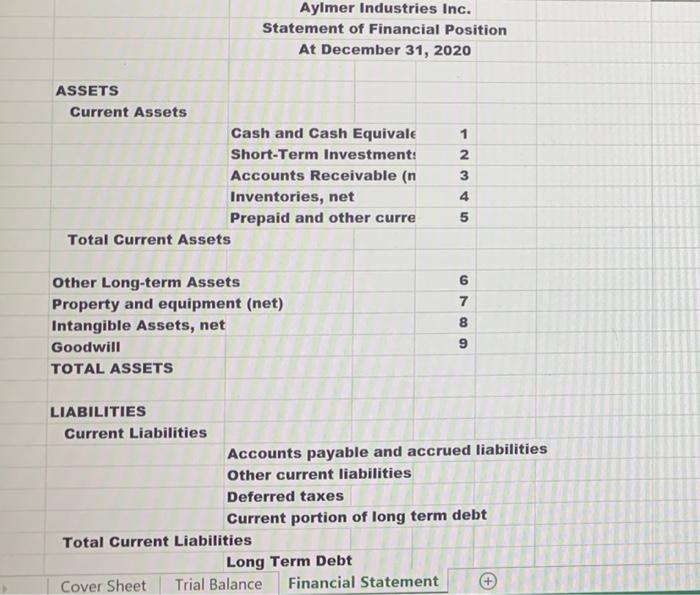

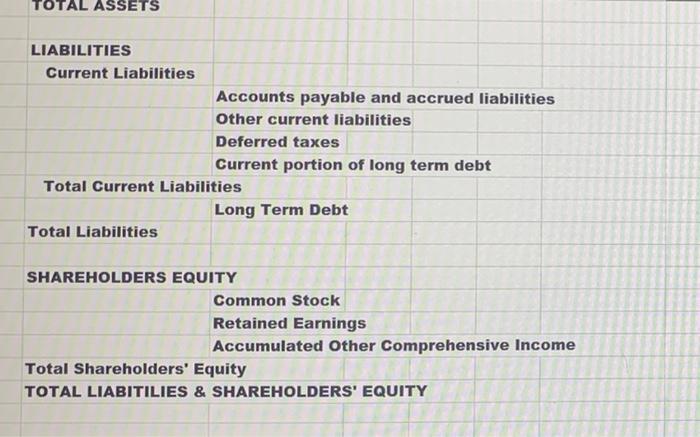

Answer should be Financial Position ONLY. The format is given in the photo. Answer should be like the format from year 2019 and 2020 ONLY.

