ANSWER QUESTIONS 4 (A),(B),(C) USING THE CASE STUDY ATTACHED TO THE APPENDIX. THANK YOU.

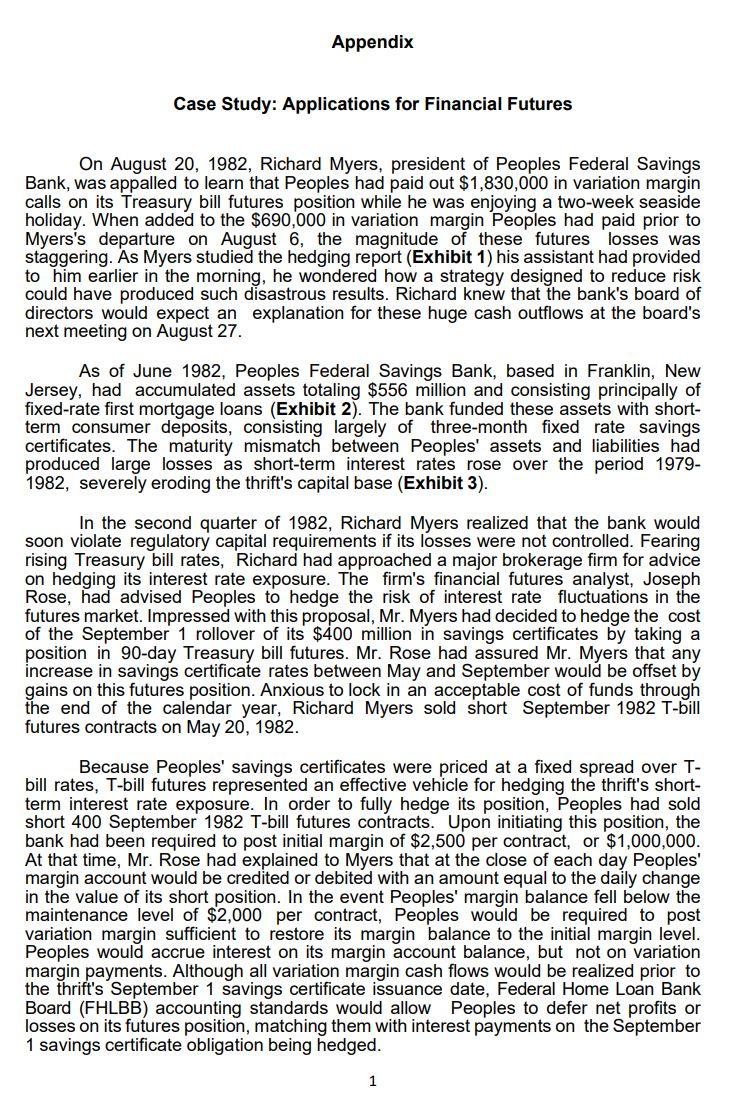

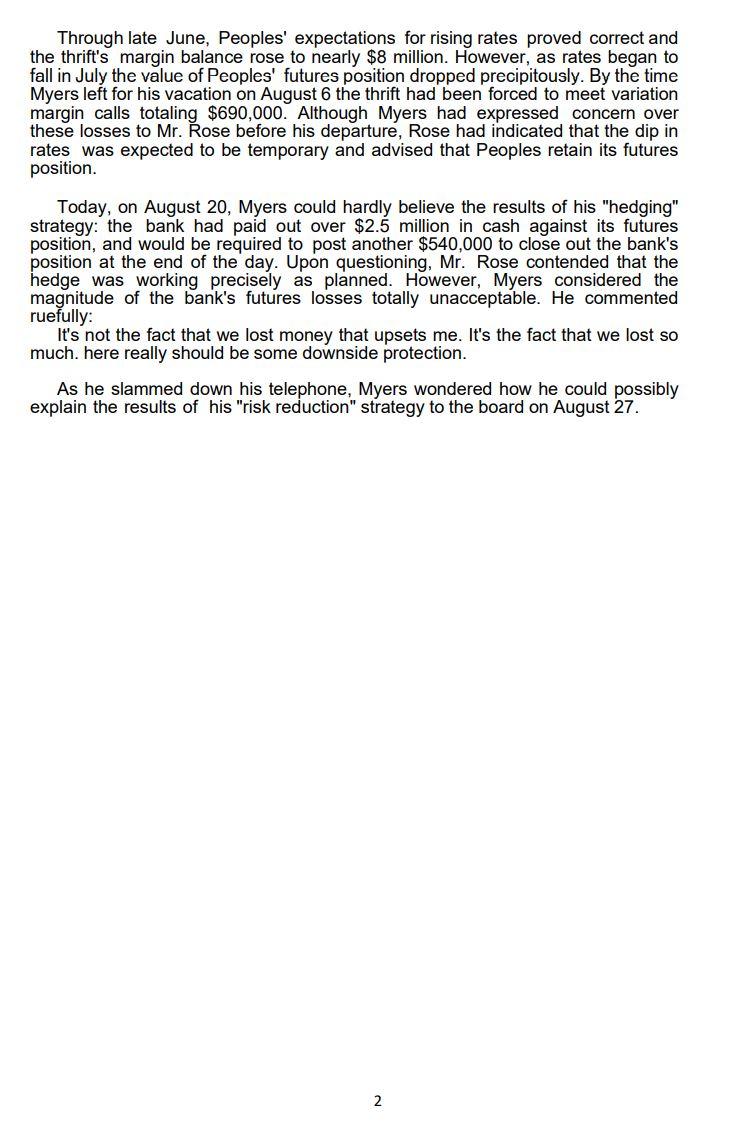

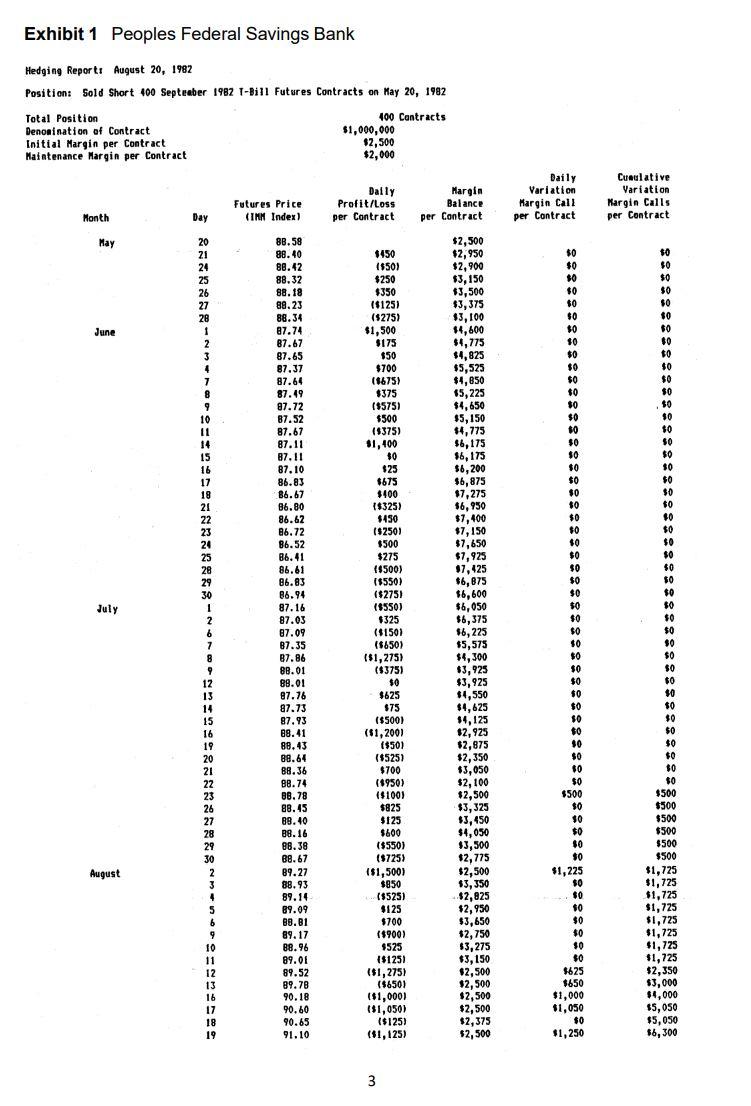

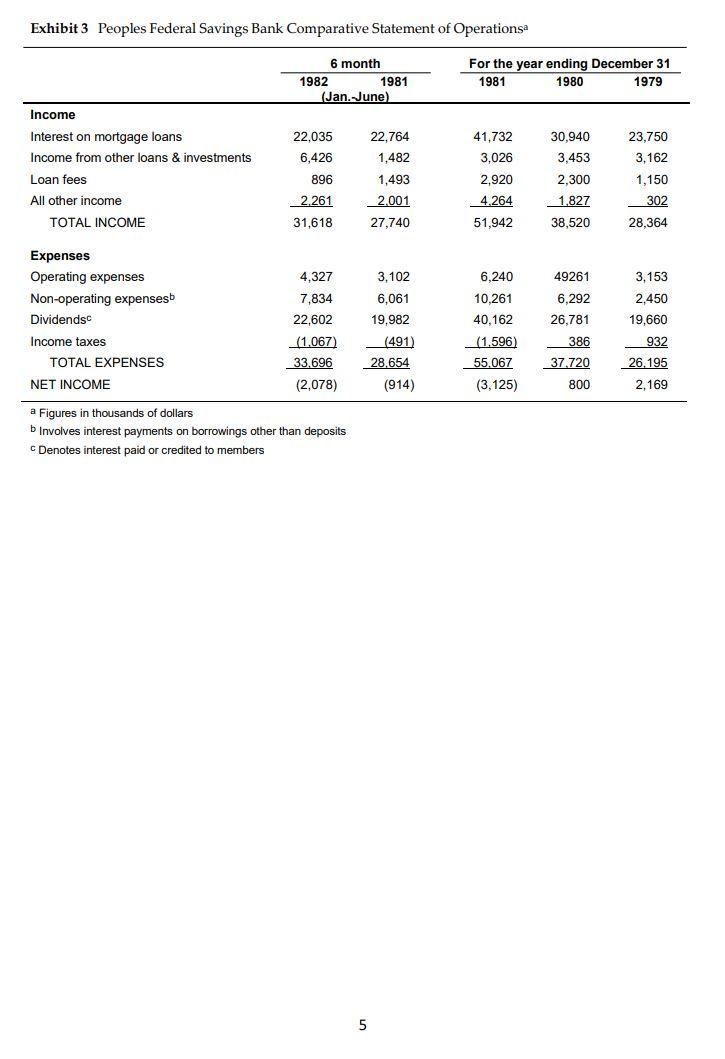

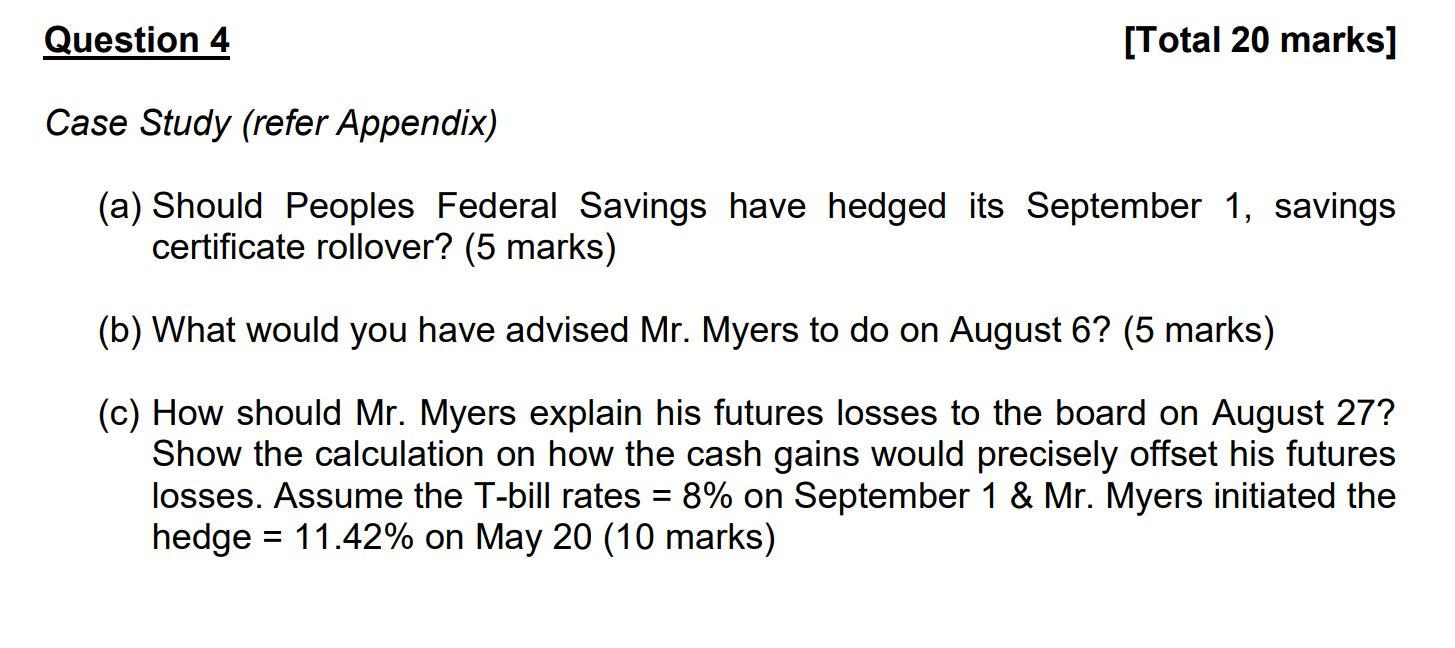

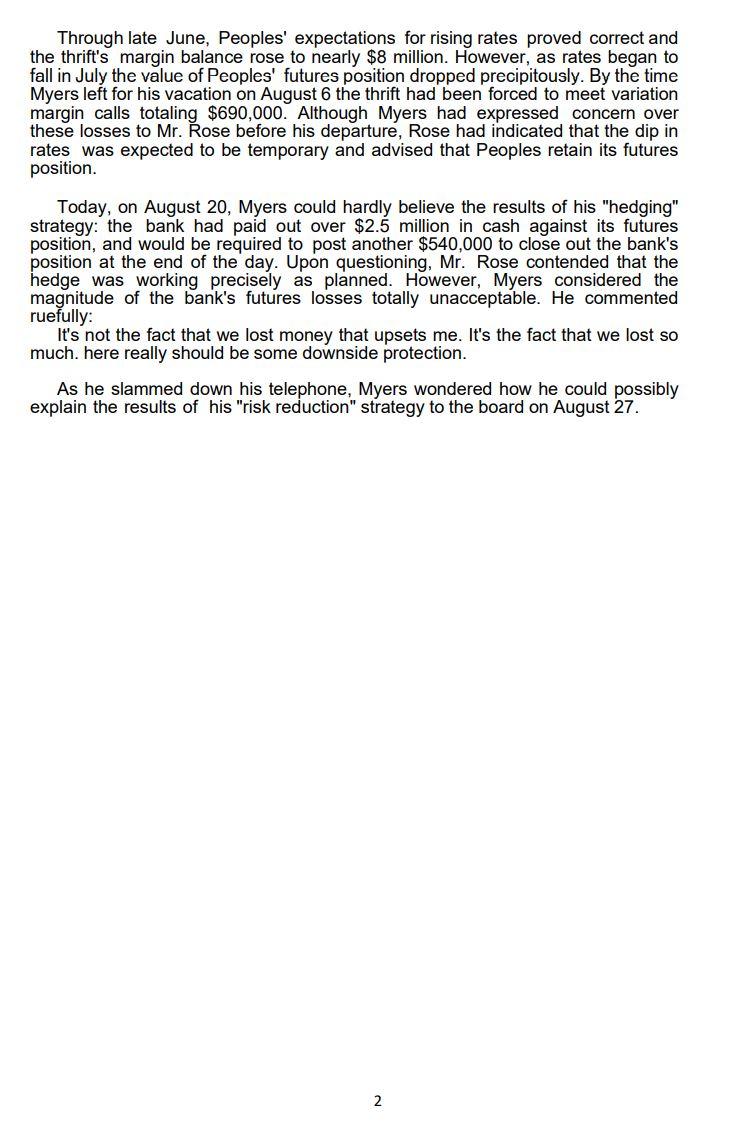

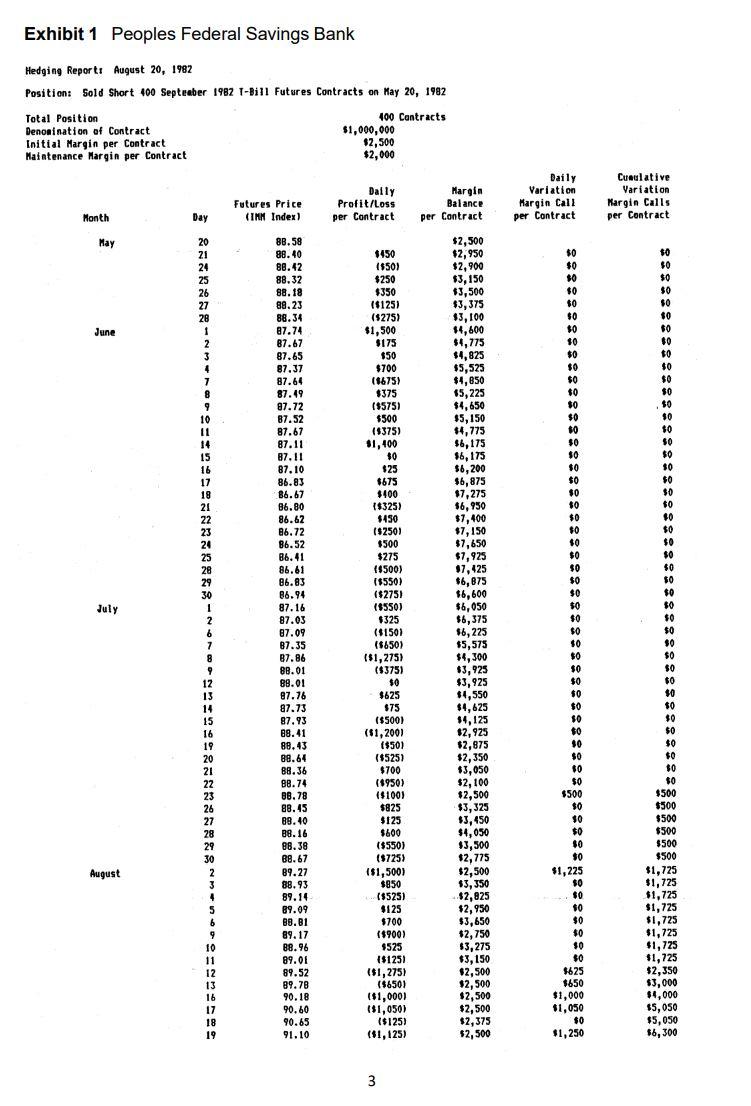

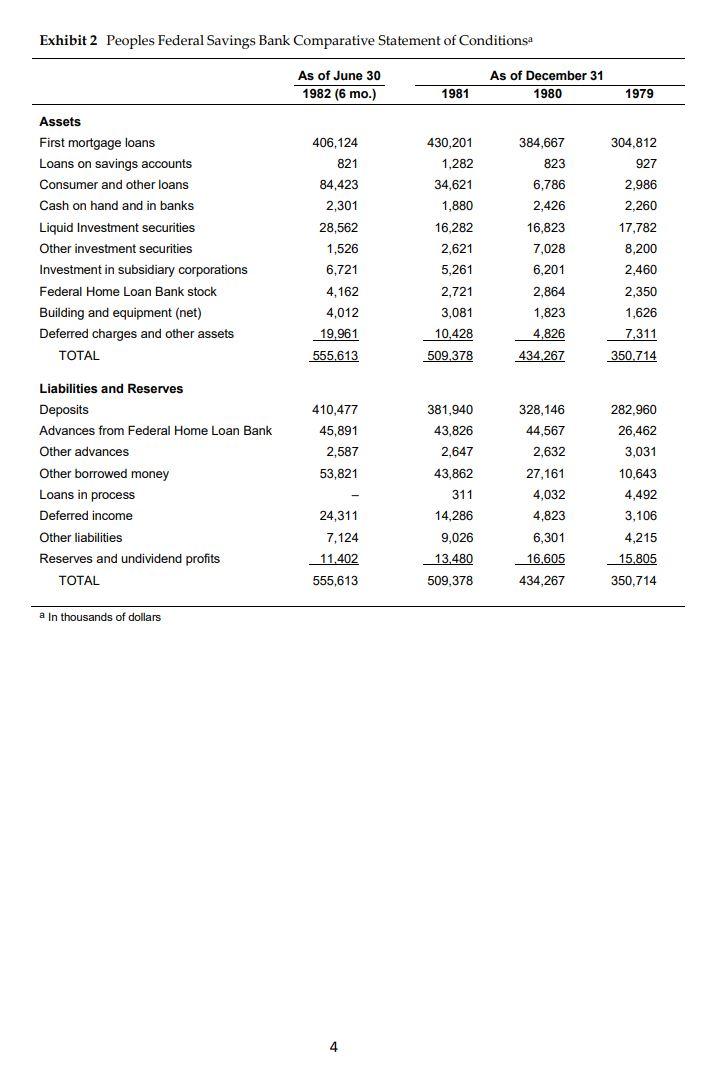

Question 4 [Total 20 marks] Case Study (refer Appendix) (a) Should Peoples Federal Savings have hedged its September 1, savings certificate rollover? (5 marks) (b) What would you have advised Mr. Myers to do on August 6? (5 marks) (c) How should Mr. Myers explain his futures losses to the board on August 27? Show the calculation on how the cash gains would precisely offset his futures losses. Assume the T-bill rates = 8% on September 1 & Mr. Myers initiated the hedge = 11.42% on May 20 (10 marks) = = Appendix Case Study: Applications for Financial Futures On August 20, 1982, Richard Myers, president of Peoples Federal Savings Bank, was appalled to learn that Peoples had paid out $1,830,000 in variation margin calls on its Treasury bill futures position while he was enjoying a two-week seaside holiday. When added to the $690,000 in variation margin Peoples had paid prior to Myers's departure on August 6, the magnitude of these futures losses was staggering. As Myers studied the hedging report (Exhibit 1) his assistant had provided to him earlier in the morning, he wondered how a strategy designed to reduce risk could have produced such disastrous results. Richard knew that the bank's board of directors would expect an explanation for these huge cash outflows at the board's next meeting on August 27. As of June 1982, Peoples Federal Savings Bank, based in Franklin, New Jersey, had accumulated assets totaling $556 million and consisting principally of fixed-rate first mortgage loans (Exhibit 2). The bank funded these assets with short- term consumer deposits, consisting largely