Answer the 3 parts related to the analysis/discussion of stocks 3 portfolio pairs of Boeing Company (BA), Best Buy Co., Inc. (BBY), Signet Jewelers Ltd.

Answer the 3 parts related to the analysis/discussion of stocks 3 portfolio pairs of Boeing Company (BA), Best Buy Co., Inc. (BBY), Signet Jewelers Ltd. (SIG).

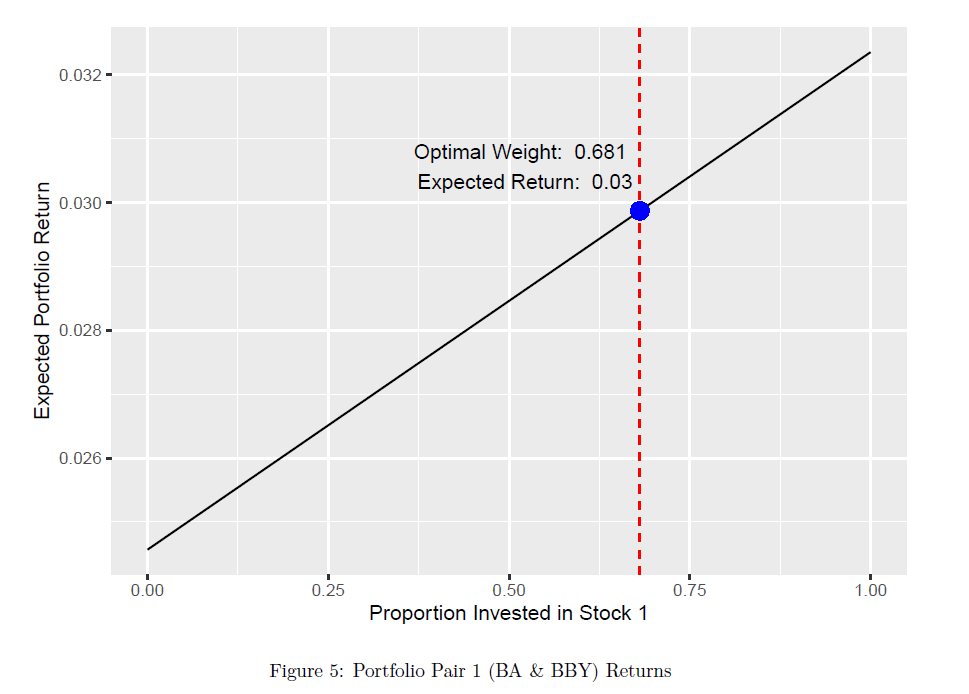

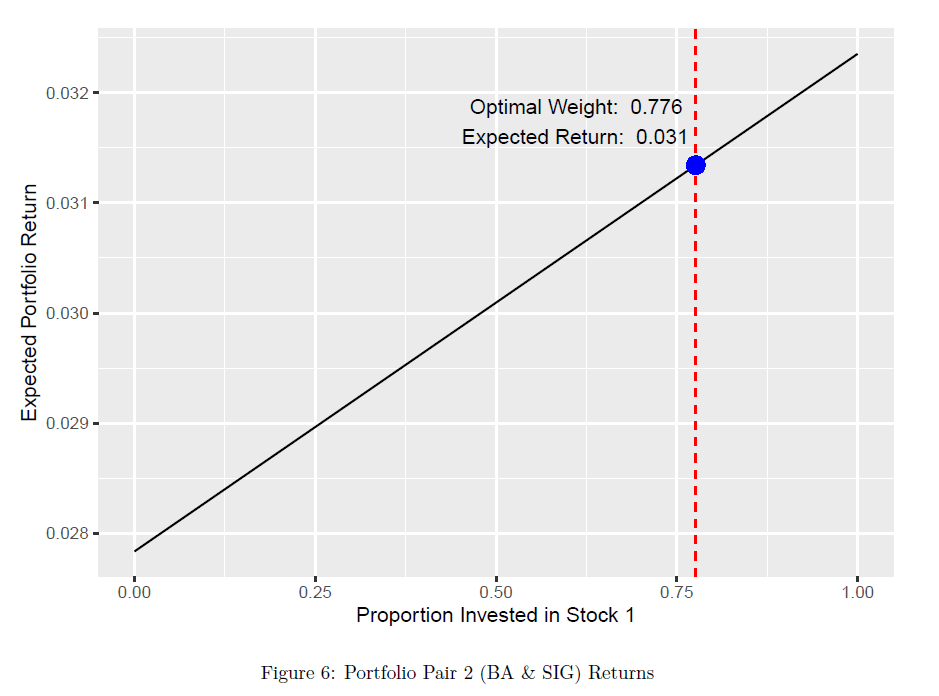

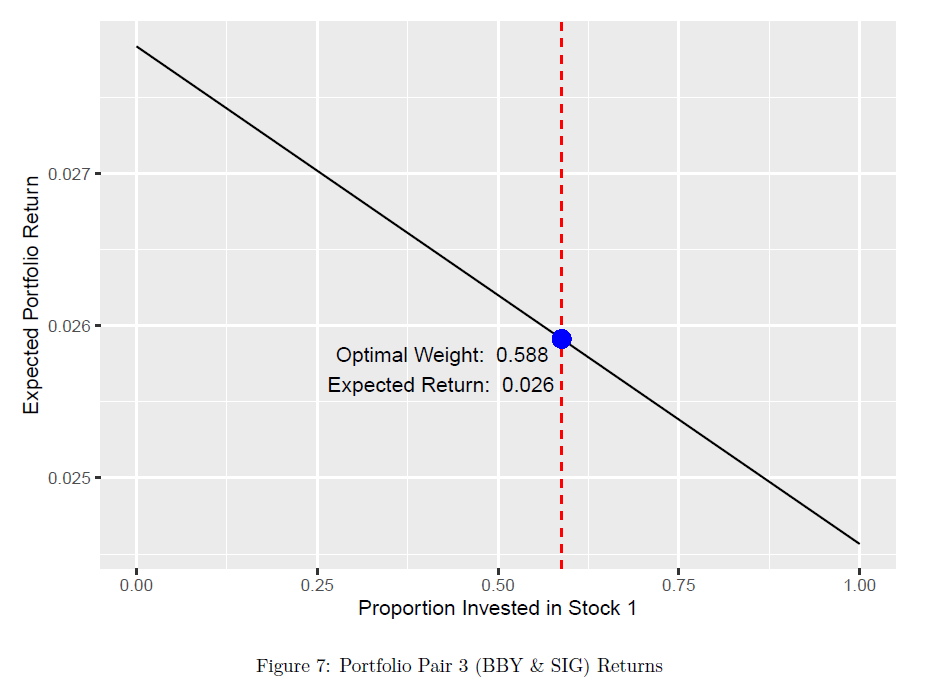

The Red Vertical Dashed Line: Represents the optimal proportion (or weight) to invest in one of the stocks. This lines x-coordinate is the optimal weight.

The Blue Dot: Where this vertical dashed line touches the diagonal line indicates the expected return for that optimal weight. The y-coordinate of this point is the optimal expected return.

So, the intersection of the vertical dashed line with the diagonal line represents the combination of the optimal weight and its corresponding expected return.

- Analyse Figure 5: Portfolio Pair 1 (BA & BBY) Returns, as a follow up test to support the calculated optimal weights for portfolio stock pair. Analysis of figure and explanation for its support is clear, concise and without spelling or grammatical errors.

ANALYSIS SHOULD SUPPORT THESE:

