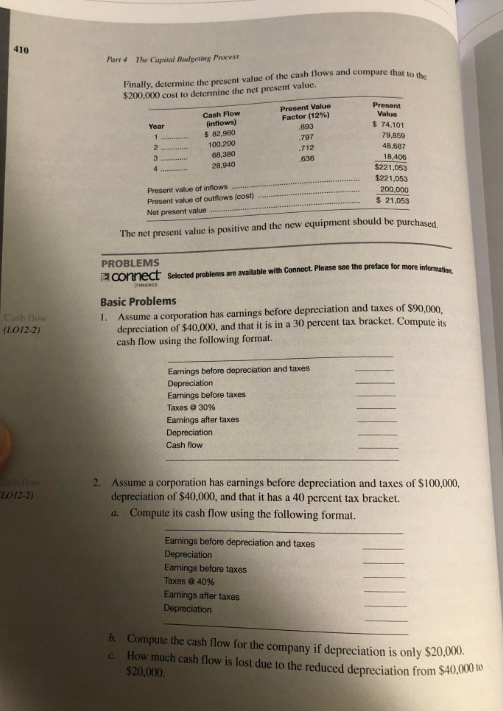

Question: Part The Capital Budgeting Process Finally, determine the present value of the cash flows and compare that $200.000 cost to determine the not present value.

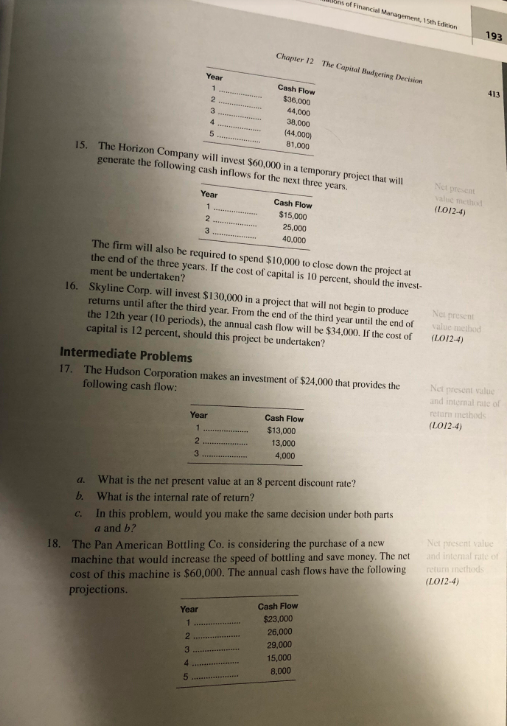

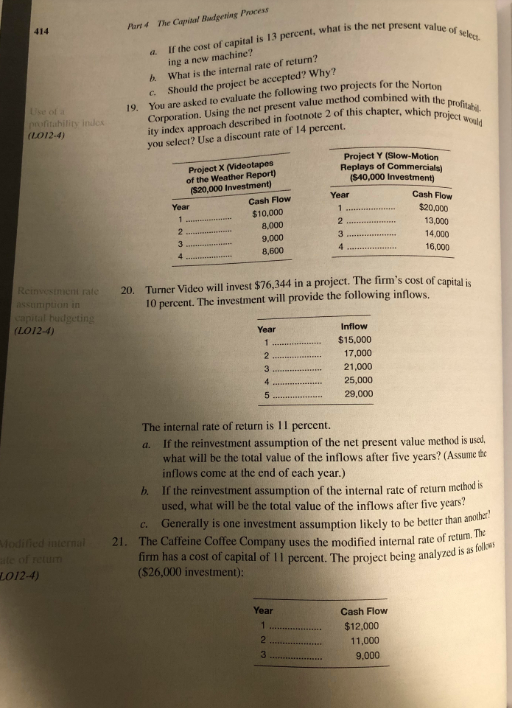

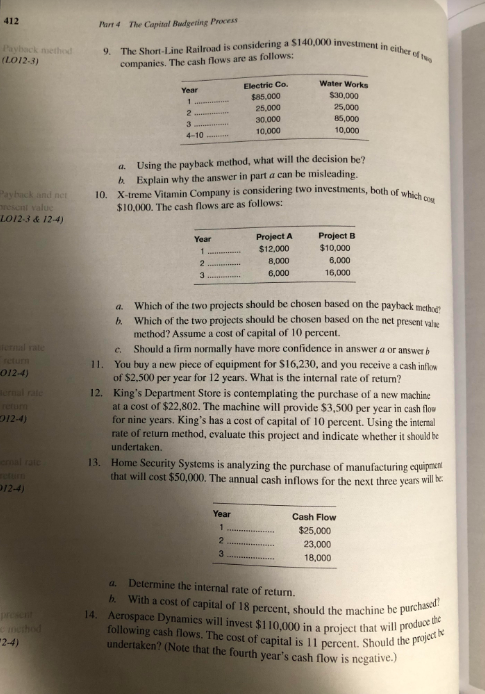

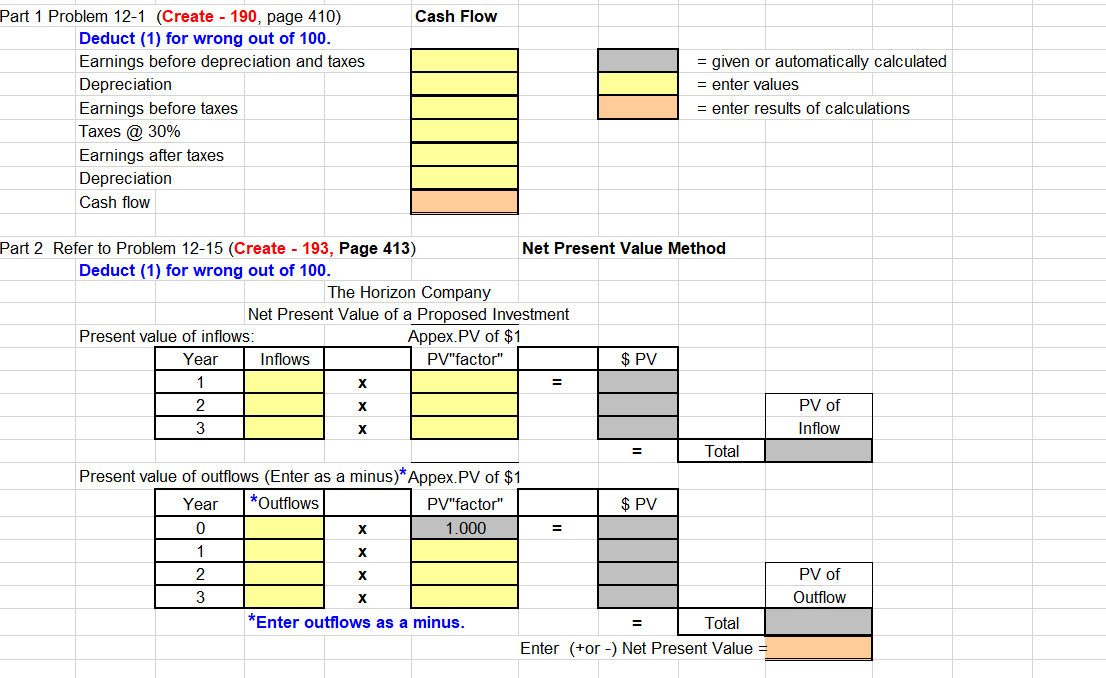

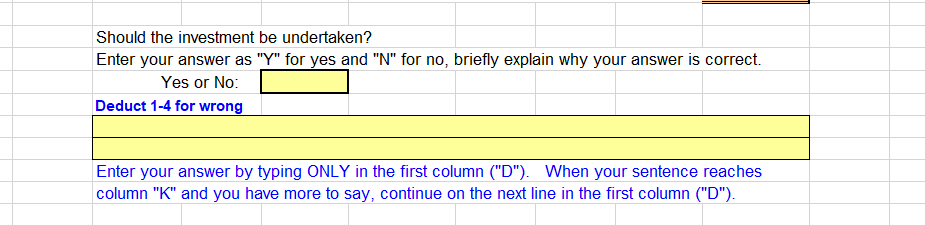

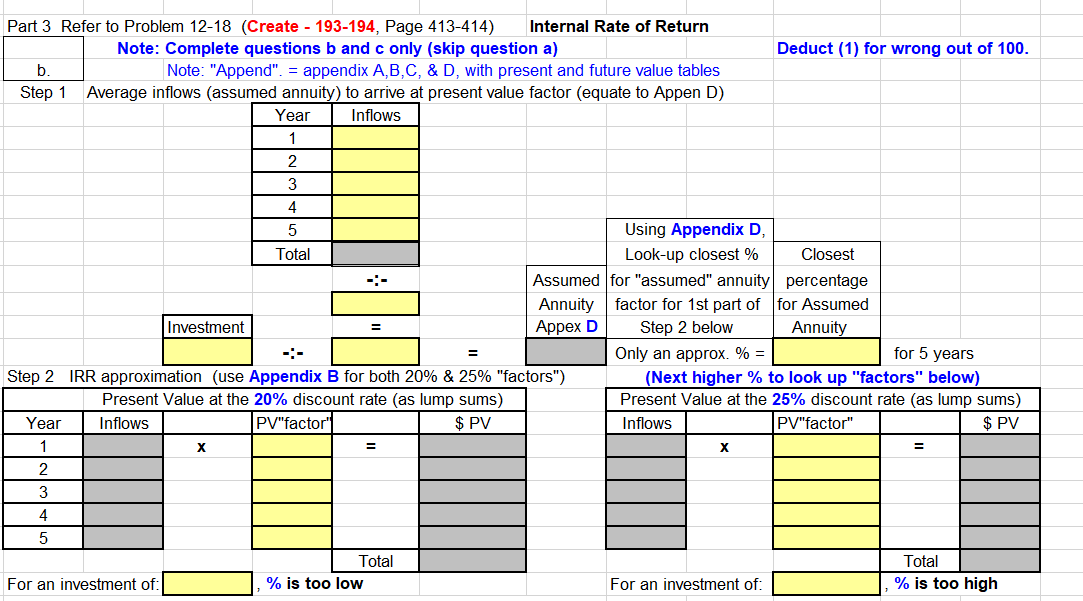

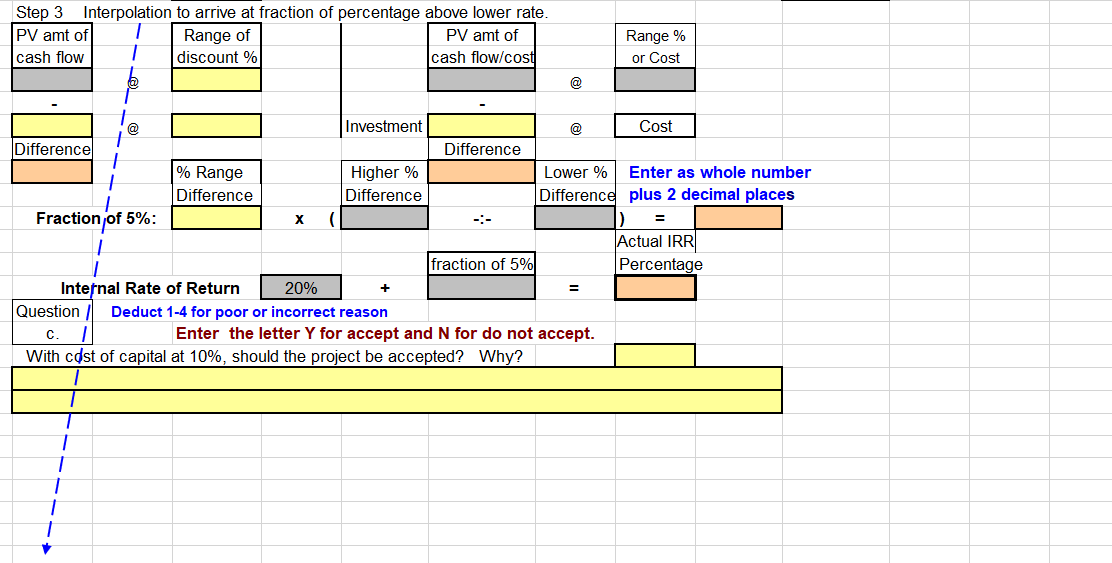

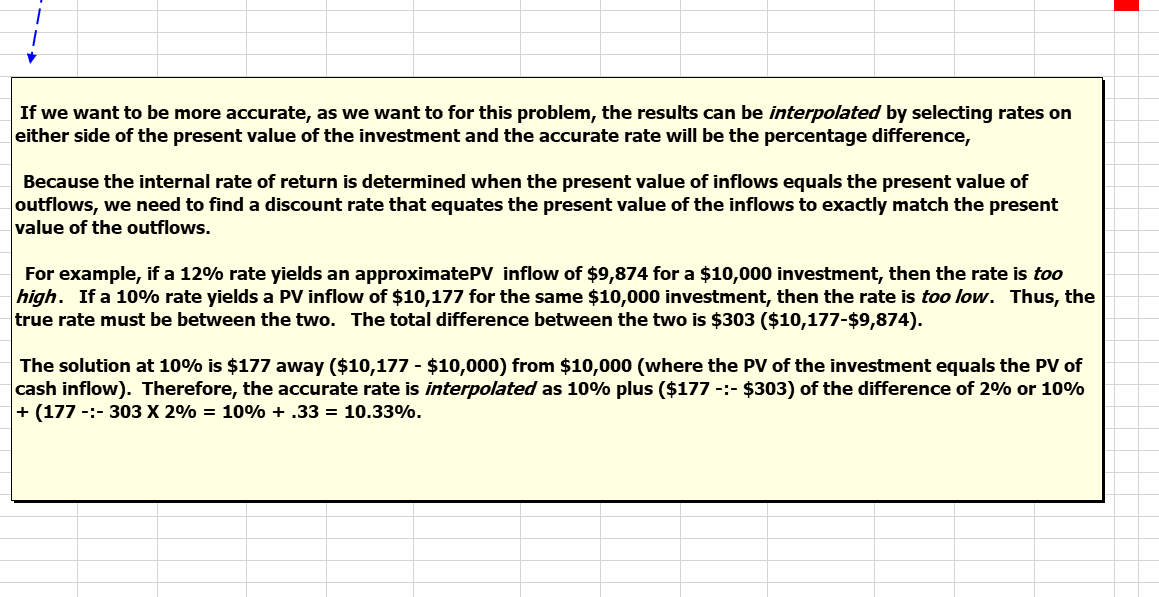

Part The Capital Budgeting Process Finally, determine the present value of the cash flows and compare that $200.000 cost to determine the not present value. Present Cash Flow Brows) Present Value Factor (124) Year 712 100,200 68.30 28,940 636 $ 74.101 79.859 48,687 18.406 $221,053 $221,053 200 000 $ 21,053 Present value of infos Present value of outflows loost) Net present value... The nel present value is positive and the new equipment should be purchased PROBLEMS connect Selected problems are available with Connect. Please see the preface for more interne Basic Problems 1. Assume a corporation has earnings before depreciation and taxes of $90.000 depreciation of $40,000, and that it is in a 30 percent tax bracket. Compute its cash flow using the following format. (LO/2-2) Earnings before depreciation and taxes Depreciation Earnings before taxes Taxes e 30% Earnings after taxes Depreciation Cash flow 2012-2) 2. Assume a corporation has earnings before depreciation and taxes of $100,000, depreciation of $40,000, and that it has a 40 percent tax bracket. a. Compute its cash flow using the following format. Earnings before depreciation and taxes Depreciation Earnings before taxes Taxes @ 40% Earnings after taxes Depreciation b. Compute the cash flow for the company if depreciation is only $20,000. c. How much cash flow is lost due to the reduced depreciation from $40.6 $20,000 Monok mancare 193 Chapter 12 The Capital I gering Dertion Cash Fle $36.000 44.000 38.000 (44.000 15. 81.000 The Horizon Company will invest $60,000 in a temporary project that will generate the following cash inflows for the next three years. Year 1012-4) Cash Flow $15,000 25,000 40.000 The firm will also be required to spend $10,000 to close down the project at the end of the three years. If the cost of capital is 10 percent, should the invest- ment be undertaken? 