of three-month fixed rate savings certificates. The maturity mismatch between Peoples' assets and liabilities had produced large losses as short-term interest rates rose over the period 1979- 1982, severely eroding the thrift's capital base (Exhibit 3). In the second quarter of 1982, Richard Myers realized that the bank would soon violate regulatory capital requirements if its losses were not controlled. Fearing rising Treasury bill rates, Richard had approached a major brokerage firm for advice on hedging its interest rate exposure. The firm's financial futures analyst, Joseph Rose, had advised Peoples to hedge the risk of interest rate fluctuations in the futures market. Impressed with this proposal, Mr. Myers had decided to hedge the cost of the September 1 rollover of its $400 million in savings certificates by taking a position in 90-day Treasury bill futures. Mr. Rose had assured Mr. Myers that any increase in savings certificate rates between May and September would be offset by gains on this futures position. Anxious to lock in an acceptable cost of funds through the end of the calendar year, Richard Myers sold short September 1982 T-bill futures contracts on May 20, 1982. Because Peoples' savings certificates were priced at a fixed spread over T- bill rates, T-bill futures represented an effective vehicle for hedging the thrift's short- term interest rate exposure. In order to fully hedge its position, Peoples had sold short 400 September 1982 T-bill futures contracts. Upon initiating this position, the bank had been required to post initial margin of $2,500 per contract, or $1,000,000. At that time, Mr. Rose had explained to Myers that at the close of each day Peoples' margin account would be credited or debited with an amount equal to the daily change in the value of its short position. In the event Peoples' margin balance fell below the maintenance level of $2,000 per contract, Peoples would be required to post variation margin sufficient to restore its margin balance to the