Answered step by step

Verified Expert Solution

Question

1 Approved Answer

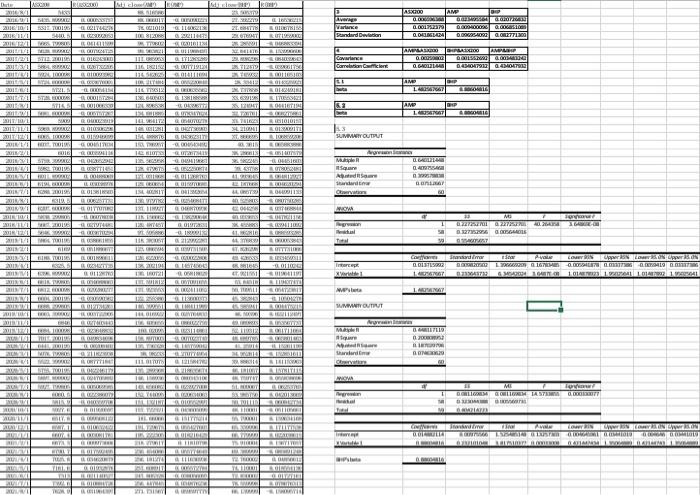

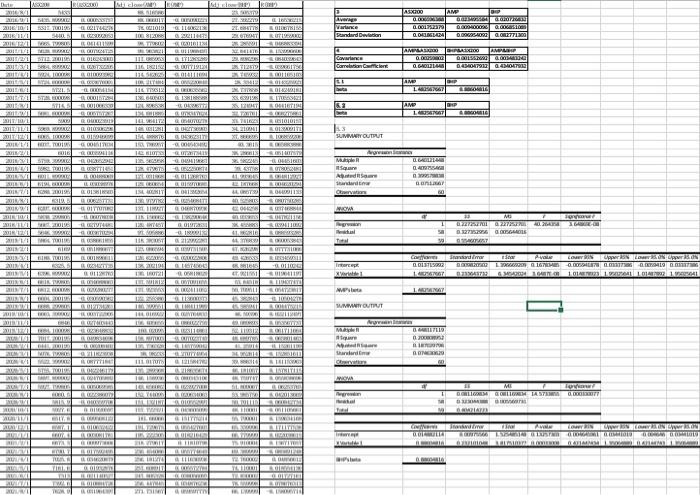

Answer questions based on the data AS WARI UN MOD TAM DOSSA OTTI OTO ARRIT E BEHERE TORS TL ZL. BORTIS ZLOGO TO ware Seandard