16. Skyline Corp. will invest $130,000 in a project that will not begin to produce returns until after the third year. From the end of the third year until the end of the 12th year (10 periods), the annual cash flow will be $34.000. If the cost of capital is 12 percent, should this project be undertaken? (012-4) Intermediate Problems 17. The Hudson Corporation makes an investment of $24,000 that provides the following cash flow: Net prosent value Year (L0/2-4) Cash Flow $13,000 13.000 4,000 ind in email a. What is the net present value at an 8 percent discount rate? b. What is the internal rate of return? c. In this problem, would you make the same decision under both parts a and b? 18. The Pan American Bottling Co. is considering the purchase of a new machine that would increase the speed of bottling and save money. The net cost of this machine is $60,000. The annual cash flows have the following projections. Year Cash Flow $23.000 25,000 29,000 15,000 8.000 (L012-4) Pure The Capital Budgerig Process vent value of selen If the cost of capital is 13 percent, what is the nel present ing a new machine? b. What is the internal rate of return? c. Should the project be accepted? Why? You are asked to evaluate the following two projects for the Nor Corporation. Using the nel present value method combined with ity index approach described in footnote 2 of this chapter, whi you select? Use a discount rate of 14 percent. 19. ined with the profita ter, which project would profitability index (L012-4) Project Y (Slow-Motion Replays of Commercials ISA0.000 Investmenti Project X (Videotapes of the Weather Report) $20,000 Investment) Cash Flow $10,000 8,000 Cash Flow $20,000 13,000 14,000 16,000 9.000 8,600 20. Turner Video will invest $76,344 in a project. The firm's cost of capital is 10 percent. The investment will provide the following inflows. Reinvestment rate Assumption in capital hudgeting (L012-4) Year Inflow $15,000 17.000 21,000 25,000 29,000 The internal rate of return is 11 percent. If the reinvestment assumption of the net present value method is used what will be the total value of the inflows after five years? (Assume the inflows come at the end of each year.) b. If the reinvestment assumption of the internal rate of retum mcthod is used, what will be the total value of the inflows after five years! c. Generally is one investment assumption likely to be better than ano 21. The Calleine Coffee Company uses the modified internal rate of retum. firm has a cost of capital of 11 percent. The project being analyzed ($26,000 investment): her! eller than Vodited internal "ing analyzed is as follows L012-4) Year Cash Flow $12,000 11,000 9.000 412 Part 4 The Capital Budgeting Process hac mete o investment in (L012-3) The Sheline Railroad is