initial margin level. Peoples would accrue interest on its margin account balance, but not on variation margin payments. Although all variation margin cash flows would be realized prior to the thrift's September 1 savings certificate issuance date, Federal Home Loan Bank Board (FHLBB) accounting standards would allow Peoples to defer net profits or losses on its futures position, matching them with interest payments on the September 1 savings certificate obligation being hedged. 1 Through late June, Peoples' expectations for rising rates proved correct and the thrift's margin balance rose to nearly $8 million. However, as rates began to fall in July the value of Peoples' futures position dropped precipitously. By the time Myers left for his vacation on August 6 the thrift had been forced to meet variation margin calls totaling $690,000. Although Myers had expressed concern over these losses to Mr. Rose before his departure, Rose had indicated that the dip in rates was expected to be temporary and advised that peoples retain its futures position. Today, on August 20, Myers could hardly believe the results of his "hedging" strategy: the bank had paid out over $2.5 million in cash against its futures position, and would be required to post another $540,000 to close out the bank's position at the end of the day. Upon questioning, Mr. Rose contended that the hedge was working precisely as planned. However, Myers considered the magnitude of the bank's futures losses totally unacceptable. He commented ruefully: It's not the fact that we lost money that upsets me. It's the fact that we lost so much. here really should be some downside protection. As he slammed down his telephone, Myers wondered how he could possibly explain the results of his "risk reduction" strategy to the board on August 27. 