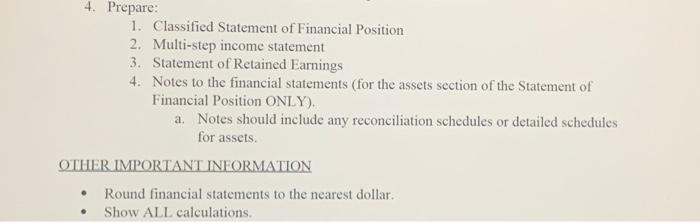

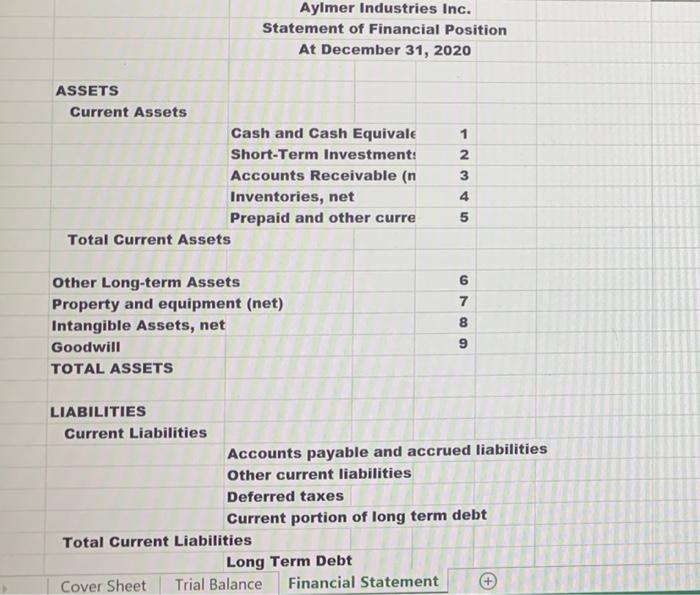

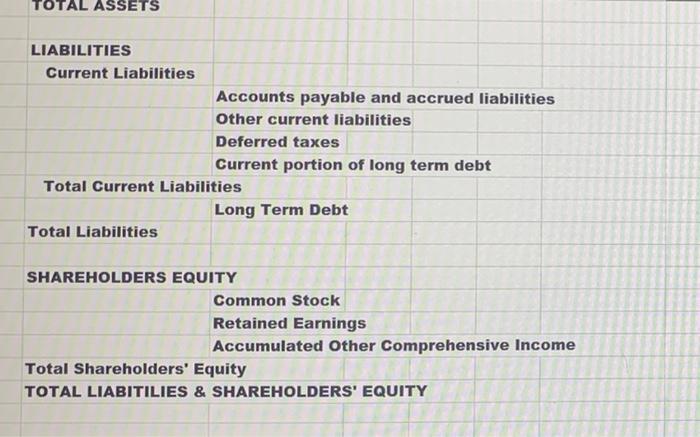

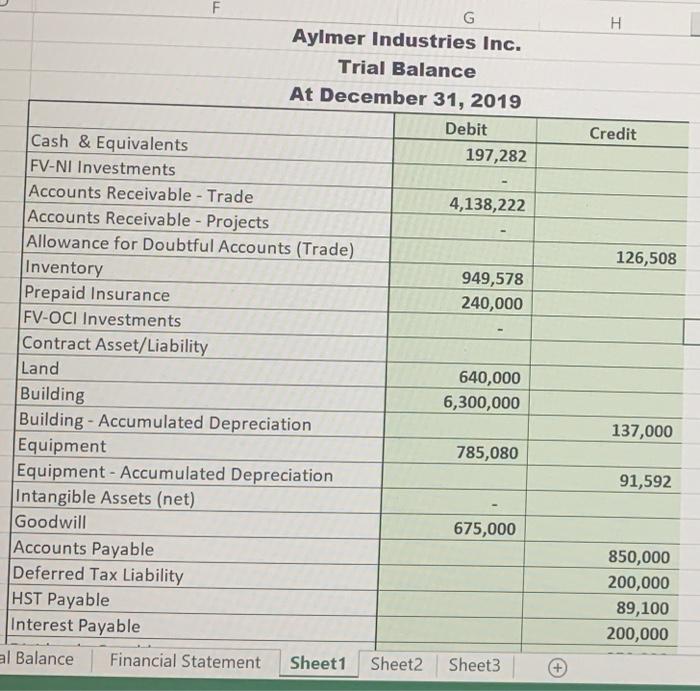

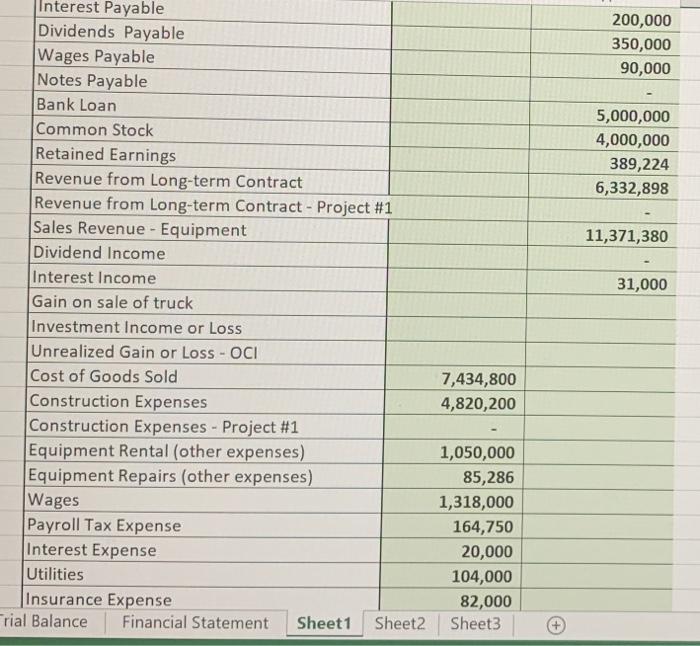

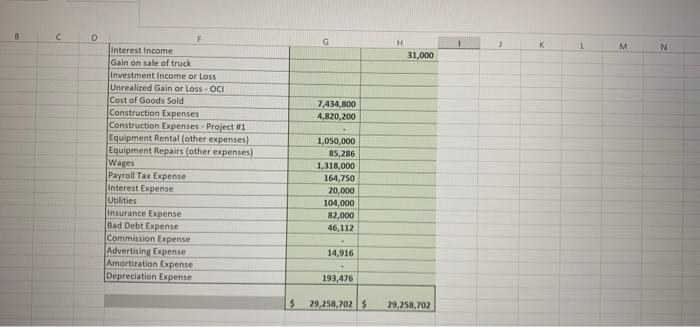

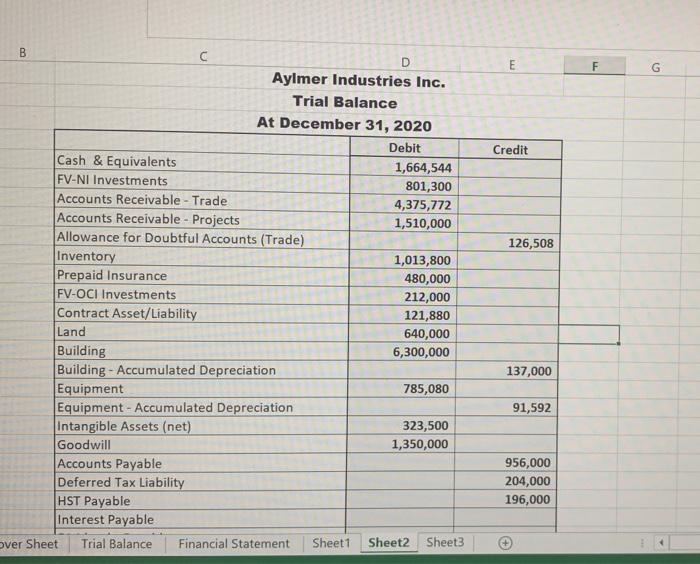

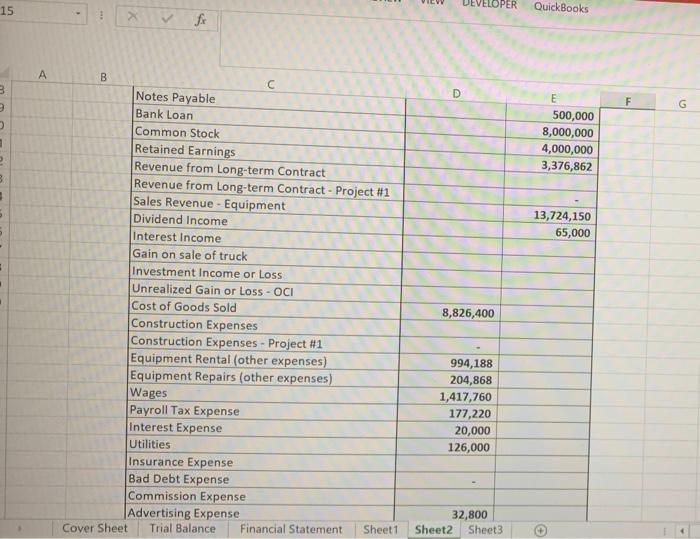

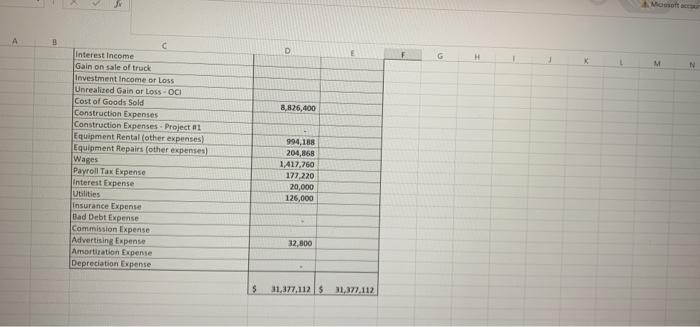

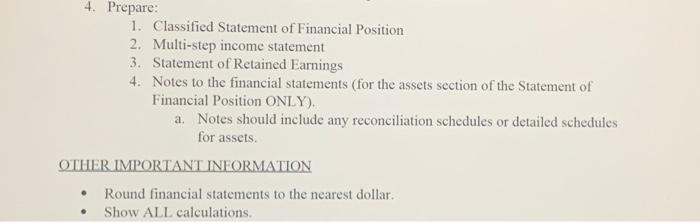

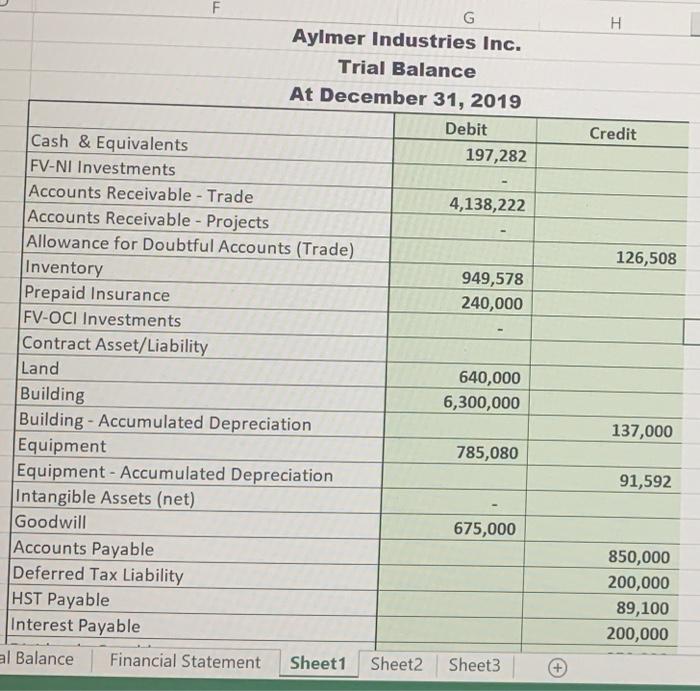

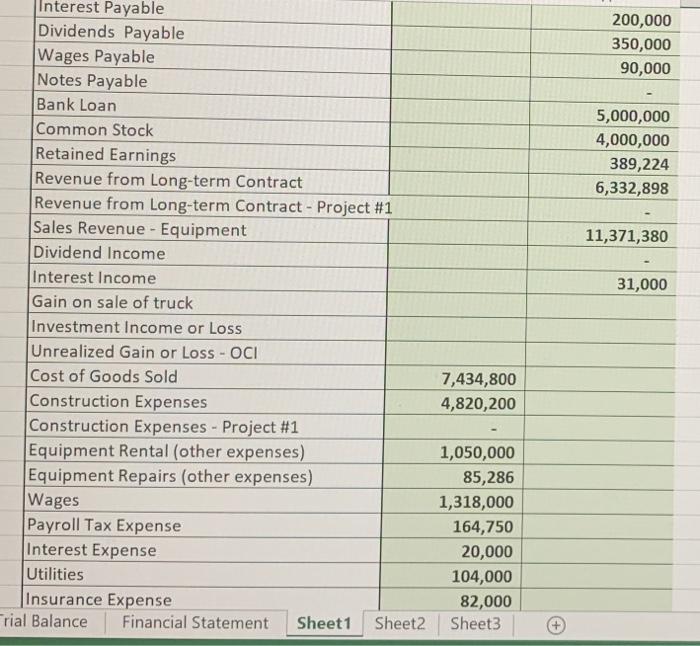

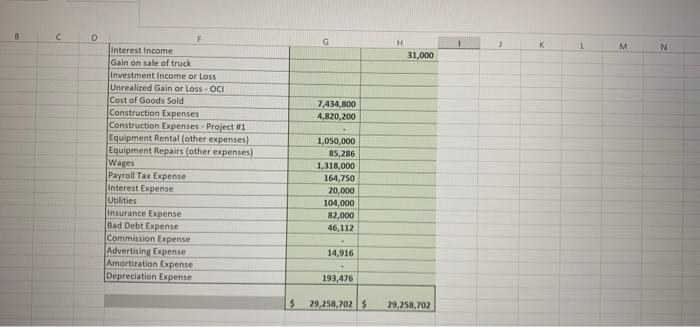

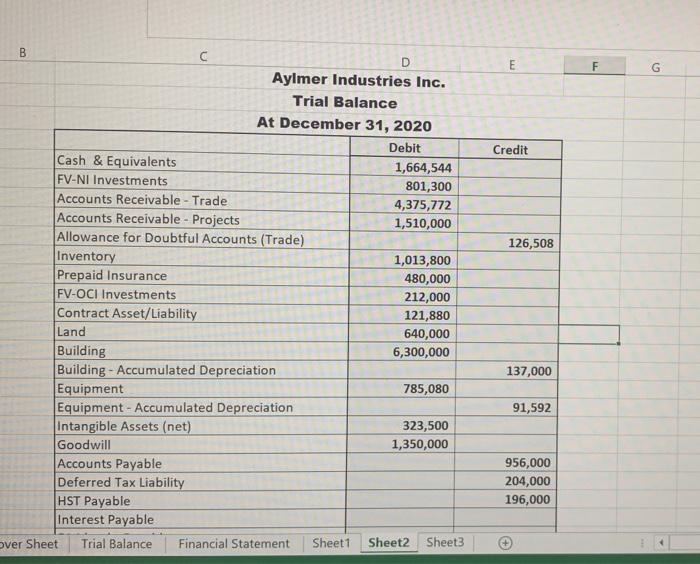

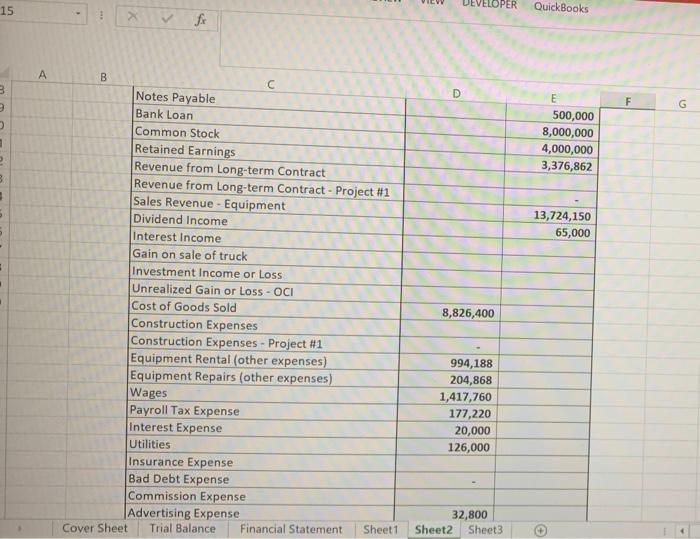

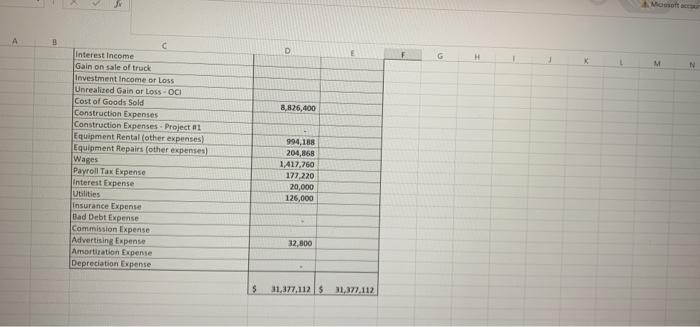

4. Prepare: 1. Classified Statement of Financial Position 2. Multi-step income statement 3. Statement of Retained Earnings 4. Notes to the financial statements (for the assets section of the Statement of Financial Position ONLY). a. Notes should include any reconciliation schedules or detailed schedules for assets. OTHER IMPORTANT INFORMATION Round financial statements to the nearest dollar. Show ALL calculations, . Aylmer Industries Inc. Statement of Financial Position At December 31, 2020 1 2 ASSETS Current Assets Cash and Cash Equivale Short-Term Investments Accounts Receivable (n Inventories, net Prepaid and other curre Total Current Assets AWN 4 5 6 Other Long-term Assets Property and equipment (net) Intangible Assets, net Goodwill TOTAL ASSETS . 