Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer Question B only Please show me step by step result. i want to learn it, dont use excel plsssssss Question 1 a. The Zahra

Answer Question B only

Please show me step by step result. i want to learn it, dont use excel plsssssss

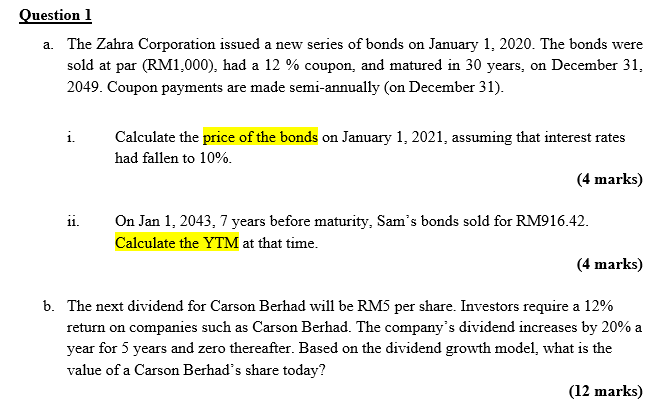

Question 1 a. The Zahra Corporation issued a new series of bonds on January 1, 2020. The bonds were sold at par (RM1,000), had a 12 % coupon, and matured in 30 years, on December 31, 2049. Coupon payments are made semi-annually (on December 31). i. Calculate the price of the bonds on January 1, 2021, assuming that interest rates had fallen to 10%. (4 marks) ii. On Jan 1, 2043, 7 years before maturity, Sam's bonds sold for RM916.42. Calculate the YTM at that time. (4 marks) b. The next dividend for Carson Berhad will be RM5 per share. Investors require a 12% return on companies such as Carson Berhad. The company's dividend increases by 20% a year for 5 years and zero thereafter. Based on the dividend growth model, what is the value of a Carson Berhad's share today? (12 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started