Optimal weight for stock BA is: w1 = 0.681 Optimal weight for stock BBY is: w2 = 0.319 The expected return of optimal portfolio pair 1 (BA & BBY) is 0.03.

2. Analyse Figure 6: Portfolio pair 2 (BA & SIG) Returns, as a follow up test to support the calculated optimal weights for portfolio stock pair. Analysis of figure and explanation for its support is clear, concise and without spelling or grammatical errors.

ANALYSIS SHOULD SUPPORT THESE:

Optimal weight for stock BA is: w1 = 0.776 Optimal weight for stock SIG is: w2 = 0.224 The expected return of optimal portfolio pair 2 (BA & SIG) is 0.031.

3. Analyse Figure 7: Portfolio pair 3 (BBY & SIG) Returns, as a follow up test to support the calculated optimal weights for portfolio stock pair. Analysis of figure and explanation for its support is clear, concise and without spelling or grammatical errors.

ANALYSIS SHOULD SUPPORT THESE:

Optimal weight for stock BBY is: w1 = 0.588 Optimal weight for stock SIG is: w2 = 0.412 The expected return of optimal portfolio pair 3 (BBY & SIG) is 0.026.

F igure o: rortiollo rall (DA \& DD D ) neturns Figure o: rortono ralr (DA Div) neturns Figure a: Fortono rall s (DD I DIG) neturns F igure o: rortiollo rall (DA \& DD D ) neturns Figure o: rortono ralr (DA Div) neturns Figure a: Fortono rall s (DD I DIG) neturnsStep by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started