7 8 9 LIABILITIES Current Liabilities Accounts payable and accrued liabilities Other current liabilities Deferred taxes Current portion of long term debt Total Current Liabilities Long Term Debt Cover Sheet Trial Balance Financial Statement TOTAL ASSETS LIABILITIES Current Liabilities Accounts payable and accrued liabilities Other current liabilities Deferred taxes Current portion of long term debt Total Current Liabilities Long Term Debt otal Liabilities SHAREHOLDERS EQUITY Common Stock Retained Earnings Accumulated Other Comprehensive Income Total Shareholders' Equity TOTAL LIABITILIES & SHAREHOLDERS' EQUITY H Credit 126,508 F G Aylmer Industries Inc. Trial Balance At December 31, 2019 Debit Cash & Equivalents 197,282 FV-NI Investments Accounts Receivable - Trade 4,138,222 Accounts Receivable - Projects Allowance for Doubtful Accounts (Trade) Inventory 949,578 Prepaid Insurance 240,000 FV-OCI Investments Contract Asset/Liability Land 640,000 Building 6,300,000 Building - Accumulated Depreciation Equipment 785,080 Equipment - Accumulated Depreciation Intangible Assets (net) Goodwill 675,000 Accounts Payable Deferred Tax Liability HST Payable Interest Payable al Balance Financial Statement Sheet1 Sheet2 Sheet3 137,000 91,592 850,000 200,000 89,100 200,000 200,000 350,000 90,000 5,000,000 4,000,000 389,224 6,332,898 11,371,380 31,000 Interest Payable Dividends Payable Wages Payable Notes Payable Bank Loan Common Stock Retained Earnings Revenue from Long-term Contract Revenue from Long-term Contract - Project #1 Sales Revenue - Equipment Dividend Income Interest Income Gain on sale of truck Investment Income or Loss Unrealized Gain or Loss - OCI Cost of Goods Sold Construction Expenses Construction Expenses - Project #1 Equipment Rental (other expenses) Equipment Repairs (other expenses) Wages