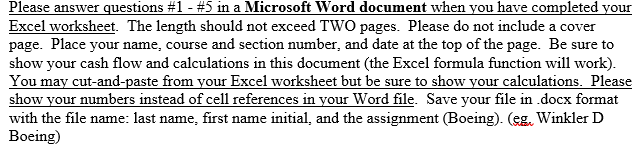

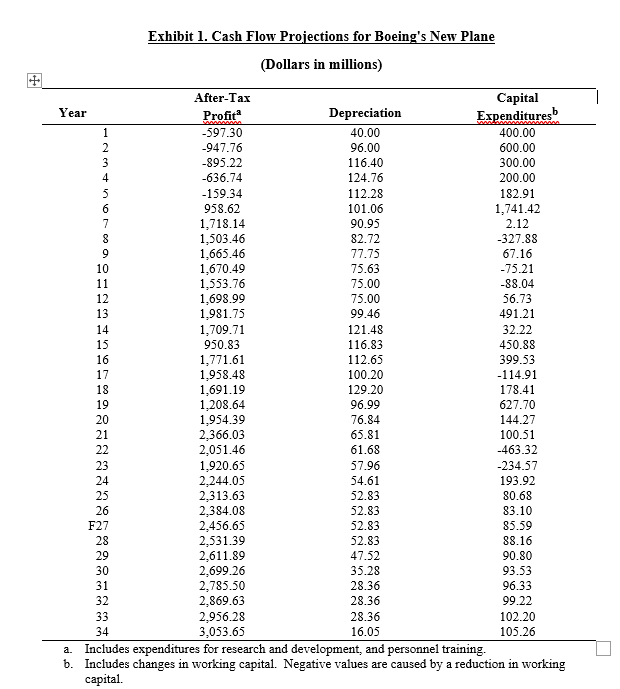

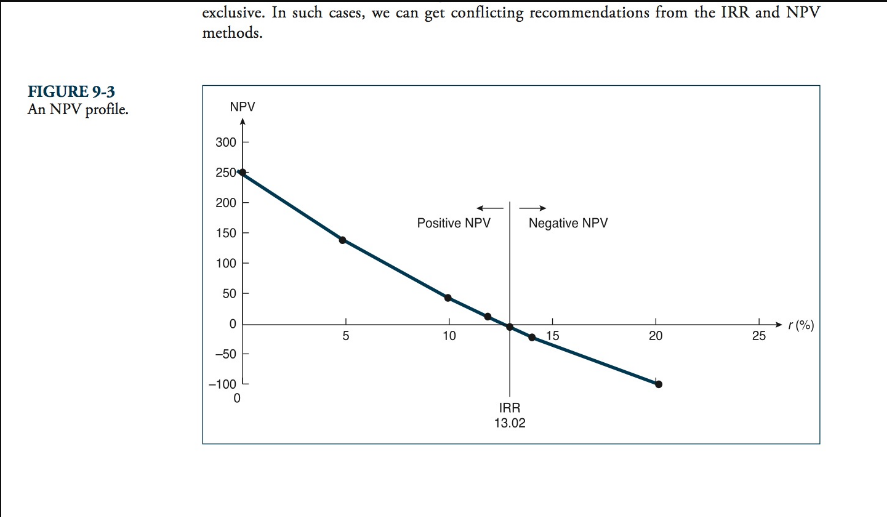

A New Aircraft Project at Boeing, Inc. Boeing announced the production of a new passenger aircraft in the wake of the Boeing 737 MAX debacle. The new plane project was an enormous undertaking, and much of the preliminary work has already been done. Research and development began two and a half years earlier and cost about $5 billion. Production facilities and personnel training would require an additional $2 billion and an additional $1.7 billion in working capital would begin in six years. The Exhibit 1 provides profit, depreciation and capital expenditure projections for the project. Also the financial analysis team has the following data for Boeing Boeing's beta 1.56 Boeing's market value debt ratio 0.09 Boeing's new issue rate for long-term debt 4.75% Riskless return 3.75% Market risk premium 5.00% Boeing's marginal income tax rate 21% Please answer the following questions: 1. What are the after-tax cash flows for the project? 2. What is the cost of equity capital and the weighted average cost of capital (WACC) for Boeing? 3. What are the NPV, IRR MIRR, payback period, and discounted payback period for Boeing's new plane? 4. Construct an NPV profile like Figure 9-3 in the textbook, including titles for the axes and the graph's name. 5. Based on your analysis in #2 and #3, would you undertake the plane project? Why? Complete the Excel worksheet template (on Canvas) to answer questions #1 - #4. Show all calculations in Excel using the built-in arithmetic and financial function formulas. No credit will be given for mathematical calculations not done in the Excel worksheet. Save your file in xlsx format with the file name: last name, first name initial, and the assignment (Boeing). (eg Winkler D Boeing) Please answer questions #1 - #5 in a Microsoft Word document when you have completed your Excel worksheet. The length should not exceed TWO pages. Please do not include a cover page. Place your name, course and section number, and date at the top of the page. Be sure to show your cash flow and calculations in this document (the Excel formula function will work). You may cut-and-paste from your Excel worksheet but be sure to show your calculations. Please show your numbers instead of cell references in your Word file. Save your file in .docx format with the file name: last name, first name initial, and the assignment (Boeing). (eg. Winkler D Boeing) Exhibit 1. Cash Flow Projections for Boeing's New Plane (Dollars in millions) 17 After-Tax Capital Year Profita Depreciation Expenditures 1 -597.30 40.00 400.00 2 -947.76 96.00 600.00 3 -895.22 116.40 300.00 4 -636.74 124.76 200.00 5 -159.34 112.28 182.91 6 958.62 101.06 1,741.42 7 1,718.14 90.95 2.12 8 1,503.46 82.72 -327.88 9 1,665.46 77.75 67.16 10 1,670.49 75.63 -75.21 11 1,553.76 75.00 -88.04 12 1,698.99 75.00 56.73 13 1,981.75 99.46 491.21 14 1,709.71 121.48 32.22 15 950.83 116.83 450.88 16 1,771.61 112.65 399.53 1,958.48 100.20 -114.91 18 1,691.19 129.20 178.41 19 1,208.64 96.99 627.70 20 1,954.39 76.84 144.27 21 2,366.03 65.81 100.51 22 2,051.46 61.68 -463.32 23 1,920.65 57.96 -234.57 24 2,244.05 54.61 193.92 25 2,313.63 52.83 80.68 26 2,384.08 52.83 83.10 F27 2.456.65 52.83 85.59 2,531.39 52.83 88.16 29 2,611.89 47.52 90.80 30 2,699.26 35.28 93.53 31 2,785.50 28.36 96.33 2,869.63 28.36 99.22 33 2.956.28 28.36 102.20 34 3,053.65 16.05 105.26 a. Includes expenditures for research and development, and personnel training. b. Includes changes in working capital. Negative values are caused by a reduction in working capital 28 32 exclusive. In such cases, we can get conflicting recommendations from the IRR and NPV methods. FIGURE 9-3 An NPV profile. NPV 300 250 200 Positive NPV Negative NPV 150 100 50 0 1 25 r(%) 5 10 15 20 -50 -100 0 IRR 13.02