Answered step by step

Verified Expert Solution

Question

1 Approved Answer

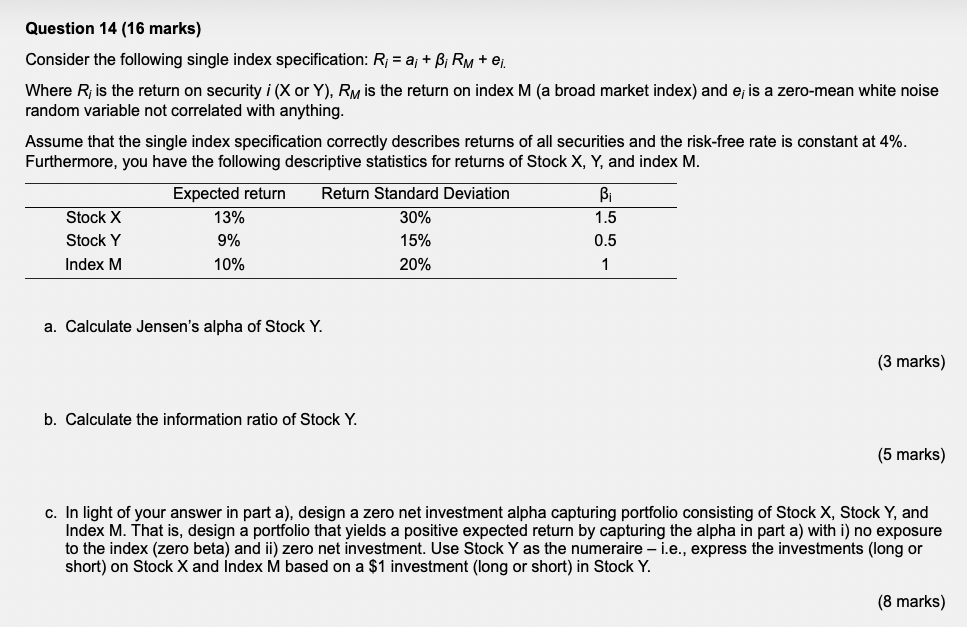

Answer quickly with working for thumbs up Consider the following single index specification: Ri=ai+iRM+ei Where Ri is the return on security i(X or Y ),

Answer quickly with working for thumbs up

Consider the following single index specification: Ri=ai+iRM+ei Where Ri is the return on security i(X or Y ), RM is the return on index M (a broad market index) and ei is a zero-mean white noise random variable not correlated with anything. Assume that the single index specification correctly describes returns of all securities and the risk-free rate is constant at 4%. Furthermore, you have the following descriptive statistics for returns of Stock X, Y, and index M. a. Calculate Jensen's alpha of Stock Y. (3 marks) b. Calculate the information ratio of Stock Y. (5 marks) c. In light of your answer in part a), design a zero net investment alpha capturing portfolio consisting of Stock X, Stock Y, and Index M. That is, design a portfolio that yields a positive expected return by capturing the alpha in part a) with i) no exposure to the index (zero beta) and ii) zero net investment. Use Stock Y as the numeraire - i.e., express the investments (long or short) on Stock X and Index M based on a $1 investment (long or short) in Stock Y. Consider the following single index specification: Ri=ai+iRM+ei Where Ri is the return on security i(X or Y ), RM is the return on index M (a broad market index) and ei is a zero-mean white noise random variable not correlated with anything. Assume that the single index specification correctly describes returns of all securities and the risk-free rate is constant at 4%. Furthermore, you have the following descriptive statistics for returns of Stock X, Y, and index M. a. Calculate Jensen's alpha of Stock Y. (3 marks) b. Calculate the information ratio of Stock Y. (5 marks) c. In light of your answer in part a), design a zero net investment alpha capturing portfolio consisting of Stock X, Stock Y, and Index M. That is, design a portfolio that yields a positive expected return by capturing the alpha in part a) with i) no exposure to the index (zero beta) and ii) zero net investment. Use Stock Y as the numeraire - i.e., express the investments (long or short) on Stock X and Index M based on a $1 investment (long or short) in Stock YStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started