considering a STO companies. The cash flows are as follows: Electric Co. $85.000 25.000 30.000 10,000 Water Works $30,000 25,000 B5,000 10,000 4-10 ....... a. Using the payback method, what will the decision be? h Explain why the answer in part a can be misleading X-treme Vitamin Company is considering two investments, both of $10,000. The cash flows are as follows: s, both of which com Rayhuck and net 10. LO123 & 12-4) Year Project A $12,000 8.000 6,000 Project B $10,000 6,000 16,000 012-4) a. Which of the two projects should be chosen based on the payback mehr Which of the two projects should be chosen based on the net presenta method? Assume a cost of capital of 10 percent. c. Should a firm normally have more confidence in answer a or answerb 11. You buy a new piece of equipment for $16,230, and you receive a cash info of $2,500 per year for 12 years. What is the internal rate of return? 12. King's Department Store is contemplating the purchase of a new machine at a cost of $22.802. The machine will provide $3,500 per year in cash flow for nine years. King's has a cost of capital of 10 percent. Using the internal rate of return method, evaluate this project and indicate whether it should be undertaken. 13 Home Security Systems is analyzing the purchase of manufacturing equipach that will cost $50,000. The annual cash inflows for the next three years will be 012-4) 2/24) Cash Flow $25,000 23,000 18,000 Determine the internal rate of return. h with a cost of capital of 18 percent, should the machine be pur 14. Aerospace Dynamics will invest $110,000 in a project that will following cash flows. The cost of capital is 11 percent. Should undertaken? (Note that the fourth year's cash flow is negative. e he purchasw! that will produce the Should the project Cash Flow Part 1 Problem 12-1 (Create - 190, page 410) Deduct (1) for wrong out of 100. Earnings before depreciation and taxes Depreciation Earnings before taxes Taxes @ 30% Earnings after taxes Depreciation Cash flow = given or automatically calculated = enter values = enter results of calculations Part 2 Refer to Problem 12-15 (Create - 193, Page 413) Net Present Value Method Deduct (1) for wrong out of 100. The Horizon Company Net Present Value of a Proposed Investment Present value of inflows: Appex.PV of $1 Year Inflows PV"factor" $ PV PV of Inflow 3 Total Present value of outflows (Enter as a minus)* Appex.PV of $1 Year *Outflows PV"factor" 1.000 $ PV PV of Outflow *Enter outflows as a minus. Total Enter (+or -) Net Present Value = Should the investment be undertaken? Enter your answer as "Y" for yes