Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer T for true or F for false. 2 marks for each correct answer. 1. In annuities due, the time of the Future Value

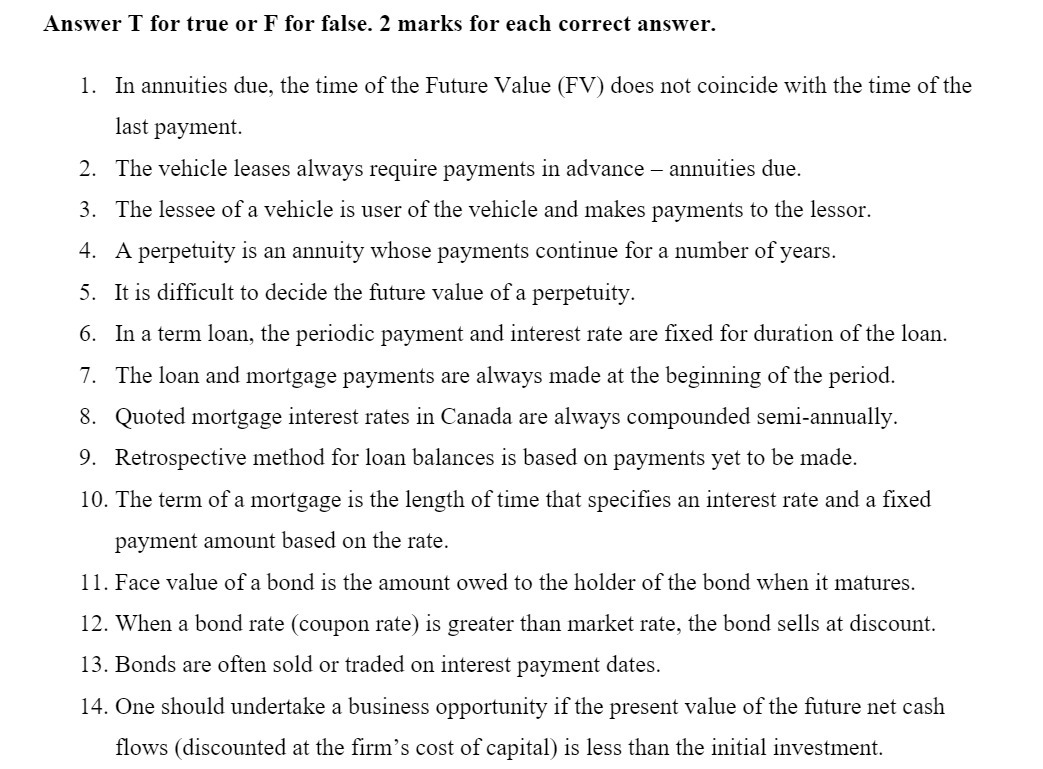

Answer T for true or F for false. 2 marks for each correct answer. 1. In annuities due, the time of the Future Value (FV) does not coincide with the time of the last payment. 2. The vehicle leases always require payments in advance - annuities due. 3. The lessee of a vehicle is user of the vehicle and makes payments to the lessor. 4. A perpetuity is an annuity whose payments continue for a number of years. 5. It is difficult to decide the future value of a perpetuity. 6. In a term loan, the periodic payment and interest rate are fixed for duration of the loan. 7. The loan and mortgage payments are always made at the beginning of the period. 8. Quoted mortgage interest rates in Canada are always compounded semi-annually. 9. Retrospective method for loan balances is based on payments yet to be made. 10. The term of a mortgage is the length of time that specifies an interest rate and a fixed payment amount based on the rate. 11. Face value of a bond is the amount owed to the holder of the bond when it matures. 12. When a bond rate (coupon rate) is greater than market rate, the bond sells at discount. 13. Bonds are often sold or traded on interest payment dates. 14. One should undertake a business opportunity if the present value of the future net cash flows (discounted at the firm's cost of capital) is less than the initial investment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started