2 Exhibit 1 Peoples Federal Savings Bank Hedging ReportAugust 20, 1982 Position: Sold Short 400 Septeaber 1982 1-Bill Futures Contracts on May 20, 1982 Total Positioniert Wees lief Contract $2.000 Maintenance Margin per Contract 100 Contracts Dall Profit/loss per Contract Futures Price (IMN Index) Margin Balance per Contract Cueglative Varisti Margin Calls per Contract Margin Call per Contrac May pes Exhibit 2 Peoples Federal Savings Bank Comparative Statement of Conditionsa As of June 30 1982 (6 mo.) As of December 31 1980 1981 1979 406,124 430,201 1,282 821 384,667 823 6.786 2,426 84,423 2,301 34,621 1,880 Assets First mortgage loans Loans on savings accounts Consumer and other loans Cash on hand and in banks Liquid Investment securities Other investment securities Investment in subsidiary corporations Federal Home Loan Bank stock Building and equipment (net) Deferred charges and other assets TOTAL 16.282 2,621 5,261 28,562 1,526 6,721 4,162 4,012 19,961 304,812 927 2,986 2,260 17,782 8,200 2,460 2,350 1,626 7,311 350.714 16,823 7,028 6,201 2,864 1,823 4,826 434,267 2,721 3,081 10,428 555,613 509,378 381,940 43,826 410,477 45,891 2,587 53,821 2,647 43,862 Liabilities and Reserves Deposits Advances from Federal Home Loan Bank Other advances Other borrowed money Loans in process Deferred income Other liabilities Reserves and undividend profits TOTAL 311 328,146 44,567 2,632 27,161 4,032 4,823 6,301 16.605 434,267 282,960 26,462 3,031 10,643 4,492 3,106 4,215 15.805 350,714 24.311 14.286 7,124 11,402 555,613 9,026 13.480 509,378 a In thousands of dollars 4 Exhibit 3 Peoples Federal Savings Bank Comparative Statement of Operationsa 1982 6 month 1981 (Jan. June) For the year ending December 31 1981 1980 1979 22,035 6,426 41,732 3,026 Income Interest on mortgage loans Income from other loans & investments Loan fees All other income TOTAL INCOME 22.764 1,482 1,493 2.001 27,740 23,750 3,162 1,150 896 2.261 31,618 2,920 30,940 3,453 2.300 1.827 38,520 _4.264 302 28.364 51,942 Expenses Operating expenses Non-operating expenses Dividendsc 3,102 6,061 19.982 6,240 10,261 40,162 3,153 2,450 19,660 4,327 7,834 22,602 (1,067) ) 33.696 (2,078) 49261 6,292 26,781 386 37.720 800 932 Income taxes TOTAL EXPENSES