Answered step by step

Verified Expert Solution

Question

1 Approved Answer

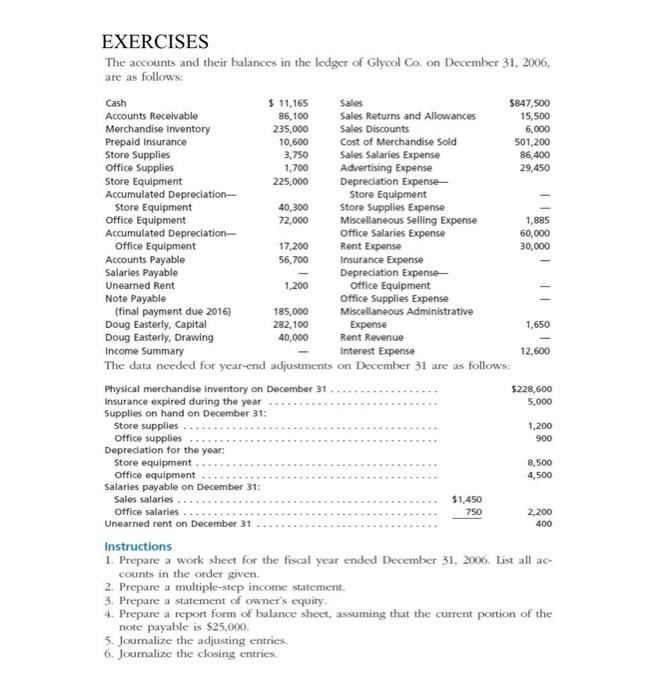

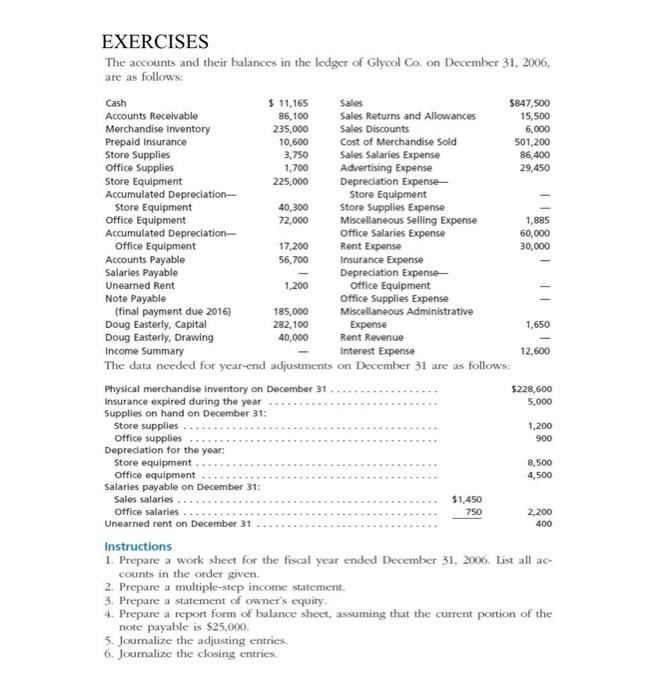

answer question 5 and 6 EXERCISES The accounts and their balances in the ledger of Glycol Co. on December 31, 2006, are as follows: Cash

answer question 5 and 6

EXERCISES The accounts and their balances in the ledger of Glycol Co. on December 31, 2006, are as follows: Cash $ 11,165 Sales $847,500 Accounts Receivable 86,100 Sales Returns and Allowances 15,500 Merchandise Inventory 235,000 Sales Discounts 6,000 Prepaid Insurance 10,600 Cost of Merchandise Sold 501,200 Store Supplies 3.750 Sales Salaries Expense 86,400 Office Supplies 1,700 Advertising Expense 29,450 Store Equipment 225,000 Depreciation Expense Accumulated Depreciation- Store Equipment Store Equipment 40,300 Store Supplies Expense Office Equipment 72,000 Miscellaneous Selling Expense 1,885 Accumulated Depreciation- Office Salaries Expense 60,000 Office Equipment 17,200 Rent Expense 30,000 Accounts Payable 56,700 Insurance Expense Salaries Payable Depreciation Expense Unearned Rent 1,200 Office Equipment Note Payable Office Supplies Expense (final payment due 2016) 185,000 Miscellaneous Administrative Doug Easterly, Capital 282,100 Expense 1.650 Doug Easterly, Drawing 40,000 Rent Revenue Income Summary Interest Expense The data needed for year-end adjustments on December 31 are as follows: Physical merchandise inventory on December 31 $228,600 Insurance expired during the year 5,000 Supplies on hand on December 31: Store supplies 1,200 Office supplies Depreciation for the year: Store equipment. 8,500 Office equipment 4,500 Salaries payable on December 31: Sales salaries $1,450 Office salaries 750 2,200 Unearned rent on December 31 400 Instructions 1. Prepare a work sheet for the fiscal year ended December 31, 2006. List all ac counts in the order given. 2. Prepare a multiple-step income statement. 3. Prepare a statement of owner's equity. 4. Prepare a report form of balance sheet, assuming that the current portion of the note payable is $25.000 5. Journalize the adjusting entries. 6. Journalize the closing entries. 12,600 900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started