Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer questions three and four. GE: Corporate Strategy Gone Wrong IN 2000. General Electric (GE) was the most valuable company globally with a market capitalization

Answer questions three and four.

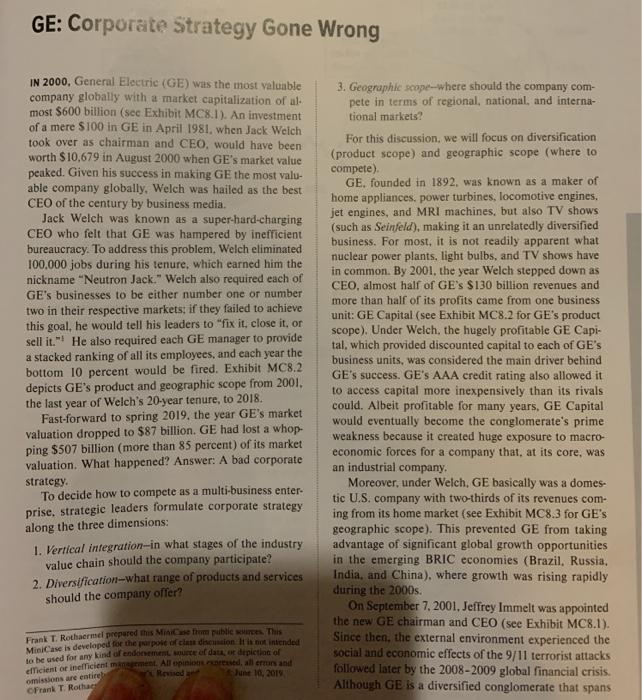

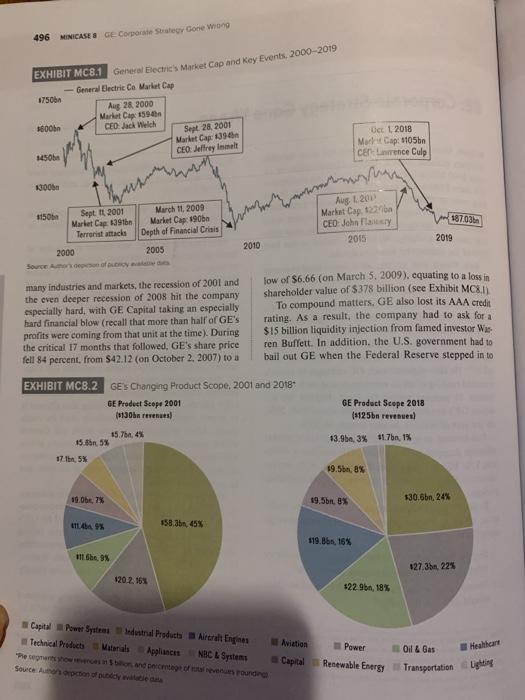

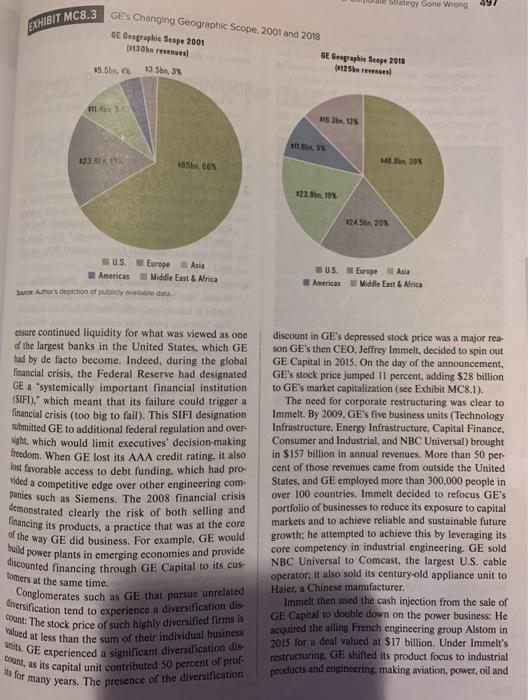

GE: Corporate Strategy Gone Wrong IN 2000. General Electric (GE) was the most valuable company globally with a market capitalization of al- most $600 billion (see Exhibit MC8.1). An investment of a mere $100 in GE in April 1981, when Jack Weich took over as chairman and CEO, would have been worth $10,679 in August 2000 when GE's market value peaked. Given his success in making GE the most valu- able company globally. Welch was hailed as the best CEO of the century by business media. Jack Welch was known as a super-hard-charging CEO who felt that GE was hampered by inefficient bureaucracy. To address this problem. Welch eliminated 100.000 jobs during his tenure, which earned him the nickname "Neutron Jack." Welch also required each of GE's businesses to be either number one or number two in their respective markets: if they failed to achieve this goal, he would tell his leaders to "fix it, close it, or sell it." He also required each GE manager to provide a stacked ranking of all its employees, and each year the bottom 10 percent would be fired. Exhibit MC8.2 depicts GE's product and geographic scope from 2001. the last year of Welch's 20-year tenure, to 2018 Fast-forward to spring 2019, the year GE's market valuation dropped to $87 billion. GE had lost a whop- ping $507 billion (more than 85 percent) of its market valuation. What happened? Answer: A bad corporate strategy. To decide how to compete as a multi-business enter- prise, strategic leaders formulate corporate strategy along the three dimensions: 1. Vertical integration-in what stages of the industry value chain should the company participate? 2. Diversification-what range of products and services should the company offer? 3. Geographic scope-where should the company com- pete in terms of regional, national, and interna- tional markets? For this discussion, we will focus on diversification (product scope) and geographic scope (where to compete). GE, founded in 1892, was known as a maker of home appliances, power turbines, locomotive engines, jet engines, and MRI machines, but also TV shows (such as Seinfeld), making it an unrelatedly diversified business. For most, it is not readily apparent what nuclear power plants, light bulbs, and TV shows have in common. By 2001, the year Welch stepped down as CEO, almost half of GE's $130 billion revenues and more than half of its profits came from one business unit: GE Capital (see Exhibit MC8.2 for GE's product scope). Under Welch, the hugely profitable GE Capi- tal, which provided discounted capital to each of GE's business units, was considered the main driver behind GE's success. GE's AAA credit rating also allowed it to access capital more inexpensively than its rivals could. Albeit profitable for many years, GE Capital would eventually become the conglomerate's prime weakness because it created huge exposure to macro- economic forces for a company that, at its core, was an industrial company. Moreover, under Welch, GE basically was a domes- tic U.S. company with two-thirds of its revenues com- ing from its home market (see Exhibit MC8.3 for GE's geographic scope). This prevented GE from taking advantage of significant global growth opportunities in the emerging BRIC economies (Brazil, Russia, India, and China), where growth was rising rapidly during the 2000s. On September 7, 2001, Jeffrey Immelt was appointed the new GE chairman and CEO (see Exhibit MC8.1). Since