and "N" for no, briefly explain why your answer is correct. Yes or No: Deduct 1-4 for wrong Enter your answer by typing ONLY in the first column ("D"). When your sentence reaches column "K" and you have more to say, continue on the next line in the first column ("D"). Deduct (1) for wrong out of 100. Part 3 Refer to Problem 12-18 (Create - 193-194, Page 413-414) Internal Rate of Return Note: Complete questions b and c only (skip question a) b. Note: "Append". = appendix A,B,C, & D, with present and future value tables Step 1 Average inflows (assumed annuity) to arrive at present value factor (equate to Appen D) Year Inflows Using Appendix D, Total Look-up closest % Closest Assumed for "assumed" annuity percentage Annuity factor for 1st part of for Assumed Investment Appex D. Step 2 below Annuity Only an approx. % = for 5 years Step 2 IRR approximation (use Appendix B for both 20% & 25% "factors") (Next higher % to look up "factors" below) Present Value at the 20% discount rate (as lump sums) Present Value at the 25% discount rate (as lump sums) Year Inflows PV"factor" $ PV Inflows PV"factor" $ PV 2 13 15 Total , % is too low Total % is too high For an investment of: For an investment of: Step 3 Interpolation to arrive at fraction of percentage above lower rate. PV amt of Range of PV amt of cash flow discount % cash flow/cost Range % or Cost Investment Cost Difference Difference % Range Difference Higher % Difference Lower % Enter as whole number Difference plus 2 decimal places Fraction of 5%: X Actual IRRI Percentage fraction of 5% Internal Rate of Return 20% Question / Deduct 1-4 for poor or incorrect reason c. 1 Enter the letter Y for accept and N for do not accept. With cost of capital at 10%, should the project be accepted? Why? If we want to be more accurate, as we want to for this problem, the results can be interpolated by selecting rates on either side of the present value of the investment and the accurate rate will be the percentage difference, Because the internal rate of return is determined when the present value of inflows equals the present value of outflows, we need to find a discount rate that equates the present value of the inflows to exactly match the present value of the outflows. For example, if a 12% rate yields an approximatePV inflow of $9,874 for a $10,000 investment, then the rate is too high. If a 10% rate yields a PV inflow of $10,177 for the same $10,000 investment, then the rate is too low. Thus, the true rate must be between the two. The total difference between the two is $303 ($10,177-$9,874). The solution at 10% is $177 