Payroll Tax Expense Interest Expense Utilities Insurance Expense rial Balance Financial Statement Sheet1 Sheet2 7,434,800 4,820,200 1,050,000 85,286 1,318,000 164,750 20,000 104,000 82,000 Sheet3 D G H K L M N 31,000 7,434,800 4,820.200 F Interest Income Gain on sale of truck Investment Income or loss Unrealized Gain or loss - OCI Cost of Goods Sold Construction Expenses Construction Expenses - Project 111 Equipment Rental (other expenses) Equipment Repairs (other expenses) Wages Payroll Tax Expense Interest Expense Utilities Insurance Expense Bad Debt Expense Commission Expense Advertising Expense Amortization Expense Depreciation Expense 1,050,000 85,286 1,318,000 164,750 20,000 104,000 82,000 46,112 14,916 193,476 $ 29,258,702 29,258,702 E F G Credit 126,508 B D Aylmer Industries Inc. Trial Balance At December 31, 2020 Debit Cash & Equivalents 1,664,544 FV-NI Investments 801,300 Accounts Receivable - Trade 4,375,772 Accounts Receivable - Projects 1,510,000 Allowance for Doubtful Accounts (Trade) Inventory 1,013,800 Prepaid Insurance 480,000 FV-OCI Investments 212,000 Contract Asset/Liability 121,880 Land 640,000 Building 6,300,000 Building - Accumulated Depreciation Equipment 785,080 Equipment - Accumulated Depreciation Intangible Assets (net) 323,500 Goodwill 1,350,000 Accounts Payable Deferred Tax Liability HST Payable Interest Payable Over Sheet Trial Balance Financial Statement Sheet1 Sheet2 Sheet3 137,000 91,592 956,000 204,000 196,000 15 DEVELOPER QuickBooks . fr P A 3 D D F G E 500,000 8,000,000 4,000,000 3,376,862 2 3 13,724,150 65,000 5 3 B Notes Payable Bank Loan Common Stock Retained