Question: Answer should be 50 007 need step by step solution (no excel please!) A large profitable company, in the 40% combined federal/state tax bracket, is

Answer should be 50 007

need step by step solution (no excel please!)

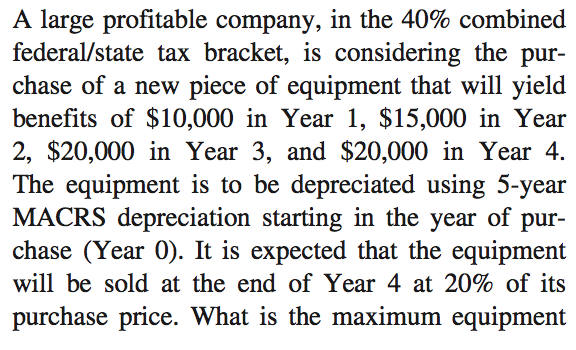

A large profitable company, in the 40% combined federal/state tax bracket, is considering the pur- chase of a new piece of equipment that will yield benefits of $10,000 in Year 1, $15,000 in Year 2, $20,000 in Year 3, and $20,000 in Year 4. The equipment is to be depreciated using 5-year MACRS depreciation starting in the year of pur- chase (Year 0). It is expected that the equipment will be sold at the end of Year 4 at 20% of its purchase price. What is the maximum equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts