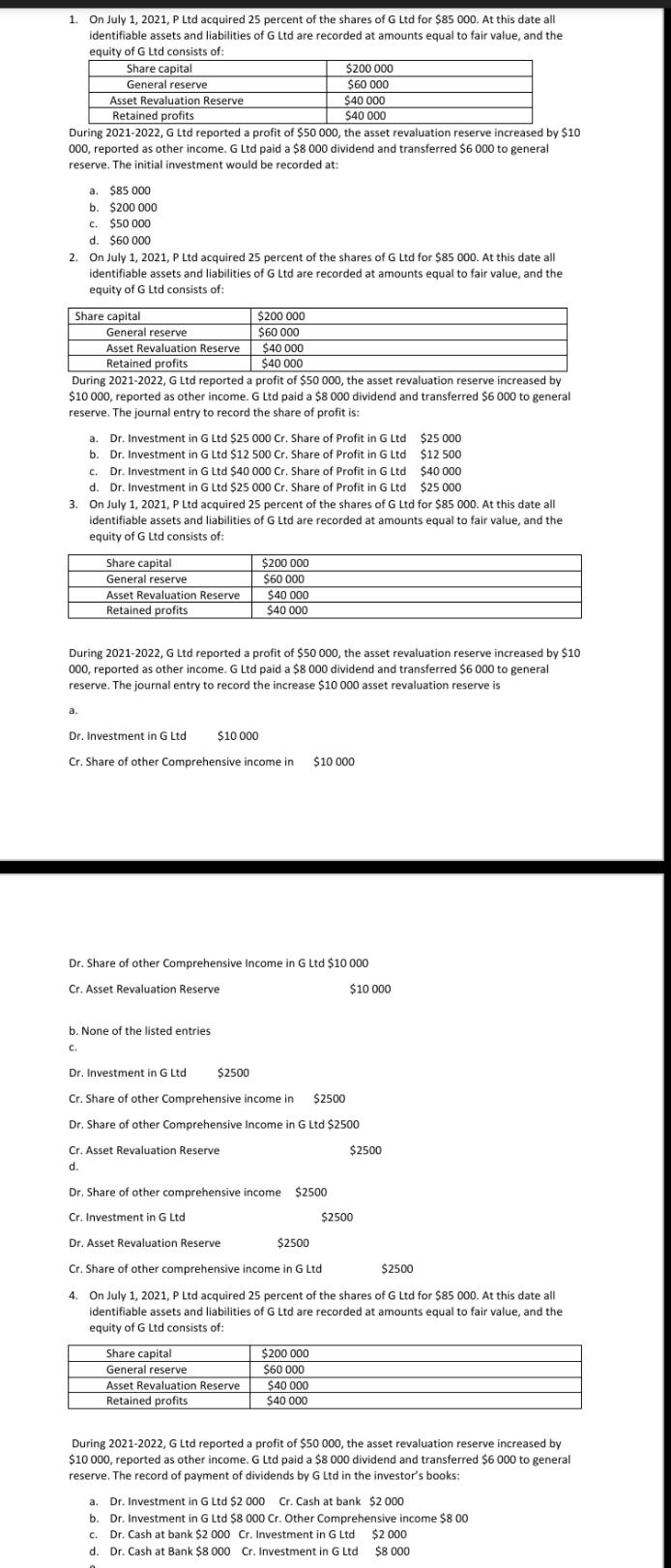

answer questions 1 -4 with working out

1. On July 1, 2021, P Led acquired 25 percent of the shares of G Ltd for $85 000. At this date all identifiable assets and liabilities of G Ltd are recorded at amounts equal to fair value, and the equity of G Ltd consists of: Share capital $200 000 General reserve $60 000 Asset Revaluation Reserve $40 000 Retained profits $40 000 During 2021-2022, G Ltd reported a profit of $50 000, the asset revaluation reserve increased by $10 000, reported as other income. G Ltd paid a $8 000 dividend and transferred $6 000 to general reserve. The initial investment would be recorded at: . $85 000 . $200 000 c. $50 000 d. $60 000 2. On July 1, 2021, P Ltd acquired 25 percent of the shares of G Ltd for $85 000. At this date all identifiable assets and liabilities of G Ltd are recorded at amounts equal to fair value, and the equity of G Ltd consists of: Share capital $200 000 General reserve $60 000 Asset Revaluation Reserve $40 000 Retained profits $40 000 During 2021-2022, G Ltd reported a profit of $50 000, the asset revaluation reserve increased by $10 000, reported as other income. G Ltd paid a $8 000 dividend and transferred $6 000 to general reserve. The journal entry to record the share of profit is: a. Dr. Investment in G Ltd $25 000 Cr. Share of Profit in G Ltd $25 000 b. Dr. Investment in G Ltd $12 500 Cr. Share of Profit in G Ltd $12 500 c. Dr. Investment in G Ltd $40 000 Cr. Share of Profit in G Ltd $40 000 d. Dr. Investment in G Ltd $25 000 Cr. Share of Profit in G Ltd $25 000 3. On July 1, 2021, P Led acquired 25 percent of the shares of G Ltd for $85 000. At this date all identifiable assets and liabilities of G Ltd are recorded at amounts equal to fair value, and the equity of G Ltd consists of: Share capital $200 000 General reserve $60 000 Asset Revaluation Reserve $40 000 Retained profits $40 000 During 2021-2022, G Ltd reported a profit of $50 000, the asset revaluation reserve increased by $10 000, reported as other income. G Ltd paid a $8 000 dividend and transferred $6 000 to general reserve. The journal entry to record the increase $10 000 asset revaluation reserve is a. Dr. Investment in G Ltd $10 000 Cr. Share of other Comprehensive income in $10 000 Dr. Share of other Comprehensive Income in G Ltd $10 000 Cr. Asset Revaluation Reserve $10 000 b. None of the listed entries C. Dr. Investment in G Ltd $2500 Cr. Share of other Comprehensive income in $2500 Dr. Share of other Comprehensive Income in G Ltd $2500 Cr. Asset Revaluation Reserve $2500 d. Dr. Share of other comprehensive income $2500 Cr. Investment in G Ltd $2500 Dr. Asset Revaluation Reserve $2500 Cr. Share of other comprehensive income in G Ltd $2500 4. On July 1, 2021, P Led acquired 25 percent of the shares of G Ltd for $85 000. At this date all identifiable assets and liabilities of G Ltd are recorded at amounts equal to fair value, and the equity of G Ltd consists of: Share capital $200 000 General reserve $60 000 Asset Revaluation Reserve $40 000 Retained profits $40 000 During 2021-2022, G Ltd reported a profit of $50 000, the asset revaluation reserve increased by $10 000, reported as other income. G Ltd paid a $8 000 dividend and transferred $6 000 to general reserve. The record of payment of dividends by G Ltd in the investor's books: a. Dr. Investment in G Ltd $2 000 Cr. Cash at bank $2 000 b. Dr. Investment in G Ltd $8 000 Cr. Other Comprehensive income $8 00 c. Dr. Cash at bank $2 000 Cr. Investment in G Ltd $2 000 d. Dr. Cash at Bank $8 000 Cr. Investment in G Ltd $8 000