then, the external environment experienced the social and economic effects of the 9/11 terrorist attacks followed later by the 2008-2009 global financial crisis. Although GE is a diversified conglomerate that spans Frank T. Rothaermel prepared this Ministrom publle mees. This Mini Case is developed for the purpose of clam dramion. It is not intended to be used for any kind of endomen wurde of dator depiction of efficient or inefficient management. All opinion and all runs and Revised June 10, 2019 omissions are entire Frank Rothuc 496 MINICASES E Corporate Strategy Gone Wrong EXHIBIT MC8.1 Geneva Becic's Market Cap and Key Events, 2000-2019 - General Electric Co Marlet Cap 750 Aug 28, 2000 Market Cap: 1590 1600bn CED: Jack Welch Sept. 28, 2001 Markety 1396 CEO Jeffrey Inael Oct 1, 2018 MorCap: 1105b cence Culp 13000 Aug 20 March 11, 2009 Market Cap 190 Depth of Financial Crisis 187.03 1150 Sept. It 2001 Market Cap 139 thn Terrorist attacks 2000 Son of Market Cap. 122 CED John Flery 2015 2019 2005 2010 many industries and markets, the recession of 2001 and the even deeper recession of 2008 hit the company especially hard, with GE Capital taking an especially hard financial blow (recall that more than half of GE's profits were coming from that unit at the time). During the critical 17 months that followed, GE's share price fell 84 percent, from $42.12 (on October 2, 2007) to a low of $6.66 (on March 5, 2009), cquating to a loss in shareholder value of $378 billion (see Exhibit MCX To compound matters, GE also lost its AAA credit rating. As a result, the company had to ask for a $15 billion liquidity injection from famed investor was ren Buffett. In addition, the U.S. government had to bail out GE when the Federal Reserve stepped in to EXHIBIT MC8.2 GE's Changing Product Scope, 2001 and 2018 GE Product Scope 2001 ($130bn revenues GE Product Scope 2018 ($125bn revenues 15.74 15.Bn 5% $3.93% 91.7b, 1% 17,5% 19.5b, 8% 19.0b, 7% 19.5. B 130.6bn, 24% 111.49% 158.3 455 119. Bhn, 15% 11169% 127.3. 224 120 2. 16% $229b, 18% Capital Power Station Products Arch Engine Aviation Power Oil & Gas Technical Products Meral Appliance NBC L Systems Capital Renewable Energy Transportation "Pe tener en meget rounding Souce non potendo Heart Strategy Gone Wrong 497 EXHIBIT MC8.3 GES Changing Geographic Scope, 2001 and 2018 GE Graphie Scope 2001 30 revel 13.5 GE Geographic Soup 2018 (M2Share 55.5. 18.30 123 185 665 18.30 123.n. 19% 124 Sb 205 U.S.Europe Asis Americas Middle East & Alnica U.S. Europe Asia American Middle East & Africa Junior's depiction of pubidy table data ensure continued liquidity for what was viewed as one of the largest banks in the United States, which GE had by de facto become. Indeed, during the global financial crisis, the Federal Reserve had designated GE a "systemically important financial institution (SIFI), which meant that its failure could trigger a financial crisis (too big to fail). This SIFI designation submitted GE to additional federal regulation and over- Night, which would limit executives' decision-making freedom. When GE lost its AAA credit rating, it also lost favorable access to debt funding, which had pro- vided a competitive edge over other engineering com- Panies such as Siemens. The 2008 financial crisis demonstrated clearly the risk of both selling and financing its products, a practice that was at the core of the way GE did business. For example, GE would build power plants in emerging economies and provide discounted financing through GE Capital to its cus. Conglomerates such as GE that pursue unrelated diversification tend to experience a diversification dis Count: The stock price of such highly diversified firms is valued at less than the sum of their individual business its, GE experienced a significant