Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer quickly very urgent please #6) (4 Marks) The following situations are independent of each other. However, all the corporations described below are Canadian controlled

answer quickly very urgent please

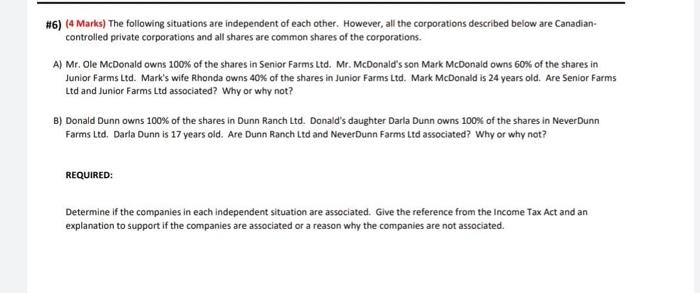

#6) (4 Marks) The following situations are independent of each other. However, all the corporations described below are Canadian controlled private corporations and all shares are common shares of the corporations. A) Mr. Ole McDonald owns 100% of the shares in Senior Farms Ltd. Mr. McDonald's son Mark McDonald owns 60% of the shares in Junior Farms Ltd. Mark's wife Rhonda owns 40% of the shares in Junior Farms Ltd. Mark McDonald is 24 years old. Are Senior Farms Ltd and Junior Farms Ltd associated? Why or why not? B) Donald Dunn owns 100% of the shares in Dunn Ranch Ltd. Donald's daughter Darla Dunn owns 100% of the shares in Never Dunn Farms Ltd, Darla Dunn is 17 years old. Are Dunn Ranch Ltd and NeverDunn Farms Ltd associated? Why or why not? REQUIRED: Determine if the companies in each independent situation are associated. Give the reference from the Income Tax Act and an explanation to support if the companies are associated or a reason why the companies are not associated. #6) (4 Marks) The following situations are independent of each other. However, all the corporations described below are Canadian controlled private corporations and all shares are common shares of the corporations. A) Mr. Ole McDonald owns 100% of the shares in Senior Farms Ltd. Mr. McDonald's son Mark McDonald owns 60% of the shares in Junior Farms Ltd. Mark's wife Rhonda owns 40% of the shares in Junior Farms Ltd. Mark McDonald is 24 years old. Are Senior Farms Ltd and Junior Farms Ltd associated? Why or why not? B) Donald Dunn owns 100% of the shares in Dunn Ranch Ltd. Donald's daughter Darla Dunn owns 100% of the shares in Never Dunn Farms Ltd, Darla Dunn is 17 years old. Are Dunn Ranch Ltd and NeverDunn Farms Ltd associated? Why or why not? REQUIRED: Determine if the companies in each independent situation are associated. Give the reference from the Income Tax Act and an explanation to support if the companies are associated or a reason why the companies are not associated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started