NET INCOME (491) 28.654 (914) (1.596) 55.067 (3,125) 26.195 2,169 a Figures in thousands of dollars b Involves interest payments on borrowings other than deposits Denotes interest paid or credited to members 5 Question 4 [Total 20 marks] Case Study (refer Appendix) (a) Should Peoples Federal Savings have hedged its September 1, savings certificate rollover? (5 marks) (b) What would you have advised Mr. Myers to do on August 6? (5 marks) (c) How should Mr. Myers explain his futures losses to the board on August 27? Show the calculation on how the cash gains would precisely offset his futures losses. Assume the T-bill rates = 8% on September 1 & Mr. Myers initiated the hedge = 11.42% on May 20 (10 marks) = = Appendix Case Study: Applications for Financial Futures On August 20, 1982, Richard Myers, president of Peoples Federal Savings Bank, was appalled to learn that Peoples had paid out $1,830,000 in variation margin calls on its Treasury bill futures position while he was enjoying a two-week seaside holiday. When added to the $690,000 in variation margin Peoples had paid prior to Myers's departure on August 6, the magnitude of these futures losses was staggering. As Myers studied the hedging report (Exhibit 1) his assistant had provided to him earlier in the morning, he wondered how a strategy designed to reduce risk could have produced such disastrous results. Richard knew that the bank's board of directors would expect an explanation for these huge cash outflows at the board's next meeting on August 27. As of June 1982, Peoples Federal Savings Bank, based in Franklin, New Jersey, had accumulated assets totaling $556 million and consisting principally of fixed-rate first mortgage loans (Exhibit 2). The bank funded these assets with short- term consumer deposits, consisting largely of three-month fixed rate savings certificates. The maturity mismatch between Peoples' assets and liabilities had produced large losses as short-term interest rates rose over the period 1979- 1982, severely