diversification dis- count, as its capital unit contributed 50 percent of prof s for many years. The preschce of the diversification discount in GE's depressed stock price was a major rea- son GE's then CEO, Jeffrey Immelt, decided to spin out GE Capital in 2015. On the day of the announcement, GE's stock price jumped 11 percent, adding $28 billion to GE's market capitalization (see Exhibit MC8.1). The need for corporate restructuring was clear to Immelt. By 2009, GE's five business units (Technology Infrastructure, Energy Infrastructure, Capital Finance, Consumer and Industrial, and NBCUniversal) brought in $157 billion in annual revenues. More than 50 per- cent of those revenues came from outside the United States, and GE employed more than 300,000 people in over 100 countries. Immelt decided to refocus GE's portfolio of businesses to reduce its exposure to capital markets and to achieve reliable and sustainable future growth: he attempted to achieve this by leveraging its core competency in industrial engineering. GE sold NBC Universal to Comcast, the largest U.S. cable operator: it also sold its century-old appliance unit to Haier, a Chinese manufacturer. Immelt then used the cash injection from the sale of GE Capital to double down on the power business: He acquired the ailing French engineering group Alstom in 2015 for a deal valued at $17 billion. Under Immelt's restructuring. GE shifted its product focus to industrial products and engineering, making aviation, power, oil and tomers at the same time. 498 MINICASE: GE Corporate Say Gone Wrong U.S. enterprises. GE's current board of directors, which now includes a seat held by the activist investor Trian Fund run by billionaire Nelson Peltz), is clearly wanting to shake things up. DISCUSSION QUESTIONS 1 What kind of diversification is GE pursuing What are the sources of valde creation with this type of diversification gus, and health care its four Largest units (see Exhibit MC82). By 2018, GEs geographic scope was more diver sified with the US now accounting for less than 40 per cent of annual sales and Europe and Asia cach accounting for about 20 percent of revenues (see Exhibit MC8.3) YetGE continued to lose money. By 2018, GES Alstom acquisition was its power unit and designated the second-largest strategic business. However, by the end of the year, its revenues fell by over 20 percent. Overall, in the third quarter of 2018 alone, GE posted a loss of $34 billion. The firm had amassed too much debt and had too little cash flow. The diagnosis was that Immelt overpaid on several high-profile acquisitions (Alstom, being one, and the oil-field services company Baker Hughes, which it acquired for $32 billion, being another). In addition to overpaying for these firms, it also sold or spun off other GE units for too little On August 1, 2017, the board of GE replaced the haphazard Immelt with John Flannery, a 30-year GE insider who had led the health care unit (see Exhibit MC8.1). After only one year on the job, the board decided to let Flannery go because it felt he was too indecisive spending too much time in endless meetings focusing on analysis and consensus building rather than on taking the drastic actions they felt were needed to right the firm. In June 2018, when morale among GE employees was already low, GE reached its lowest point: It was dropped from the Dow Jones Industrial Average (DJIA) and replaced by Walgreens. GE had 2. How did GE lose SS0 illion (more than 85 Der cent) of its market valuation since its peak? What went wrong? 