Answered step by step

Verified Expert Solution

Question

1 Approved Answer

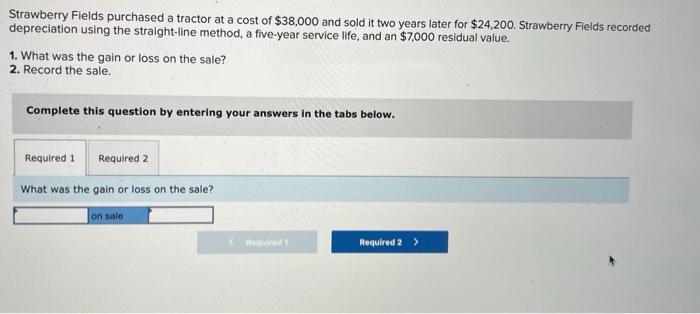

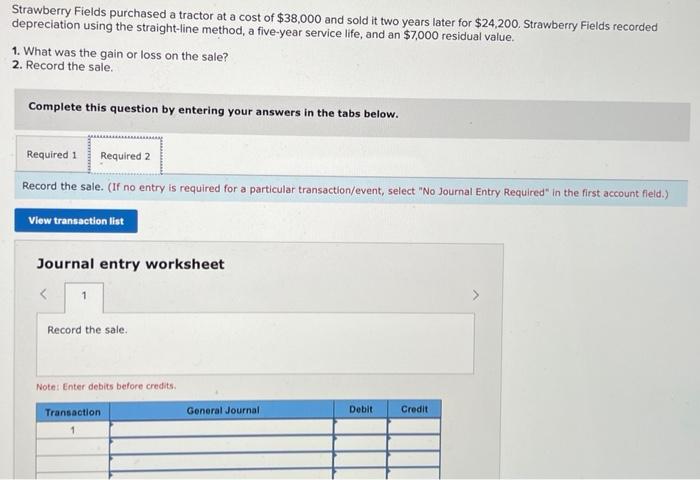

answer required 1 & 2 Strawberry Fields purchased a tractor at a cost of $38,000 and sold it two years later for $24.200. Strawberry Fields

answer required 1 & 2

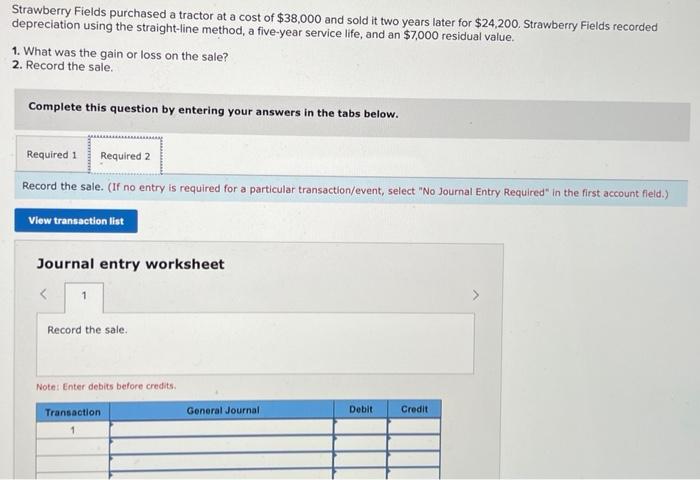

Strawberry Fields purchased a tractor at a cost of $38,000 and sold it two years later for $24.200. Strawberry Fields recorded depreciation using the straight-line method, a five-year service life, and an $7,000 residual value. 1. What was the gain or loss on the sale? 2. Record the sale. Complete this question by entering your answers in the tabs below. Required 1 Required 2 What was the gain or loss on the sale? on sale Required 2 > Strawberry Fields purchased a tractor at a cost of $38,000 and sold it two years later for $24,200. Strawberry Fields recorded depreciation using the straight-line method, a five-year service life, and an $7,000 residual value. 1. What was the gain or loss on the sale? 2. Record the sale. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Record the sale. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the sale Note: Enter debits before credits Transaction General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started