eroding the thrift's capital base (Exhibit 3). In the second quarter of 1982, Richard Myers realized that the bank would soon violate regulatory capital requirements if its losses were not controlled. Fearing rising Treasury bill rates, Richard had approached a major brokerage firm for advice on hedging its interest rate exposure. The firm's financial futures analyst, Joseph Rose, had advised Peoples to hedge the risk of interest rate fluctuations in the futures market. Impressed with this proposal, Mr. Myers had decided to hedge the cost of the September 1 rollover of its $400 million in savings certificates by taking a position in 90-day Treasury bill futures. Mr. Rose had assured Mr. Myers that any increase in savings certificate rates between May and September would be offset by gains on this futures position. Anxious to lock in an acceptable cost of funds through the end of the calendar year, Richard Myers sold short September 1982 T-bill futures contracts on May 20, 1982. Because Peoples' savings certificates were priced at a fixed spread over T- bill rates, T-bill futures represented an effective vehicle for hedging the thrift's short- term interest rate exposure. In order to fully hedge its position, Peoples had sold short 400 September 1982 T-bill futures contracts. Upon initiating this position, the bank had been required to post initial margin of $2,500 per contract, or $1,000,000. At that time, Mr. Rose had explained to Myers that at the close of each day Peoples' margin account would be credited or debited with an amount equal to the daily change in the value of its short position. In the event Peoples' margin balance fell below the maintenance level of $2,000 per contract, Peoples would be required to post variation margin sufficient to restore its margin balance to the initial margin level. Peoples would accrue interest on its margin account balance, but not on variation margin payments. Although all variation margin cash flows would be realized prior to the thrift's September 1 savings certificate issuance date, Federal Home Loan Bank Board (FHLBB) accounting standards would allow Peoples to defer net profits or losses on its futures position, matching them with interest payments on the September 1 savings certificate obligation being hedged. 