Question

*** ANSWER QUESTIONS USING FORMAT PROVIDED *** Laramie Leatherworks, which manufactures saddles and other leather goods, has three departments. The Assembly Department manufactures various leather

*** ANSWER QUESTIONS USING FORMAT PROVIDED ***

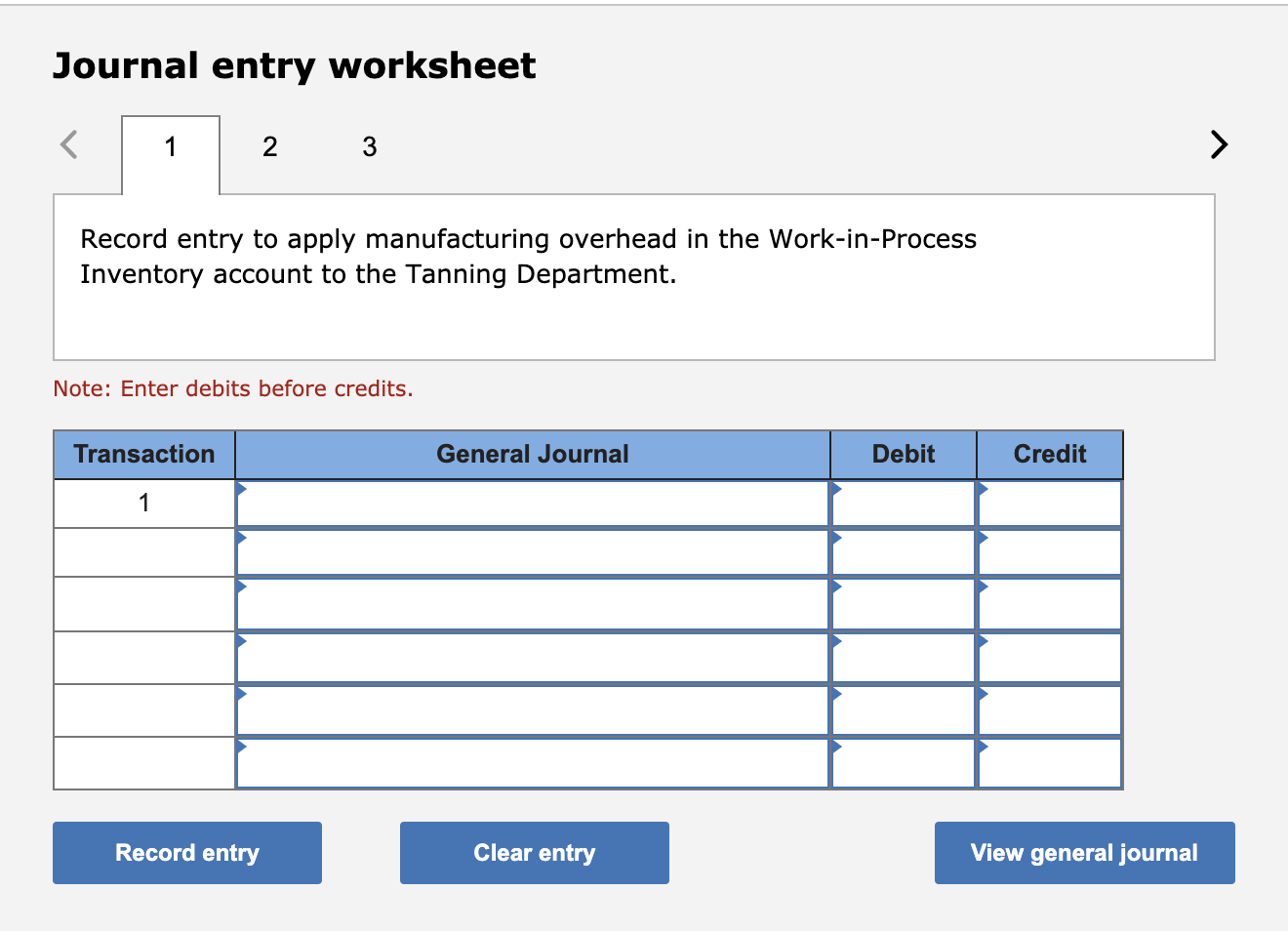

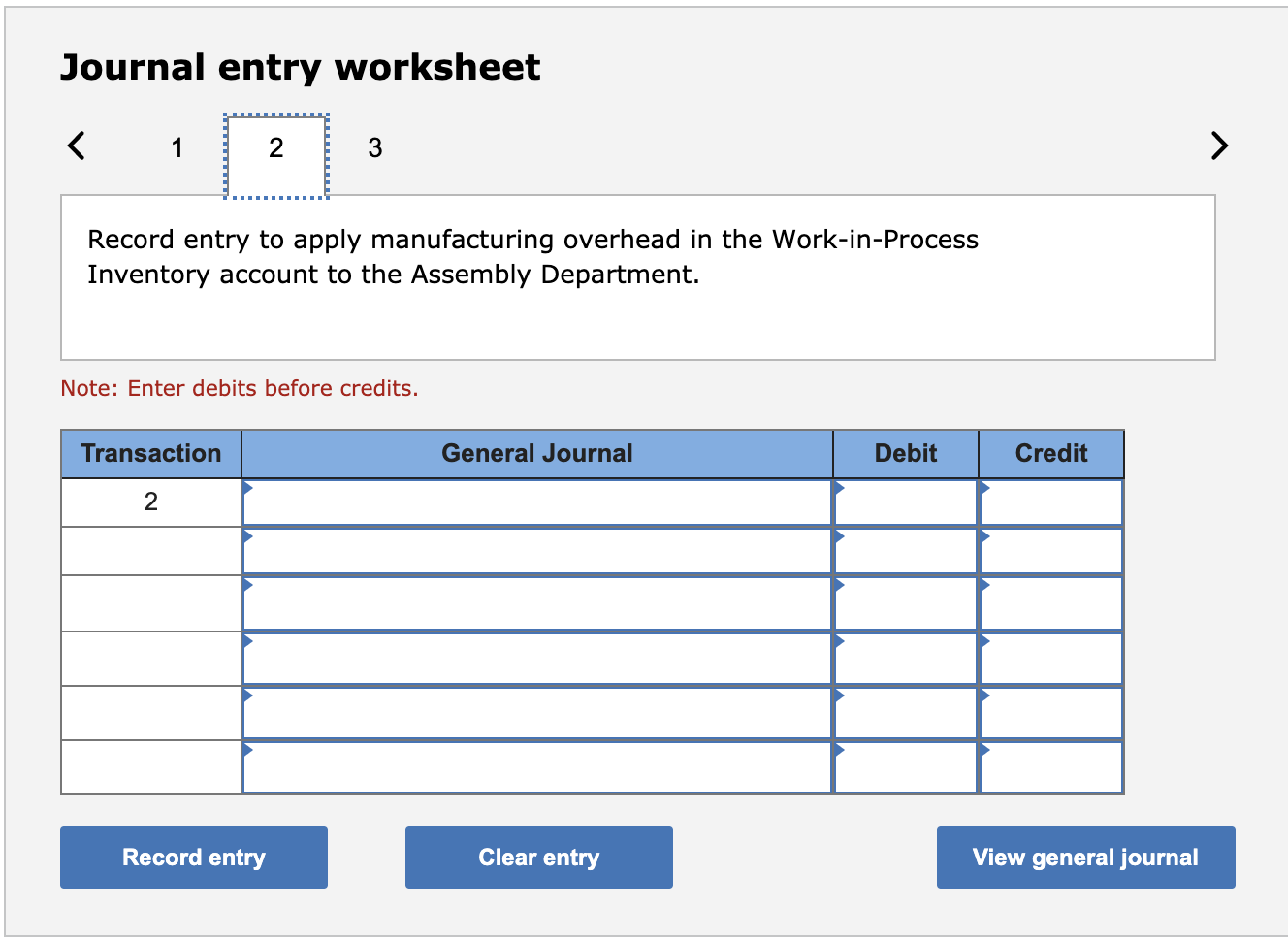

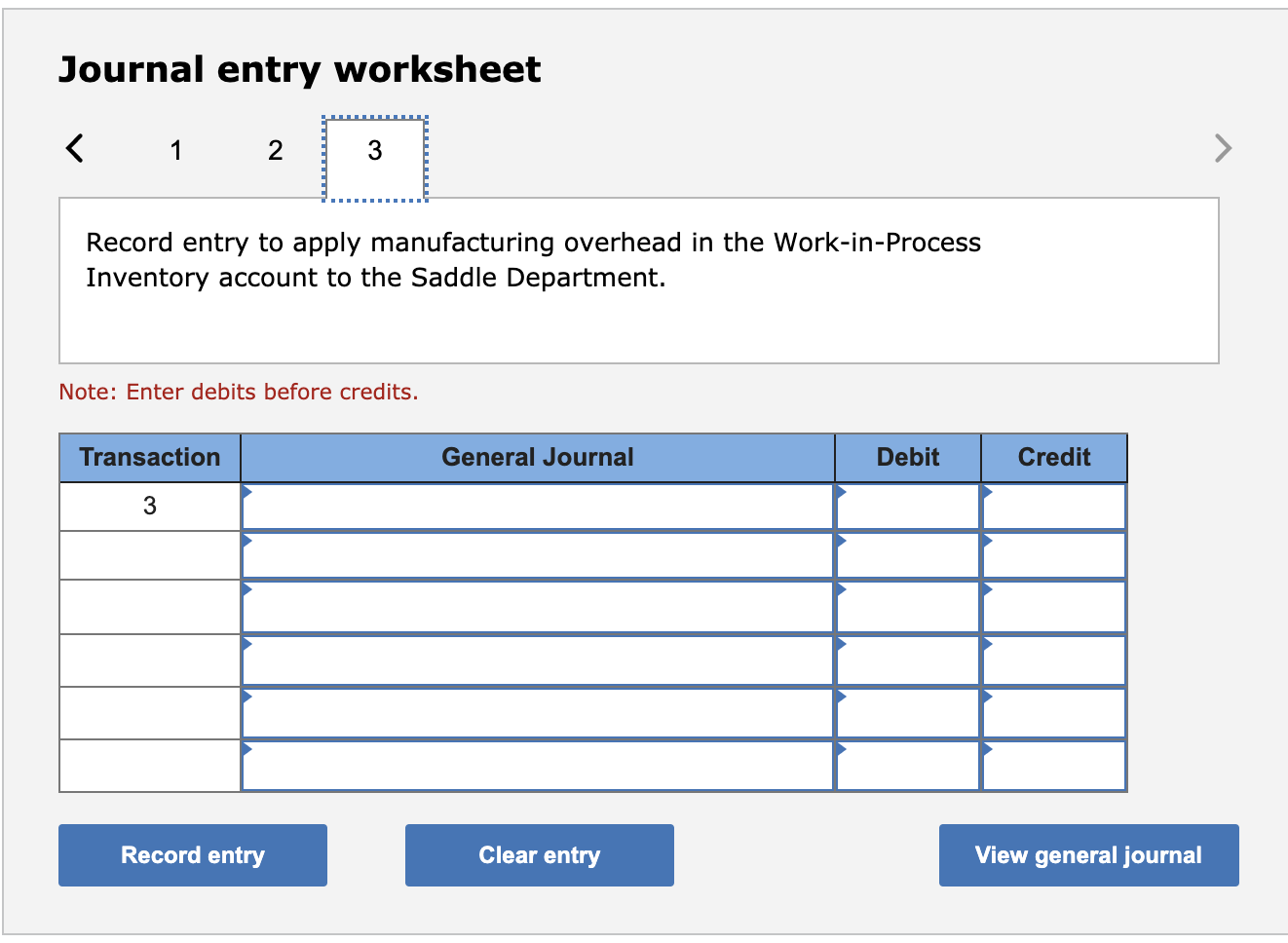

Laramie Leatherworks, which manufactures saddles and other leather goods, has three departments. The Assembly Department manufactures various leather products, such as belts, purses, and saddlebags, using an automated production process. The Saddle Department produces handmade saddles and uses very little machinery. The Tanning Department produces leather. The tanning process requires little in the way of labor or machinery, but it does require space and process time. Due to the different production processes in the three departments, the company uses three different cost drivers for the application of manufacturing overhead. The cost drivers and overhead rates are as follows:

| Department | Cost Driver | Predetermined Overhead Rate | ||

| Tanning Department | Square feet of leather | $ | 3 | per square foot |

| Assembly Department | Machine time | $ | 7 | per machine hour |

| Saddle Department | Direct-labor time | $ | 6 | per direct-labor hour |

The companys deluxe saddle and accessory set consists of a handmade saddle, two saddlebags, a belt, and a vest, all coordinated to match. The entire set uses 100 square feet of leather from the Tanning Department, 3 machine hours in the Assembly Department, and 50 direct-labor hours in the Saddle Department. Required: Job number DS-20 consisted of 20 deluxe saddle and accessory sets. Prepare journal entries to record applied manufacturing overhead in the Work-in-Process Inventory account for each department. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started