answer questions 1-4

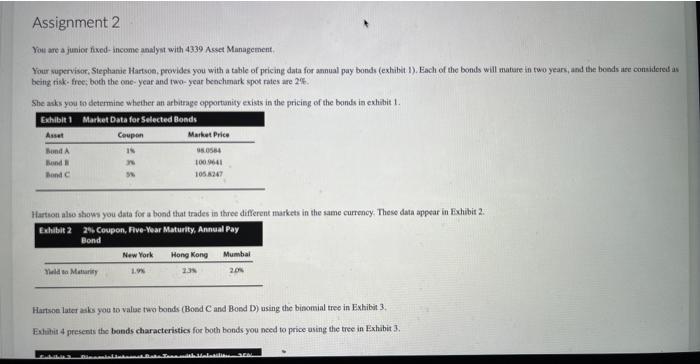

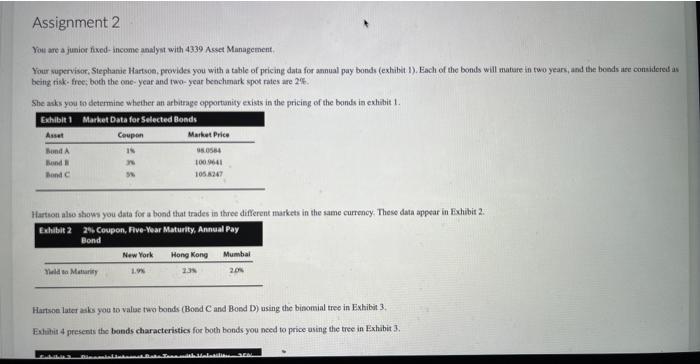

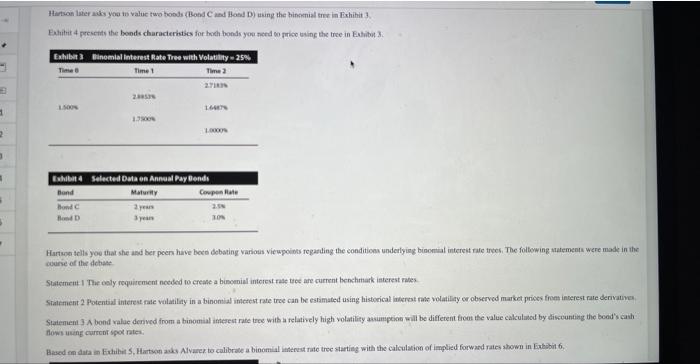

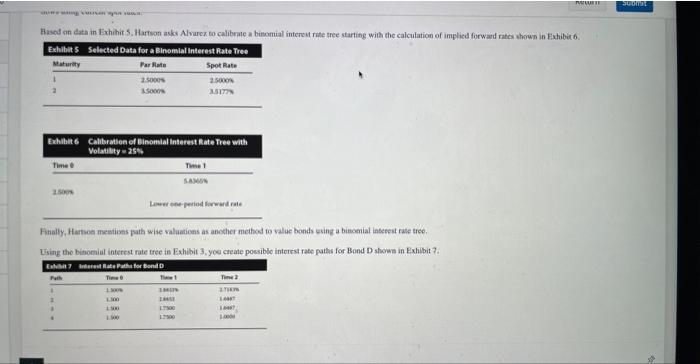

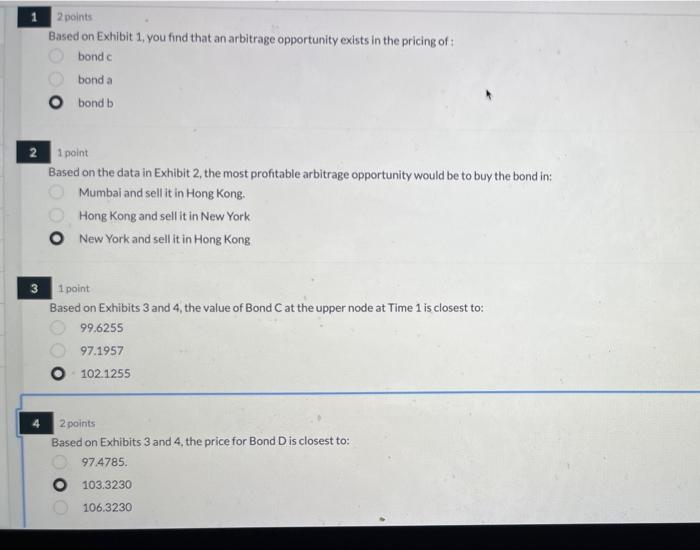

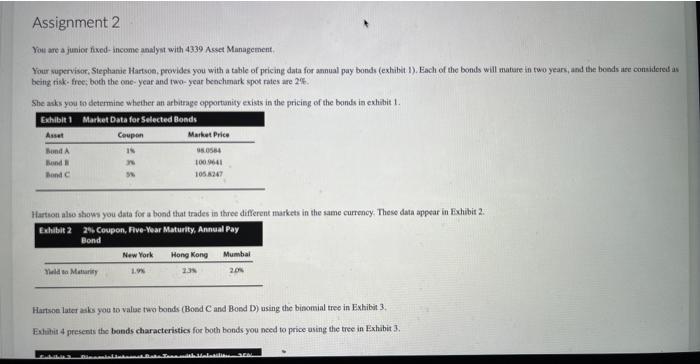

You are a junior fixed-income andyst with 4339 Asee Management. Your supervisar, Stephanie Hartsoe, provides you with a table of pricing data for annual pay bonds (exhibut 1). Each of the bonds will mature in two years, and the bonds ate considores as being risk- froe: both the cne- year and tao-year benchmark spot rates are 2%. She asks you to determine whether an arbitrage opportanity exists in the pricing of the bonds ia exhibit 1. Hartion alwe shows you data for a bond that trades is three different makkets in the same currency. These data appear in Fxhibis 2. Hartson later asks you to value two bonds (Bosd C and Bosd D) using the bisonial treo in Exbibit 3. Evtitis 4 presents the bands characteristies for both bonds you need to price using the tree in Exhibit 3. Hatson liher aids yoa in value two toods (thond C and Hosd D) using the hinsenial tret in Fxhihit 3. Fetutrit 4 presents the bonds characieristios for hoth bonds yoe noed wo prico ewing the tree in Evaibut 3. Hartspen telis yoe that she and ber peen have beco debsting various viewpoins regarting the conditions underlying binontiat intereit rale trech. The foltowing satements were made in the ouurse of the Achase Statement I The coly requirenient noeded to create a biocenial interest raat tece are current benchmark isterest rates flows usng current sped rates: Hased an dati in Fachihit 5, Hartoon askor Alvaex to calibrate an biromial intereut rite tree starting witt the calculaticen of implied forward rates shown in Fxhibit 6 . Finally, Hartsoe mestions path wise valuations as anocher meibod to value bonds esing a bincmial intereat fate tree. Lsing the binomial interest rate tree in Exhibit 3, yoe create possible interest rate paths for Bond D stoowe in Exhibit? 12 points Based on Exhibit 1, you find that an arbitrage opportunity exists in the pricing of : bond c bond a bond b 1 point Based on the data in Exhibit 2, the most profitable arbitrage opportunity would be to buy the bond in: Mumbai and sell it in Hong Kong. Hong Kong and sell it in New York New York and sell it in Hong Kong 3 ipoint. Based on Exhibits 3 and 4 , the value of Bond C at the upper node at Time 