Answer the a), b) and c)

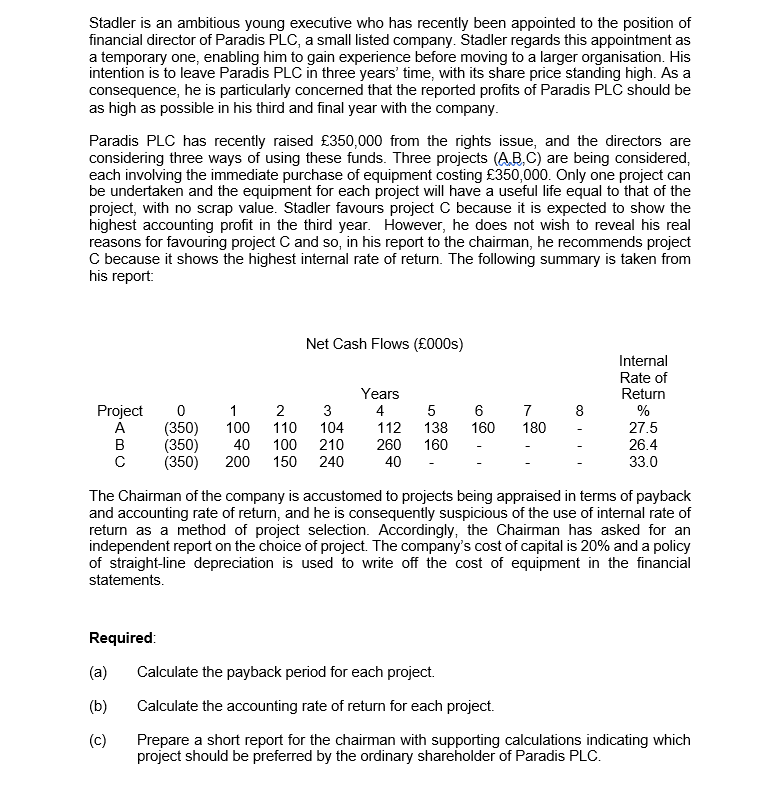

Stadler is an ambitious young executive who has recently been appointed to the position of financial director of Paradis PLC, a small listed company. Stadler regards this appointment as a temporary one, enabling him to gain experience before moving to a larger organisation. His intention is to leave Paradis PLC in three years' time, with its share price standing high. As a consequence, he is particularly concerned that the reported profits of Paradis PLC should be as high as possible in his third and final year with the company. Paradis PLC has recently raised $350,000 from the rights issue, and the directors are considering three ways of using these funds. Three projects (A.B,C) are being considered, each involving the immediate purchase of equipment costing $350,000. Only one project can be undertaken and the equipment for each project will have a useful life equal to that of the project, with no scrap value. Stadler favours project C because it is expected to show the highest accounting profit in the third year. However, he does not wish to reveal his real reasons for favouring project C and so, in his report to the chairman, he recommends project C because it shows the highest internal rate of return. The following summary is taken from his report: Net Cash Flows (1000s) Internal Years Rate of Return Project 0 1 2 3 4 5 6 7 8 % A (350) 100 110 104 112 138 160 180 27.5 (350) 40 100 210 260 160 26.4 (350) 200 150 240 40 33.0 The Chairman of the company is accustomed to projects being appraised in terms of payback and accounting rate of return, and he is consequently suspicious of the use of internal rate of return as a method of project selection. Accordingly, the Chairman has asked for an independent report on the choice of project. The company's cost of capital is 20% and a policy of straight-line depreciation is used to write off the cost of equipment in the financial statements. Required: (a) Calculate the payback period for each project. (b) Calculate the accounting rate of return for each project. (c) Prepare a short report for the chairman with supporting calculations indicating which project should be preferred by the ordinary shareholder of Paradis PLC