3. After leaving GE, Jeffrey Immelt stated in 2018: "The notion of plugging financial services and in dustrial companies together, maybe it was a good idea at a point in time, but it is a uniquely bad idea now. To what is Immelt referring? Why does he think this is a bad idea? Do you agree? Why, or why not? 4. In the bestseller Good to Great, Jim Collins ad vances the hypothesis that the greatness of a leader is known only after the leader has departed. The business press has celebrated Jack Welch as the greatest CEO of the last century. After reading this MiniCase, do you agree with Collins' strategic leadership hypothesis? Why, or why not? Note: When interviewed in 2018 about the GE situation, Jack Welch had this to say: "I give myself an A for the operation of GE, but an F for my choice of successor, continuously been listed on the DJIA (the most widely cited stock index representing the 30 most prestigious U.S. companies) since 1907. Its replacement by Wal- greens was the final blow for the firm. In 2019 the board appointed Lawrence "Larry" Culp as the new CEO; he had previously led Danaher Corp., another globally diversified conglomerate, albeit much smaller than GE. Culp is the first outsider to be appointed CEO in GE's 126-year history. To GE-lifers such as Welch, Immelt, and Flannery, the appointment of an outsider came as a complete shock in their minds the best managers in the world that could run any business better than anyone else were all produced at GE Executives that did not ascend to the CEO job Icft and became CEOs elsewhere, for example. 3M. Boeing, and The Home Depot among many others. Each of these firms is considered among the greates Endnotes 1. As quoted i Gryta. T. and T Mann (2018. Dec. 15), "GE powered the American centary-Then it burned out. The Wall Street Journal 2. Gryta. Land T. Mann (2018, Dec. 15). "GE perwered the American century-Then it burned out. The Wall Street Journal 2 As quoted le Gryta. Land T. Mann (2018. Dec. 151 "GE power the American century-Then it burned out. The Wall Street Journal Gta 1. and T. Mas 2018. Dec. 15). "GE powered the Ano dou." The Sural General El med The Eo2018, No. 3x GryTIS LED Reh. Ho Jeffrey Immit's success the main the The Soral Collins 1.2001 GG SC Malther Other Day (No York: Harper est reports fous years) GE: Corporate Strategy Gone Wrong IN 2000. General Electric (GE) was the most valuable company globally with a market capitalization of al- most $600 billion (see Exhibit MC8.1). An investment of a mere $100 in GE in April 1981, when Jack Weich took over as chairman and CEO, would have been worth $10,679 in August 2000 when GE's market value peaked. Given his success in making GE the most valu- able company globally. Welch was hailed as the best CEO of the century by business media. Jack Welch was known as a super-hard-charging CEO who felt that GE was hampered by inefficient bureaucracy. To address this problem. Welch eliminated 100.000 jobs during his tenure, which earned him the nickname "Neutron Jack." Welch also required each of GE's businesses to be either number one or number two in their respective markets: if they failed to achieve this goal, he would tell his leaders to "fix it, close it, or sell it." He also required each GE manager to provide a stacked ranking of all its employees, and each year the bottom 10 percent would be fired. Exhibit MC8.2 depicts GE's product and geographic scope from 2001. the last year of Welch's 20-year tenure, to 2018 Fast-forward to spring 2019, the year GE's market valuation dropped to $87 billion. GE had lost a whop- ping $507 billion (more than 85 percent) of its market valuation. What happened? Answer: A bad corporate strategy. To decide how to compete as a multi-business enter- prise, strategic leaders formulate corporate strategy along the three dimensions: 1. Vertical integration-in what stages of the industry value chain should the company participate? 2. Diversification-what range of products and services should the company offer? 