Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer serial wise 1-i,ii,iii and 2 i,ii,iii. 1) 2) An investor is bullish on ACMELAB stock. The current market price is Tk. 108.40 per share,

Answer serial wise 1-"i,ii,iii" and 2 "i,ii,iii". 1)

2)

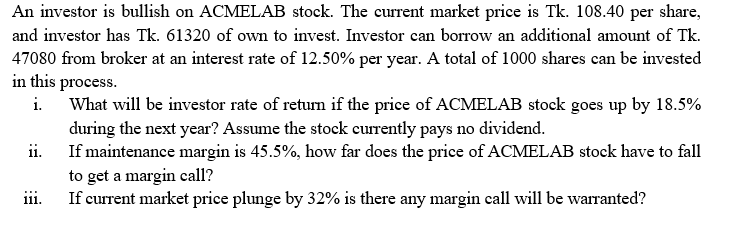

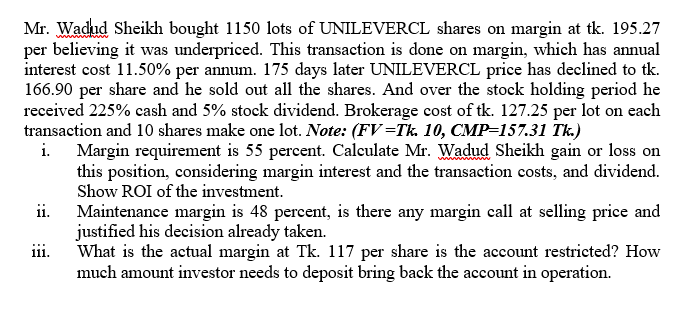

An investor is bullish on ACMELAB stock. The current market price is Tk. 108.40 per share, and investor has Tk. 61320 of own to invest. Investor can borrow an additional amount of Tk. 47080 from broker at an interest rate of 12.50% per year. A total of 1000 shares can be invested in this process. i. What will be investor rate of return if the price of ACMELAB stock goes up by 18.5% during the next year? Assume the stock currently pays no dividend. ii. If maintenance margin is 45.5%, how far does the price of ACMELAB stock have to fall to get a margin call? iii. If current market price plunge by 32% is there any margin call will be warranted? 166.90 per Mr. Wadud Sheikh bought 1150 lots of UNILEVERCL shares on margin at tk. 195.27 per believing it was underpriced. This transaction is done on margin, which has annual interest cost 11.50% per annum. 175 days later UNILEVERCL price has declined to tk. share and he sold out all the shares. And over the stock holding period he received 225% cash and 5% stock dividend. Brokerage cost of tk. 127.25 per lot on each transaction and 10 shares make one lot. Note: (FV =Tk. 10, CMP=157.31 Tk.) i. Margin requirement is 55 percent. Calculate Mr. Wadud Sheikh gain or loss on this position, considering margin interest and the transaction costs, and dividend. Show ROI of the investment. ii. Maintenance margin is 48 percent, is there any margin call at selling price and justified his decision already taken. What is the actual margin at Tk. 117 per share is the account restricted? How much amount investor needs to deposit bring back the account in operation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started