away ($10,177 - $10,000) from $10,000 (where the PV of the investment equals the PV of cash inflow). Therefore, the accurate rate is interpolated as 10% plus ($177 -:- $303) of the difference of 2% or 10% + (177 -:- 303 X 2% = 10% +.33 = 10.33%. Part The Capital Budgeting Process Finally, determine the present value of the cash flows and compare that $200.000 cost to determine the not present value. Present Cash Flow Brows) Present Value Factor (124) Year 712 100,200 68.30 28,940 636 $ 74.101 79.859 48,687 18.406 $221,053 $221,053 200 000 $ 21,053 Present value of infos Present value of outflows loost) Net present value... The nel present value is positive and the new equipment should be purchased PROBLEMS connect Selected problems are available with Connect. Please see the preface for more interne Basic Problems 1. Assume a corporation has earnings before depreciation and taxes of $90.000 depreciation of $40,000, and that it is in a 30 percent tax bracket. Compute its cash flow using the following format. (LO/2-2) Earnings before depreciation and taxes Depreciation Earnings before taxes Taxes e 30% Earnings after taxes Depreciation Cash flow 2012-2) 2. Assume a corporation has earnings before depreciation and taxes of $100,000, depreciation of $40,000, and that it has a 40 percent tax bracket. a. Compute its cash flow using the following format. Earnings before depreciation and taxes Depreciation Earnings before taxes Taxes @ 40% Earnings after taxes Depreciation b. Compute the cash flow for the company if depreciation is only $20,000. c. How much cash flow is lost due to the reduced depreciation from $40.6 $20,000 Monok mancare 193 Chapter 12 The Capital I gering Dertion Cash Fle $36.000 44.000 38.000 (44.000 15. 81.000 The Horizon Company will invest $60,000 in a temporary project that will generate the following cash inflows for the next three years. Year 1012-4) Cash Flow $15,000 25,000 40.000 The firm will also be required to spend $10,000 to close down the project at the end of the three years. If the cost of capital is 10 percent, should the invest- ment be undertaken? 16. Skyline Corp. will invest $130,000 in a project that will not begin to produce returns until after the third year. From the end of the third year until the end of the 12th year (10 periods), the annual cash flow will be $34.000. If the cost of capital is 12 percent, should this project be undertaken? (012-4) Intermediate Problems 17. The Hudson Corporation makes an investment of $24,000 that provides the following cash flow: Net prosent value Year (L0/2-4) Cash Flow $13,000 