Question

Answer question A A large defense contractor is considering making a specialized investment in a facility to make helicopters. The firm currently has a contract

Answer question A

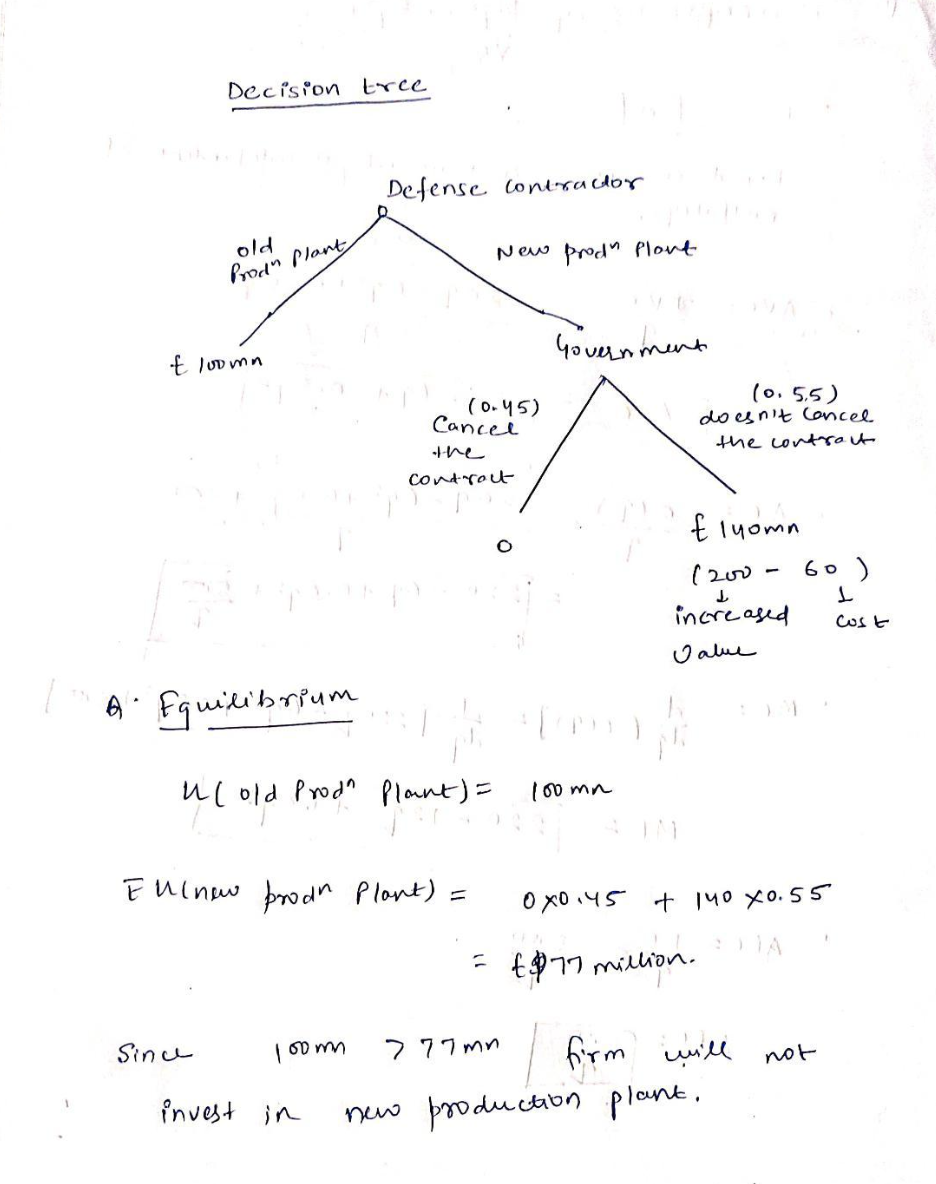

A large defense contractor is considering making a specialized investment in a facility to make helicopters. The firm currently has a contract with the government, which, over the lifetime of the contract, is worth 100mn euro to the firm. It is considering building a new production plant for these helicopters; doing so will reduce the production costs to the company, increasing the value of the contract from 100mn euro to 200mn euro. The cost of the plant will be 60mn euro. However, there is the possibility that the government will cancel the contract. If that happens, the value of the contract will fall to zero. The problem (from the companys point of view) is that it will only find out about the cancellation after it completes the new plant. At this point, it appears that the probability that the government will cancel the contract is 0.45. Draw a decision tree reflecting the decisions and find the equilibrium.

(the first part of the question is already answered in the picture attachment)

a) Assuming that the firm is a risk -neutral decision maker, should the firm build a new plant? What is the expected value associated with the optimal decision? [1]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started