1 is closest to: 99.625597.1957102.1255 4 points Based on Exhibits 3 and 4 , the price for Bond D is closest to: 97.4785.103.3230106.3230 You are a junior fixed-income andyst with 4339 Asee Management. Your supervisar, Stephanie Hartsoe, provides you with a table of pricing data for annual pay bonds (exhibut 1). Each of the bonds will mature in two years, and the bonds ate considores as being risk- froe: both the cne- year and tao-year benchmark spot rates are 2%. She asks you to determine whether an arbitrage opportanity exists in the pricing of the bonds ia exhibit 1. Hartion alwe shows you data for a bond that trades is three different makkets in the same currency. These data appear in Fxhibis 2. Hartson later asks you to value two bonds (Bosd C and Bosd D) using the bisonial treo in Exbibit 3. Evtitis 4 presents the bands characteristies for both bonds you need to price using the tree in Exhibit 3. Hatson liher aids yoa in value two toods (thond C and Hosd D) using the hinsenial tret in Fxhihit 3. Fetutrit 4 presents the bonds characieristios for hoth bonds yoe noed wo prico ewing the tree in Evaibut 3. Hartspen telis yoe that she and ber peen have beco debsting various viewpoins regarting the conditions underlying binontiat intereit rale trech. The foltowing satements were made in the ouurse of the Achase Statement I The coly requirenient noeded to create a biocenial interest raat tece are current benchmark isterest rates flows usng current sped rates: Hased an dati in Fachihit 5, Hartoon askor Alvaex to calibrate an biromial intereut rite tree starting witt the calculaticen of implied forward rates shown in Fxhibit 6 . Finally, Hartsoe mestions path wise valuations as anocher meibod to value bonds esing a bincmial intereat fate tree. Lsing the binomial interest rate tree in Exhibit 3, yoe create possible interest rate paths for Bond D stoowe in Exhibit? 12 points Based on Exhibit 1, you find that an arbitrage opportunity exists in the pricing of : bond c bond a bond b 1 point Based on the data in Exhibit 2, the most profitable arbitrage opportunity would be to buy the bond in: Mumbai and sell it in Hong Kong. Hong Kong and sell it in New York New York and sell it in Hong Kong 3 ipoint. Based on Exhibits 3 and 4 , the value of Bond C at the upper node at Time 1 is closest to: 99.625597.1957102.1255 4 points Based on Exhibits 3 and 4 , the price for Bond D is closest to: 97.4785.103.3230106.3230