Earnings Revenue from Long-term Contract Revenue from Long-term Contract - Project #11 Sales Revenue - Equipment Dividend Income Interest Income Gain on sale of truck Investment Income or Loss Unrealized Gain or Loss - OCI Cost of Goods Sold Construction Expenses Construction Expenses - Project #1 Equipment Rental (other expenses) Equipment Repairs (other expenses) Wages Payroll Tax Expense Interest Expense Utilities Insurance Expense Bad Debt Expense Commission Expense | Advertising Expense Cover Sheet Trial Balance Financial Statement Sheet1 8,826,400 994,188 204,868 1,417,760 177,220 20,000 126,000 32,800 Sheet2 Sheet3 Mosso A B D G H x M N 8,826,400 Interest Income Gain on sale of truck Investment income or loss Unrealized Gain or Loss - OCI Cost of Goods Sold Construction Expenses Construction Expenses - Project 1 Equipment Rental (other expenses) Equipment Repairs (other expenses Wages Payroll Tax Expense Interest Expense Utilities Insurance Expense Dad Debt Expense Commission Expense Advertising Expense Amortization Expense Depreciation Expense 994,188 204,868 1,417,760 177.220 20,000 126,000 32,800 5 31,377,112 S 31,377.112 4. Prepare: 1. Classified Statement of Financial Position 2. Multi-step income statement 3. Statement of Retained Earnings 4. Notes to the financial statements (for the assets section of the Statement of Financial Position ONLY). a. Notes should include any reconciliation schedules or detailed schedules for assets. OTHER IMPORTANT INFORMATION Round financial statements to the nearest dollar. Show ALL calculations, . Aylmer Industries Inc. Statement of Financial Position At