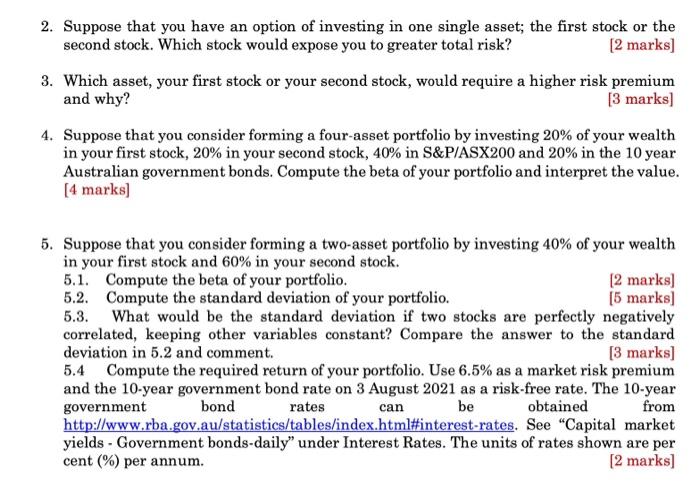

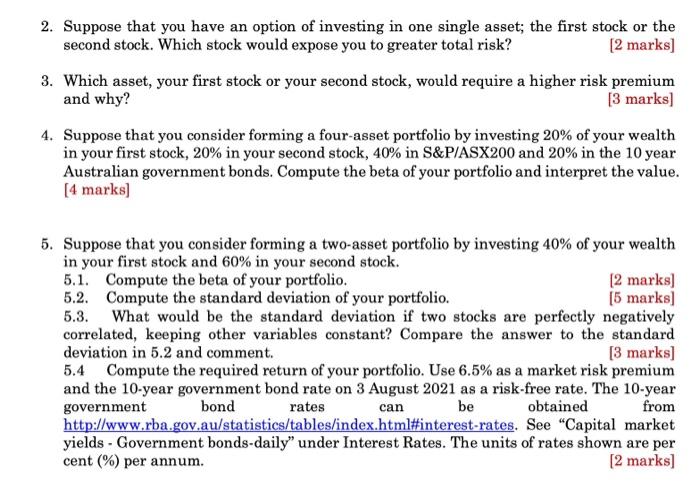

Answer questions based on the data

AS WARI UN MOD TAM DOSSA OTTI OTO ARRIT E BEHERE TORS TL ZL. BORTIS ZLOGO TO ware Seandard Dwon BUSTOOD WYSUOD TAI SER BELO ANON III TIL 116 II Garance Correlation Camicient AMPLA DIPLO DEO Q.GALAMI DURYSTO DAGOOD OVERO 1279 MRT BELIS DI BATT 1. 1100 cu 11 AM OP TO 1 HILFE Com 1. BOLES TRESS W 18 HET SITES DER AM 1. SETGT PM SERIT GEOTC BER LOLLA SEBASTI TER il RSS RA REA 720 STILO LOPER PA WS NO LES STABLE ATIA MASO IN BRE B.O. CERT FREE PROIR LIM ROID 2011 STRE 20 UBE FOR VI BARA IL EST um am LO ES DR mm WI One MIRI RTLE RET les 1. BULETRERO AUS IMBIER SEREME CE ST BIOD LONDITI BOLESTI WA LBS SUIVIYOUTUT - Argen 2 OLI STRANI www . . BORRE 12 UURI LRT 12 TEST A Standard Cervo BOURS LOG SERIAL Hunt LO NE BITAT THE 00 WON DITS 1 LO ROT GENTO M 220 3273528 SMD ATAT M 1/1 11 21 LUNE CHARLES AM 1 RUS VA TERET Din REVIT SRET SUM LIDL VLTM TMK Coro Sanam Low Upper Loops 0.00TL DO LE 16 RESO.GL. NELSO 1 DZIYATIG MAART 1.0 1.1 LATAR 1 AL LATINA SISTEM WAT TE UN w 1 ON RE ET TESTI ETTE HARI TRI BC Gm BRUNO ARTIST RAT ta WANT OUTPUT HD BE LETNI 1 WAR DIE PRINT Me 1 ml ET 1 MILE 12V mm MALA TRE Tunt mm GEROU RE son som STITI BUITE Shared Cars NOVI w WWW BOLEST GER 12 SON BRE TIVITI SON Megren BOLIG GLASA SARRO MIDI RES WY BER AVAL STI NOVE ONLINE FR TER AN TITLE SL IWY Toni TESSORI in NI TIT HA LIEU ERU VERLO MARTTI RULUI AUTO 11 VERRE TI w DAVID BERATE MILANO ELLER BALI ERLE UNITE WWW 2. Suppose that you have an option of investing in one single asset; the first stock or the second stock. Which stock would expose you to greater total risk? [2 marks] 3. Which asset, your first stock or your second stock, would require a higher risk premium and why? [3 marks) 4. Suppose that you consider forming a four-asset portfolio by investing 20% of your wealth in your first stock, 20% in your second stock, 40% in S&P/ASX200 and 20% in the 10 year Australian government bonds. Compute the beta of your portfolio and interpret the value. [4 marks) 5. Suppose that you consider forming a two-asset portfolio by investing 40% of your wealth in your first stock and 60% in your second stock. 5.1. Compute the beta of your portfolio. [2 marks) 5.2. Compute the standard deviation of your portfolio. [5 marks) 5.3. What would be the standard deviation if two stocks are perfectly negatively correlated, keeping other variables constant? Compare the answer to the standard deviation in 5.2 and comment. [3 marks] 5.4 Compute the required return of your portfolio. Use 6.5% as a market risk premium and the 10-year government bond rate on 3 August 2021 as a risk-free rate. The 10-year government bond rates can be obtained from http://www.rba.gov.au/statistics/tables/index.html#interest-rates. See "Capital market yields - Government bonds-daily" under Interest Rates. The units of rates shown are per cent (%) per annum. [2 marks] AS WARI UN MOD TAM DOSSA OTTI OTO ARRIT E BEHERE TORS TL ZL. BORTIS ZLOGO TO ware Seandard Dwon BUSTOOD WYSUOD TAI SER BELO ANON III TIL 116 II Garance Correlation Camicient AMPLA DIPLO DEO Q.GALAMI DURYSTO DAGOOD OVERO 1279 MRT BELIS DI BATT 1. 