3. Geographic scope-where should the company com- pete in terms of regional, national, and interna- tional markets? For this discussion, we will focus on diversification (product scope) and geographic scope (where to compete). GE, founded in 1892, was known as a maker of home appliances, power turbines, locomotive engines, jet engines, and MRI machines, but also TV shows (such as Seinfeld), making it an unrelatedly diversified business. For most, it is not readily apparent what nuclear power plants, light bulbs, and TV shows have in common. By 2001, the year Welch stepped down as CEO, almost half of GE's $130 billion revenues and more than half of its profits came from one business unit: GE Capital (see Exhibit MC8.2 for GE's product scope). Under Welch, the hugely profitable GE Capi- tal, which provided discounted capital to each of GE's business units, was considered the main driver behind GE's success. GE's AAA credit rating also allowed it to access capital more inexpensively than its rivals could. Albeit profitable for many years, GE Capital would eventually become the conglomerate's prime weakness because it created huge exposure to macro- economic forces for a company that, at its core, was an industrial company. Moreover, under Welch, GE basically was a domes- tic U.S. company with two-thirds of its revenues com- ing from its home market (see Exhibit MC8.3 for GE's geographic scope). This prevented GE from taking advantage of significant global growth opportunities in the emerging BRIC economies (Brazil, Russia, India, and China), where growth was rising rapidly during the 2000s. On September 7, 2001, Jeffrey Immelt was appointed the new GE chairman and CEO (see Exhibit MC8.1). Since then, the external environment experienced the social and economic effects of the 9/11 terrorist attacks followed later by the 2008-2009 global financial crisis. Although GE is a diversified conglomerate that spans Frank T. Rothaermel prepared this Ministrom publle mees. This Mini Case is developed for the purpose of clam dramion. It is not intended to be used for any kind of endomen wurde of dator depiction of efficient or inefficient management. All opinion and all runs and Revised June 10, 2019 omissions are entire Frank Rothuc 496 MINICASES E Corporate Strategy Gone Wrong EXHIBIT MC8.1 Geneva Becic's Market Cap and Key Events, 2000-2019 - General Electric Co Marlet Cap 750 Aug 28, 2000 Market Cap: 1590 1600bn CED: Jack Welch Sept. 28, 2001 Markety 1396 CEO Jeffrey Inael Oct 1, 2018 MorCap: 1105b cence Culp 13000 Aug 20 March 11, 2009 Market Cap 190 Depth of Financial Crisis 187.03 1150 Sept. It 2001 Market Cap 139 thn Terrorist attacks 2000 Son of Market Cap. 122 CED John Flery 2015 2019 2005 2010 many industries and markets, the recession of 2001 and the even deeper recession of 2008 hit the company especially hard, with GE Capital taking an especially hard financial blow (recall that more than half of GE's profits were coming from that unit at the time). During the critical 17 months that followed, GE's share price fell 84 percent, from $42.12 (on October 2, 2007) to a low of $6.66 (on March 5, 2009), cquating to a loss in shareholder value of $378 billion (see Exhibit MCX To compound matters, GE also lost its AAA credit rating. As a result, the company had to ask for a $15 billion liquidity injection from famed investor was ren Buffett. In addition, the U.S. government had to bail out GE when the Federal Reserve stepped in to EXHIBIT MC8.2 GE's Changing Product Scope, 2001 and 2018 GE Product Scope 2001 ($130bn revenues GE Product Scope 2018 ($125bn revenues 15.74 15.Bn 5% $3.93% 91.7b, 1% 17,5% 19.5b, 8% 19.0b, 7% 19.5. B 130.6bn, 24% 111.49% 158.3 455 119. Bhn, 15% 11169% 127.3. 224 120 2. 