Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer question A3 please For the Week 4 Assignment, review and explain the Weighted Average Cost of Capital (WACC) concepts as follows: When writing your

Answer question A3 please

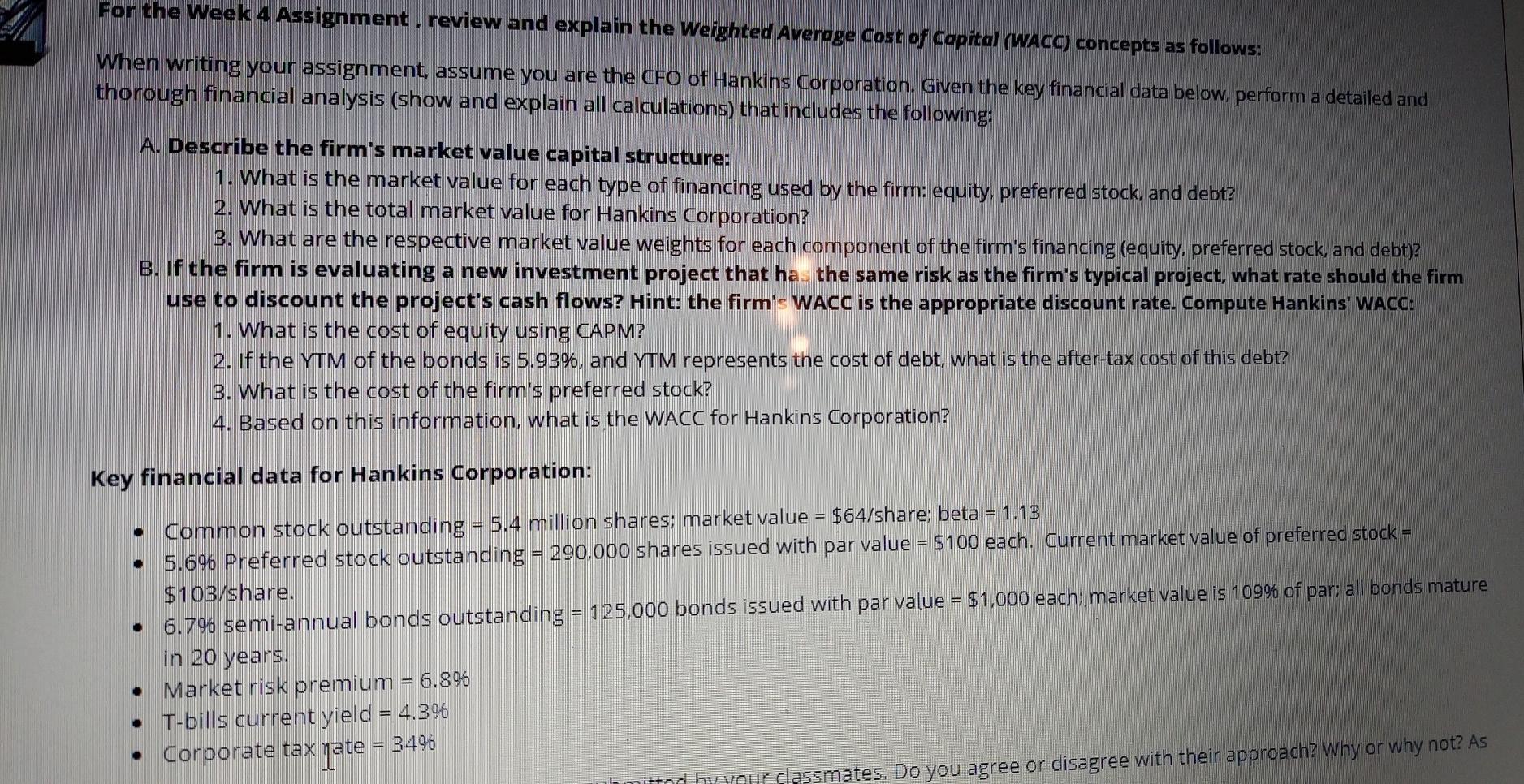

For the Week 4 Assignment, review and explain the Weighted Average Cost of Capital (WACC) concepts as follows: When writing your assignment, assume you are the CFO of Hankins Corporation. Given the key financial data below, perform a detailed and thorough financial analysis (show and explain all calculations) that includes the following: A. Describe the firm's market value capital structure: 1. What is the market value for each type of financing used by the firm: equity, preferred stock, and debt? 2. What is the total market value for Hankins Corporation? 3. What are the respective market value weights for each component of the firm's financing (equity, preferred stock, and debt)? B. If the firm is evaluating a new investment project that has the same risk as the firm's typical project, what rate should the firm use to discount the project's cash flows? Hint: the firm's WACC is the appropriate discount rate. Compute Hankins' WACC: 1. What is the cost of equity using CAPM? 2. If the YTM of the bonds is 5.93%, and YTM represents the cost of debt, what is the after-tax cost of this debt? 3. What is the cost of the firm's preferred stock? 4. Based on this information, what is the WACC for Hankins Corporation? Key financial data for Hankins Corporation: . Common stock outstanding = 5.4 million shares; market value = $64/share; beta = 1.13 5.696 Preferred stock outstanding = 290,000 shares issued with par value = $100 each. Current market value of preferred stock = $103/share. 6.7% semi-annual bonds outstanding = 125,000 bonds issued with par value = $1,000 each; market value is 109% of par; all bonds mature in 20 years. Market risk premium = 6.896 T-bills current yield = 4.3% Corporate tax rate = 34% ilmitted by your classmates. Do you agree or disagree with their approach? Why or why not? AsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started