Answered step by step

Verified Expert Solution

Question

1 Approved Answer

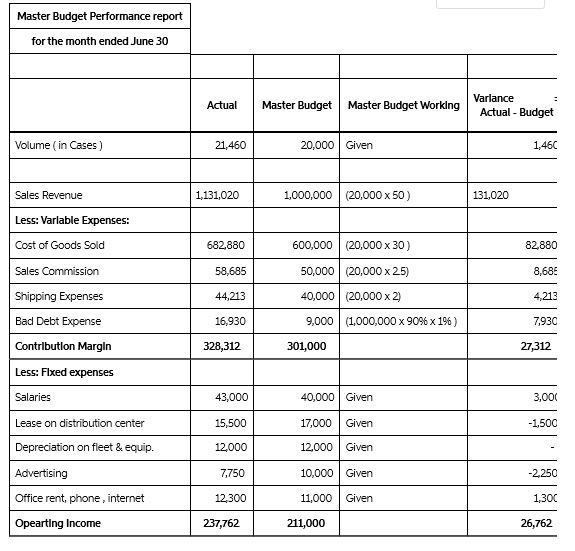

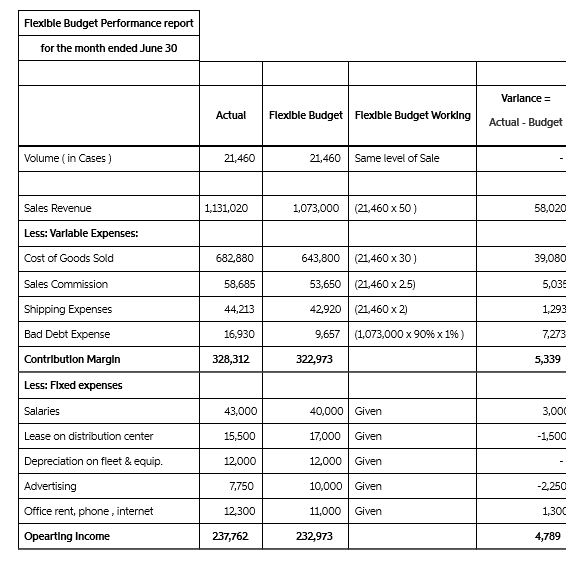

Answer questions 7 A and B, 8, 9, and 10 please Please show work in excel Master Budget Performance report for the month ended June

