Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer question 3 please 1. Consider the following. A group of 4 Real Estate graduates decide to pool their funds and purchase a local strip

Answer question 3 please

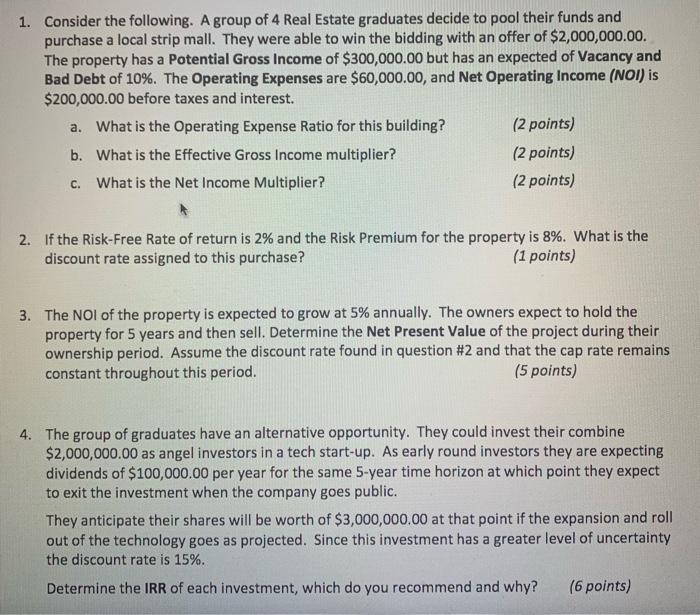

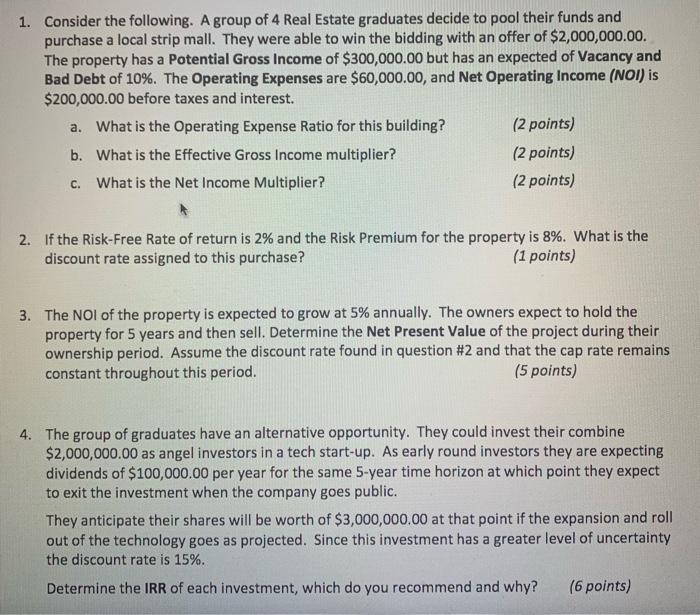

1. Consider the following. A group of 4 Real Estate graduates decide to pool their funds and purchase a local strip mall. They were able to win the bidding with an offer of $2,000,000.00. The property has a Potential Gross Income of $300,000.00 but has an expected of Vacancy and Bad Debt of 10%. The Operating Expenses are $60,000.00, and Net Operating Income (NOI) is $200,000.00 before taxes and interest. a. What is the Operating Expense Ratio for this building? (2 points) b. What is the Effective Gross Income multiplier? (2 points) c. What is the Net Income Multiplier? (2 points) 2. If the Risk-Free Rate of return is 2% and the Risk Premium for the property is 8%. What is the discount rate assigned to this purchase? (1 points) 3. The NOI of the property is expected to grow at 5% annually. The owners expect to hold the property for 5 years and then sell. Determine the Net Present Value of the project during their ownership period. Assume the discount rate found in question #2 and that the cap rate remains constant throughout this period. (5 points) 4. The group of graduates have an alternative opportunity. They could invest their combine $2,000,000.00 as angel investors in a tech start-up. As early round investors they are expecting dividends of $100,000.00 per year for the same 5-year time horizon at which point they expect to exit the investment when the company goes public. They anticipate their shares will be worth of $3,000,000.00 at that point if the expansion and roll out of the technology goes as projected. Since this investment has a greater level of uncertainty the discount rate is 15%. Determine the IRR of each investment, which do you recommend and why? (6 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started