1100 cu 11 AM OP TO 1 HILFE Com 1. BOLES TRESS W 18 HET SITES DER AM 1. SETGT PM SERIT GEOTC BER LOLLA SEBASTI TER il RSS RA REA 720 STILO LOPER PA WS NO LES STABLE ATIA MASO IN BRE B.O. CERT FREE PROIR LIM ROID 2011 STRE 20 UBE FOR VI BARA IL EST um am LO ES DR mm WI One MIRI RTLE RET les 1. BULETRERO AUS IMBIER SEREME CE ST BIOD LONDITI BOLESTI WA LBS SUIVIYOUTUT - Argen 2 OLI STRANI www . . BORRE 12 UURI LRT 12 TEST A Standard Cervo BOURS LOG SERIAL Hunt LO NE BITAT THE 00 WON DITS 1 LO ROT GENTO M 220 3273528 SMD ATAT M 1/1 11 21 LUNE CHARLES AM 1 RUS VA TERET Din REVIT SRET SUM LIDL VLTM TMK Coro Sanam Low Upper Loops 0.00TL DO LE 16 RESO.GL. NELSO 1 DZIYATIG MAART 1.0 1.1 LATAR 1 AL LATINA SISTEM WAT TE UN w 1 ON RE ET TESTI ETTE HARI TRI BC Gm BRUNO ARTIST RAT ta WANT OUTPUT HD BE LETNI 1 WAR DIE PRINT Me 1 ml ET 1 MILE 12V mm MALA TRE Tunt mm GEROU RE son som STITI BUITE Shared Cars NOVI w WWW BOLEST GER 12 SON BRE TIVITI SON Megren BOLIG GLASA SARRO MIDI RES WY BER AVAL STI NOVE ONLINE FR TER AN TITLE SL IWY Toni TESSORI in NI TIT HA LIEU ERU VERLO MARTTI RULUI AUTO 11 VERRE TI w DAVID BERATE MILANO ELLER BALI ERLE UNITE WWW 2. Suppose that you have an option of investing in one single asset; the first stock or the second stock. Which stock would expose you to greater total risk? [2 marks] 3. Which asset, your first stock or your second stock, would require a higher risk premium and why? [3 marks) 4. Suppose that you consider forming a four-asset portfolio by investing 20% of your wealth in your first stock, 20% in your second stock, 40% in S&P/ASX200 and 20% in the 10 year Australian government bonds. Compute the beta of your portfolio and interpret the value. [4 marks) 5. Suppose that you consider forming a two-asset portfolio by investing 40% of your wealth in your first stock and 60% in your second stock. 5.1. Compute the beta of your portfolio. [2 marks) 5.2. Compute the standard deviation of your portfolio. [5 marks) 5.3. What would be the standard deviation if two stocks are perfectly negatively correlated, keeping other variables constant? Compare the answer to the standard deviation in 5.2 and comment. [3 marks] 5.4 Compute the required return of your portfolio. Use 6.5% as a market risk premium and the 10-year government bond rate on 3 August 2021 as a risk-free rate. The 10-year government bond rates can be obtained from http://www.rba.gov.au/statistics/tables/index.html#interest-rates. See "Capital market yields - Government bonds-daily" under Interest Rates. The units of rates shown are per cent (%) per annum. [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started