Answer questions 7 A and B, 8, 9, and 10 please

Please show work in excel

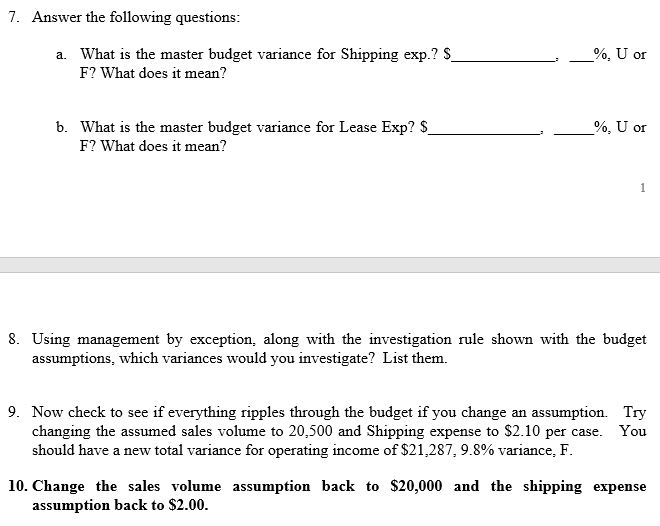

Master Budget Performance report for the month ended June 30 Actual Master Budget Master Budget Working Varlance Actual - Budget Volume (in Cases) 21,460 20,000 Given 1,46C Sales Revenue 1,131,020 1,000,000 (20,000 x 50 ) 131,020 Less: Variable Expenses: 682,880 82,880 8,68 Cost of Goods Sold Sales Commission Shipping Expenses Bad Debt Expense Contribution Margin 600,000 (20,000 x 30) 50,000 (20,000 x 25) 40,000 (20,000 x 2) 9,000 1,000,000 X 90% x 196 ) 301,000 58,685 44,213 16,930 328,312 4,213 7,930 27,312 Less: Fixed expenses Salaries 3,000 Lease on distribution center -1,500 43,000 15,500 12,000 7,750 40,000 Given 17,000 Given 12,000 Given 10,000 Given 11,000 Given Depreciation on fleet & equip. Advertising Office rent, phone, internet Opearting Income -2.250 12,300 1,300 237,762 211,000 26,762 Flexible Budget Performance report for the month ended June 30 Varlance = Actual Flexible Budget Flexible Budget Working Actual - Budget Volume (in Cases) 21,460 21,460 Same level of Sale Sales Revenue 1,131,020 1,073,000 (21,460 x 50 ) 58,020 Less: Varlable Expenses: Cost of Goods Sold 39,080 Sales Commission 5,035 682,880 58,685 44,213 16,930 328,312 643,800 (21,460 x 30 ) 53,650 (21,460 x 25) 42920 (21,460 x 2) 9,657 1,073,000 x 90% x 19) Shipping Expenses Bad Debt Expense 1,293 7,273 Contribution Margin 322,973 5,339 Less: Fixed expenses Salaries 40,000 Given 3,000 Lease on distribution center 17,000 Given -1,500 Depreciation on fleet & equip. 43,000 15,500 12000 7,750 12300 Advertising 12,000 Given 10,000 Given 11,000 Given -2.250 Office rent, phone, internet 1,300 Opearting Income 237,762 232,973 4,789 7. Answer the following questions: a. What is the master budget variance for Shipping exp.? $_ F? What does it mean? ____%. U or b. What is the master budget variance for Lease Exp? $_ F? What does it mean? %. U or 8. Using management by exception, along with the investigation rule shown with the budget assumptions, which variances would you investigate? List them. 9. Now check to see if everything ripples through the budget if you change an assumption. Try changing the assumed sales volume to 20,500 and Shipping expense to $2.10 per case. You should have a new total variance for operating income of $21,287,9.8% variance. F. 10. Change the sales volume assumption back to $20,000 and the shipping expense assumption back to $2.00. Master Budget Performance report for the month ended June 30 Actual Master Budget Master Budget Working Varlance Actual - Budget Volume (in Cases) 21,460 20,000 Given 1,46C Sales Revenue 1,131,020 1,000,000 (20,000 x 50 ) 131,020 Less: Variable Expenses: 682,880 82,880 8,68 Cost of Goods Sold Sales Commission Shipping Expenses Bad Debt Expense Contribution Margin 600,000 (20,000 x 30) 50,000 (20,000 x 25) 40,000 (20,000 x 2) 9,000 1,000,000 X 90% x 196 ) 301,000 58,685 44,213 16,930 328,312 4,213 7,930 27,312 Less: Fixed expenses Salaries 3,000 Lease on distribution center -1,500 43,000 15,500 12,000 7,750 40,000 Given 17,000 Given 12,000 Given 10,000 Given 11,000 Given Depreciation on fleet & equip. Advertising Office rent, phone, internet Opearting Income -2.250 12,300 1,300 237,762 211,000 26,762 Flexible Budget Performance report for the month ended June 30 Varlance = Actual Flexible Budget Flexible Budget Working Actual - Budget Volume (in Cases) 21,460 21,460 Same level of Sale Sales Revenue 1,131,020 1,073,000 (21,460 x 50 ) 58,020 Less: Varlable Expenses: Cost of Goods Sold 39,080 Sales Commission 5,035 682,880 58,685 44,213 16,930 328,312 643,800 (21,460 x 30 ) 53,650 (21,460 x 25) 42920 (21,460 x 2) 9,657 1,073,000 x 90% x 19) Shipping Expenses Bad Debt Expense 1,293 7,273 Contribution Margin 322,973 5,339 Less: Fixed expenses Salaries 40,000 Given 3,000 Lease on distribution center 17,000 Given -1,500 Depreciation on fleet & equip. 43,000 15,500 12000 7,750 12300 Advertising 12,000 Given 10,000 Given 11,000 Given -2.250 Office rent, phone, internet 1,300 Opearting Income 237,762 232,973 4,789 7. Answer the following questions: a. What is the master budget variance for Shipping exp.? $_ F? What does it mean? ____%. U or b. What is the master budget variance for Lease Exp? $_ F? What does it mean? %. U or 8. Using management by exception, along with the investigation rule shown with the budget assumptions, which variances would you investigate? List them. 9. Now check to see if everything ripples through the budget if you change an assumption. Try changing the assumed sales volume to 20,500 and Shipping expense to $2.10 per case. You should have a new total variance for operating income of $21,287,9.8% variance. F. 10. Change the sales volume assumption back to $20,000 and the shipping expense assumption back to $2.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started