Answered step by step

Verified Expert Solution

Question

1 Approved Answer

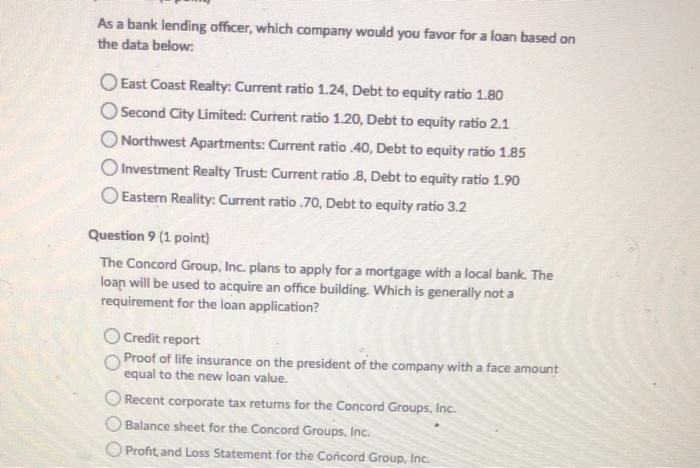

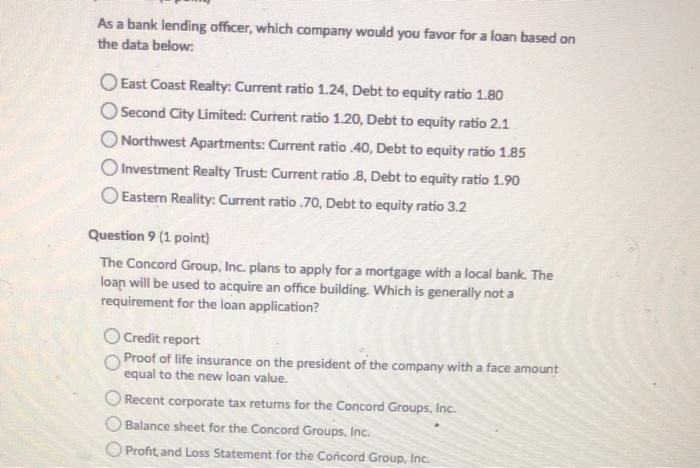

answer questions 8-9 As a bank lending officer, which company would you favor for a loan based on the data below: East Coast Realty: Current

answer questions 8-9

As a bank lending officer, which company would you favor for a loan based on the data below: East Coast Realty: Current ratio 1.24, Debt to equity ratio 1.80 Second City Limited: Current ratio 1.20, Debt to equity ratio 2.1 Northwest Apartments: Current ratio.40, Debt to equity ratio 1.85 Investment Realty Trust Current ratio 8, Debt to equity ratio 1.90 Eastern Reality: Current ratio.70, Debt to equity ratio 3.2 Question 9 (1 point) The Concord Group, Inc. plans to apply for a mortgage with a local bank. The loan will be used to acquire an office building. Which is generally not a requirement for the loan application? Credit report Proof of life insurance on the president of the company with a face amount equal to the new loan value. Recent corporate tax returns for the Concord Groups, Inc. Balance sheet for the Concord Groups, Inc. Profit and Loss Statement for the Concord Group, Inc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started