13.000 4,000 ind in email a. What is the net present value at an 8 percent discount rate? b. What is the internal rate of return? c. In this problem, would you make the same decision under both parts a and b? 18. The Pan American Bottling Co. is considering the purchase of a new machine that would increase the speed of bottling and save money. The net cost of this machine is $60,000. The annual cash flows have the following projections. Year Cash Flow $23.000 25,000 29,000 15,000 8.000 (L012-4) Pure The Capital Budgerig Process vent value of selen If the cost of capital is 13 percent, what is the nel present ing a new machine? b. What is the internal rate of return? c. Should the project be accepted? Why? You are asked to evaluate the following two projects for the Nor Corporation. Using the nel present value method combined with ity index approach described in footnote 2 of this chapter, whi you select? Use a discount rate of 14 percent. 19. ined with the profita ter, which project would profitability index (L012-4) Project Y (Slow-Motion Replays of Commercials ISA0.000 Investmenti Project X (Videotapes of the Weather Report) $20,000 Investment) Cash Flow $10,000 8,000 Cash Flow $20,000 13,000 14,000 16,000 9.000 8,600 20. Turner Video will invest $76,344 in a project. The firm's cost of capital is 10 percent. The investment will provide the following inflows. Reinvestment rate Assumption in capital hudgeting (L012-4) Year Inflow $15,000 17.000 21,000 25,000 29,000 The internal rate of return is 11 percent. If the reinvestment assumption of the net present value method is used what will be the total value of the inflows after five years? (Assume the inflows come at the end of each year.) b. If the reinvestment assumption of the internal rate of retum mcthod is used, what will be the total value of the inflows after five years! c. Generally is one investment assumption likely to be better than ano 21. The Calleine Coffee Company uses the modified internal rate of retum. firm has a cost of capital of 11 percent. The project being analyzed ($26,000 investment): her! eller than Vodited internal "ing analyzed is as follows L012-4) Year Cash Flow $12,000 11,000 9.000 412 Part 4 The Capital Budgeting Process hac mete o investment in (L012-3) The Sheline Railroad is considering a STO companies. The cash flows are as follows: Electric Co. $85.000 25.000 30.000 10,000 Water Works $30,000 25,000 B5,000 10,000 4-10 ....... a. Using the payback method, what will the decision be? h Explain why the answer in part a can be misleading X-treme Vitamin Company is considering