16% $229b, 18% Capital Power Station Products Arch Engine Aviation Power Oil & Gas Technical Products Meral Appliance NBC L Systems Capital Renewable Energy Transportation "Pe tener en meget rounding Souce non potendo Heart Strategy Gone Wrong 497 EXHIBIT MC8.3 GES Changing Geographic Scope, 2001 and 2018 GE Graphie Scope 2001 30 revel 13.5 GE Geographic Soup 2018 (M2Share 55.5. 18.30 123 185 665 18.30 123.n. 19% 124 Sb 205 U.S.Europe Asis Americas Middle East & Alnica U.S. Europe Asia American Middle East & Africa Junior's depiction of pubidy table data ensure continued liquidity for what was viewed as one of the largest banks in the United States, which GE had by de facto become. Indeed, during the global financial crisis, the Federal Reserve had designated GE a "systemically important financial institution (SIFI), which meant that its failure could trigger a financial crisis (too big to fail). This SIFI designation submitted GE to additional federal regulation and over- Night, which would limit executives' decision-making freedom. When GE lost its AAA credit rating, it also lost favorable access to debt funding, which had pro- vided a competitive edge over other engineering com- Panies such as Siemens. The 2008 financial crisis demonstrated clearly the risk of both selling and financing its products, a practice that was at the core of the way GE did business. For example, GE would build power plants in emerging economies and provide discounted financing through GE Capital to its cus. Conglomerates such as GE that pursue unrelated diversification tend to experience a diversification dis Count: The stock price of such highly diversified firms is valued at less than the sum of their individual business its, GE experienced a significant diversification dis- count, as its capital unit contributed 50 percent of prof s for many years. The preschce of the diversification discount in GE's depressed stock price was a major rea- son GE's then CEO, Jeffrey Immelt, decided to spin out GE Capital in 2015. On the day of the announcement, GE's stock price jumped 11 percent, adding $28 billion to GE's market capitalization (see Exhibit MC8.1). The need for corporate restructuring was clear to Immelt. By 2009, GE's five business units (Technology Infrastructure, Energy Infrastructure, Capital Finance, Consumer and Industrial, and NBCUniversal) brought in $157 billion in annual revenues. More than 50 per- cent of those revenues came from outside the United States, and GE employed more than 300,000 people in over 100 countries. Immelt decided to refocus GE's portfolio of businesses to reduce its exposure to capital markets and to achieve reliable and sustainable future growth: he attempted to achieve this by leveraging its core competency in industrial engineering. GE sold NBC Universal to Comcast, the largest U.S. cable operator: it also sold its century-old appliance unit to Haier, a Chinese manufacturer. Immelt then used the cash injection from the sale of GE Capital to double down on the power business: He acquired the ailing French engineering group Alstom in 2015 for a deal valued at $17 billion. Under Immelt's restructuring. GE shifted its product focus to industrial products and engineering, making aviation, power, oil and tomers at the same time. 498 MINICASE: GE Corporate Say Gone Wrong U.S. enterprises. GE's current board of directors, which now includes a seat held by the activist investor Trian Fund run by billionaire Nelson Peltz), is clearly wanting to shake things up. DISCUSSION QUESTIONS 1 What kind of diversification is GE pursuing What are the sources of valde creation with this type of diversification gus, and health care its four Largest units (see Exhibit MC82). By 2018, GEs geographic scope was more diver sified with the US now accounting for less than 40 per cent of annual sales and Europe and Asia cach accounting