Answered step by step

Verified Expert Solution

Question

1 Approved Answer

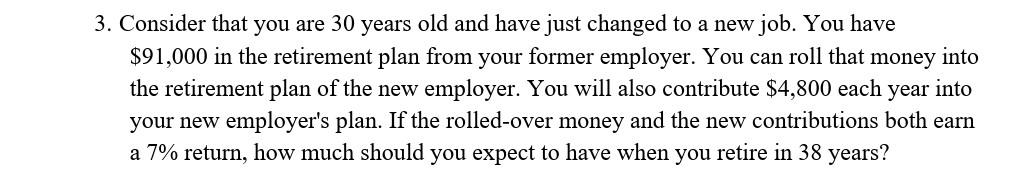

answer question 3 Solve the problems below. Be sure to show your work. If you use the formula, be sure to write it out a

answer question 3

Solve the problems below. Be sure to show your work. If you use the formula, be sure to write it out a long with each step. If you are using a financial calculator, be sure to write out your inputs (including if you switch you calculator from end mode to beginning mode). 3. Consider that you are 30 years old and have just changed to a new job. You have $91,000 in the retirement plan from your former employer. You can roll that money into the retirement plan of the new employer. You will also contribute $4,800 each year into your new employer's plan. If the rolled-over money and the new contributions both earn a 7% return, how much should you expect to have when you retire in 38 yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started