December 31, 2020 1 2 ASSETS Current Assets Cash and Cash Equivale Short-Term Investments Accounts Receivable (n Inventories, net Prepaid and other curre Total Current Assets AWN 4 5 6 Other Long-term Assets Property and equipment (net) Intangible Assets, net Goodwill TOTAL ASSETS . 7 8 9 LIABILITIES Current Liabilities Accounts payable and accrued liabilities Other current liabilities Deferred taxes Current portion of long term debt Total Current Liabilities Long Term Debt Cover Sheet Trial Balance Financial Statement TOTAL ASSETS LIABILITIES Current Liabilities Accounts payable and accrued liabilities Other current liabilities Deferred taxes Current portion of long term debt Total Current Liabilities Long Term Debt otal Liabilities SHAREHOLDERS EQUITY Common Stock Retained Earnings Accumulated Other Comprehensive Income Total Shareholders' Equity TOTAL LIABITILIES & SHAREHOLDERS' EQUITY H Credit 126,508 F G Aylmer Industries Inc. Trial Balance At December 31, 2019 Debit Cash & Equivalents 197,282 FV-NI Investments Accounts Receivable - Trade 4,138,222 Accounts Receivable - Projects Allowance for Doubtful Accounts (Trade) Inventory 949,578 Prepaid Insurance 240,000 FV-OCI Investments Contract Asset/Liability Land 640,000 Building 6,300,000 Building - Accumulated Depreciation Equipment 785,080 Equipment - Accumulated Depreciation Intangible Assets (net) Goodwill 675,000 Accounts Payable Deferred Tax Liability HST Payable Interest Payable al Balance Financial Statement Sheet1 Sheet2 Sheet3 137,000 91,592 850,000 200,000 89,100 200,000 200,000 350,000 90,000 5,000,000 4,000,000 389,224 6,332,898 