for about 20 percent of revenues (see Exhibit MC8.3) YetGE continued to lose money. By 2018, GES Alstom acquisition was its power unit and designated the second-largest strategic business. However, by the end of the year, its revenues fell by over 20 percent. Overall, in the third quarter of 2018 alone, GE posted a loss of $34 billion. The firm had amassed too much debt and had too little cash flow. The diagnosis was that Immelt overpaid on several high-profile acquisitions (Alstom, being one, and the oil-field services company Baker Hughes, which it acquired for $32 billion, being another). In addition to overpaying for these firms, it also sold or spun off other GE units for too little On August 1, 2017, the board of GE replaced the haphazard Immelt with John Flannery, a 30-year GE insider who had led the health care unit (see Exhibit MC8.1). After only one year on the job, the board decided to let Flannery go because it felt he was too indecisive spending too much time in endless meetings focusing on analysis and consensus building rather than on taking the drastic actions they felt were needed to right the firm. In June 2018, when morale among GE employees was already low, GE reached its lowest point: It was dropped from the Dow Jones Industrial Average (DJIA) and replaced by Walgreens. GE had 2. How did GE lose SS0 illion (more than 85 Der cent) of its market valuation since its peak? What went wrong? 3. After leaving GE, Jeffrey Immelt stated in 2018: "The notion of plugging financial services and in dustrial companies together, maybe it was a good idea at a point in time, but it is a uniquely bad idea now. To what is Immelt referring? Why does he think this is a bad idea? Do you agree? Why, or why not? 4. In the bestseller Good to Great, Jim Collins ad vances the hypothesis that the greatness of a leader is known only after the leader has departed. The business press has celebrated Jack Welch as the greatest CEO of the last century. After reading this MiniCase, do you agree with Collins' strategic leadership hypothesis? Why, or why not? Note: When interviewed in 2018 about the GE situation, Jack Welch had this to say: "I give myself an A for the operation of GE, but an F for my choice of successor, continuously been listed on the DJIA (the most widely cited stock index representing the 30 most prestigious U.S. companies) since 1907. Its replacement by Wal- greens was the final blow for the firm. In 2019 the board appointed Lawrence "Larry" Culp as the new CEO; he had previously led Danaher Corp., another globally diversified conglomerate, albeit much smaller than GE. Culp is the first outsider to be appointed CEO in GE's 126-year history. To GE-lifers such as Welch, Immelt, and Flannery, the appointment of an outsider came as a complete shock in their minds the best managers in the world that could run any business better than anyone else were all produced at GE Executives that did not ascend to the CEO job Icft and became CEOs elsewhere, for example. 3M. Boeing, and The Home Depot among many others. Each of these firms is considered among the greates Endnotes 1. As quoted i Gryta. T. and T Mann (2018. Dec. 15), "GE powered the American centary-Then it burned out. The Wall Street Journal 2. Gryta. Land T. Mann (2018, Dec. 15). "GE perwered the American century-Then it burned out. The Wall Street Journal 2 As quoted le Gryta. Land T. Mann (2018. Dec. 151 "GE power the American century-Then it burned out. The Wall Street Journal Gta 1. and T. Mas 2018. Dec. 15). "GE powered the Ano dou." The Sural General El med The Eo2018, No. 3x GryTIS LED Reh. Ho Jeffrey Immit's success the main the The Soral Collins 1.2001 GG SC Malther Other Day (No York: Harper est reports fous years) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started