1 Through late June, Peoples' expectations for rising rates proved correct and the thrift's margin balance rose to nearly $8 million. However, as rates began to fall in July the value of Peoples' futures position dropped precipitously. By the time Myers left for his vacation on August 6 the thrift had been forced to meet variation margin calls totaling $690,000. Although Myers had expressed concern over these losses to Mr. Rose before his departure, Rose had indicated that the dip in rates was expected to be temporary and advised that peoples retain its futures position. Today, on August 20, Myers could hardly believe the results of his "hedging" strategy: the bank had paid out over $2.5 million in cash against its futures position, and would be required to post another $540,000 to close out the bank's position at the end of the day. Upon questioning, Mr. Rose contended that the hedge was working precisely as planned. However, Myers considered the magnitude of the bank's futures losses totally unacceptable. He commented ruefully: It's not the fact that we lost money that upsets me. It's the fact that we lost so much. here really should be some downside protection. As he slammed down his telephone, Myers wondered how he could possibly explain the results of his "risk reduction" strategy to the board on August 27. 2 Exhibit 1 Peoples Federal Savings Bank Hedging ReportAugust 20, 1982 Position: Sold Short 400 Septeaber 1982 1-Bill Futures Contracts on May 20, 1982 Total Positioniert Wees lief Contract $2.000 Maintenance Margin per Contract 100 Contracts Dall Profit/loss per Contract Futures Price (IMN Index) Margin Balance per Contract Cueglative Varisti Margin Calls per Contract Margin Call per Contrac May pes Exhibit 2 Peoples