11,371,380 31,000 Interest Payable Dividends Payable Wages Payable Notes Payable Bank Loan Common Stock Retained Earnings Revenue from Long-term Contract Revenue from Long-term Contract - Project #1 Sales Revenue - Equipment Dividend Income Interest Income Gain on sale of truck Investment Income or Loss Unrealized Gain or Loss - OCI Cost of Goods Sold Construction Expenses Construction Expenses - Project #1 Equipment Rental (other expenses) Equipment Repairs (other expenses) Wages Payroll Tax Expense Interest Expense Utilities Insurance Expense rial Balance Financial Statement Sheet1 Sheet2 7,434,800 4,820,200 1,050,000 85,286 1,318,000 164,750 20,000 104,000 82,000 Sheet3 D G H K L M N 31,000 7,434,800 4,820.200 F Interest Income Gain on sale of truck Investment Income or loss Unrealized Gain or loss - OCI Cost of Goods Sold Construction Expenses Construction Expenses - Project 111 Equipment Rental (other expenses) Equipment Repairs (other expenses) Wages Payroll Tax Expense Interest Expense Utilities Insurance Expense Bad Debt Expense Commission Expense Advertising Expense Amortization Expense Depreciation Expense 1,050,000 85,286 1,318,000 164,750 20,000 104,000 82,000 46,112 14,916 193,476 $ 29,258,702 29,258,702 E F G Credit 126,508 B D Aylmer Industries Inc. Trial Balance At December 31, 2020 Debit Cash & Equivalents 1,664,544 FV-NI Investments 801,300 Accounts Receivable - Trade 4,375,772 Accounts Receivable - Projects 1,510,000 Allowance for Doubtful Accounts (Trade) Inventory 1,013,800 Prepaid Insurance 480,000 FV-OCI Investments 212,000 Contract Asset/Liability 121,880 Land 640,000 Building 