two investments, both of $10,000. The cash flows are as follows: s, both of which com Rayhuck and net 10. LO123 & 12-4) Year Project A $12,000 8.000 6,000 Project B $10,000 6,000 16,000 012-4) a. Which of the two projects should be chosen based on the payback mehr Which of the two projects should be chosen based on the net presenta method? Assume a cost of capital of 10 percent. c. Should a firm normally have more confidence in answer a or answerb 11. You buy a new piece of equipment for $16,230, and you receive a cash info of $2,500 per year for 12 years. What is the internal rate of return? 12. King's Department Store is contemplating the purchase of a new machine at a cost of $22.802. The machine will provide $3,500 per year in cash flow for nine years. King's has a cost of capital of 10 percent. Using the internal rate of return method, evaluate this project and indicate whether it should be undertaken. 13 Home Security Systems is analyzing the purchase of manufacturing equipach that will cost $50,000. The annual cash inflows for the next three years will be 012-4) 2/24) Cash Flow $25,000 23,000 18,000 Determine the internal rate of return. h with a cost of capital of 18 percent, should the machine be pur 14. Aerospace Dynamics will invest $110,000 in a project that will following cash flows. The cost of capital is 11 percent. Should undertaken? (Note that the fourth year's cash flow is negative. e he purchasw! that will produce the Should the project Cash Flow Part 1 Problem 12-1 (Create - 190, page 410) Deduct (1) for wrong out of 100. Earnings before depreciation and taxes Depreciation Earnings before taxes Taxes @ 30% Earnings after taxes Depreciation Cash flow = given or automatically calculated = enter values = enter results of calculations Part 2 Refer to Problem 12-15 (Create - 193, Page 413) Net Present Value Method Deduct (1) for wrong out of 100. The Horizon Company Net Present Value of a Proposed Investment Present value of inflows: Appex.PV of $1 Year Inflows PV"factor" $ PV PV of Inflow 3 Total Present value of outflows (Enter as a minus)* Appex.PV of $1 Year *Outflows PV"factor" 1.000 $ PV PV of Outflow *Enter outflows as a minus. Total Enter (+or -) Net Present Value = Should the investment be undertaken? Enter your answer as "Y" for yes and "N" for no, briefly explain why your answer is correct. Yes or No: Deduct 1-4 for wrong Enter your answer by typing ONLY in the first column ("D"). When your sentence reaches column "K" and you have more to say, continue on the next line in the first column ("D"). Deduct (1) for wrong out of 