Federal Savings Bank Comparative Statement of Conditionsa As of June 30 1982 (6 mo.) As of December 31 1980 1981 1979 406,124 430,201 1,282 821 384,667 823 6.786 2,426 84,423 2,301 34,621 1,880 Assets First mortgage loans Loans on savings accounts Consumer and other loans Cash on hand and in banks Liquid Investment securities Other investment securities Investment in subsidiary corporations Federal Home Loan Bank stock Building and equipment (net) Deferred charges and other assets TOTAL 16.282 2,621 5,261 28,562 1,526 6,721 4,162 4,012 19,961 304,812 927 2,986 2,260 17,782 8,200 2,460 2,350 1,626 7,311 350.714 16,823 7,028 6,201 2,864 1,823 4,826 434,267 2,721 3,081 10,428 555,613 509,378 381,940 43,826 410,477 45,891 2,587 53,821 2,647 43,862 Liabilities and Reserves Deposits Advances from Federal Home Loan Bank Other advances Other borrowed money Loans in process Deferred income Other liabilities Reserves and undividend profits TOTAL 311 328,146 44,567 2,632 27,161 4,032 4,823 6,301 16.605 434,267 282,960 26,462 3,031 10,643 4,492 3,106 4,215 15.805 350,714 24.311 14.286 7,124 11,402 555,613 9,026 13.480 509,378 a In thousands of dollars 4 Exhibit 3 Peoples Federal Savings Bank Comparative Statement of Operationsa 1982 6 month 1981 (Jan. June) For the year ending December 31 1981 1980 1979 22,035 6,426 41,732 3,026 Income Interest on mortgage loans Income from other loans & investments Loan fees All other income TOTAL INCOME 22.764 1,482 1,493 2.001 27,740 23,750 3,162 1,150 896 2.261 31,618 2,920 30,940 3,453 2.300 1.827 38,520 _4.264 302 28.364 51,942 Expenses Operating expenses Non-operating expenses Dividendsc 3,102 6,061 19.982 6,240 10,261 40,162 3,153 2,450 19,660 4,327 7,834 22,602 (1,067) ) 33.696 (2,078) 49261 6,292 26,781 386 37.720 800 932 Income taxes TOTAL EXPENSES NET INCOME (491) 28.654 (914) (1.596) 55.067 (3,125) 26.195 2,169 a Figures in thousands of dollars b Involves interest payments on borrowings other than deposits Denotes interest paid or credited to members 5