6,300,000 Building - Accumulated Depreciation Equipment 785,080 Equipment - Accumulated Depreciation Intangible Assets (net) 323,500 Goodwill 1,350,000 Accounts Payable Deferred Tax Liability HST Payable Interest Payable Over Sheet Trial Balance Financial Statement Sheet1 Sheet2 Sheet3 137,000 91,592 956,000 204,000 196,000 15 DEVELOPER QuickBooks . fr P A 3 D D F G E 500,000 8,000,000 4,000,000 3,376,862 2 3 13,724,150 65,000 5 3 B Notes Payable Bank Loan Common Stock Retained Earnings Revenue from Long-term Contract Revenue from Long-term Contract - Project #11 Sales Revenue - Equipment Dividend Income Interest Income Gain on sale of truck Investment Income or Loss Unrealized Gain or Loss - OCI Cost of Goods Sold Construction Expenses Construction Expenses - Project #1 Equipment Rental (other expenses) Equipment Repairs (other expenses) Wages Payroll Tax Expense Interest Expense Utilities Insurance Expense Bad Debt Expense Commission Expense | Advertising Expense Cover Sheet Trial Balance Financial Statement Sheet1 8,826,400 994,188 204,868 1,417,760 177,220 20,000 126,000 32,800 Sheet2 Sheet3 Mosso A B D G H x M N 8,826,400 Interest Income Gain on sale of truck Investment income or loss Unrealized Gain or Loss - OCI Cost of Goods Sold Construction Expenses Construction Expenses - Project 1 Equipment Rental (other expenses) Equipment Repairs (other expenses Wages Payroll Tax Expense Interest Expense Utilities Insurance Expense Dad Debt Expense Commission Expense Advertising Expense Amortization Expense Depreciation Expense 994,188 204,868 1,417,760 177.220 20,000 126,000 32,800 5 31,377,112 S 31,377.112