100. Part 3 Refer to Problem 12-18 (Create - 193-194, Page 413-414) Internal Rate of Return Note: Complete questions b and c only (skip question a) b. Note: "Append". = appendix A,B,C, & D, with present and future value tables Step 1 Average inflows (assumed annuity) to arrive at present value factor (equate to Appen D) Year Inflows Using Appendix D, Total Look-up closest % Closest Assumed for "assumed" annuity percentage Annuity factor for 1st part of for Assumed Investment Appex D. Step 2 below Annuity Only an approx. % = for 5 years Step 2 IRR approximation (use Appendix B for both 20% & 25% "factors") (Next higher % to look up "factors" below) Present Value at the 20% discount rate (as lump sums) Present Value at the 25% discount rate (as lump sums) Year Inflows PV"factor" $ PV Inflows PV"factor" $ PV 2 13 15 Total , % is too low Total % is too high For an investment of: For an investment of: Step 3 Interpolation to arrive at fraction of percentage above lower rate. PV amt of Range of PV amt of cash flow discount % cash flow/cost Range % or Cost Investment Cost Difference Difference % Range Difference Higher % Difference Lower % Enter as whole number Difference plus 2 decimal places Fraction of 5%: X Actual IRRI Percentage fraction of 5% Internal Rate of Return 20% Question / Deduct 1-4 for poor or incorrect reason c. 1 Enter the letter Y for accept and N for do not accept. With cost of capital at 10%, should the project be accepted? Why? If we want to be more accurate, as we want to for this problem, the results can be interpolated by selecting rates on either side of the present value of the investment and the accurate rate will be the percentage difference, Because the internal rate of return is determined when the present value of inflows equals the present value of outflows, we need to find a discount rate that equates the present value of the inflows to exactly match the present value of the outflows. For example, if a 12% rate yields an approximatePV inflow of $9,874 for a $10,000 investment, then the rate is too high. If a 10% rate yields a PV inflow of $10,177 for the same $10,000 investment, then the rate is too low. Thus, the true rate must be between the two. The total difference between the two is $303 ($10,177-$9,874). The solution at 10% is $177 away ($10,177 - $10,000) from $10,000 (where the PV of the investment equals the PV of cash inflow). Therefore, the accurate rate is interpolated as 10% plus ($177 -:- $303) of the difference of 2% or 10% + (177 -:- 303 X 2% = 10% +.33 = 10.33%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts